Dimarik

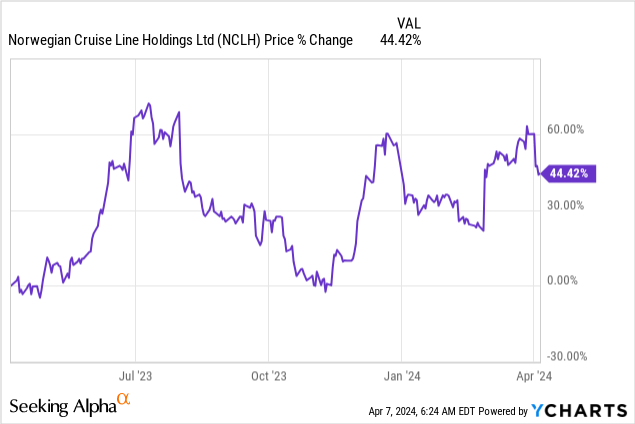

Norwegian Cruise Line Holdings (NYSE:NCLH) is seeing record demand for new ocean-going cruise ships amid a strong consumer environment and an upward trajectory for cruise passengers following the COVID-19 pandemic.I think the recent decline in the company’s share price is Considering the impressive booking and pricing trends the company is seeing across its business, this is a buy-it-now opportunity. With the recent share price decline (likely due to profit-taking), I believe the risk profile here has improved, and as the company’s ability to accelerate debt repayments improves in 2024, I think there is room for upside.

Previous rating

I rated Norwegian Cruise Line Holdings a Hold in December because the company’s stock repriced strongly in the fourth quarter despite the deteriorating Red Sea risk profile.Houthi armed forces begin attacking container ships in fourth quarter quarter, which raises some concerns for me about booking trends. Recently, however, the share price has corrected again without any major company announcements and pricing trends have not been affected… which I believe has once again improved NCLH’s value proposition. Additionally, Norwegian Cruise Line Holdings reported strong pricing and booking trends for its future ocean cruise ships and a return to full-year operating income profitability in fiscal 2023. Another lever for the company’s earnings growth could come from accelerated debt repayment in fiscal 2024.

Strong operating conditions in the cruise market

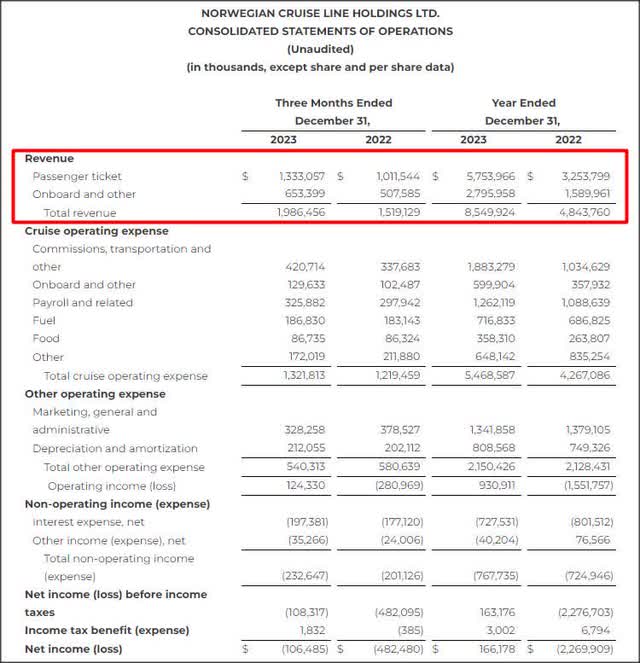

Norwegian Cruise Line Holdings delivered very solid results in the fourth quarter and fiscal 2023, driven by an industry-wide recovery largely supported by passengers returning to cruise ships post-pandemic. The company announced its results at the end of February. showing improvement trends All major key metrics (revenue, operating income, EPS). As a result, the cruise line recorded very strong revenue in fiscal 2023: Norwegian Cruise Line Holdings’ total revenue was $8.6B, up 77% year over year.

This growth was primarily driven by growth in passenger ticket sales as pent-up demand for ocean cruise ships was fully unleashed in fiscal 2023. As the chart below shows, Norwegian Cruise Line Holdings has also returned to positive operating income profitability and is fully profitable. Fiscal 2023 marks a major milestone for the cruise line after the COVID-19 pandemic devastated the industry. NCLH’s operating income was $930.9 million, and operating profit fluctuated significantly by $2.5B from the same period last year.

