PeopleImages/iStock via Getty Images

We previously covered Digital Realty Trust (NYSE:NYSE:DLR) in December 2023 discussed why we maintain a Buy rating on the stock due to improving monetization rates and impressive AI momentum through 2027.

combine Data center partnerships announced real estate income (oxygen)/ black stone (Bacchus), we believe DLR is well capitalized and capable of achieving profitable growth in the future.

In this article, we discuss why DLR’s prudent growth strategy was misunderstood, attributing what should have been lackluster fiscal 2024 guidance to diversification of capital resources and ultimately balance sheet management.

As the REIT is expected to remain profitable through fiscal 2024, we believe the recent pullback presents an opportunity for dollar-cost averaging for interested investors.

DLR investment thesis remains attractive due to prudent fiscal 2024 guidance

Currently, DLR reports a decent FQ4’23 earnings call with revenue of $1.36B (-2.8% month-on-month/ +10.5% YoY), core FFO per share is $1.63 (+0.6% QoQ/ -1.2% YoY), AFFO per share is $1.30 (-7.1% QoQ/ +0.7% YoY), and FY2023 numbers are $5.47B ( They were +16.6% year-on-year), US$6.59 (-1.6% year-on-year) and US$5.84 (-2.6% year-on-year) respectively.

Meanwhile, the REIT reported on-cap cash NOI growth of +9.9% in the most recent quarter (+0.5 points QoQ/15.7 points YOY), further underscoring the success of its data center portfolio to date .

While these numbers seem promising, unfortunately, DLR is giving fiscal 2024 revenue guidance of $5.6B (2.3% annual growth) and core FFO per share guidance of $6.67 (1.5% annual growth), in the middle of the range Not impressive.

This compares with market consensus estimates of $5.84B (annual growth of 6.7%) and $6.83 (annual growth of 3.9%), respectively, which represents a significant slowdown in revenue growth compared to fiscal 2023 levels.

Apparently, DLR’s diversification of risk by ceding partnership interests to other companies such as O and BX inadvertently led to a slowdown in expected top/bottom line growth, especially since the former held only a 20% stake in these joint ventures.

However, we still believe DLR’s partnership has been very cautious as debt to EBITDA ratio ballooned to 7.24x in 4Q23, compared to 6.78x in 3Q23 and 7.62x in 4Q22, In fiscal year 2019, it was 5.59 times.

This is based on the REIT’s long-term debt of $16.44B (up 3.9% QoQ/62.4% YOY and 62.4% above the FY19 level of $10.12B) and Adjusted EBITDA of $568.75M (-2.7% QoQ/YoY) Growth of 4.9% last year/+ 25.4% decrease from the $1.81B level in fiscal 2019).

When we compare DLR’s leverage with REIT Major Average Compare this to 5.81x for data center REIT peers such as Equinix (EQIX) at 4.60x, Iron Mountain (IRM) at 6.49x, and American Tower (AMT) at 5.09x, and it’s clear that the former’s leverage may be temporarily affected. out of control.

Although the fixed interest rate weighting is relatively high at 85.3% (an annual increase of 4.3 percentage points) and the effective interest rate is relatively low at 2.89% (an annual increase of 0.38 percentage points), the acceleration of debt growth and the slowdown in adjusted EBITDA growth directly led to DLR’s profitability Expansion slows.

For context, the REIT reported revenue CAGR of +14.4% between fiscal 2016 and fiscal 2023, with AFFO per share growth stagnant at +1.4% and dividends per share growing at +4.8 %, partly due to a doubling of share. Counted in the same period.

Combined with the reduced capex obligations, we can understand why DLR management opted for the latest partnership, especially since its $2.12B of debt is due in 2025, meaning that as management works to meet its leverage targets, Short-term capital preservation is about 5.5 times more important.

If anything, most of the joint venture projects are expected to come online in 2025, by which time most of the new capacity is expected to add to its profits, thanks to a growing backlog and strong pricing power.

