Gunther Fraulob

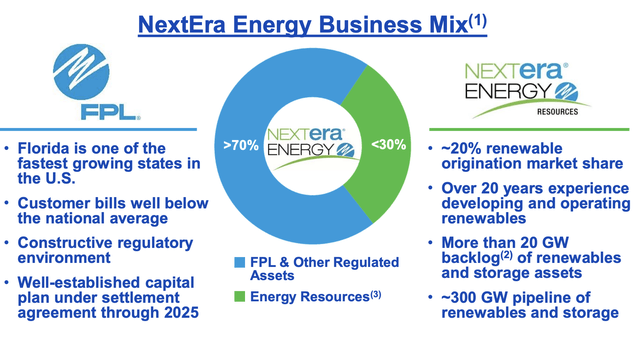

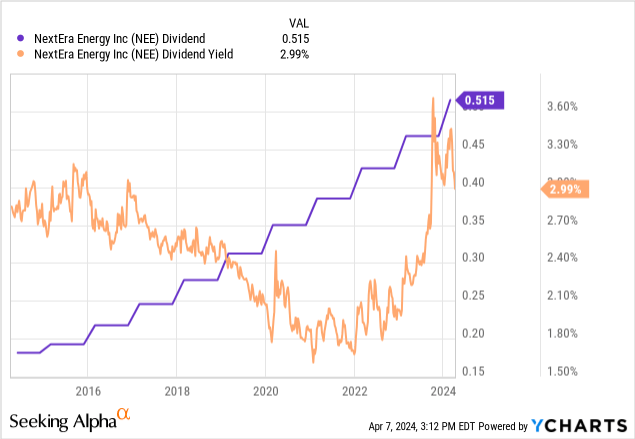

next generation energy (NYSE: No) is an incredible dividend growth machine. The power company last announced a quarterly cash dividend of $0.515 per share, a sharp increase of 10% from the previous quarter, with an annualized dividend rate of $2.06 and a dividend yield of 3.2%. NEE has The next two years also provide guidance for dividend growth of at least 10% annually through 2026, solidifying its status as an outstanding Dividend Aristocrat aligned with shareholders. This title is revered for a company that has raised its dividend every year for at least 25 consecutive years. With a market capitalization of $132 billion, NEE is the largest electric utility company in the United States. The company has 72 gigawatts of operating capacity through Florida Power & Light (“FPL”) and NextEra Energy Resources (“NEER”).

NextEra Energy March 2024 Investor Presentation

NEER is a renewable energy giant with a record commissioning capacity of 5.6 GW The backlog of wind and solar renewable energy projects and storage is 20 GW by 2023. The company grew its backlog of projects by 9 gigawatts last year and plans to bring a large portion of them online within the next two to three years. FPL is a rate-regulated electric utility serving approximately 5.8 million customer accounts in Florida.The Sunshine State’s population has seen material growth since the pandemic, growing 1.9% By 2022, the population will exceed 22 million people. That means the third-largest state is the fastest-growing state for the first time since 1957.

Earnings growth and operating cash flow

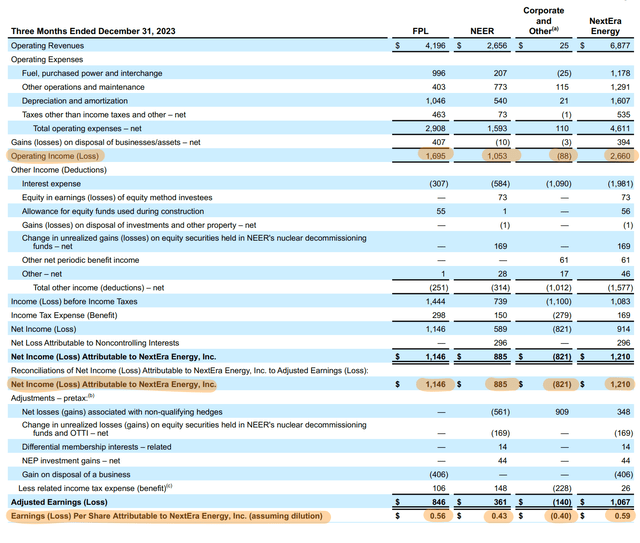

NEE’s renewable energy segment forms a core engine for NEE’s future growth, especially with the support of the Inflation Reduction Act of 2022 (“IRA”), which provides investment and production tax credits for renewable energy projects, essentially Underwriting hundreds of billions of dollars in green energy spending over the next decade. The company’s revenue in the fourth quarter of fiscal 2023 was US$6.87 billion, an increase of 11.5% over the same period last year, exceeding market expectations by US$550 million.

