Pictures of Jet City

So far this year, Microsoft’s share price (NASDAQ: MSFT) has experienced a sustained rise, rising from approximately $370 to $425—an increase of nearly 15% in just 4 months. That same year, the company surpassed Apple (NASDAQ: AAPL) as The world’s most valuable companies Calculated by market capitalization.As one of the blue chip stocks Hao QiMicrosoft stock has found a place in the portfolios of many retail and institutional investors. However, the recent surge in the share price has value investors questioning whether the stock is still at fair value. In this article, I look back at Microsoft’s impressive run over the years and what they’re doing to prepare for the future. Using a simple EPS forecast, I explain why Microsoft stock is currently trading at its fair value.

A promising development trajectory

it’s no secret Microsoft has made a global reputation for itself. The company’s growth over the past few years has been impressive, and its future trajectory remains bright.

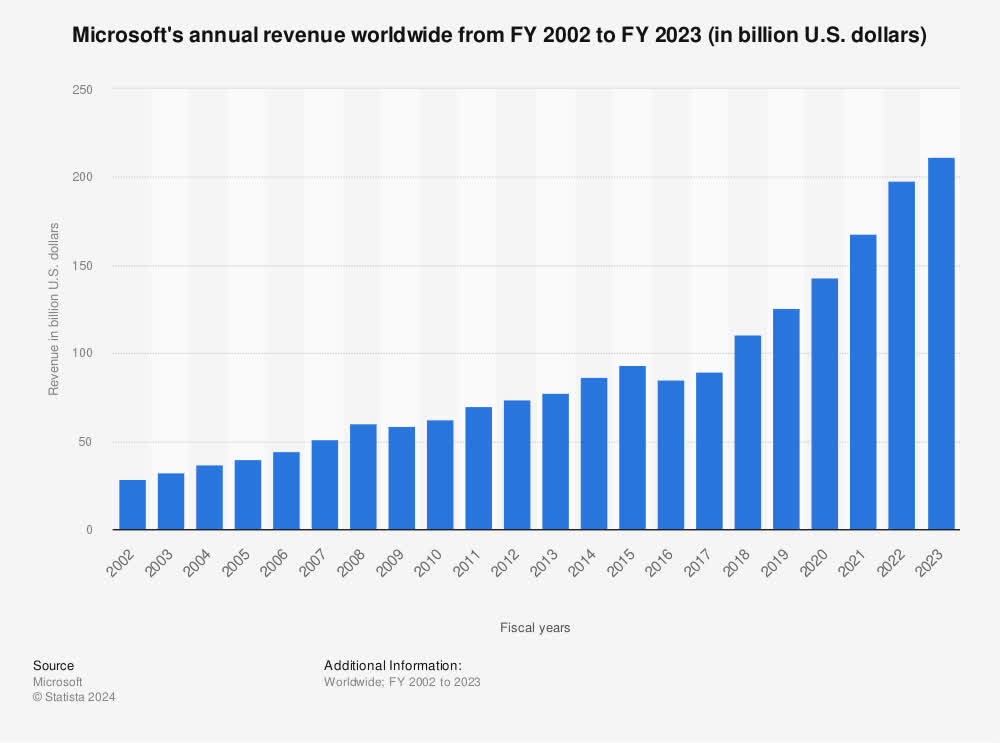

revenue growth

The company’s revenue in 2023 is as high as $21.192 billion, which is almost double the company’s revenue in 2019 ($12.55 billion). From 2019 to 2023, the compound annual growth rate will be 14%. If we zoom out further, we see that despite various economic crises and multiple changes in the technological landscape, the company’s revenue has continued to grow.

Microsoft’s annual revenue from 2002 to 2023 (politician)

