Sebastian Gorczowski/iStock via Getty Images

Since this year, NIO (NYSE: NIO) has been in free fall, down more than 35% year to date, with the stock near its 52-week low and lingering in penny stock territory.Although some people think that NIO stock Given that the current price-to-sales ratio is near all-time lows, this could be an opportunity, but I think Nio has more downside. I think this is happening because Nio has been losing market share in its main market, China, for years.

In addition, NIO’s focus on battery swapping technology will further expand its losses this year. Open As early as December 2023, during NIO Day, 1,000 new battery swap stations were added this year.Meanwhile, NIO’s European push leaves a lot to be desired because it hasn’t yet delivered 1,000 cars per season in Europe European electric vehicle registration status. In fact, the company has been surpassed in Europe by struggling new electric car maker Fisker Inc. (FSR) just started initial delivery Q2 2023. Based on this, I give NIO a sell rating and a target price of $3.36 per share.

Overview of China’s electric vehicle market

China is the world’s largest and most dynamic electric vehicle market, with an estimated 94 brands offering more than 300 models, with prices ranging from US$5,000 to more than US$90,000.Sales of electric vehicles in China have grown over the past three years 2.99 million 2021 units 6.9 million by 2022 9.4 million 2023 units.

However, demand for electric vehicles in China is showing signs of slowing as government subsidies decline and consumers cut back on spending. Lots of questions These include slow economic growth, high youth unemployment, and a housing market crisis. As a result, electric vehicle sales growth will decelerate from nearly 131% in 2022 to only 38% in 2023.

Recent data suggests this trend is likely to continue this year. Earlier this month, several Chinese electric vehicle manufacturers released delivery updates for January, showing sales in January were down from December 2023.Although delivery figures are still higher than the same period last year, it is worth mentioning that January 2023 deliveries were affected by Wave of COVID-19 cases After China dismantled Controlling the pandemic in December 2022.

In other words, NIO has delivered a total of 10,055 Car ownership in January was 18,012 units, a quarterly decrease of 44.2%. Likewise, Li Auto Co.’s (LI) January deliveries fell 38.1% month-on-month, 31,165 Even giant BYD Co., Ltd. (OTCPK: BYDDF ) reported sequential gains compared to 50,353 vehicles in December 2023 down 40.9% Sales of new energy vehicles in January were 201,493 units.

Most Chinese EV manufacturers still face significant decrease Compared with January, the number of insurance registrations increased. However, this decline may be due to the celebration of the Lunar New Year holiday. However, the downward trend in electric vehicle sales in China is a clear sign that at least this quarter’s electric vehicle sales are likely to be lower than those in the first quarter of 2023, which is particularly negative for Nio.

Lose market share

At the heart of my pessimistic thesis about NIO is the fact that the company is losing market share despite growing EV sales. As mentioned earlier, China’s electric vehicle sales in 2021 will be 2.99 million units.That year, Weilai sold 91,429 vehicles, accounting for 3.06% of China’s total electric vehicle sales.In comparison, the delivery volumes of Li Ka-shing and BYD 90,491 and 320,810 During the year, electric vehicle sales accounted for 3.03% and 10.73% of China’s total electric vehicle sales respectively.

In 2022, China’s electric vehicle sales will be 6.9 million, an increase of 131% over the same period last year. That year, NIO’s vehicle delivery volume only increased by 34%. 122,486 Accounting for 1.78% of total sales in China.Li Shufu was in a similar situation to NIO at the time. Its delivery volume in 2022 increased by 47% year-on-year, reaching 133,246, its market share dropped to 1.93%. At the same time, BYD’s sales grew by 184%, exceeding market growth. 911,140 For automobiles, the market share increased to 13.2%.

In 2023, China’s electric vehicle sales will increase by 38% to 9.49 million units, while NIO’s vehicle delivery volume will increase by 31% compared with the same period last year, which is once again lower than the total market volume.At the same time, Li’s delivery volume grew by 72%, reaching 376,030 Vehicle and BYD deliveries increased by 73% 1.5 million car. According to the data, NIO’s share of total EV sales in China fell to 1.69% for the second consecutive year, while Lithium and BYD’s shares grew to 3.96% and 16.59% respectively.

