Ansonso

Now is a great time to be an income investor, especially given that most of the market is now focused on chasing speculative growth. Added to this is the practice of index investing, which perpetuates high valuations for companies like Tesla (TSLA).) and NVIDIA (NVDA) due to its huge market capitalization and huge influence on the S&P 500 (spy) compared to most other companies.

That’s why I prefer to cut out the noise and focus on growing income streams from undervalued dividend-paying stocks that have a long track record of shareholder returns.

I found this to be the case with NNN REIT (NYSE: NNN), I last gave it a Buy rating in December, emphasizing its high occupancy rate and conservatively leveraged balance sheet. The stock has since been flat (price up 0.35%, total return including dividends 1.7%) as markets remain optimistic about the pace of rate cuts Has faded since December.

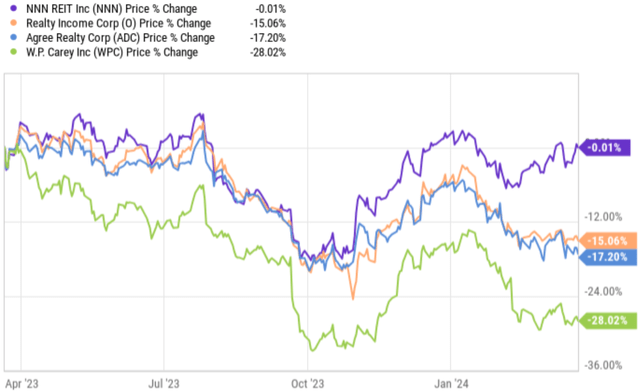

NNN has outperformed peers Realty Income (O), Agree Realty (ADC), and WP Carey (WPC) over the past year, in part because NNN started at a lower valuation than O and ADC and avoided office towers, etc. The real estate industry is in trouble, which has plagued peer WPC and led to spin-offs and dividend cuts.

NNN vs. Peers 1 Year Price Change (YCharts)

In this article, I take a fresh look at NNN and discuss why market uncertainty for the stock makes now a good time to buy this reliable dividend-paying company, so let’s get started!

Why NNN?

NNN REIT is a net lease REIT with a longer record of dividend growth than Realty Income Corp., having raised its annual dividend for 34 consecutive years. The company currently owns 3,532 properties in 49 states with an average remaining lease term of 10.1 years.

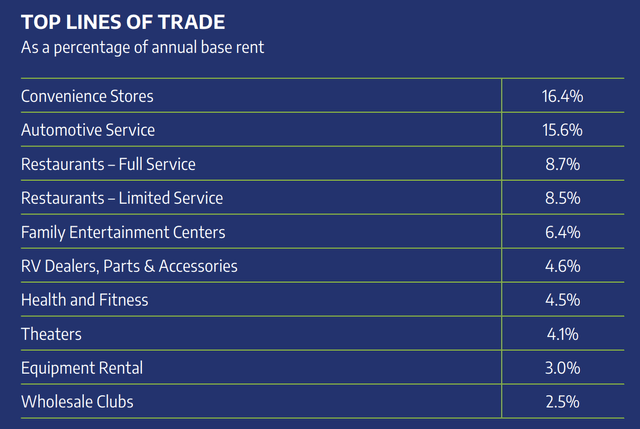

Its tenants are also diverse, covering more than 30 different trade areas in the retail sector, which are based on essential goods and resist e-commerce. This is reflected in the breakdown below, which shows convenience stores, car services, restaurants and family entertainment centers accounted for 55.6% of NNN’s annual base rent.