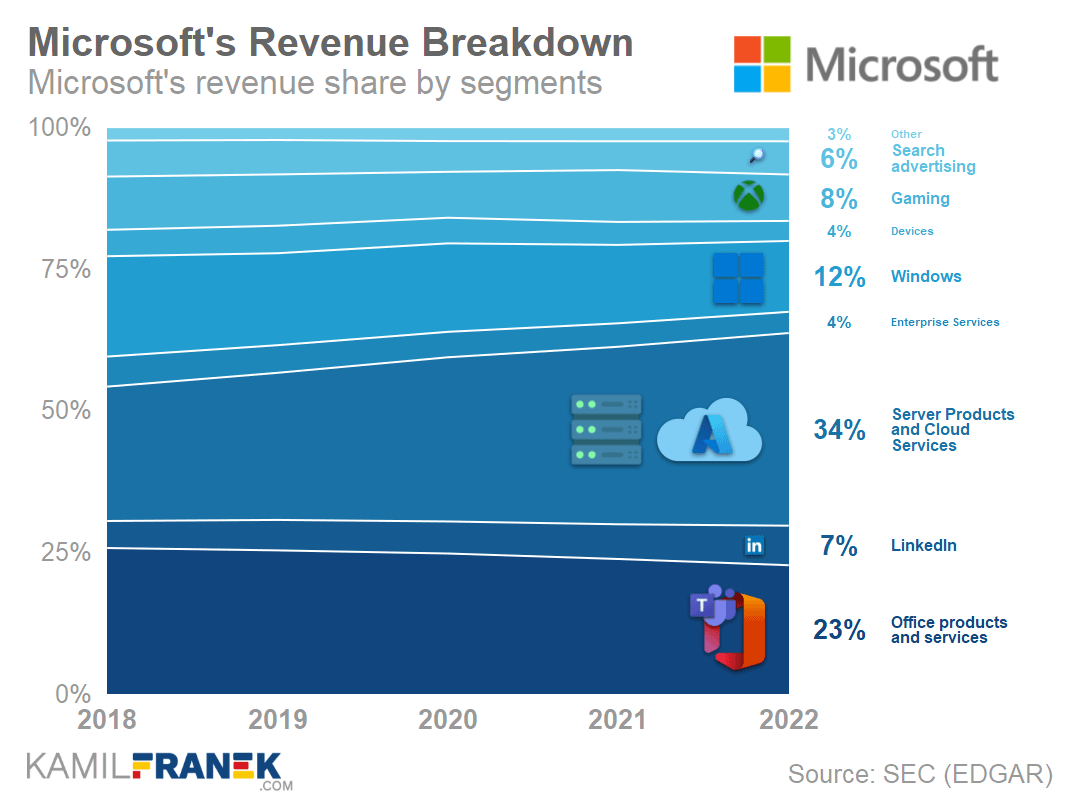

While this won’t be surprising to most, the composition of the revenue makes me confident in the company.

Microsoft revenue breakdown (2018 – 2022) (U.S. Securities and Exchange Commission)

We often know the company for its famous operating system Windows and the various applications that come with it. Others learn about the company through search engines, devices or online platforms like LinkedIn. However, we see above that the lion’s share of the revenue pie comes from server products and cloud services – these products will contribute more than a third of Microsoft’s revenue in 2022. Now, why is this important?

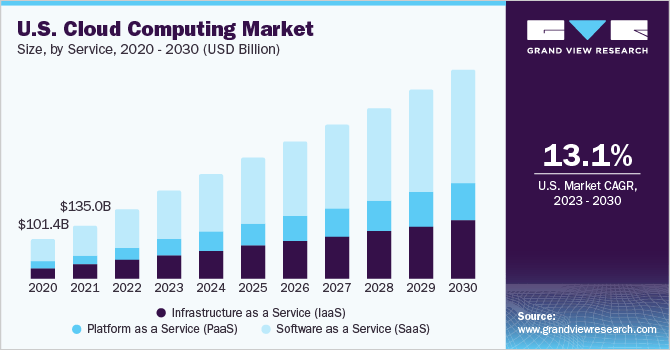

US Cloud Computing Forecast (2020 – 2030) (Research on the real scene)

We see that the U.S. cloud computing market is on an upward trajectory.In fact, the cloud is becoming new normal Used for servers, networks and data storage.Shifting focus to products like these shows the company is adapting to technology trends, and we’re seeing MicrosoftAzure It definitely has a place in the field of cloud computing.

