Andy Feng

NIO Company (NYSE: NIO) Just made one announcement The electric vehicle company is cutting its delivery forecast for 1Q24 due to a weak demand environment in the company’s core market of China, the company said.

Although the slowdown in growth is clearly A huge challenge for NIO and an impediment to NIO stock price appreciation, I think the EV company is overly exposed to the painful change in sentiment toward the EV business.

NIO’s stock just hit a new low, but its valuation is now at its most compelling point ever, in my opinion. Investors appear to have overreacted to the company’s forecast, and NIO should benefit from a rebound in deliveries later this year.

My rating history

I revised NIO’s stock classification to Buy in December due to strategic investment transactions between NIO and CYVN Holdings. 2023, holding company Chosen to invest $2.2 billion in NIO to fund the electric vehicle company’s EV growth strategy. Unfortunately, contrary to my expectations, NIO shares have been trading lower since December as concerns about EV demand took center stage.

Although NIO’s EV growth is flat in the short term, I think its margin settings are compelling and NIO has recovery potential.

Updated delivery forecast and delivery recovery for Q1 2024

NIO expects to deliver about 30,000 electric vehicles in the first quarter, down from its previous forecast of 31,000 to 33,000 vehicles, according to an update to its delivery forecast released on Wednesday. The guidance means NIO will deliver approximately 11,813 vehicles in March. The guidance is obviously a negative catalyst, but I think investors may be overreacting a bit.

NIO only revised its outlook modestly by 3% compared to the lower end of its previous guidance, so the new guidance clearly shouldn’t be viewed as a major deal-breaker.

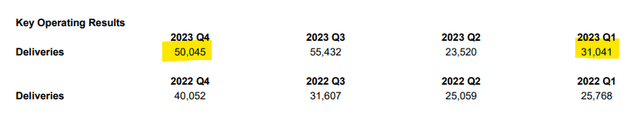

Under the new forecast, Nio expects to deliver 120,000 electric vehicles in 2023, but the company’s deliveries could increase significantly later this year. That’s because first-quarter deliveries were skewed due to the inclusion of the 15-day Lunar New Year period, meaning NIO should have seen a rebound in deliveries last quarter. For example, from the first quarter of 2023 to the fourth quarter of 23, NIO’s vehicle delivery volume surged by 61%.

During the Lunar New Year holiday, factory activity was reduced to zero as workers in China’s manufacturing hubs such as Shenzhen returned to their hometowns. As a result, first-quarter deliveries fell sharply for all EV companies. However, as workers return and factories return to normal, NIO and other EV makers should be able to ramp up production again.

Main operating results (NIO)

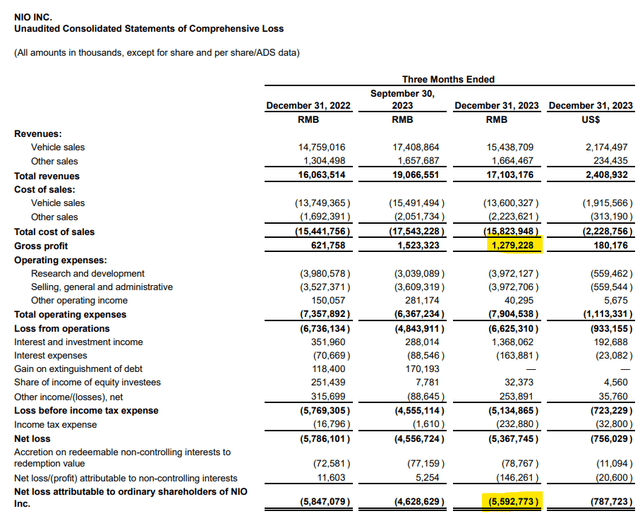

NIO’s gross profit situation is improving

The outlook change sent Nio shares to a new low on Wednesday. Nonetheless, NIO’s business is growing in encouraging ways.

