Michael M. Santiago/Getty Images News

investment thesis

I believe Netflix, Inc.’s (NASDAQ: NFLX)’s strategy of using artificial intelligence to reduce password sharing presents an interesting investment opportunity for the streaming giant (although such password crackdowns are well-publicized).

With the introduction of transfer profile schemes and stricter regulations, users have been forced to either pay extra to add additional members to their profiles or kick people off. These strict regulations have fueled Netflix’s recent success. They found success soon after implementing these plans, gaining a record 13.1 million subscribers in the fourth quarter of 2023 alone.

The results of these methods have proven successful so far. In the fourth quarter of 2023, net profit increased to US$938 million from US$55 million in the previous year. Revenue also grew significantly by 12.5% to US$8.8 billion.In addition to these revenue increases, the introduction of Their ad-supported program, which appeals to more price-sensitive consumers. The program essentially allows Netflix to offer subsidized plans to users who previously used someone else’s password.

Given the strong revenue and net profit growth from Crypto Strike, I think the company has found new avenues for growth, and I think there’s more room to operate. Clearly, Netflix can continue to grow its user base and revenue streams. I think the stock is a strong buy.

background

In 2023, Netflix began its password crackdown by: test Their transfer profile program allows additional users to set up new profiles while still retaining all of their account data, such as viewing history. The trials will be implemented first in the Latin American market and then expanded to the following areas in early 2023: Canada, New Zealand, Portugal and Spain. In May 2023, Netflix implemented a rule in the United States that if users wanted to add another member to their current Netflix account, they had to pay an additional $7.99 per month or have it deleted.