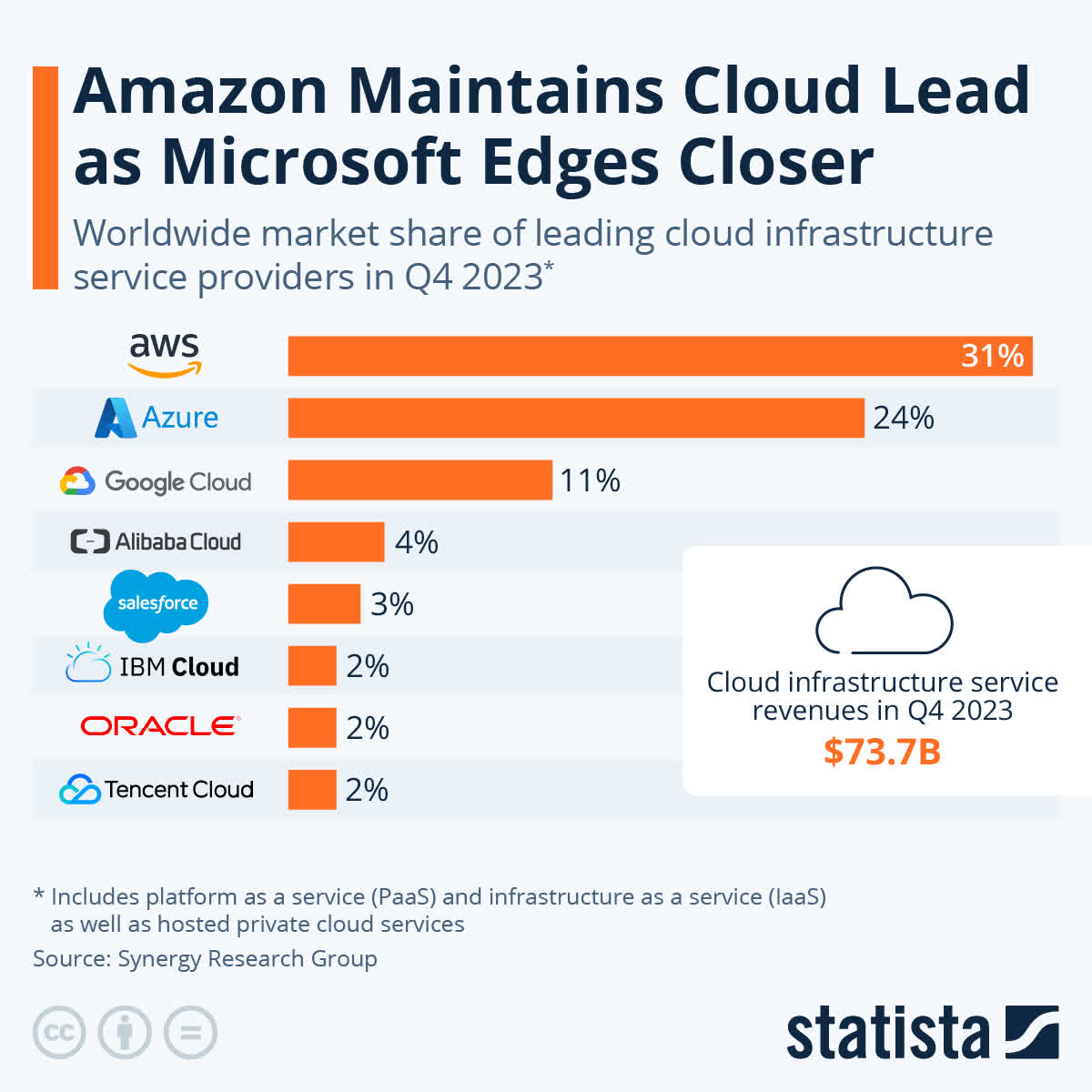

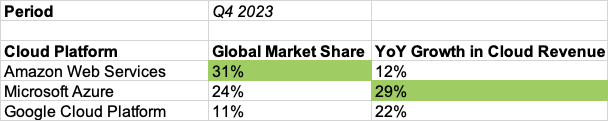

Cloud infrastructure market share (Q4 2023) (Collaborative Research Group)

We observe that as of the third quarter of 2024, Microsoft Azure has a 24% cloud infrastructure market share, largely surpassing well-known companies such as Google Cloud and Alibaba Cloud, and only falling behind Amazon Web Services. This is a good reflection of Microsoft’s dominance in the market, and we can expect the company’s revenue from such services to continue its upward trend. As a result, we’ve seen the company not only have growing revenue over the past two decades, but also continually pivot to become revolutionary and profitable in the technology space.

