XH4D/E+ from Getty Images

In my last article on Nemetschek SE (OTCPK:NEMTF) from August 2023, I was quite bearish (or at least very cautious) on the stock as an investment, writing:

Nemetschek’s share price has fallen by about 60% The previous all-time high has now fallen sharply. Currently, the stock is still trading nearly 50% below its previous all-time high. But if Nemetschek is already a good investment and the stock currently remains on my watch list, I’d still be a little cautious.

At the same time, however, the stock has performed well, significantly outperforming the overall market (which has grown rapidly). About two weeks ago, on March 21, 2024, Nemetschek had announced its full-year results for fiscal year 2023, and the combination of rather mediocre results (we’ll come to this later) and a higher share price, Making me more cautious about Nemetschek as an investment, an update seems warranted.

Report results

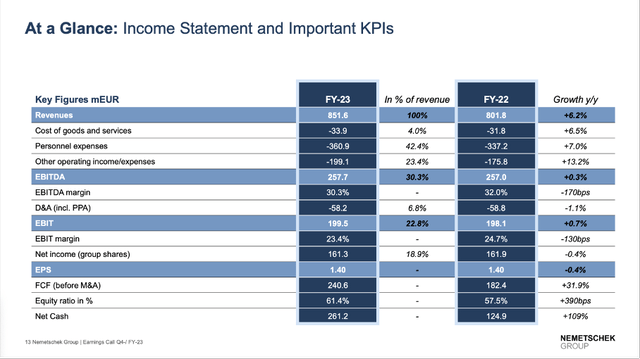

About two weeks ago, Nemetschek reported results for fiscal 2023, and while the results were once again solid, they weren’t as good as in previous years. Nemetschek’s revenue in fiscal year 2023 was 851.6 million euros, compared with 801.8 million euros in fiscal 2023, an annual increase of 6.2%. Although revenue achieved mid-single-digit growth, EBIT increased by only 0.7% annually, from 198.1 million euros in fiscal 2022 to 199.5 million euros in fiscal 2023. Finally, net profit per share was unchanged from fiscal 2023. Previous year – FY2022 and FY2023 it was €1.40.

Nemetschek Q4/23 Demo

While the income statement isn’t that great, free cash flow increased from €161.4 million in fiscal 2022 to €215 million in fiscal 2023, an annual increase of 33.2%. But the more important indicator is free cash flow before mergers and acquisitions – this indicator increased from 182.4 million euros in fiscal 2022 to 240.6 million euros in fiscal 2023, an annual increase of 31.9%.

Nemetschek Q4/23 Demo

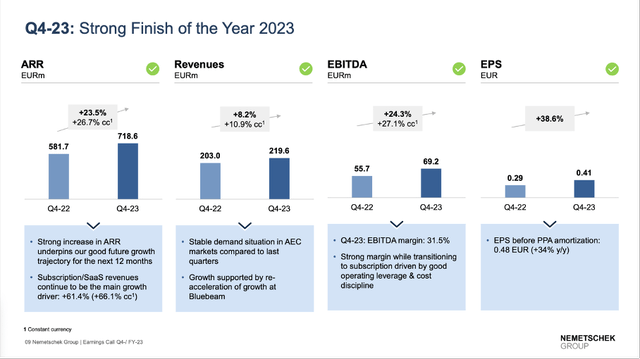

Looking at the fourth quarter, results look much better than fiscal 2023. Revenue in the fourth quarter increased by 8.2% year-on-year (or even increased by 10.9% at constant exchange rates), and earnings per share increased by 38.6% year-on-year, from 0.29 euros in the previous year to 0.41 euros in the fourth quarter of fiscal year 2023. But I don’t know if we should look at a quarter as a positive sign that growth is picking up again.

Nemetschek Q4/23 Demo

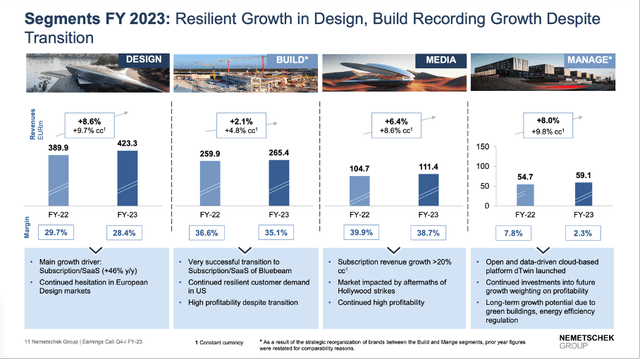

When looking at the four different segments, all four segments contributed to the growth, out of which put up Year-on-year growth of only 2.1% design Year-over-year growth of 8.6% (the other two segments are in between). While all four segments can grow revenue, margins across all four segments declined compared to fiscal 2022.

