Sergio Delle Vedove/iStock Editorial via Getty Images

Since I wrote about Italian luxury outerwear brand Moncler ( OTCPK:MONRF ) ( OTCPK:MONRY ) last October, the stock is up 28%, going against my holdings. evaluation of it at the time. While the company’s strong revenue growth in the first half of 2023 (H1 2023) and margin expansion potential for the rest of the year look promising, there are two reasons for a Hold rating.

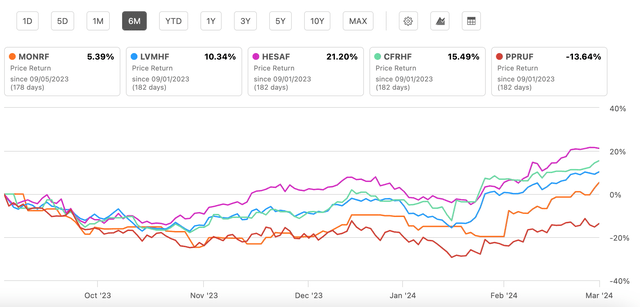

First, its market multiple was higher than its peers, and second, the momentum at the time was not conducive to luxury goods stocks.However, the industry has been on an upward trend since then, especially so far in 2024, with the S&P Global Luxury Index rising increased by 6.8% Year-to-date (YTD) growth is 7.3% compared to last year. In fact, the stock prices of most large luxury brands have exceeded Moncler. Price performance over the past six months (see chart below).

Cost-effectiveness, compared with peers (Source: Seeking Alpha)

At first glance, this comparison seems positive for Moncler.But there’s a lot to unpack in this story, including the recently released final quarter (Q4 2023) for all of 2023 result. Let me take a look here:

- Key takeaways from the latest data

- What do they and the company suggest about the outlook for 2024?

- Moncler’s current market multiple compared to peers

4 takeaways from 2023 results

The company’s 2023 numbers still look good. But the most important theme is actually the divergence between the first half of 2023 and the second half of 2023, with the first half of 2023 results providing significant support, followed by some weakness in the second half of 2023. The only exception is operating margin expansion in the second half of 2023. Specifically, here are four key takeaways from the results.

#1. Revenue growth remains strong in 2023: Although revenue growth slowed to 17% in constant currency (cfx) terms compared with 25% in 2022, revenue growth itself is still good considering the weak demand in the luxury industry. In fact, it’s the fastest growing of the major luxury goods companies after Hermès ( OTCPK:HESAY ) , with 21% growth in 2023. What’s more, its growth rate improved in the fourth quarter of 2023, when it grew 12.7% year over year (YoY), before slowing to just 7%.

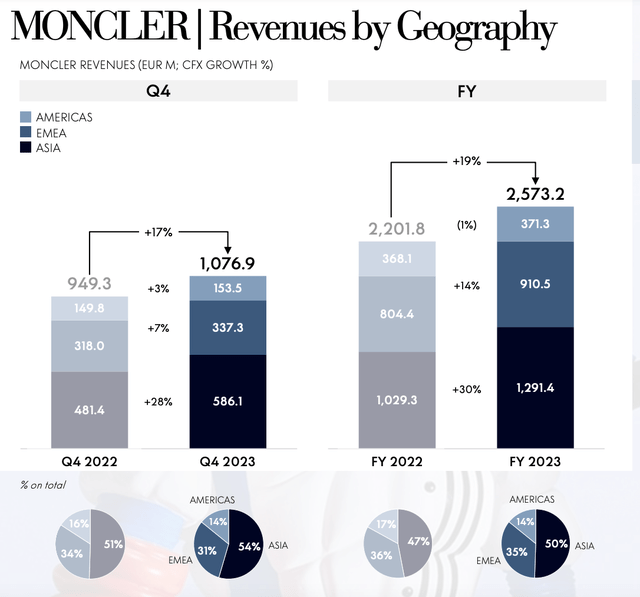

Source: Mengke Favor

#2. Geographical advantages: Moncler benefited from a blowout in its big Asian market (see chart above), as demand in China particularly accelerated in the fourth quarter of 2023 from a low base in 2022, when the market faced COVID-19 restrictions. The decline in sales in the Americas contributed relatively little to its revenue and had a relatively limited impact. But it’s worth noting that even demand growth in the Americas turned positive in the final quarter.