Leverage and Solvency

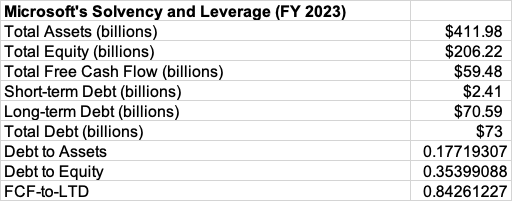

In addition to being a revenue-generating machine, Microsoft’s financials also show that the company is solvent and therefore fully capable of meeting its long-term debt obligations. We review the company’s key solvency and leverage ratios as of 2023.

Microsoft Solvency and Leverage (2023) (Compiled by the author, data from MarketWatch)

The company’s gearing ratio is about 0.18 – an impressive metric that suggests the company has total assets of about 5.6 times total debt. The company’s debt-to-equity ratio is also impressive. At about 0.35, the company’s total equity is almost three times its total liabilities! One thing to note, however, is that Microsoft’s free cash flow to long-term debt (FCF to LTD) ratio pales in comparison, with its free cash flow actually being lower than long-term debt. In fact, with the company’s recent investments in artificial intelligence – Notable is the $10 billion investment in OpenAI in 2023 – Free cash flow is expected to decline. Nonetheless, the company as a whole has proven to be capable of meeting its obligations – an important consideration when assessing a company’s financial health.

overall profitability

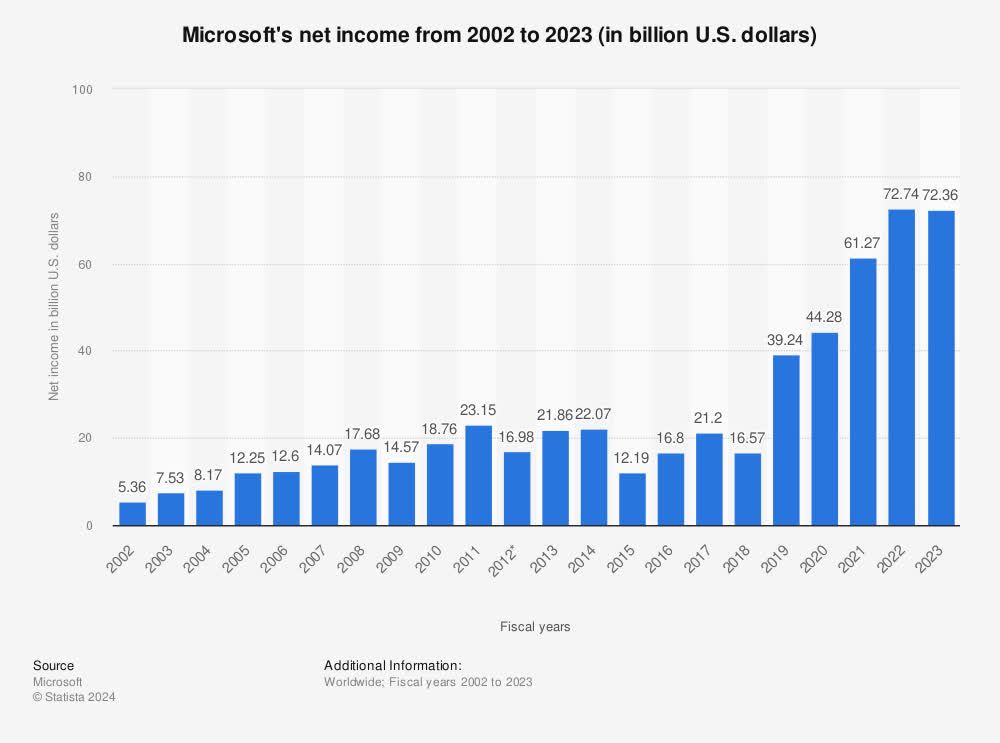

Now we review the latest trends in profitability metrics to show that Microsoft has been consistently profitable over the years. First of all, in 2023, the company’s gross profit margin will be 68.92%. In other words, for every $1 of revenue earned, approximately 69 cents are retained as profit. Consider that Microsoft outperformed industry rivals Amazon.com Inc (NASDAQ: AMZN ) and Alphabet (NASDAQ: GOOG ), which posted profit margins of 46.98% and 56.75% respectively during the same fiscal year , this achievement is impressive. Now let’s zoom out and look at the company’s net earnings over the past two decades.

