Spencer Platt

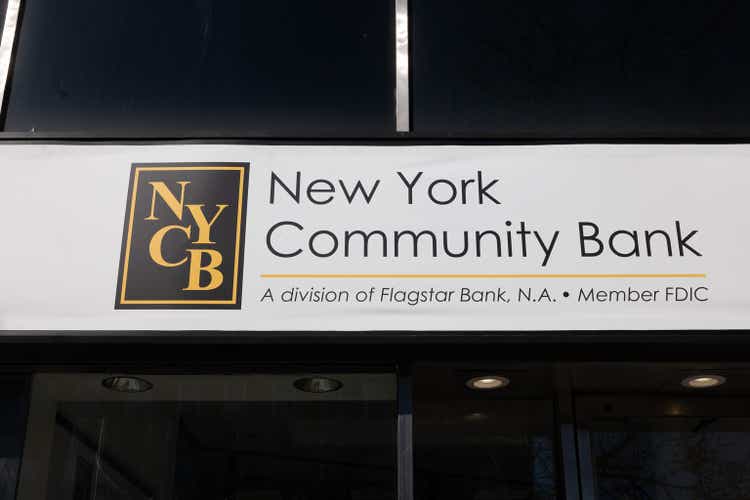

Sometimes heroic actions are not rewarded. Sometimes there is a good reason for a stock to sell, and although the price anchor makes us think it is “cheaper” than it was the day before, we have to look at the facts first.watching There’s overwhelming bad news coming from New York’s community banking companies (New York Stock Exchange: NYCB), we believe that caution is an important component of courage, and we do not believe that a 37% drop will occur in one day.

But the story has changed. Big money managers won’t be pursuing this after being blindsided by this quarter’s results. How did they go from nearly 180% dividend coverage to a 70% dividend cut in four quarters? We know the bulls will be lining up to attack us, but whatever story you believe ahead of these results, it’s wrong. Wrong, wrong, wrong.It’s a new day, it will take at least six more days Rebuilding confidence quarterly. guess what? You no longer have to wait to get paid. We don’t have a position here, and we may not initiate one.

Source: Slump on Dividend Cut

Since then, the stock has quickly fueled demand for antacids, causing it to lag another 53%.

Seeking Alpha

We review the major developments since then and weigh the outlook for the troubled bank.

1) Material weakness

NYCB dealt a double blow to its shareholders in late February. Investors are still reeling from dividend cuts and from goodwill impairments and disclosures of material weaknesses in controls.

The Company completed its goodwill impairment assessment on February 23, 2024, and management determined that GAAP requires a provision in the Company’s “Consolidated Statement of Income and Statement of Comprehensive Income” for the quarter and fiscal year ending December 31, 2023. “Goodwill impairment” charges reduced annual net (loss) income available to common shareholders in the fourth quarter by $2.4 billion.

Additionally, as part of management’s evaluation of the Company’s internal controls, management identified significant deficiencies in the Company’s internal controls related to internal loan reviews that resulted from inadequate oversight, risk assessment and monitoring activities. Although the evaluation of the Company’s internal controls has not yet been completed, the Company expects to disclose in its 2023 Form 10-K that its disclosure controls and procedures and internal control over financial reporting were not effective as of December 31, 2023.

source: NYCB 8-K

The weaknesses appear to be across the board in many areas, significantly changing the bank’s image. If loan review and risk assessment fail, how can we trust the loan-to-value ratio is accurate? How can we have confidence in these regulations? It’s certainly possible that these weaknesses could lead to some real changes in actual profits. There may also be some significant weaknesses in loan originations through at least 2023. Investors hoping for a quick resolution may be disappointed. These repairs take time because the entire process must be reviewed and estimates of loan quality and potential losses are required. Auditors have some discretion as to how to proceed, but with a large regional bank in the spotlight, you can expect the handling to be rough. At the very least, we expect higher reserves to take a toll again. At worst, this could drag on for weeks, adding to uncertainty.

2) Financing

NYCB stock has seen waves of buying and selling, but has generally been lower since our last article. The drama culminated a month ago when the bank, which still had plenty of liquidity, was apparently seeking funding. The stock fell 45% intraday and was halted on at least four separate occasions. NEW YORK COMMUNITY BANK, INC. DEP SHS REPSTG A (NYSE: NYCB.PR.A) and New York Community Capital Trust V UNIT 05/07/51 (NYCB.PR.U) experienced similar declines. Unfortunately, these transactions were halted at various times throughout the day as stock exchanges struggled to control panic. The funding story is semi-accurate, as NYCB actually closed $1 billion in funding before noon.

