Colin Anderson Productions Ltd.

Bonds are falling due to “longer-term higher” interest rate expectations, and I view this dip as a buying opportunity. I’m particularly interested in long-term bond funds, Nuveen Premium Municipal Income Fund (NYSE: NAD) caught my attention not because it has fallen to an attractive buy point; rather, it has fallen only slightly, but that relative strength tends to reflect good fundamentals and may mean it is not affected by The impact of external shocks.

industries with comparative advantages

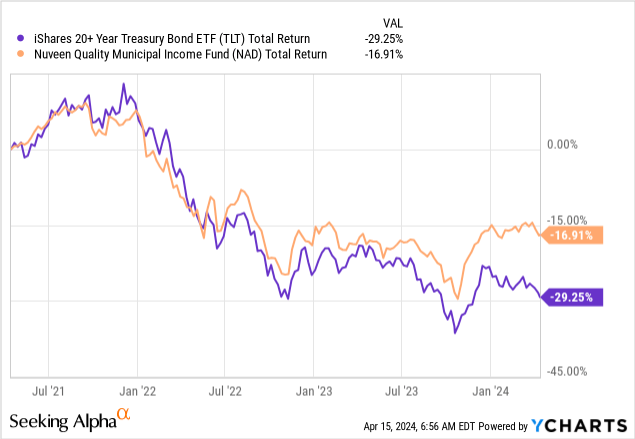

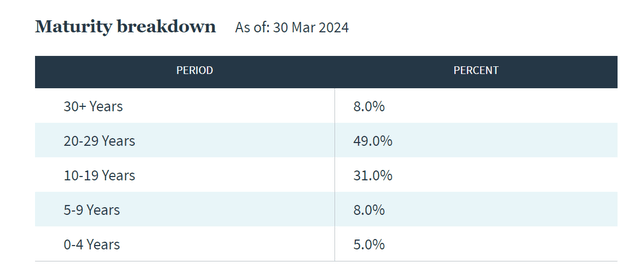

NAD holds a portfolio of municipal securities with an average maturity of 18.77 years. As such, it has similar interest rate sensitivities to the iShares 20+ Year Treasury Bond ETF (TLT) and tends to be closely correlated.

However, NAD has significantly outperformed the rest of the market over the past three years by a wide margin expand. Importantly, NAD has performed better during the recent economic downturn and has significantly outperformed the market by 6.61% over the past six months.

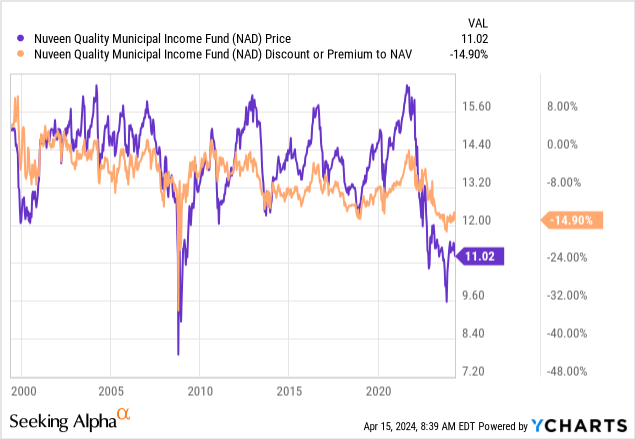

This relative strength is ideal. Not only should NAD be immune to macroeconomic downturns, but it’s also likely to outperform during a rebound. Additionally, the fund trades at an attractive -14.90% discount to NAV. This time last year, the discount was -12.5%. Another attraction is its 5.66% dividend increase in March.