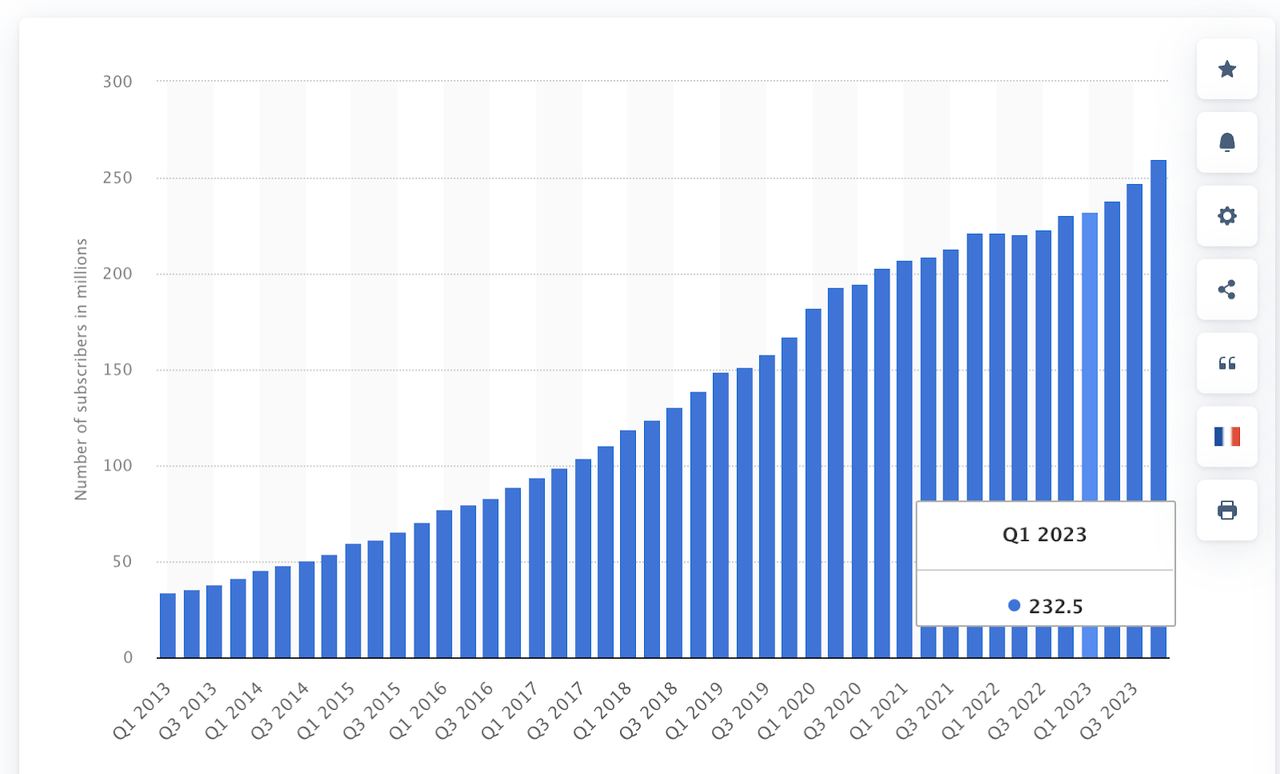

By introducing these tighter controls and alternative subscription options, Netflix added 5.9 million new subscribers in the second quarter of 2023 alone. Netflix has been estimated to have exceeded 100000000 Potential subscribers around the world can access Netflix through password sharing. Considering these numbers, a large portion of users are still engaging in password sharing, which means that as Netflix implements stricter guidelines, they will be able to convert these password sharers into subscribers.as the picture shows politician As the chart below shows, user growth significantly re-accelerated after the password sharing ban began in Q2 (Q1 data highlighted to show the starting base). The company currently has more than 260 million subscribers worldwide.

Netflix Quarterly Subscriber Count (Statista)

In addition to generating additional revenue from cracking down on password sharing, Netflix is also beginning to acknowledge the preferences of its users (especially those who previously shared passwords to get content for free). By introducing more affordable advertising support plans, they have greatly increased their appeal to more budget-conscious consumers. The new ad-supported program, which was implemented before the password-sharing ban began but has since become the go-to subscription for beginners, has attracted more than 23 million subscribers to date. In the United States, the plan costs $6.99 per month.

How artificial intelligence can help Netflix combat

To achieve password crackdown, Netflix implemented a sophisticated AI-driven approach to solving the password sharing problem.An example of this technology in the industry is Conner Media Corporation Credential sharing and fraud insights. The white paper provided provides insight into how streaming giants such as Netflix prevent password sharing.

Essentially, the system detects and differentiates between casual and fraudulent sharing by analyzing user behavior, IP addresses and device IDs.The system ensures users are connected to Wi-Fi in primary locations and watch content at least once 31 days Verify their account usage. For users on vacation, Netflix allows the use of a temporary verification code valid for seven days to access their account from a different location.

Season 4 Review

Digging deeper, numbers from Netflix’s fourth-quarter 2023 earnings call prove its growth. As I mentioned before, Netflix reported 13.1 million new subscribers in the fourth quarter, causing the stock price to rise 11% the next day. When looking at global active users, the company reported at CES that the user base has grown to 23 million, a significant increase from 15 million in November 2023. Netflix expects revenue growth to increase to double-digit percentages annually in 2024 on a currency-neutral basis (fourth-quarter earnings call).

Taking a closer look at the full year, total subscribers increased by nearly 30 million in 2023, significantly higher than 2022, which added just 8.9 million subscribers. As I showed in my previous chart from Statista, most of this jump occurs after the password crackdown begins.

As of now, Netflix’s basic subscription costs $11.99 per month, an increase of $2 from $9.99 in November 2023. During the fourth-quarter earnings call, co-CEO Greg Peters mentioned that subscription fee increases have been put on hold while the paid share plan is implemented.

Even with the pause in price increases, quarterly annual revenue grew at a healthy rate of about 12.5%, reaching $8.83 billion in the fourth quarter. This may accelerate once they resume subscription price increases.

While analysts expressed concern on the call about the amount of money Netflix is spending to keep existing subscribers happy (it currently spends $17 billion per year, and the recent acquisition of WWE rights may affect this spending plan), management was quick to calmed those concerns. Management noted on the conference call that WWE’s streaming rights fit within its $17 billion budget.