Investor introduction

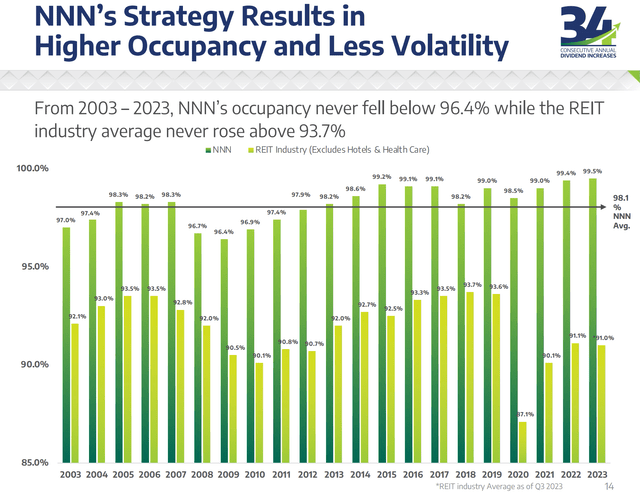

While NNN’s share price performance over the past year might suggest otherwise, it’s still proving to be a solid choice, with full-year 2023 FFO per share up 4.5% year-over-year to $3.24. This was driven by healthy organic growth from annual rent increases and a high portfolio occupancy rate of 99.5%, which increased 30 basis points sequentially and 10 basis points year-on-year. As shown in the chart below, NNN’s occupancy rate has never been lower than 96.4% over the past 20 years, while the average occupancy rate for the entire REIT industry has never been higher than 93.7%.

Investor introduction

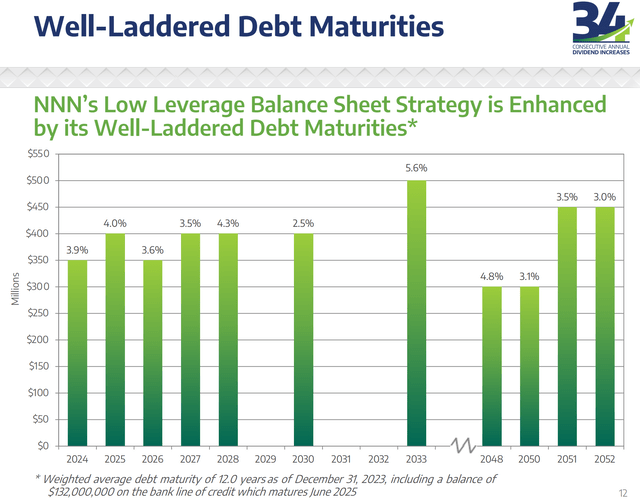

NNN’s growth has also been driven by strong acquisition volume, with 165 properties acquired last year with a total value of $820 million, an initial cash cap rate of 7.3%, and a weighted average remaining lease term of 18.8 years, significantly longer than the portfolio’s 10.1 years Average term. This was primarily funded through the issuance of $500 million of 10-year unsecured notes at an attractive rate of 5.6%, implying an investment spread of 170 basis points (compared to the 7.3% cap rate mentioned above) . The additional funding came from asset disposals worth $116 million, with a cap rate of 5.9%, implying an investment spread of 140 basis points, while dilutive share issuance was only $31 million.

Going forward, NNN remains well-positioned from a balance sheet perspective should the opportunity arise. This includes a safe net debt to EBITDA ratio of 5.5x, below the 6.0x level that ratings agencies generally consider safe, and an S&P BBB+ investment grade credit rating, which comes in handy in the current higher interest rate environment. This helps ensure that NNN obtains financing at more favorable rates compared to more leveraged private market participants.

Additionally, NNN has strong fixed charge coverage and a safe unsecured debt to total assets ratio of 42%, which is below the 50% threshold I generally consider safe for REITs. As you can see below, NNN’s debt maturities are also reasonable, with no more than 4.3% of its debt due between now and the end of the decade.

Investor introduction

While rates may not drop as quickly as some initially thought, an eventual drop in rates would be a boon to REITs like NNN that purchase properties at the current higher cap rates. This is because rents are unlikely to fall due to the annual escalator, whereas interest rates may change.The Federal Open Market Committee will hold seven more meetings this year, and the Fed has indicated Interest rates are likely to be cut in 2024, but more positive signs from the economy related to inflation are awaited.

