Galenu Mihai

Investment thesis:

The market has underestimated the exciting prospects of NICE’s cloud business. The business has a strong balance sheet position, a long history of serving markets and is positioned to benefit from the artificial intelligence wave. 11x EV / 2027 adjusted pre-tax profit forecast of Woxiang Information This investment has good risk/reward characteristics.

business model

Nice Ltd (Nasdaq: good) is one of the leading providers of enterprise software solutions that help organizations manage and improve customer experiences, ensure compliance, fight financial crime, and protect people and assets. Under its current structure, the company has three reportable segments and three business units. Reportable segments are Cloud, Products and Services, while business segments are Customer Engagement, Financial Crime & Compliance, and Public Safety & Justice.

The Most Innovative Cloud Solutions segment includes revenue from solutions in the cloud, e.g. CXone (customer experience platform), X-Sight (financial crime detection and compliance cloud platform) and Evidencentral (cloud-based public safety and justice platform). This is the fastest growing segment and the one that this article will focus on. According to the company’s disclosures, the company serves 10/10 of the top U.S. health insurance companies, 5/5 of the top U.S. telecommunications companies, 9/10 of the top global financial services companies, and 6/10 of the top Fortune 10 companies. The industry-leading CXone platform is Contact Center as a Service (CCaaS) in a cloud-based, scalable format.

The second part, called products, mainly includes professional services and consulting fees related to the implementation and optimization of NICE solutions.

The third and final segment is product revenue, which includes on-premises software licensing (legacy) and hardware sales.

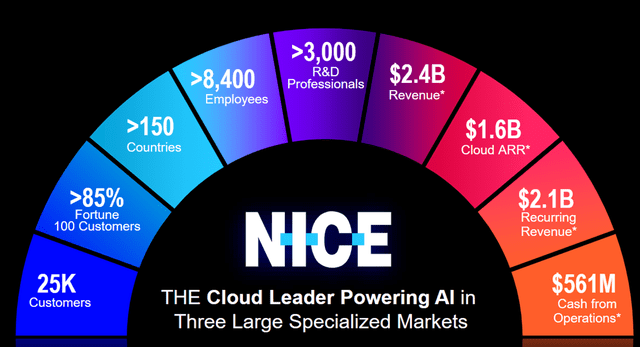

NICE Ltd. Investor Introduction

growth booster

The first and most obvious commercial use case for large language models (LLMs) and generating artificial intelligence is streamline and effective resolution of customer service interactions. Especially for simple customer issues, these low-hanging fruit take away the time of humans who could be solving tougher requests. Evidence of increased productivity is rare, but Klarna’s breakthrough claims set the bar high.Recently, Klarna declare It handled two-thirds (approximately 2.3 million) of customer service chats in its first month of operation. It is estimated to have the equivalent workload of 700 full-time customer service staff and reduce resolution time from 11 minutes to less than 2 minutes. If that wasn’t enough, it also achieved comparable satisfaction levels to human agents and reduced duplicate queries by 25%. This customer service efficiency is expected to generate $40 million in profit growth for Klarna in 2024, according to its parent company.

Klarna’s data rocks the corporate world, with many organizations left shaken disturb Plan for customer service automation. NICE will benefit from this wave as it offers a comprehensive set of solutions that help organizations deliver customer service across multiple channels. The CXone platform helps customers through seven functions:

- Omni-channel routing: Customer interactions are directed to the most appropriate and capable agent based on the required request.

- Self-service: AI-powered virtual assistants. These are tailored by the client according to the purpose.

- Workforce Engagement: Forecasting and Scheduling for Contact Center Workforce Optimization and Utilization.

- Analytics & Reporting: Gain insights into customer interactions, agent performance and KPIs to improve decision-making.

- Artificial Intelligence and Automation: Provide instant recommendations to agents during interactions.

- Integrated API: CRM, ESP and third-party data sharing.

- Compliance and security: Comply with regulatory standards such as PCI-DSS, GDPR and HIPAA, protect customer data, and more.