Norwegian Cruise Line Holdings

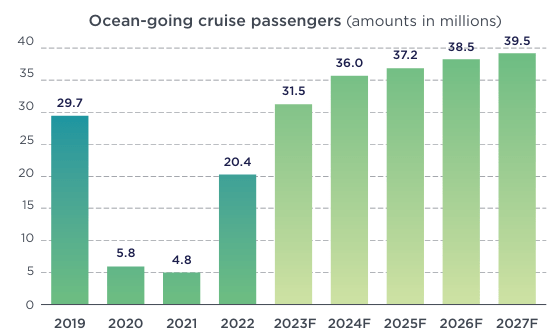

this Appearance The cruise industry remains favorable, with strong consumer spending and falling inflation likely contributing to this positive operating environment. The cruise industry’s passenger traffic is expected to continue its upward trend in fiscal 2024, which could result in Norwegian Cruise Line Holdings setting a new passenger record, according to Cruise Lines International.

Fiscal years 2022 and 2023 are already years of strong rebound for the industry, with 36 million cruise passengers expected this year, which, if true, would be a massive 21% increase over the pre-pandemic passenger record of 2019. As the third largest cruise line by market capitalization, NCLH is a great way to participate in the growth of the industry. Additionally, NCLH has stronger catalysts for earnings growth related to its balance sheet restructuring/debt paydown.

chemiluminescence analysis

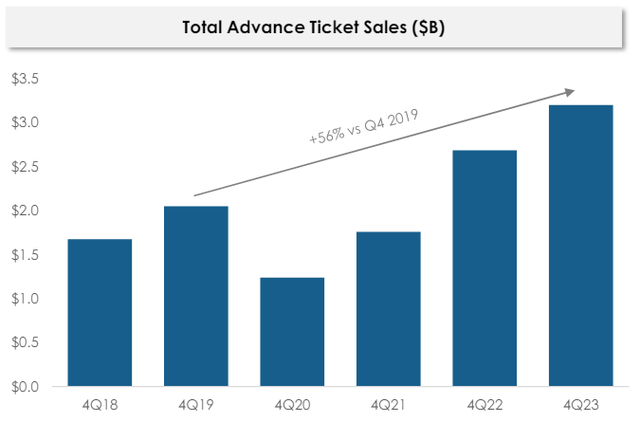

Norwegian Cruise Line Holdings also experienced strong booking trends, leading to record advance ticket sales. Compared with the fourth quarter of 2023, the cruise line’s advance ticket sales increased by 56%, strengthening the company’s pricing advantage.

Norwegian Cruise Line Holdings

According to the latest data from Norwegian Cruise Line Holdings earnings releasethe company’s upcoming ocean cruises hit record prices, while recent Red Sea turmoil has not had a significant impact on the company’s core business trends:

The company continues to experience healthy consumer demand and is at all-time high bookings and pricing, reflecting some of the best booking weeks in the company’s history starting with Black Friday and Cyber Monday. Additionally, onboard revenue per passenger cruise day remains strong, up 20% for the quarter compared to 2019, with broad strength across all revenue streams.

Potential Leverage for NCLH Profitable Growth

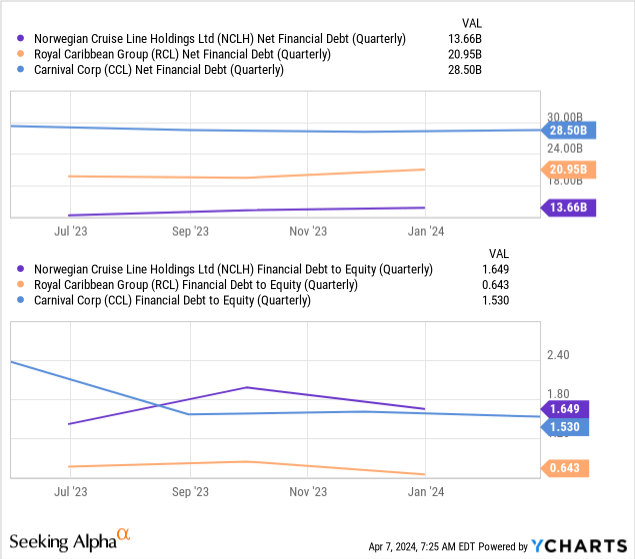

The cruise line still has a lot of debt to repay, which could affect the company’s valuation going forward. Norwegian Cruise Line Holdings has the highest leverage in the industry, although not the highest in absolute terms. Norwegian Cruise Line Holdings has net financial debt of $13.7B and a leverage ratio of 1.7x. Royal Caribbean Cruises ( RCL ) and Carnival ( CCL ) have higher absolute debt levels but stronger balance sheets… resulting in lower financial leverage. The average leverage of the three companies discussed here is 1.3x.