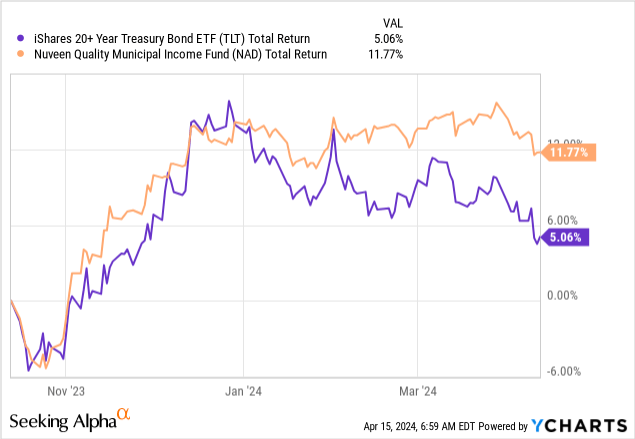

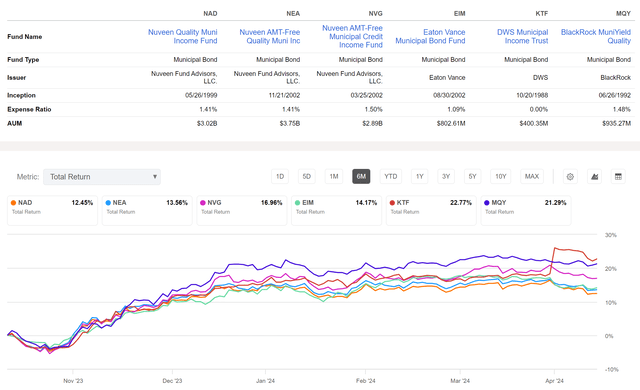

Still, NAD has underperformed over the past six months compared with other municipalities in its industry.

NAD compared to peers (Seeking Alpha)

Looking at the long term, NAD has performed slightly better over the past five years, but it’s worth noting that the overall industry has underperformed due to significant losses in 2022-2023.

NAD vs. Peers 5 Year View (Seeking Alpha)

I do think this poor performance is in the rearview mirror; bonds (and muni bonds) should have bottomed out and any dip is a buying opportunity. The Fed has ended raising interest rates and is almost certain to cut rates this year, even if inflation rises slightly and delays a rate cut until September.

Take a closer look at NAD

Allocations and Fees

NAD is a leveraged CEF, based on Fund page“invests in municipal securities that are exempt from federal income taxes.” It provides holders with monthly tax-free distributions and currently yields 5.66% based on the last payment.

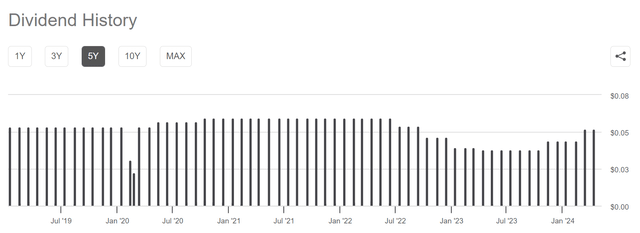

After allocations declined in 2022 and early 2023, allocations are rising again, and There was an increase in March.

Dividend history (Seeking Alpha)

While this is attractive, the distribution increase is funded by return on capital (ROC), and distribution coverage has dropped to just 74%.

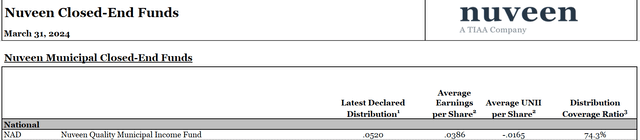

Distribution scope (Nouwen)

This can be off-putting, and a high expense ratio is also a red flag.

expense ratio (Nouwen)

When buying funds for income, every percentage matters. That said, fees are complicated by leverage and other factors that may increase fees but improve overall performance. So I look back at total returns, which still compare favorably to many bond ETFs but lag behind peers in the municipal space.

Performance matters

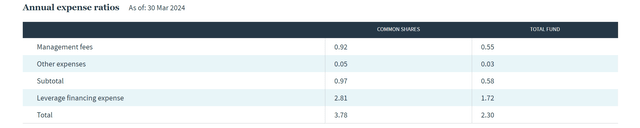

Clearly, the increased allocations have not improved NAD’s relative performance over the past six months. Neither uses leverage, which is used primarily for preferred stocks but also for tender-option bonds. The fund has effective leverage of up to 40%, which can be expensive in the high interest rate environment we’re in now.

NAD capital structure (Nouwen)

The maturities of the 1,183 bonds it holds provide some flexibility, and since the average maturity is lower than, for example, TLT, it will be less hurt by recent interest rate increases.

NAD Maturity Date Breakdown (Nouwen)

NAD does have an attractive discount of -14.9% relative to NAV. This number was pulled lower as NAD prices plummeted from 2022 to October 2023, with the discount reaching -17.6%. 2008 was the only time the company traded at a deeper discount.