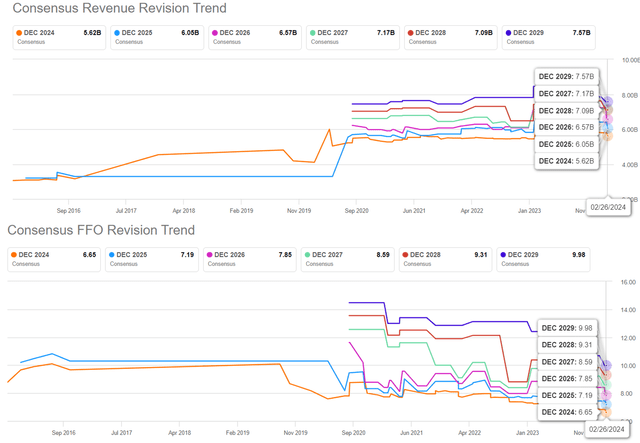

Consensus forward estimate

Seeking Alpha

Consensus forward forecasts are now seeing the same downward revision, with DLR expected to post revenue/profit CAGR of +6.2%/+8.4% through fiscal 2026.

That compares with previous estimates of +11%/+11.2%, although still an expansion from historical growth rates of +14.4%/-1.4% in FY2016 and FY2026, respectively.

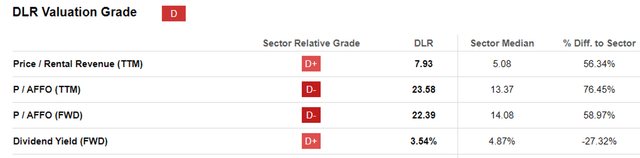

German Aerospace Center Valuation

Seeking Alpha

Nonetheless, DLR stock continues to trade at a relatively reasonable FWD price/rental revenue valuation of 7.93x and FWD price/AFFO per share valuation of 22.39x. In comparison, the 1-year average is 6.23x/18.93x, the 3-year pre-pandemic average is 7.55x/19.19x, and the industry median is 5.08x/14.08x.

We believe it does make sense that the REIT sector’s growing premium to the median is driven by artificial intelligence. Especially since DLR’s valuation is also close to its data center peers, such as EQIX at 8.38x/23.32x, IRM at 3.06x/14.80x, and AMT at 8.02x/19.30x.

Further fueled by the fact that DLR’s projected top-line/bottom-line growth likely won’t pale in comparison to EQIX’s +8.9%/+8.8%, IRM’s +9.4%/+9.8%, and AMT’s +4.4%/+10.5 Got this. %, but expanded compared to historical averages.

With its solid earnings growth guidance for FY24, we believe DLR has been cautious in “diversifying its capital sources through the formation of two new development joint ventures” as this is also tied to the future of its balance sheet Improvement is directly related.

So, is DLR stock a buy?sell, or hold?

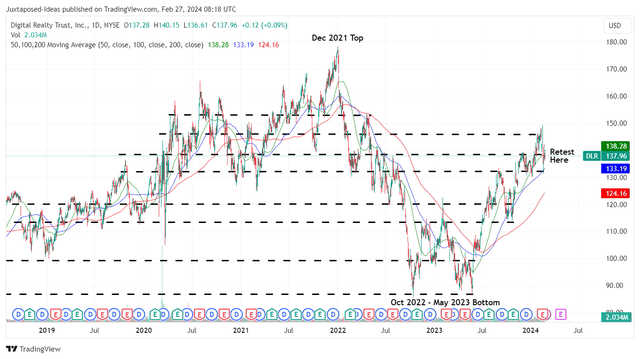

DLR 5-Year Stock Price

trading ideas

Currently, DLR shares have retreated significantly following the recent Q4’23 earnings call, with the stock’s market value down -9.1% at its worst. However, with bullish support also moving toward $135, long-term investors are clearly not worried about the impressive forward guidance.

Although dividend payments have stagnated since the last rate hike in March 2022, the Data Center REIT continues to offer a decent forward dividend yield of 3.54%, in line with peers such as EQIX at 1.94%, IRM at 3.45%, and AMT is 3.62%.

While its performance itself is poor compared to the overall REIT industry median of 4.87%, we still firmly believe that DLR is still a pretty good dividend stock.

This is especially helped by the fact that DLR currently trades closer to our fair value estimate of $130.70 due to the recent pullback, based on fiscal 2023 AFFO per share of $5.84 and FWD price/AFFO of 22.39x.

Our long-term price target of $166.30 also appears to have significant upside potential of +20.3% based on the consensus FY2026 AFFO forecast of $7.43.

We maintain a Buy rating on DLR stock due to its (expected) two-pronged returns.