Daniel Grizzell

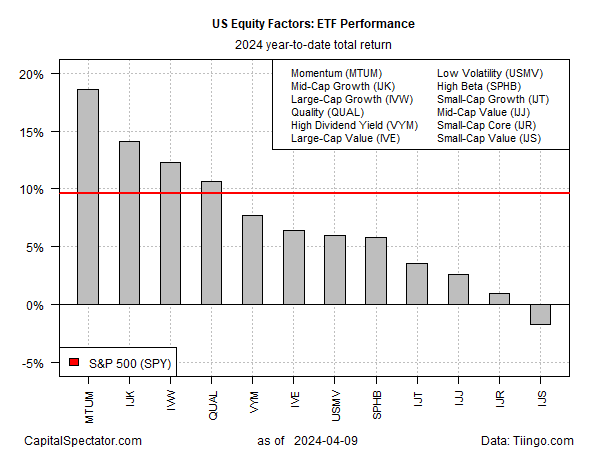

Most sectors of the U.S. stock market continue to enjoy solid gains so far in 2024, but momentum risk factors remain upside outliers based on a group of ETFs as of Tuesday’s close (April 9).

this iShares MSCI US Momentum Factor ETF (MTUM) year-to-date increase is as high as 18.6%. This was well ahead of the market’s 9.6% gain (spy) and the world of the worst stock factor performance in 2024: Small-cap value stocks fell 1.7% (ice).

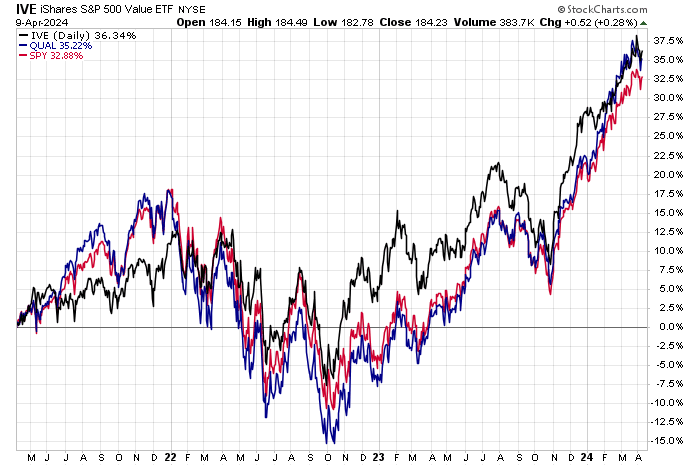

MTUM’s strong performance this year may be related to a recovery from relatively weak performance in 2023, when the ETF significantly underperformed the broader market (SPY).

As for small caps, frustration and regret abound. In recent years, many analysts have argued that this part of the market is poised for growth. rally, but the false dawn continues.

“You take on more risk because these companies are smaller and less mature,” explain Steve Sosnick, chief strategist at Interactive Brokers. “They usually don’t have … bottom-line results that they can rely on. That’s usually a real headwind for them, and unfortunately, this is one of them.”

Where it works, it’s hard to beat the market (SPY) from a factor perspective, with two exceptions: market value (IVE) and quality (QUAL). Using the past three-year window, both parts of the equity factor universe have outperformed the standard measure of U.S. equities.

Something to watch out for: poor performance. The chart above reminds us that beating relatively simple cap-weighted equity strategies has always been challenging. In fact, critics of factor-based investing argue that recent history shows that traditional market-cap indexes remain a more attractive option than trying to slice and dice them. If the past three years are any guide, that’s a hard argument to dismiss.

Editor’s note: Summary highlights for this article were selected by Seeking Alpha editors.