In addition to the four different segments, we can also classify income based on different sources. On the one hand, Nemetschek is generating revenue through software licensing, and revenue from this source fell from 233.1 million euros in the previous year to 161.1 million euros in fiscal 2023, which is a good sign as it indicates that more and more customers There is a shift towards subscription models as well as recurring revenue. Recurring revenue, on the other hand, increased from €532.6 million in fiscal 2022 to €652.7 million in fiscal 2023 (subscriptions and SaaS increased from €204.2 million in the previous year to €301.8 million this year).

Performance during recessions

While we can clearly see that subscriptions are driving growth, we also have to acknowledge that Nemetschek reported its lowest revenue growth since 2013. In addition to a slowdown in growth rates, there are many other hints (such as an inverted yield curve in the U.S. states) that make us very cautious about what might happen.

While the stock market is running from all-time highs to all-time highs, we should try to think ahead and already account for what might happen. Part of thinking ahead is also looking at different businesses and assessing which companies (and stocks) are likely to do well even during a recession and which ones definitely won’t. As far as Nemechek is concerned, there are several reasons to be cautious.

Performance during past recessions

First, when looking back at the last few recessions, we can clearly see Nemechek’s response to them. In 2020, we saw a mixed picture: While revenue continued to grow by mid-to-high single digits, EBIT and EPS fell significantly in 2020 (but recovered quickly in 2021). Looking at the financial crisis, we see that revenue fell in 2009 (down about 10% compared to fiscal 2008) and earnings per share (and EBIT) fell by about 25%.

Looking back on the years after the dot-com bubble, things got even worse. Revenue fell from approximately 126 million euros in fiscal 2000 to 96 million euros in fiscal 2003, and between 2000 and 2002, the company made no profits.

It’s not always double-digit growth

Furthermore, we shouldn’t just look at the recession years but at the bigger picture. When talking about past growth rates, we often look at the past ten years and reported a revenue CAGR of 16.44% and an EPS CAGR of 21.04% during this decade. But looking back over the past 20 or 30 years, things are starting to look a little different. We can see that there are “two Nemecheks” – the Nemechek after the financial crisis and the company, especially in the 2000s.

|

1999-2010 |

2010-2023 |

|

|---|---|---|

|

income |

Compound annual growth rate 1.63% |

The annual compound growth rate is 14.31% |

|

EBIT |

Compound annual growth rate 2.87% |

Compound annual growth rate 17.00% |

|

Earnings per share |

Compound annual growth rate 6.50% |

Compound annual growth rate of 18.16% |

Looking at growth rates since 2010, we’ve seen impressive double-digit growth in both revenue and profit. However, when looking at the decade before 2010 (1999 to 2010 in this case), we see a completely different picture. Revenue only increased from 125.29 million euros in 1999 to 149.75 million euros in 2010, a compound annual growth rate of 1.63%. Earnings per share could at least double from €0.08 to €0.16, a CAGR of 6.50%, which is a solid bottom-line growth rate, but well below what Nemetschek has reported over the past decade.

When seeing the huge difference between two different time frames, we can ask the question: should we really look at the past decade and assume similar growth rates in the next decade.

Real estate and housing market

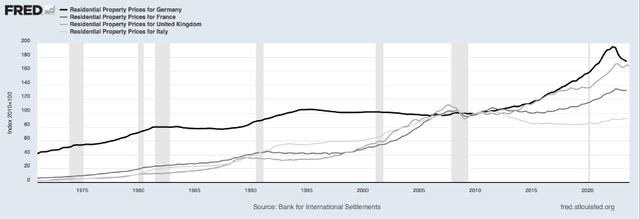

We can see that Nemetschek’s performance in these two phases is also consistent with the German real estate market (in other European countries the difference is not so clear). In 2010 (and in previous years), the German market had a greater impact on Nemetschek (41% of revenue in 2010).

fred

We can look at the housing prices in Germany since 2000. From 2000 to 2010, housing prices have been basically stable. The situation is a little different in the rest of Europe (and of course the United States). After the financial crisis, German house prices began to rise. Despite the extremely high growth rates reported by Nemechek, house prices in Germany are also growing at extremely high rates.

Real estate expectations

When Nemechek tries to predict the next few years, the future of housing and the real estate market seems to play a big role.In the 2000s, particularly in the German real estate market, Nemetschek generated 41% of revenues (see 2010 Annual Report)In 2010. By 2023, the picture is very different: 38% of Nemetschek’s revenue comes from the United States, 21% from Germany, and 32% from Europe (excluding Germany).