Microsoft Net Profit (2002-2023) (politician)

Much like revenue, the company’s net profit has been on an upward trend, especially surging post-2018 as the adoption of cloud technology increased rapidly. As the company continues to repurchase shares (7.75b shares in 2019 and 7.47b shares in 2023, a compound annual decline of approximately 1%), this has also led to continued growth in the company’s earnings per share (EPS) – from 2019’s US$5.06 to US$9.68 in 2023, a CAGR of 17.6%. A company’s EPS ultimately measures how much the company earns per share, and it’s a metric that most Microsoft stock investors care about, so this is definitely a promising trend. All in all, Microsoft’s profitability indicators are pointing in the right direction.

future future

Now that we have a look at the company’s financial health, let’s take a look at what we can expect from Microsoft in the next few years.

Invest heavily in artificial intelligence

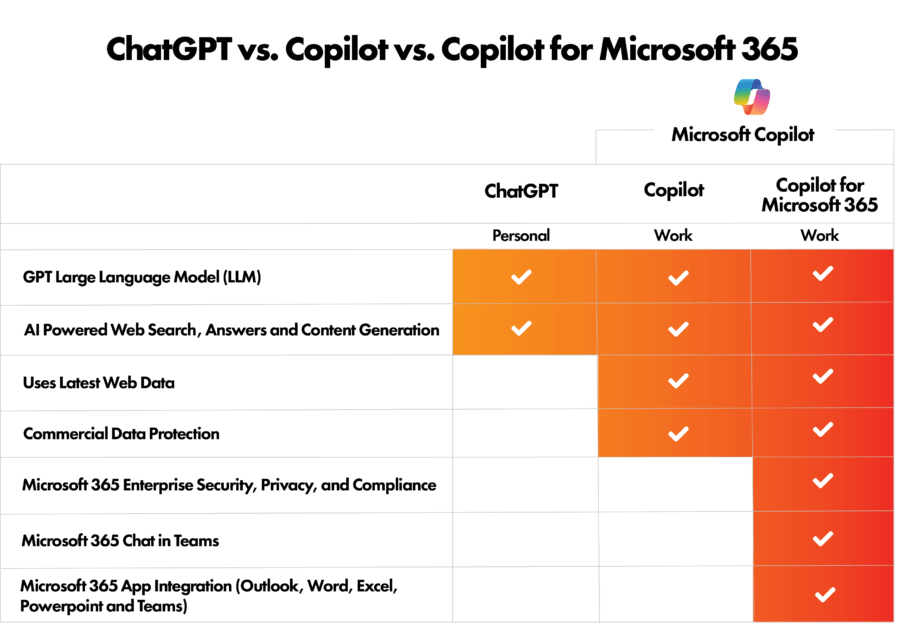

Microsoft has been in the AI scene, As we all know, OpenAI has invested a total of $13 billion. The company made its first investment in the AI startup back in 2019 — even before ChatGPT was invented! Through OpenAI’s cutting-edge solutions in the field of artificial intelligence, microsoft copilot Born in 2023. This feature integrates the technology behind the famous ChatGPT to optimize the user experience of Microsoft 365 applications. Leveraging the same technology, Copilot also provides solutions for businesses and individuals by increasing productivity and streamlining traditional processes.

ChatGPT vs Copilot comparison (Aviation Information Technology)

From the simple description above, we can see that the new products launched by Microsoft do have their own unique features in terms of practicality. In addition to basic functionality for content generation, integration with data security and Microsoft 365 is included.In addition to Copilot, we also see Microsoft Invest in various artificial intelligence startups – and digit and Mistral Artificial Intelligence is the latest. While we haven’t seen the full scale of these investments yet, it certainly demonstrates Microsoft’s commitment to keeping up with current technology trends and cementing itself as one of the key leaders in integrated AI solutions.

game acquisition

In addition to entering the field of artificial intelligence, Microsoft has also recently completed the Activision Blizzardis a popular video game company known for publishing some of the world’s most popular games, such as World of Warcraft, Candy Crush, and Call of Duty. This acquisition, valued at US$6.87 billion, is Microsoft’s largest acquisition to date. The move will further support the company’s gaming arm powered by the famous Xbox. We have seen earlier in the article that only 8% of Microsoft’s revenue comes from the gaming business – considering Activision Blizzard’s huge player base and dominance in the e-sports field, this number may rise.