Fund holding

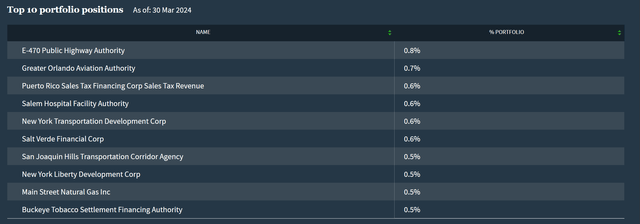

NAD’s holdings are diversified, with no single holding exceeding 1% of the fund.

NAD Top Holdings (Nouwen)

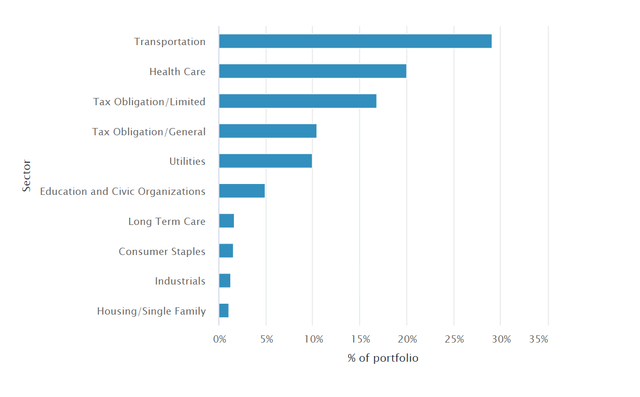

In addition, diversification also extends to industry.

Industry exposure (Nouwen)

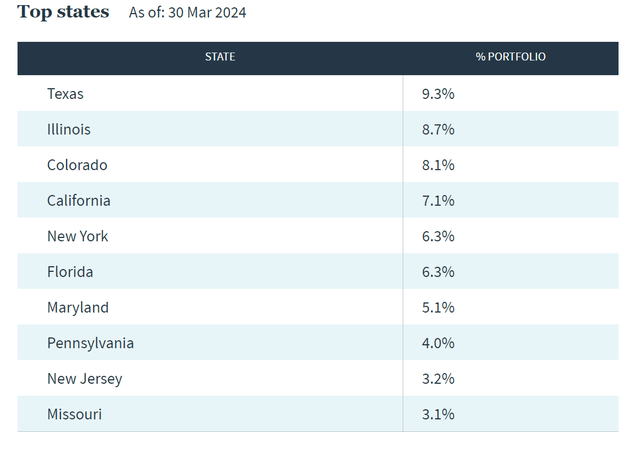

and country.

NAD state-owned holding (Nouwen)

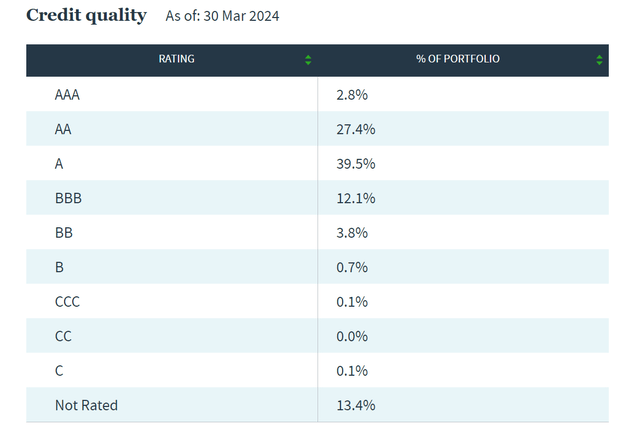

My only minor complaint is the “quality” statement in the fund’s name. Yes, the vast majority are investment grade BBB or above, which is an overall safe portfolio, but since 4.7% of the fund is a BB or even C-grade investment, the quality could be better.

Holdings credit rating (Nouwen)

Other considerations

NAD has $3.02B in AUM. The firm is actively managed by Stephen J. Candido and Michael S. Hamilton, CFAs, who use a bottom-up stock-picking approach to find undervalued or undervalued investments.

Average daily stock trading volume is as high as 1,045,485 shares.

in conclusion

NAD is an attractive closed-end fund with a 5.66% dividend rate and monthly distributions that are tax-free. The use of leverage, maturity breakdown, diversification, and discounts to NAV are all positives and lead to outperformance compared to traditional bond ETFs like TLT. However, its performance is less impressive compared to other municipal bonds, and there may be better opportunities in the space.