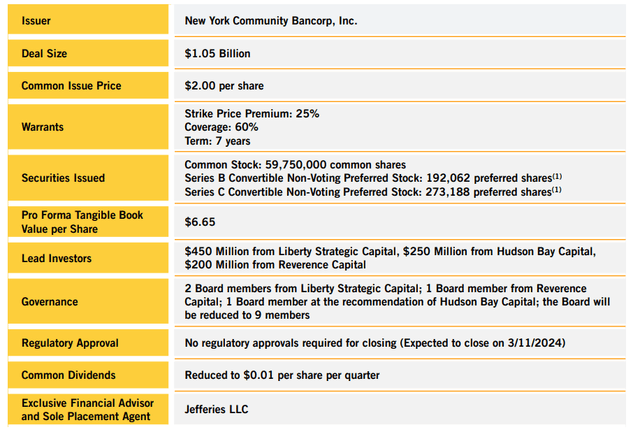

Under the terms of the deal, NYCB will sell common stock to investors at a price of $2.00 per share, as well as a series of convertible preferred shares with a conversion price of $2.00, for a total investment of $1.05B. Investors will also receive 60% of the warrants to purchase non-voting shares of common stock with an exercise price of $2.50 per share, a 25% premium over the price paid for the common shares.

Source: Seeking Alpha

That’s pretty huge in terms of its increased equity cushion, but it also undermines the upside, as we’ll see in the valuation section.

3) Valuation

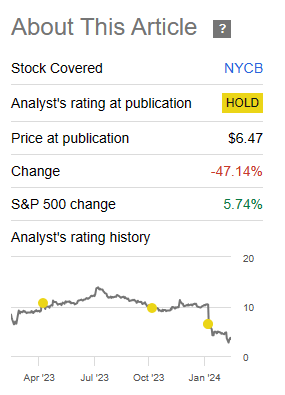

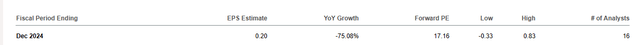

Do you remember the good old days? NYCB was cheap at the time, with a forward P/E ratio of 6.5x, even though it was trading at $9.00? At the time, there was a high degree of consensus about what those returns would look like. Fast forward to the middle of this drama (and we’re far from over yet), and this is what the estimate looks like. Profit estimates have dropped from a peak of around $1.40 to $0.20, and with many projected losses, that range is pretty wild.

Seeking Alpha

We think the analyst forecast of $0.83 could be a vacation somewhere without internet service. Nowhere else on the planet could New York City Bank of Commerce (NYCB) be as diluted as that. Even without warrants, the total number of shares outstanding (315 million shares worth) would be closer to 1.25 billion shares, up from the 722 million shares you see in the Y chart above. NYCB plans to use stock settlement to settle the warrants, assuming the warrants are in-the-money. This will actually only issue shares on the upside above $2.50. So instead of having the right to buy the stock at $2.50, the investor receives the value of the stock equal to the stock’s upside.

If the stock price is $3.50 at the time of exercise, the bank will grant $315 million worth of stock to the investor group based on the intrinsic value of each warrant of $1 ($3.50 minus the warrant exercise price of $2.50). This would mean the issuance of approximately 90 million shares.

source: NYCB via Barron’s

Upon completion of the financing (March 11, 2024), tangible book value per share will be approximately $6.65.

New York City Commercial Bank

We believe the ultimate expected tangible book value with warrant dilution and further provisions should be approximately $6.00 per share. Since the stock trades at a 40% discount, you have some cushion here.

judgment

Profits in 2024 will be poor. Pressure will come from more losses and potentially significantly higher interest costs as NYCB will try to attract more FDIC-insured deposits (i.e. from smaller customers). We wouldn’t be surprised to see huge losses this year. By 2025, profits will depend on whether we actually see the long-awaited recession. But even without that, a severely inverted yield curve could mean that generating 6-7% of tangible book value (35-40 cents per share) will be a challenge. You can bet on the curve inversion disappearing, but that could mean a recession. Even in the best of recent times, NYCB traded at a P/E ratio of 6-7x. Here, even extending to 2025, we see NYCB trading at 8x the optimistic 2025 figure. While investors are grappling with the fallout and stocks are trading on a technical level, we believe material upside is unlikely from here on out. Even though the stock is down significantly from 2 months ago, it’s still valued at $3.50, and we’d be selling any rebound above $4.50. Investors can also take advantage of the options’ high implied volatility to hedge their positions. The existential risk has been significantly reduced, but we wouldn’t consider this a “buy it and forget it” stance. At this point, we think NYCB.PR.U may be a better choice than the common stock due to its huge yield (9.6%) and significantly reduced risk.NYCB.PR.A, on the other hand, has a slightly lower yield (9.1%), a lower capital structure, and Launched in March 2027. Therefore, we favor NYCB.PR.U.

Please note that this is not financial advice. It looks like it, sounds like it, but surprisingly, it’s not. Investors should conduct their own due diligence and consult with professionals who understand their objectives and limitations.