Esports market share of the world’s top ten game companies in 2021 (Tifosi)

The chart above shows that Activision Blizzard held more than 21% of the e-sports market share in 2021, far exceeding companies such as Nintendo and Tencent. With this new large-scale acquisition, we can see overall revenue growth due to the growth of the company’s gaming business.

Rapid growth of cloud

As mentioned earlier, 34% of Microsoft’s revenue comes from server products and cloud services. Considering the development trajectory of the cloud computing industry, we expect this growth to accelerate.

Comparison of the largest cloud platforms in the fourth quarter of 2023 (Prepared by the author)

As we can see from the above, although Microsoft Azure lags behind Amazon Web Services in global market share, its cloud revenue grew the most compared to the same period last year. That’s significant, especially considering the company’s cloud revenue grew an impressive 26% year over year last quarter.Furthermore, it is reported earlier this year Microsoft Azure’s OpenAI service will be integrated into the cloud government platform. blue government, discover new solutions that leverage generated artificial intelligence to develop policy and analyze data. The rapid adoption of Azure and the integration of artificial intelligence can certainly take Microsoft to heights we have never seen before.

Valuation

Now, we use a simple 5-year forecast of the company’s earnings per share and discount it at the weighted average cost of capital to get an estimate of the fair valuation of Microsoft stock.

hypothesis

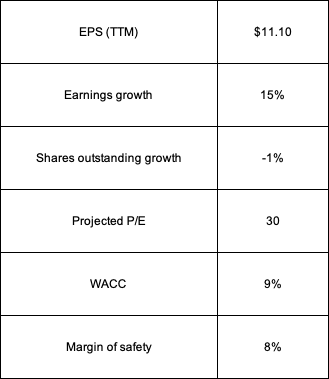

Assumptions used in the model (Prepared by the author)

We’ll use Microsoft’s current trailing twelve month earnings per share of $11.10 and the company’s weighted average cost of capital of 8.79%. As for annualized earnings growth, I decided to go with a reasonable forecast of 15% — a few percentage points lower than the company’s average growth rate from 2019 to 2023. I also believe it’s fair to expect a 1% annualized share repurchase given the company’s history of repurchasing stock. For the company’s forecast P/E ratio, I chose 30, which is slightly higher than the company’s 10-year average P/E ratio of 29.4, but significantly lower than the company’s current P/E ratio of 38.6. Finally, I added an additional 8% margin of safety.

Intrinsic Value

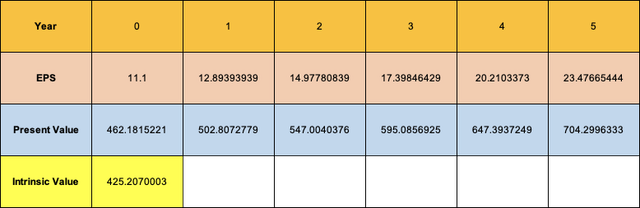

Fair valuation of Microsoft stock (Prepared by the author)

Based on my relatively conservative assumptions, we get a fair value for Microsoft stock of $425.21 per share. That’s not too far off from where the stock is currently trading!

Analyst Ratings

Microsoft stock price target (Compiled by the author (data from Finviz))

A quick look at coverage of Microsoft stock this year shows price targets well above the current share price – Morgan Stanley is the most bullish, with a price target of $520. The average price target for Microsoft stock based on 2024 ratings is about $494 per share.

final investment decision

All in all, it’s hard to deny that Microsoft is a company with a strong track record and a bright future. With investments in gaming, cloud technology and artificial intelligence, the company can remain profitable even in an evolving technology environment. As for the company’s stock valuation, the assumptions in my EPS model are relatively conservative, and other analysts from larger institutions certainly have more optimistic forecasts. In my opinion, the company has considerable investment value at its current valuation, because if Microsoft continues on its path of growth and innovation, it has a good chance of performing at or above my forecasts. Therefore, I rate Microsoft stock a Buy with a price target of $425.21.