In its latest fourth-quarter 2023 results, NICE reported that cloud revenue increased by 20% annually in 2023, and the number of artificial intelligence transactions increased significantly by 300%. The gross profit margin of cloud revenue is approximately 66% (non-GAAP 71%), showing software-like characteristics, but there is still room for further growth. Management guided for revenue growth of 15%, and adjusted growth of 19%. Full-year 2024 EPS growth midpoint. This guidance assumes full-year cloud growth conservatively decelerates to 18% (excluding LiveVox) get. Management may downplay cloud computing’s growth potential in 2024, as the segment grew 30%, 31%, 27% and 22% in 2020, 2021, 2022 and 2023, respectively. If anything, this segment is growing with all the interest related to artificial intelligence.

Management expects Cloud TAM to grow at an annualized rate of 18%, from about $8 billion in 2023 to $22 billion in 2028, the company filing said. Currently, only 5% of interactions include conversational AI, and only 20% of business includes conversational AI. Migrate to CCaaS.Gartner study It is predicted that by 2025, 80% of customer service organizations will apply generative artificial intelligence technology in some way to improve the efficiency of customer service personnel.

NICE has the upper hand in CCaaS

Assuming the market grows at an annualized rate of 18%, I think NICE’s cloud division will grow faster than the market, thanks to its competitive advantage in the customer experience industry for more than 35 years. CXone platform named CCaaS industry leader forrest research corp., ventana research corp., Work research and Ghana Magic Quadrant. The company has a data advantage over its competitors because it has a long track record built over years of resolving customer queries. 85 of the Fortune 500 companies do business with NICE Ltd, and management invests 12-14% of revenue in R&D to innovate its current product offerings.

NICE builds long-term customer partnerships and solves reliability challenges in data, security and case resolution.Leading IT service providers such as cognition, Infosys and Microsoft Partner with NICE to provide cutting-edge CCaaS solutions to its customers. Large organizations tend to work with large vendors such as NICE rather than trust smaller vendors to handle interactions with valued customers. An example of what can go wrong when automating customer inquiries is the case of Air Canada, which promised passengers non-existent discounts.This case belongs to AI hallucinationartificial intelligence chatbots may provide inaccurate information.

Valuation:

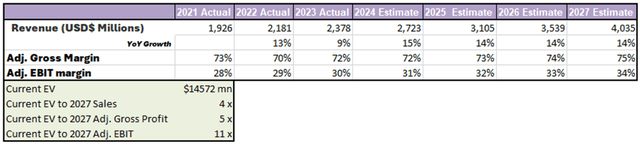

Author’s predictions

Based on the reasoning I stated earlier, I think cloud revenue growth will continue to outpace service and product revenue growth. This will drive the company’s annualized revenue growth to close to 14-15% in 2027. With the expansion of the cloud business, the company’s fundamentals will steadily transform into a software business with high gross profit margins, and operating leverage will continue to increase, thus pushing up profit margins. These assumptions yield an attractive valuation of 11 times 2027 adjusted valuations. EBIT forecast.

risk:

Artificial intelligence is an expensive pursuit, and projects related to its application are somewhat haphazard in the current environment. This exposes NICE to the risk of an economic slowdown that could delay discretionary spending. Klarna, on the other hand, has proven that applying artificial intelligence can lead to significant cost savings.

CCaaS is an attractive and lucrative industry that may attract new competitors. For example, recently, RingCentral declare A new CCaaS product will compete with NICE. As technology becomes more widely deployed, monitoring the competitive landscape is critical.

in conclusion:

NICE’s 35-year history in the customer experience industry puts it in a leading position in leveraging the power of data cultivated in building lasting relationships with customers. The growing wave of artificial intelligence and generative artificial intelligence will play an important catalytic role in driving the growth of the cloud space. 11x EV to my 2027 Adj. The EBIT forecast is a good multiple for a business with an excellent competitive position, a net cash balance sheet, and benefit from artificial intelligence.