NextEra Energy releases fourth quarter financial results for fiscal year 2023

NEE’s adjusted net profit was US$1.07 billionAbout $0.52 per share, up from $1.01 billion and $0.51 per share a year ago. Adjusted net profit for the full year of 2023 will be US$6.4 billion, or approximately US$3.17 per share, an increase of 9.3% from the adjusted earnings of US$5.742 billion, or US$2.90 per share, in 2022. The company expects adjusted earnings in 2024 to be $3.23 to $3.43 per share, which would represent growth of 5.05% from the 2023 midpoint. NEE expects adjusted earnings per share to grow 7% annually over the next five years, so actual earnings will likely exceed the high end of its guidance range. NEE has built the world’s largest renewable energy business, with a 20% share of the U.S. renewable energy origination market, and will be hit hard by the incredible IRA.

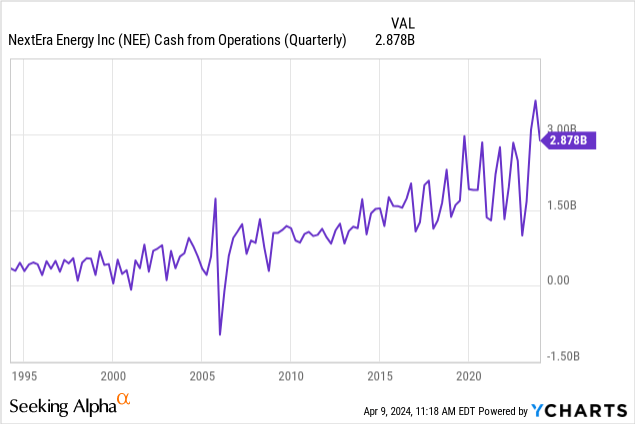

The utility had $2.88 billion in operating cash in the fourth quarter and $11.3 billion in full-year 2023 cash, while dividends paid to common shareholders totaled $3.78 billion. NEE can pay dividends through operating cash flow and adjusted net income. As that number grows, power company shareholders will see another banner year of double-digit dividend growth. Crucially, the Fed’s impending interest rate cuts and headwinds to curb inflation will boost NEE this year, with the market still expecting at least three rate cuts of 75 basis points each this year.

Dividend growth, units and the future of energy

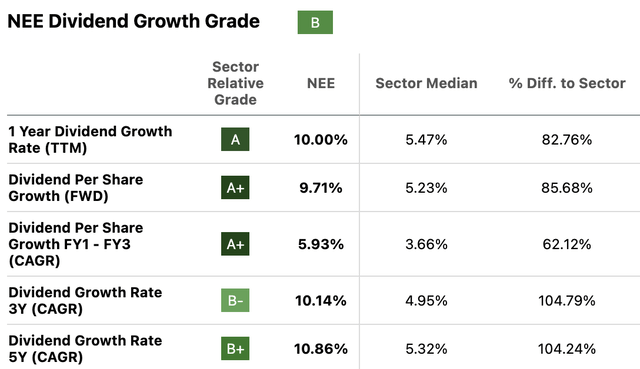

NEE’s dividend chart history is compelling, with consecutive annual increases forming a baseline for common price gains. The utility has a history of dividend growth that outperforms its peers, with a 3-year dividend growth CAGR of 10.14%, more than double the industry median. NEE also has 8.7% The Earnings Corporation Unit (NEE.PR.R) is set to expire in a few months, on September 1, 2025.

Seeking Alpha

If NEE’s market price is at or below $88.88 per share, the settlement amount for these units would be 0.5626 shares per unit. Therefore, at the current price of $40 per unit and a price of $4,000, 100 units would be settled for 56.26 shares of common stock, for a total cost of $3,670 at the current price of $65.24. This means that if you want to buy more NEE shares through the back door, there is no clear benefit to these units, although the units will pay significantly higher interim dividends in the other two quarters.

U.S. Energy Information Administration

As solar and wind power continue to play a key role in the U.S. energy mix, renewable energy storage will further grow. Their share of total electricity generation has increased over the past few years, and they are expected to overtake coal in the short term. I’m bullish on NEE due to its prospects for a dividend increase, upcoming rate cuts from the Federal Reserve, and the positive policy backdrop for renewable energy.