lucky photographer

Last week, the Fed meeting went as expected, with underwhelming results. I’ve been thinking more about bonds around that date, and it’s a good time to update my view that short-dated bonds are still quite attractive.At the same time, I Still don’t have a strong view on long-term goals. The key points of this meeting have been widely reported, but I think it’s worth taking the time to discuss them. Review things yourself Or better yet watch or re-watch the content in the video. No matter which medium you use, whether it’s Seeking Alpha, WSJ, Bloomberg or Fintwit, there’s always something that gets lost in translation.

Overall, not much has changed. Federal Reserve Chairman Powell once again reiterated that the Federal Open Market Committee will continue to focus on inflation management, and the long-term goal is still 2% and full employment.I tend to Policymakers believe that if inflation fluctuates in the 1.5%-4% range for a few years, it won’t be the end of the world. That’s a relatively high number given their goals, but it won’t be a problem for them as long as long-term inflation expectations remain low. At the same time, addressing high government debt, driven at least in part by the pandemic, could help. It could also make it easier for the Fed to shrink its balance sheet over time. But this is just my subjective interpretation and not the official position of the FOMC.

Digging into the details, I’d say the economy is probably already on the strong end of the range expected by Federal Open Market Committee (FOMC) members so far. This is definitely much stronger than I expected given the historical rate hikes we’ve seen.

Here’s what Powell said to describe where we are now (emphasis mine):

we know Reduce policy restrictions too quickly or too much could lead to a reversal of the progress we have made on inflation and Stricter policies will eventually be needed Bring inflation back to 2%. at the same time, Reducing policy restrictions too late or too little could unduly weaken economic activity and employment.

…The Committee does not anticipate lowering the target range until it is more confident that inflation will continue to fall to 2%.. Of course, as we commit to both sides of our dual mission, unexpected weakness in the labor market may also require policy responses…

He’s basically saying the FOMC could err in either direction. From listening to Fed chairmen over the years, I understand that Powell may think easing rates too early would be a bigger mistake. If there were clear signs of significant labor force weakness, I don’t think he would hesitate to ease monetary policy even if inflation was still above target at that time.

The most interesting comments related to the balance sheet runoff (emphasis mine):

At this meeting, we discussed issues related to slowing the rate of decline in securities holdings. While we have not made any decisions on this today, the overall feeling of the Council is that it is appropriate to slow the runoff as quickly as possible, in line with our previously published plans. The decision to slow down the runoff does not mean that our balance sheet will ultimately shrink less than it would have otherwise, but rather it will allow us to move closer more gradually to that final level. In particular, slowing runoff will help ensure a smooth transition, Reduce the likelihood of currency market stress This will facilitate the continued decline of our securities holdings and the achievement of appropriate adequacy reserve levels.

Later he responded to a question about balance sheet runoff (emphasis mine):

Chairman Powell. So, it’s kind of ironic that by slowing down, you can go further, but that’s the idea. The idea is that by having a smoother transition, you don’t, you run the risk of various liquidity issues that could develop into shocks and potentially cause you to stop the process prematurely. So as far as how this plays out, we will be carefully monitoring money market conditions and asking ourselves what they are telling us about reserves. Are they? Now we describe them as abundant, and our goal is sufficiency. And the quantity is a bit small. So there’s not a dollar amount or a percentage of GDP or anything like that, we think we have a very clear understanding and we’re going to be looking at those, particularly what’s going on in the currency markets, a bunch of different indicators, including what I mentioned of those that tell us when to approach.

If I remember correctly, not too long ago the Fed put the balance sheet on autopilot. Part of the reason for the self-driving runoff is that it avoids signaling to the market that the Fed thinks something is wrong. Another benefit is reduced volatility because the market can more easily predict supply and demand.

Powell has made it clear multiple times that they are not worried about the banking system. The last thing he wanted to do was throw them under the bus. There is this sentence in the December 2023 FOMC press release:

The U.S. banking system is sound and resilient.

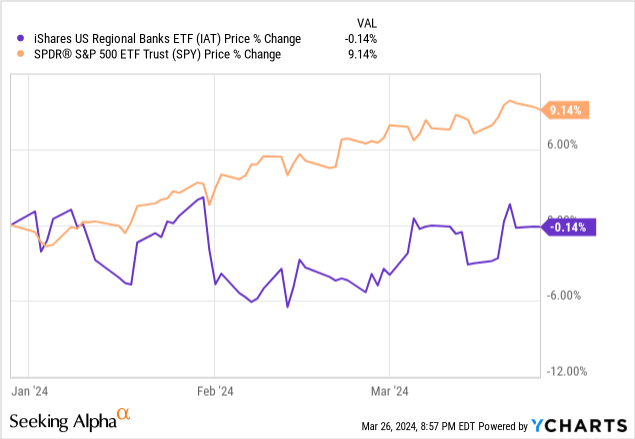

This sentence appears in virtually every FOMC meeting press release except for the first meeting press release in 2023. Maybe they just thought it was time to drop the subject in the New Year. With a few exceptions, regional banks haven’t fared well, but it doesn’t look like there’s a huge crisis going on:

I’m not sure what the above means for the bond or stock markets. The potential liquidity issues cited by Powell appear unlikely to have a negative impact on short-term bonds. I think reducing runoff would have a beneficial effect on the longer end, but if the runoff scale is reduced, it may not have an impact because something is wrong with that end of the curve.

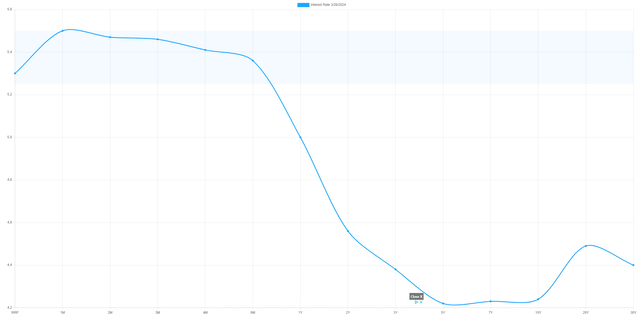

Over the past year or so, I’ve written a lot about bond positions (short or long). For quite some time I have favored the short end of the curve. The curve remains inverted, with shorter maturities yielding higher yields.

US yield curve in March 2024 (U.S.TreasuryYieldCurve.com)

This should indicate that the market thinks rates are going to fall, and if you don’t lock in these higher rates, you’re missing out on an opportunity. At some point, interest rates will fall. If interest rates fall back to 1% next year, people buying long-term bonds now will do very well. Suddenly, short-term bond positions will look downright foolish. So far, markets continue to surprise, with short-term rates remaining strong and long-term rates remaining low.

Short-term notes are one of my top 5 positions for 2024. There are some opportunities and reinvestment risks. However, there is almost no credit risk in the short term. When talking about my bond positions, I usually emphasize only large-cap short-term bond ETFs. Many people prefer the future.This time, I want to highlight a lesser-known bond ETF called U.S. Treasury 3-Month Notes ETF (NASDAQ:TBIL). It gets the job done. This passively managed ETF attempts to mimic the price and yield performance of the ICE Bank of America U.S. 3-Month Treasury Index. The fund charges just 0.15% in fees, which means it’s among the cheapest 20% of funds in this category, according to Morningstar.