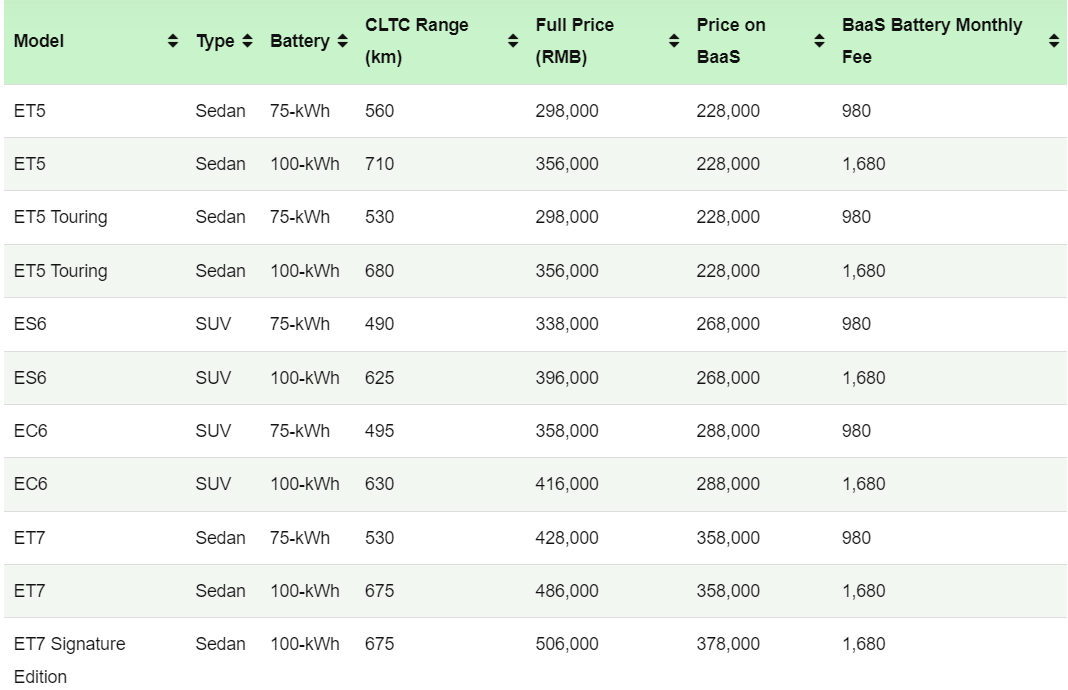

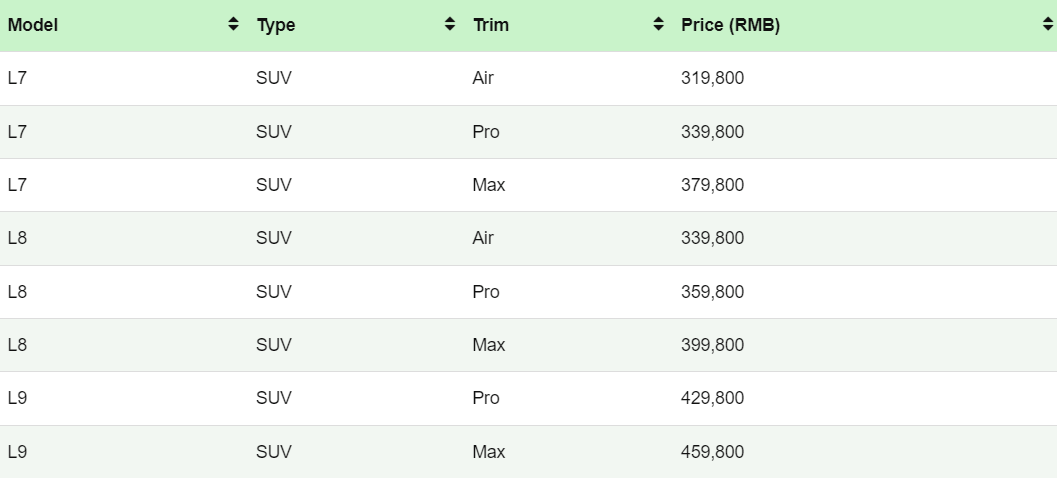

Due to the economic situation in China, I expect the situation in 2024 to be the same as in 2023. NIO’s brand revolves around luxury electric vehicles. Therefore, its vehicles are priced higher than LI and BYD, given the battery fees it charges consumers, as shown in the chart below.

Starting prices of various NIO models (CNEVPost)

Li Starting Price by Model (CNEVPost)

Meanwhile, BYD’s 5 best-selling electric vehicles starting price The price ranges from 73,800 yuan to 159,800 yuan, which is much lower than NIO and Li.

Battery replacement expansion will increase losses

Another reason I’m bearish on NIO is the high cost of building its battery swap stations.As early as November 2023, the company announced a partnership with Changan Automobile and auspicious Jointly build and share China’s power grid.

Following these deals, the company announced at NIO Day in December that it plans to build 1,000 battery swap stations in 2024, including fourth-generation battery swap stations that can perform 480 battery services per day. The new generation battery swap station will use 4 Nvidia Orin X chips and 6 ultra-wide-angle lidars, with an overall computing power of 1,016 Tops.

