texel

next generation energy (NYSE: NoInvestors have underperformed the S&P 500 (SPX) (SPY) over the past year, despite its solid performance amid a challenging macroeconomic backdrop.My last update on NEE investors was in December 2023, assessing With interest rates falling from their October 2023 highs, further economic recovery is possible. However, NEE bulls lost steam as the market reassessed optimism over the pace of Fed rate cuts. Given the resilience of the U.S. economy, Investors must temper Their initial expectations were for six cuts, suggesting The Fed is unlikely Shifting to lower gears at the upcoming March meeting.

NextEra Energy performs strongly NEE fourth quarter financial report Released in late January 2024. Its core Florida Power & Light, or FPL, utility business continues to make progress. As a result, FPL reported “an increase in adjusted earnings per share of 22 cents.”Additionally, its ROCE is steady at 12.5%, while Adding more solar projects to its rate base will benefit its move toward renewable energy. Additionally, NextEra also posted a “record year for new renewable energy and storage origins” at NextEra Energy Resources (NER). The NER business is NextEra’s pure-play clean energy portfolio focused on wind, solar and battery storage opportunities. Despite a challenging year for utilities and renewable energy companies, NER’s project backlog increased by approximately 9,000 MW, supporting its long-term strategy.

NextEra Energy’s adjusted earnings per share for fiscal 2023 were $3.17, a growth of 9.3%. This marks a sharp slowdown from growth of 13.7% in fiscal 2022. NextEra management’s forward guidance suggests growth is expected to slow further this year but remains consistent with its long-term outlook. As a result, NextEra expects its adjusted earnings per share to increase to $3.33 at the midpoint in fiscal 2024. However, the company clarified that it expects “annual results through 2026 to be at or near the top of NEE’s adjusted earnings per share forecast range.”

As a result, NextEra Energy believes earnings visibility is sufficient over the medium term. It’s crucial to maintaining dividend investor confidence as it says dividends per share will increase by 10% annually. While its forward dividend yield of 3.7% is relatively attractive compared to the 10-year average dividend yield of 2.7%, it is much less attractive compared to the 2-year dividend yield (US2Y) since its last The published dividend rate is 4.54%. Therefore, my assessment of NEE’s near-term thesis may hinge on market confidence in a faster-than-expected rate cut, thereby increasing the relative attractiveness of its proposition.

Nonetheless, NextEra Energy remains committed to sustainable renewable energy generation over the long term, supported by its core FPL business.Well-positioned to benefit from energy surge The need for generative artificial intelligence Attributed to the insatiable data center. Therefore, I assess that NEE’s scale and expertise should be well-positioned to drive a long-term recovery. NEE’s relative attractiveness is enhanced as its adjusted forward EBITDA multiple of 12.7x is still significantly lower than the 10-year average of 13.8x.

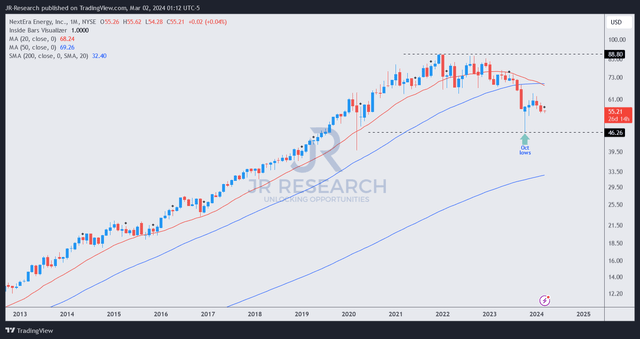

NEE Price Chart (Long Term, Monthly, Dividend Adjusted) (TradingView)

As seen above, NEE’s price action suggests that bargain hunters did well to defend the October 2023 lows at the $46 level. However, the early recovery in December 2023 has lost steam as the 10-year Treasury note (US10Y) bottomed out. Therefore, NEE’s buying sentiment still seems to be affected by the level and magnitude of the Fed’s interest rate cuts. Given that the Fed is expected to release its outlook this month, I assess that near-term sentiment on the NEE is expected to remain uncertain and unstable.

However, I believe that NEE’s relatively attractive valuation and constructive price action based on October’s long-term bottom should attract strong buying support at current levels.

Rating: Maintain Buy.

IMPORTANT NOTE: Investors are reminded to conduct due diligence and not to rely on the information provided as financial advice. It’s important to keep your thoughts to yourself and note that ratings are not intended to pinpoint specific entry/exit times at the time of this writing unless otherwise stated.

I want to contact you

Have constructive comments to improve our paper? Spot a critical gap in our perspective? See something important we didn’t? Agree or disagree? Leave a comment below to help everyone in the community learn better!