Risks to NNN include the possibility of no rate cuts, or even rate hikes, if inflation becomes difficult to contain, as this would reset NNN’s outlook for when the spread between invested cash yields widens and debt refinancing rates fall. Increased timetable for roads. Other risks include the potential for cap rates to be compressed on new property acquisitions if private market buyers become more accustomed to the new normal and return to the bidding table following balance sheet deleveraging.

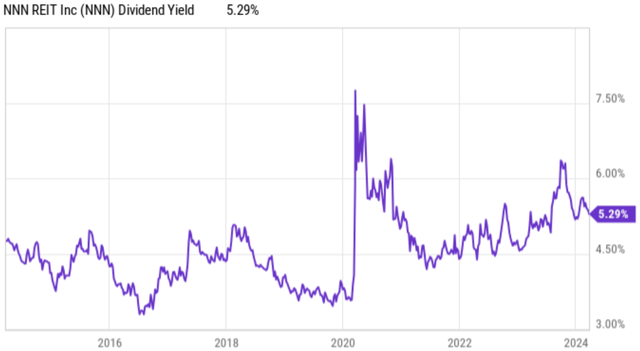

Importantly for income investors, NNN currently has an attractive 5.5% dividend yield, which is well served by a 69% payout ratio. The company increased its dividend by 2.7% last year despite uncertainty about interest rates, and I expect another dividend increase this summer, which would extend its current streak of 34 consecutive annual increases. Over the long term, NNN’s dividend yield remains at the high end of its 10-year range, excluding outliers such as the early 2020 pandemic time frame and last October’s rate-driven panic selling, as shown below.

Y chart

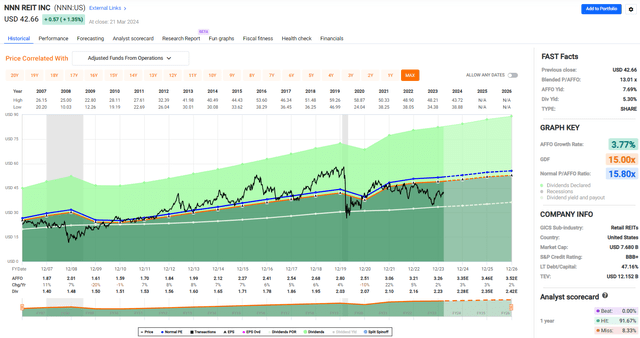

In the end, I still think NNN is worth its weight in gold at its current price of $42.43 at the time of writing and its forward P/FFO of 12.8, well below its normal P/FFO of 15.8. While the market is absorbing the opportunity costs and risks of the current interest rate environment, I believe the market is also failing to realize the potential long-term benefits from realized inflation and the potential for high cap rates in real estate and lower interest rates. road.

quick chart

If NNN returns to its normal long-term FFO/share growth rate of 5%, coupled with its current yield of 5.3%, it could provide investors with market-beating returns, even without accounting for the stock’s appreciation to its average valuation.

Compared with peers, NNN currently trades at a premium to Realty Income’s 12.3x P/FFO and WPC’s 11.9x, and below Agree Realty’s 13.7x. While I currently think Real Estate Income is the better value right now, I think NNN is a solid alternative due to its purely US-based portfolio of similar quality investments.In the short to medium term, if the Fed sticks to its policy, I would target NNN’s P/FFO in the 14-16x range set objectives There will be three interest rate cuts this year, providing more visibility and stability to interest rates.

Important points for investors

NNN is a well-positioned triple net lease REIT with a diversified portfolio of necessity-based retail properties and solid internal and external growth prospects. Its strong balance sheet, investment-grade credit rating and attractive dividend yield make it an attractive choice for income investors looking for portfolio stability.

While risks do exist, NNN is likely to achieve long-term outperformance due to lower interest rates going forward, making NNN a compelling choice for investors looking for income and capital appreciation potential. Taking all of the above into consideration, I maintain my Buy rating on NNN, with no change in view since my last visit to the stock.