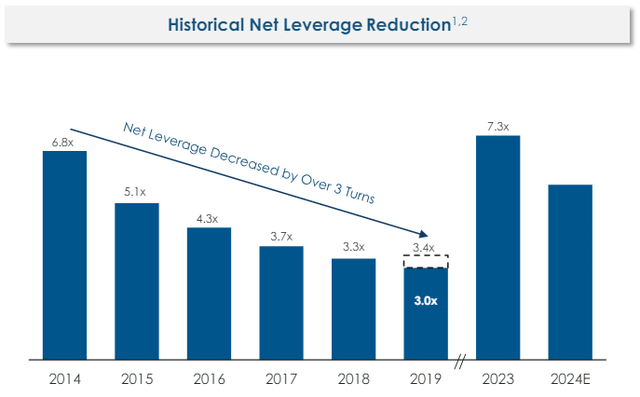

As a result, Norwegian Cruise Line Holdings has greater potential to clean up its balance sheet and create catalysts for profitable growth on its own. As a result, the cruise line can drive future earnings growth by restructuring its balance sheet and accelerating debt repayments… especially with booking and pricing trends so favorable. Norwegian Cruise Line Holdings paid down a massive $1.9B in debt last year, including $875M in revolving loan facilities.

The cruise line said it would prioritize debt repayment in 2024 and further reduce its leverage ratio to optimize its balance sheet. If NCLH repays a similar amount of cash this year to last year ($1.9B), its outstanding debt would likely be reduced by ~14%.

Norwegian Cruise Line Holdings

Potential rise to $25

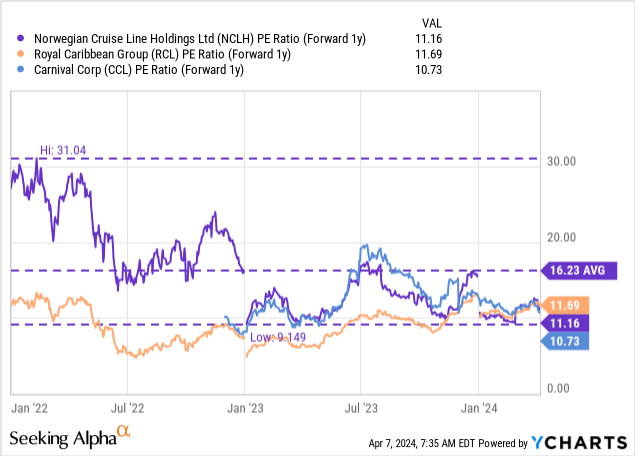

NCLH’s stock is currently valued at 11.2x P/E, which is roughly in line with the valuation multiples of Royal Caribbean Group (11.7x) and Carnival Corporation (10.7x), with the industry average P/E of 11.2x. Norwegian Cruise Line Holdings is also currently trading just below its 3-year average P/E of 16.2x, again suggesting that the stock may have a favorable risk profile for investors considering a dip here.

In my view, Norwegian Cruise Line Holdings could trade at 15 times earnings, assuming the cruise line can free up cash by paying down more debt in fiscal 2024 and its leverage remains in line with its competitors. I use the P/E ratio because NCLH has returned to profitability in fiscal 2023, as has Royal Caribbean Cruises.

Norwegian Cruise Line Holdings expects to post stronger EPS growth this year than its industry rivals, and in my opinion, the cruise line has more upside to its EPS expectations due to the possibility of a balance sheet restructuring…I think it’s believed Support reasons for purchase. NCLH expects earnings per share to grow 85% this year, while Carnival expects to return to profitability only this year (on a full-year basis). RCL expects earnings per share to grow 48% this year and is already profitable. In terms of EPS growth potential, NCLH appears to be undervalued relative to its competitors.

A fair value P/E of 15x (FY2025 EPS estimate of $1.69) – still below the 3-year average P/E – translates into a fair value share price of $25. My fair value estimate for NCLH is a dynamic number that will change as the company’s deleveraging progresses and its impact on the company’s EPS estimates.

Risks of NCLH

Norwegian Cruise Line Holdings relies on consumer spending and positive attitudes from passengers. If the industry sees signs of slowing advance ticket sales and weakening pricing power (metrics I monitor), then the industry may be headed for an earnings recession and the company may have to delay its deleveraging strategy. Delays in debt repayments could hinder equity repricing, so this is a major risk to investment presentations. My view on Norwegian Cruise Line Holdings will change if it sees a drop in passenger numbers and a drop in ticket sales.

final thoughts

Norwegian Cruise Line Holdings is benefiting from improving operating fundamentals in the cruise industry, driven primarily by a rebound in passenger traffic after the pandemic. While the stock price is broadly in line with other cruise lines’ valuations, I believe Norwegian Cruise Line Holdings has stronger leverage to drive its future earnings growth because the company is focused on paying down debt and has higher leverage. Booking trends have also been unaffected by the recent turmoil in the Red Sea, and Norwegian Cruise Line Holdings returned to a full-year operating profit last year…two favorable developments as well. I view NCLH shares as a speculative buy and believe they have the potential to rerate to $25!