#3. Operating margin improvement in second half of 2023: Its full-year 2023 operating margin is 30%, which is a relief, after reporting an operating margin of 19.2% in the first half of 2023. There is significant historical seasonality in its margins, so it is expected to improve, but it cannot be taken as a given amid weak demand (see the article’s first link on why margins are relatively low “discussion) ). The current full-year profit margin is slightly higher than 29.8% in 2022. Strong operating profit margin is a highlight of Moncler. Its operating profit margin is 42%, second only to Hermès, which is very similar to revenue growth.

#4. Net profit margin weakens: Net profit margin also improved from 12.8% in the first half of 2023 to 20.5% in 2023. However, it does slow down from 2023 levels of 23.3%. However, this difference occurs only because of the positive impact of taxes on Stone Island’s brand value adjustment last year. The latest profit margin is not significantly different from the 20.7% average over the past decade. In other words, based on the latest data, there are no ongoing underlying reasons why net profits will decline.

Prepare for slower growth in 2024

The question now is whether Moncler can continue to grow at the same rate as 2023. This seems unlikely for three reasons. First, the growth rate slowed to 9.7% in the second half of 2023, while the growth rate in the first half of 2023 was 24%, showing that even if the growth rate picked up in the fourth quarter of 2023, the overall growth rate still slowed down significantly.

Second, while Moncler did not provide a quantitative outlook, it did say that “entering 2024, the global macroeconomic and geopolitical landscape remains uncertain and unpredictable,” suggesting that weak growth may continue. Finally, this is reinforced by analyst forecasts from Seeking Alpha, which predicts revenue growth of 8% in 2024 in U.S. dollars and 9.7% when converted to its national currency, the euro.

market multiple

Since analysts’ forecasts are consistent with revenue growth in the second half of 2023, I think this is exactly what growth looks like when forecasting forward multiples. Assuming the net profit margin also remains at the 20.5% level in 2023, net profit will reach 659.2 million euros ($715.5 million). Even with slower revenue growth, revenue growth will improve to 7.7% from less than 1% in 2023.

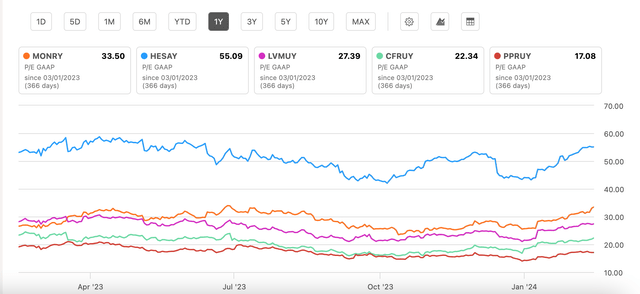

However, the forward price-to-earnings (P/E) ratio remains at a fairly high 27.6 times. For reference, this is higher than the 25.4x level the last time I checked. Furthermore, Moncler’s trailing 12 month (TTM) price-to-earnings ratio is 33.5x, up from 26.1x when I last wrote. It’s also higher than its peers’ numbers (see chart below).

Price to earnings ratio, GAAP, TTM, comparison with peers (Source: Seeking Alpha)

What’s next?

Heading into the remainder of 2024, the demand situation not only for Moncler but also for the luxury goods industry remains incredible. Slowing U.S. growth is evident in demand for luxury goods, while worries about China’s recovery are not helping. The company’s revenue growth in the second half of 2023 has slowed significantly.

Even so, if Moncler can maintain its net profit margin, its net profit will grow faster than last year. However, this does not translate into a favorable forward P/E ratio, which is higher than that of its peers.

It does have the advantage that its sales to the United States are much lower than those of its peers, which could insulate it from a slowdown in the U.S. economy. The company also has higher revenue growth and operating margins than peers other than Hermès. However, this advantage is already reflected in the current premium on the stock.

Given the stunning price gains over the past few months, it’s easy to believe this is here to stay. But that’s more due to a rebound in luxury sector stocks than any fundamental factors. For now, price momentum remains likely to deteriorate. Therefore, I retain a Hold rating on Moncler.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.