Additionally, management noted that these new rights will help gain access to “sports storytelling“The content side. It’s still very much theirs”(They are) very happy with the general licensing deals and economic conditions around the world“(Fourth quarter earnings call).

size of opportunity

I mentioned before that an estimated 100 million people around the world share their Netflix password with someone. In May 2023, Netflix warned consumers that they would begin cracking down on password sharing, resulting in nearly 100,000 New users registered every day on May 26th and 27th. Over the next 60 days, an average of 73,000 users joined each day, a 102% increase from the previous 60 days. Of course, not everyone supported the policy, leading some users to cancel their subscriptions. Fortunately for Netflix, since the announcement in May 2023, its sign-up to cancellation ratio has increased by 25.6% compared to the previous 60 days.

As I mentioned before, Netflix is launching a cheaper subscription version in 2022 that comes with ads. One noteworthy aspect of this growth is that the majority of users are not downgrading from their regular plans. A report from Samba TV concluded: twenty one% Millennials who subscribed to Netflix signed up for the ad-supported version, while 68% of this group subscribed to the cheaper version that included ads after it was released.

Since the end of the first quarter of 2023, Netflix has added a total of 28 million subscribers. While not all of these signups are from users who previously shared their passwords, if Netflix’s estimate of 100 million password-sharing users is true, that means the company could still capture up to 72 million new paying users.

Valuation and why I don’t think this is priced

Despite a record number of new users in the fourth quarter, revenue grew 6.67% last year, 184.34% higher than the industry median revenue growth of 2.34%, and expected revenue growth of 10.83%, 184.34% higher than the industry median estimate of 2.76%. . 291.93% The company’s PEG ratio of 1.22 is lower than the industry median of 1.40.

While the company’s growth has accelerated as a result of the crypto crackdown, the PEG ratio implied by the company’s current valuation suggests that analysts and investors don’t expect the company’s future growth prospects to be stronger than those of the industry (which I believe is a mistake of).

Keep in mind that a higher P/E ratio usually means investors are pricing in higher growth. The opposite is true here, even though the median revenue growth forecast is higher than the industry’s median revenue growth.

If the company can see its forward PEG ratio converge towards the industry median (which itself may be a lower benchmark since Netflix’s growth rate is well above the industry median), we may see the stock continue to grow. Appreciation of 14.75%. This is on top of the 25.59% growth we’ve seen so far this year. Essentially, I believe there is more room to run.

risk

Netflix’s crackdown on password sharing may lead some existing consumers to seek alternatives, such as switching to other streaming services rather than buying new Netflix accounts. Despite an initial surge in sign-ups after the crackdown was announced – with daily sign-ups reportedly reaching nearly 100,000 immediately – the long-term impact on user loyalty and growth remains uncertain. For example, many of these new users (23%, according to one survey) source Since the password crackdown has begun, a cheaper ad-supported subscription model has been chosen. Considering how receptive users are to ad-based streaming services, this does raise some concerns that Tubi, the self-proclaimed “free Netflix,” may pose real competition due to their free ad-supported model.

Tubi’s library still exists 50,000 That’s far more than the 10,000 titles Netflix offers. Given Tubi’s larger content base and free, ad-supported access options, they will be a tough competitor for Netflix.

While there are concerns about users switching platforms, considering Netflix has collected more than 1,500 people Originals; titles not found elsewhere and titles that users like. One example of this type of original content is high-profile originals like “Squid Games,” which has been streamed for 1.65 billion hours across 111 million accounts, demonstrating just how powerful and engaging Netflix’s content can be.

bottom line

Netflix’s solution to the password sharing issue caused many people to worry about whether they would lose their customer base, but it has proven to be very successful since it was implemented, and I think this trend will continue. Through the use of artificial intelligence, Netflix is getting better and better at policing account sharing. In addition to this, Netflix is also expanding its revenue streams by introducing an ad-supported subscription tier to help users who previously shared their passwords easily access their premium accounts. Despite the potential risks of consumers switching to competitors, Netflix has achieved promising results. Given its favorable PEG ratio and what I believe is room for further growth, the company has established itself as a solid investment opportunity, showing a bright outlook for 2024 and beyond. I think the stock is a strong buy.