This will significantly increase NIO’s costs this year, as the cost of setting up a battery swap station is estimated to be around $420,000.To demonstrate how these gas stations drain the company’s cash, NIO President Qin Lihong explain It would take eight years for the battery-swapping station to perform more than 50 replacement services per day to break even. Nio’s situation may get worse considering the advancement of next-generation power swap stations, which could cost more than $420,000.

Currently, the new charging station will have 23 battery slots, compared to 21 in the current generation of charging stations. Given that NIO cars are equipped with either 75 kWh or 100 kWh batteries, it’s easy to predict the cost of the 1,000 charging stations planned to be built this year.

Assuming that the cost of building one station is US$420,000, NIO will bear a cost of US$420 million for 1,000 stations. In addition, the company must install batteries in these charging stations, which increases costs.According to reports, the cost of domestically produced batteries in China is $80-$90 per kWh NMC is used in most of NIO’s vehicles.

Assuming that each charging station will be equipped with 12 100 kWh batteries and 11 75 kWh batteries, equipping a single charging station with batteries will cost NIO $172,125 (or $85 per kWh). This means that NIO will spend more than $172 million to equip these 1,000 sites. By adding this number to station construction costs, I expect NIO to report costs associated with this in excess of $592.1 million. As shown in the table below.

|

1 station construction cost |

$420,000 |

|

Construction cost of 1000 stations |

$420 million |

|

1 75 kWh battery costs $85 |

$6,375 |

|

1 100 kWh battery costs $85 |

$8,500 |

|

Cost of 11 75 kWh batteries |

$70,125 |

|

12 Cost of a 100 kWh battery |

$102,000 |

|

cost/site |

$172,125 |

|

Battery cost for 1000 stations |

$172,125,000 |

|

Total cost of 1000 sites |

$592,125,000 |

Europe’s failure

In addition to NIO’s difficulties in China, its performance in the European market can only be described as disappointing.NIO will enter Europe in 2021 Launched in Norway Before entering Germany, Netherlands, Sweden and Denmark October 2022. Since then, the company has delivered a total of 3,980 vehicles in Europe, according to European electric vehicle registrations. To make matters worse, NIO’s highest single-quarter sales in Europe was 790 units in the third quarter of 2023.

These numbers are simply underwhelming for three years.Another Chinese EV maker, BYD, entered the European market in 2017 Second quarter of 2020By the end of 2022, it had delivered 5,598 vehicles in Europe. Compared with Fisker, which will only start delivering vehicles in the third quarter of 2023, Nio’s European deliveries even pale in comparison. Looking at NIO’s deliveries in Europe since the third quarter of 2023, it sold 1,725 cars, while Fisker delivered 1,878 cars in the same period.

|

quarter |

NIO European Sales |

FSR European sales |

|

Season 2 21 |

2 |

– |

|

Season 3 21 |

29 |

– |

|

Season 4 21 |

169 |

– |

|

2021 total |

200 |

-% |

|

Season 1 22 |

245 |

– |

|

Season 2 22 |

265 |

– |

|

Season 3 22 |

229 |

– |

|

Season 4 22 |

Chapter 484 |

– |

|

2022 total |

1223 |

-% |

|

Season 1 23 |

328 |

– |

|

Season 2 23 |

504 |

– |

|

Season 3 23 |

Chapter 790 |

Chapter 726 |

|

Season 4 23 |

Chapter 742 |

Chapter 869 |

|

2023 total |

2364 |

1,595 |

|

Season 1 24* |

193 |

Chapter 283 |

|

All Europe |

3980 |

1,878 |

*Compiled by the author based on European EV registration data.

With this in mind, I expect NIO and other Chinese EV makers to suffer in Europe EU Countervailing Investigation Enter Chinese electric vehicles. The EU will have up to 13 months to evaluate whether to impose tariffs on cars higher than the EU’s standard 10% rate. If such tariffs were imposed, Chinese EV manufacturers would be forced to pass on additional costs to end consumers, which would eliminate a major advantage of Chinese EVs. Affordability.

Valuation

At first glance, NIO’s current stock price of $5.85 appears to be undervalued. Currently, NIO’s forward price-to-earnings ratio is 1.6, while Li Ka-shing’s and BYD’s sales price-to-earnings ratios are 1.95 and 0.81 respectively.While NIO may be undervalued compared to Li Ka-shing, it is worth noting that Li Ka-shing is expected to achieve 800 000 By 2024, automobile production will increase by 113% annually.Meanwhile, Nio didn’t even hit its original 2023 delivery target 250000 Because it only delivered 160,038 cars. Based on this, I believe NIO should trade close to the industry average P/E ratio of 0.92, which would result in a target price of $3.36, 42.5% below current levels.

|

Forward P/S |

|

|

NIO |

1.6 |

|

plum |

1.95 |

|

BYD |

0.81 |

|

industry average |

0.92 |

Upside risks

While I’m bearish on NIO stock this year, there are some upside risks to my view. The first risk is that NIO is laying off employees. Initially, the company announced it would lay off 10% of its workforce.However, there is news that the scope of layoffs may be expanded. from 20% to 30%. Considering NIO’s SG&A expenses account for about 19% of its revenue, these layoffs could significantly boost its bottom line.