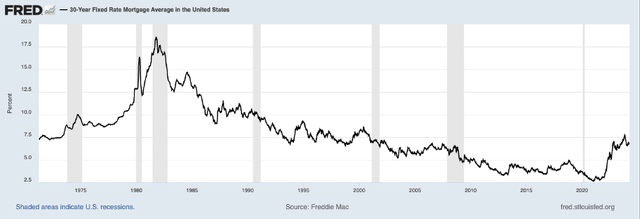

Therefore, it is important to pay attention to developments in the United States and Europe (especially Germany), as well as the real estate market and construction industry. First, mortgage rates in the United States remain high (their highest in the past 20 to 25 years).

fred

In Germany, the situation is similar.I have Data for the past 15 yearscurrent interest rates are the highest since 2011.

Regarding interest rates, one could argue that interest rates were much higher in the 1980s and 1990s, but homes were still being built. Of course, it’s not just interest rates that are at play. But looking at different indicators, things don’t look good – especially in Germany, where the situation seems grim.

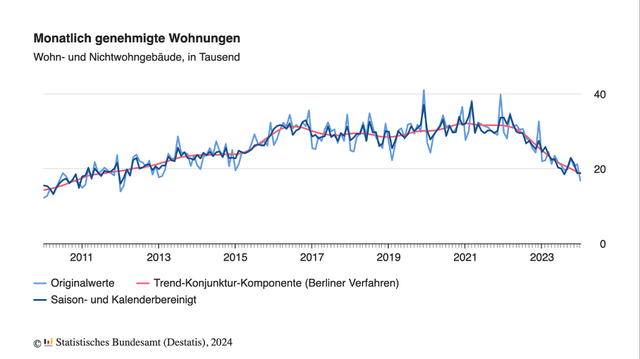

we can take a look housing permit Housing permits in the United States have been stagnant for about 1.5 years after falling in 2022.But while U.S. housing permits remain at fairly high levels, building permits in germany Sharp declines continue—especially for single-family homes, where we expect a 42.7% annual decline in January 2024. For two-family or multi-family dwellings, the annual reduction remains at 20%.and Construction new order The annual decrease in January 2024 is approximately 7%.

German monthly residential permit (stand up)

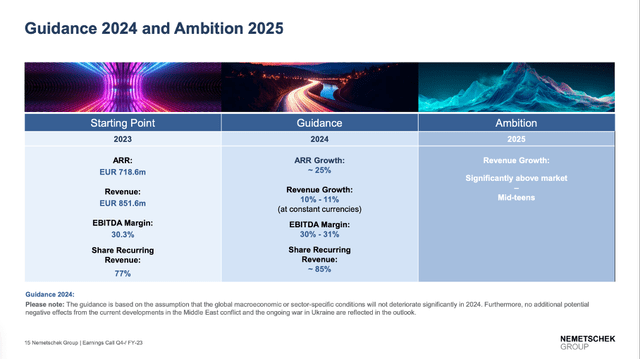

On the other hand, Nemetschek is quite optimistic about fiscal 2024, and the company expects revenue to grow by double digits again (at least at constant exchange rates).

Nemetschek Q4/23 Demo

Nonetheless, I am cautious about the growth rate Nemetschek can achieve, nor do I think that in the foreseeable future the construction industry (Germany and the US) will see similar activity to the past 5-10 years.

intrinsic value calculation

But even if we’re optimistic about Nemechek and assume high growth rates over the next few years, questions remain. The stock is so expensive and trades at such a high valuation multiple that it would require an extremely high growth rate to justify the current share price.

When calculating simple valuation multiples, this depends somewhat on the data we use. When using FY2023 earnings per share of €1.40, we get a P/E ratio of 64, which is an extremely high valuation multiple. We can use free cash flow instead of EPS (I will use free cash flow before M&A), which is €240.6 million in FY23, resulting in a P/FCF ratio of 42. That looks a lot cheaper than the valuation multiple of 64, but it’s still an extremely high valuation multiple that can only be justified by extremely high growth rates.

Using a discounted cash flow calculation, we can determine the growth rate required to fairly value Nemetschek. As the basis for our calculations, we use free cash flow of €240.6 million and 115.5 million shares outstanding, and as always apply a 10% discount rate. Calculating under these assumptions, Nemechek would have to grow 14% annually over the next decade and 6% forever.

Now we can go back to two different time frames. When looking at Nemetschek since 2010, we can say that Nemetschek is at least fairly valued and should be able to grow at least 14% per year. But judging from the growth rate before 2010, almost everyone would think that Nemechek’s valuation is overvalued, and it is difficult to justify an annual growth rate of 14%.

add up

I still rate Nemetschek a “Hold” because we’re talking about a high-quality business. But I think shareholders should really analyze for themselves whether the current stock price is an opportunity to reduce their positions. As always, I recommend against shorting quality businesses like Nemetschek, but I’m certainly not a buyer at this time.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.