hapapapa

Will NFLX Stock Continue to Rise?

Netflix shareholders (NASDAQ: NFLX) has enjoyed excellent value for money over the past year (see image below).The stock has risen nearly 100% in the past year, easily outperforming the S&P 500 index.

Seeking Alpha

However, looking forward, I think a variety of factors may limit its share price’s continued upside in the near future. In the remainder of this article, I will detail these factors. Before I do that, though, I want to clarify that I’m not arguing a bearish thesis. My argument is simply that given the mix of positive and negative catalysts, the stock is unlikely to continue its current momentum in the short to medium term.

positive side

So I’ll start with the positives first.Despite the challenging operating environment As competition intensifies (more on that later), Netflix remains dominant. Management’s various new initiatives have proven to be very successful. Even as the writers’ and actors’ strikes halted new content creation in 2023, Netflix deftly shifted its focus to its vast content library, sustaining subscriber growth. Strong membership growth (see next article) chart (below) close to 250 million. The company was also able to implement price increases on certain services to further increase profits.

politician

Although in my opinion NFLX is now starting to face a saturated North American market. Netflix has successfully combated this saturation issue through recent strategies. Notably, Netflix has launched a new, ad-supported subscription plan at a lower cost. This strategic move has proven successful and paid off handsomely, attracting 15 million members within a year of launch. By October 2023, that number had soared to a staggering 23 million monthly users. Additionally, Netflix has addressed another revenue leakage issue: password sharing. Concerned about the loss of revenue, they implemented a system where users could add users outside their household for a small monthly fee (as low as $6.99). A crackdown on password sharing has also given a huge boost to user growth.

Competition and Valuation Risks

As just mentioned, my view is that NFLX is now beginning to face market saturation, at least in the North American market. The streaming market is filled with competitors such as Disney+, Hulu and HBO Max. These players are constantly producing new content, making it harder for Netflix to retain and attract subscribers. Therefore, Netflix’s recent subscriber growth may be due to one-time effects such as advertising tiers and password-sharing crackdowns. These may not be sustainable sources of long-term growth.

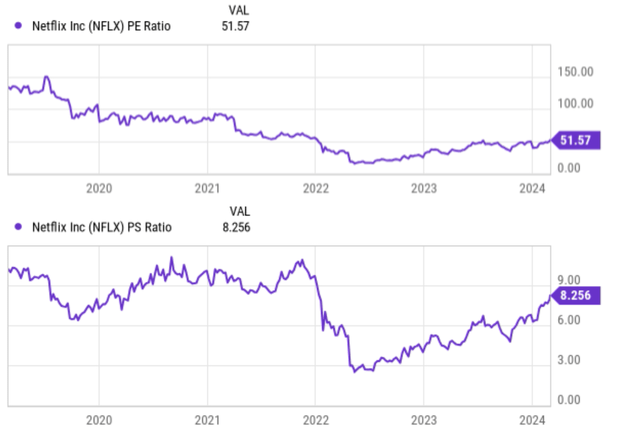

At the same time, NFLX also faces considerable valuation risk at current price levels, in my opinion. As shown in the two charts below, NFLX’s valuation ratios, from bottom-line metrics like the P/E ratio to top-line metrics like the P/E ratio, are at relatively high levels in both absolute terms and valuations. Relative term. In other words, NFLX’s FY2019 P/E ratio is currently 36 times, which is a large premium compared to its competitor Disney (FY24 P/E ratio of 24 times). Among revenue metrics, NFLX currently trades at a price-to-earnings ratio hovering around 8.1x, nearly four times that of DIS’s 2.3x. Such a high valuation multiple indicates that the market expects significant future growth to justify the current price. If Netflix’s future growth fails to live up to the high expectations embedded in its valuation, I think the likelihood of a price correction is high.

Seeking Alpha Seeking Alpha

insider activity

Another downside risk worth mentioning, or you could think of it as a reflection of the downside risks mentioned above, involves its recent internal activity. As you can see from the chart below, the insider trading surrounding NFLX is dominated by selling activity. In other words, in the past three months alone, a total of 51 insider lawsuits have been filed, 100% of which were sales. The total value of these activities has reached $155.8 million. In the last two weeks of February 2024 alone, the co-CEO and two directors reported a series of selling momentum in the price range of $560 to $600.

Granted, as mentioned in my previous article, insider selling does not send a clear bearish signal;

When it comes to insider activity, I generally focus more on buying activity than selling activity. The reason is that a range of factors unrelated to business fundamentals, such as a divorce or the purchase of a new home, can trigger sales activity. In contrast, insider buying activity usually has only one explanation – insiders believe the stock is undervalued.

Even though the internal activity was as one-sided as is currently the case with NFLX, it certainly caught my attention. As noted above, it seems to me that current insider activity reflects at least near-term downside risks.

computer room

Other risks and final thoughts

While all streaming services face many common risks (such as the competition and market saturation risks discussed above), Netflix may have unique vulnerabilities in certain areas. The biggest thing in my mind is its heavy reliance on homemade content. Unlike some of its competitors, Netflix invests heavily in its own original content. If their originals underperform or fail to get the attention they need, it could be a bigger blow to Netflix than competitors with more diverse content libraries.

At the same time, I think the long-term impact of its ad layer experiment remains to be seen. Netflix’s move into ad-supported territory is a new one and one that has been successful so far. While it has attracted subscribers so far, I don’t know how enlightening these ads are to its subscribers, how this will impact its existing subscriber base accustomed to an ad-free experience, and how quickly other competitors will follow the same strategy. quick.

All in all, as clarified earlier, I’m not arguing a bearish thesis here. My thesis is that I see both positive and negative catalysts for NFLX. In the short term, I see no clear forces pushing the stock price in a definite direction. Therefore, I think the stock is unlikely to extend its recent price momentum and end with a hold thesis.