NIO’s gross profit in 4Q23 was 1.2792 billion yuan ($180.2 million), more than double the company’s profit a year ago. It’s clear that NIO is still trying to drive the business towards black zero (net loss in Q4 2023 was RMB 5,592.8 million ($787.7 million)), but I think it could be in Q1 2024 as deliveries increase After recovery) In fact, NIO’s business growth in 2024 is indeed on a very good path.

gross profit (NIO)

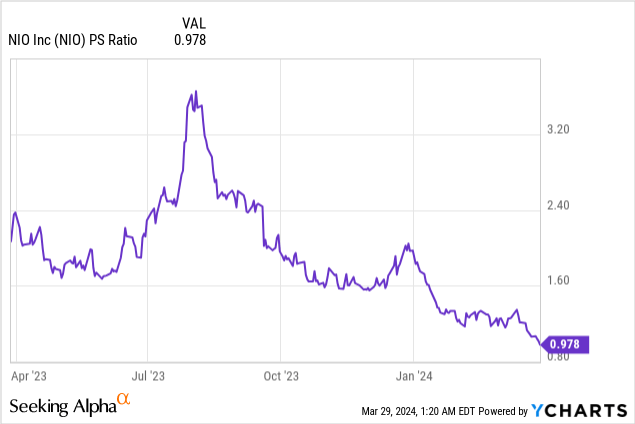

Nio’s sales multiple seems too good to be true

If there’s one thing working in Nio’s favor right now, it’s its valuation multiple. NIO encountered fresh selling pressure, with its shares falling to a new low of $4.67 after an adjustment to its delivery outlook. Nonetheless, NIO’s sales potential is not currently overestimated in my opinion, which equates to a very favorable risk/reward relationship. Nio stock trades at a price-to-earnings ratio of 0.98, which is based on the company’s expected sales in 2024. The price-to-earnings ratio relates to fiscal 2024. Given that NIO’s sales are expected to grow in 2024, I believe the price-to-sales ratio is the most appropriate valuation ratio for the electric vehicle company.

Xpeng Motors (XPEV)is the top competitor, with sales 1.4 times higher (also based on current year sales).However, Xpeng Motors’ expected delivery volume in 1Q24 is much lower than NIO: Electric Vehicle Company guided Deliveries in the first quarter were only 21,000 to 22,500 units.

Xpeng’s net loss decreased by 43% in 4Q23, mainly due to strong sales growth, but the electric vehicle company’s gross profit margin is indeed weaker than that of NIO (compared to Xpeng, NIO Gross margin in 4Q23 was 7.5% (profit margin of 6.2%). Xpeng’s 1Q24 delivery targets are also much smaller, which is why I prefer Nio to Xpeng every day of the week.

Historically, Nio’s sales multiples have been much higher. In 2023, NIO’s sales increased by more than 3.0 times, and the company has made great progress in improving gross profit.

Why investment theories can disappoint

Nio clearly can’t escape market forces, which in this case suggest waning demand for electric vehicles in China, the company’s core market.

Obviously the potential for delivery disappointment in the near term is a wildcard for NIO, but investors should keep in mind that 1Q24 delivery numbers are not representative due to the Chinese New Year. Most likely, they will rebound in the coming quarters.

If NIO’s gross profit margin continues to deteriorate in 2024, this paper of mine will be disappointing.

my conclusion

NIO shares recently fell below $5, but in my opinion, now is the best time to buy NIO in years.

The long-term prospects of the electric vehicle industry are optimistic, and investors should expect increases and decreases in NIO’s underlying business and stock price.

The first-quarter delivery adjustment, while not huge, is not a major disaster either, as the expected decline is only a paltry 3% below the lower end of Nio’s previous guidance.

I still expect deliveries to gradually recover in the coming quarters and believe NIO currently has the best risk/reward relationship in years.

Given that the stock trades at such a low sales multiple, I think Nio’s valuation actually implies a very high margin of safety. Strong Buy.