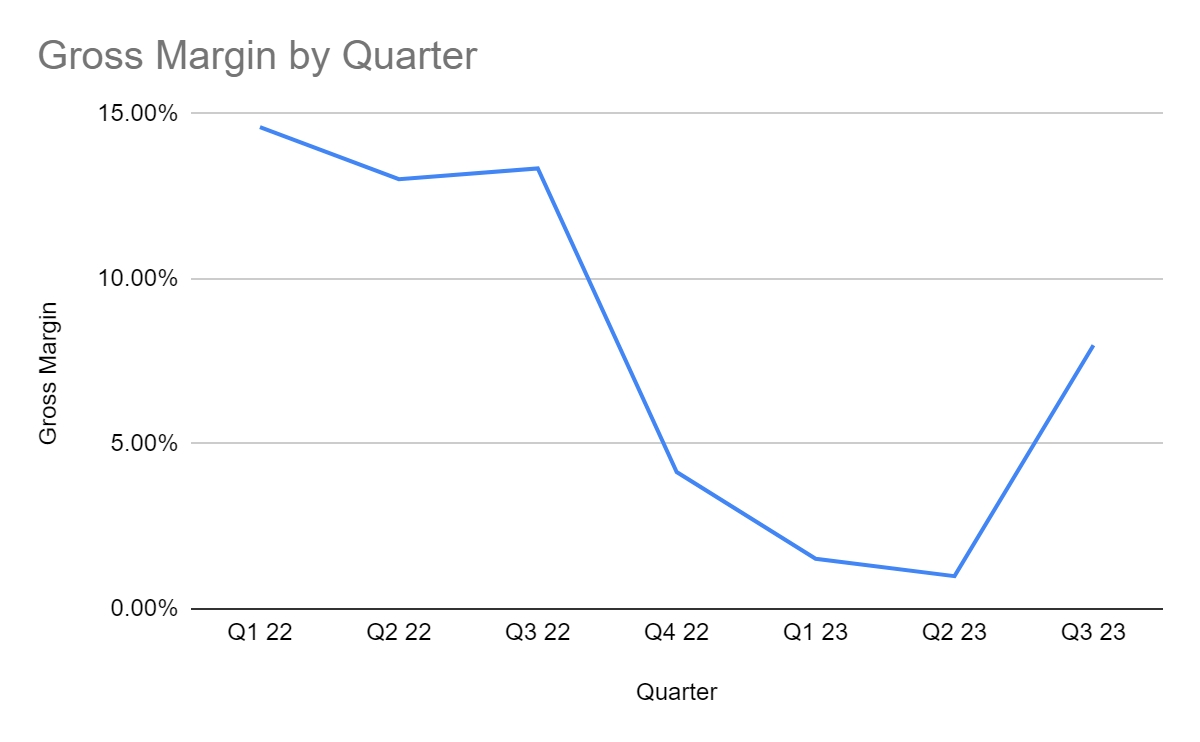

In addition, NIO’s gross profit margin improved significantly in the third quarter of 2023, increasing from 1% in the second quarter of 2023 to 8%. If NIO’s gross profit margin continues its upward trend, the company’s losses may improve in 2024, in addition to layoffs.

Quarterly reporting

The final point in my bearish thesis is that Nio’s liquidity position is strong following its investment in Abu Dhabi’s CYVN Holdings. $2.2 billion In December, the company increased its stake in the electric vehicle maker, raising its stake to 20.1%. In this way, NIO can absorb growing losses and pursue growth initiatives, especially if CYVN supports it in a similar manner to PIF and Lucid.

in conclusion

All in all, while Nio’s current valuation may appear undervalued, I think it’s a value trap given the headwinds it faces in China’s EV market. In fact, demand for EVs in China is declining, as shown by January deliveries from most EV manufacturers. Additionally, the company’s share of total EV sales in China has been declining over the past three years, from 3.03% in 2021 to 1.69% in 2023.

NIO’s plan to build 1,000 battery swap stations in 2024 is also likely to increase its losses, considering I estimate the effort will cost the company $592.1 million. Meanwhile, NIO’s poor performance in the European market could become a major problem for the EV maker in the future if the EU imposes additional tariffs on Chinese EVs, which would further reduce demand for its cars in Europe. Given my price target of $3.36, I have to rate NIO a Sell.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.