RichVintage/E+ via Getty Images

The artificial intelligence craze among investors buying semiconductor stocks finally appears ready to turn into a sell-off. Why? Of course, since last summer, valuations and pricing have reached unprecedented heights.mine The bearish view is that an unexpected rise in inflation and interest rates over the summer will undermine the rationale for falling interest rates that has underpinned big tech and semiconductor stocks’ surge since October.

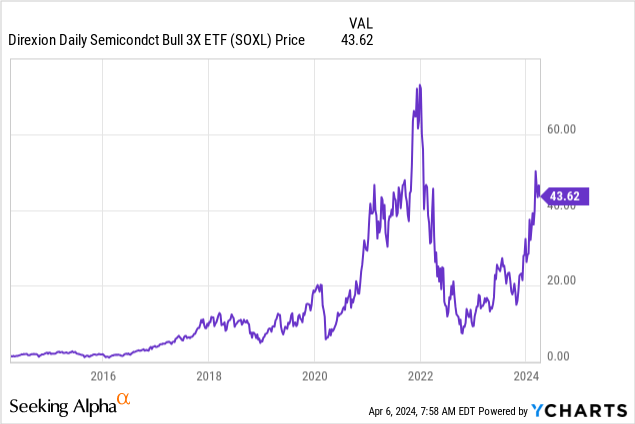

So if the rest of 2024 is followed by a painful -20% correction for the leading semiconductor companies leading up to a -50% crash, then I would definitely avoid it Direxion Daily Semiconductor 3x Bull ETF (NYSE: SOXL).We may be entering longer periods like 2022 where daily rebalancing and compounding functions work against holders because of fund fees and swap contract costs accumulation. A deep sell-off in the big tech sector, especially in the top semi-finished companies in the AI craze, could initially cost investors huge losses on the SOXL 300% long design while making the calculation of a rebound to unchanged pricing levels over the next few years very complicated. difficulty.

YCharts – SOXL, weekly price changes, 10 years

Bad valuation background

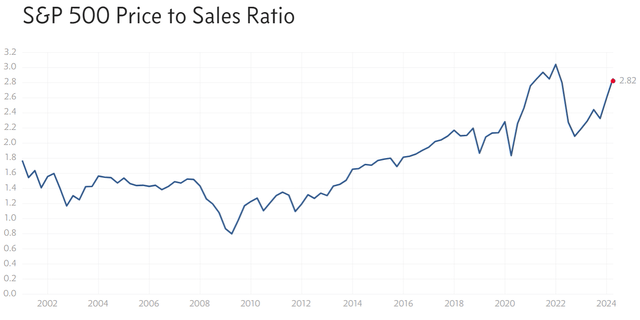

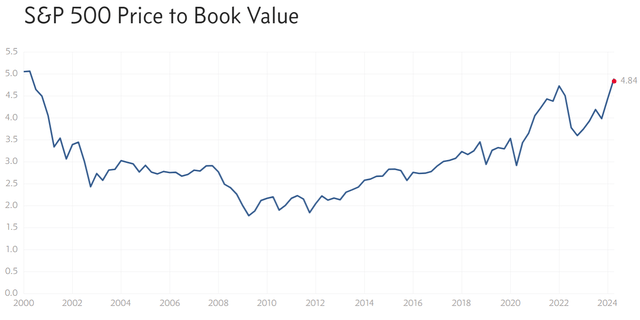

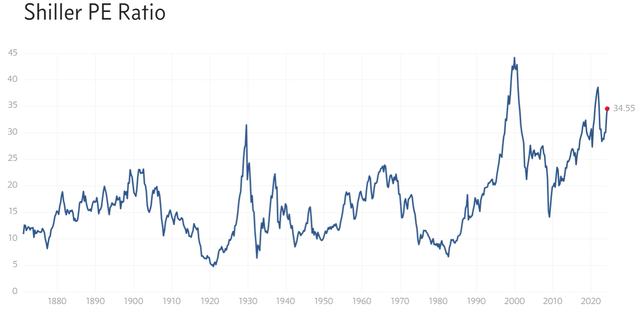

The entire U.S. stock market (as measured by the S&P 500) is now priced at near record price-to-sales and book value multiples, and one of the worst setups in the famous long-term Shiller CAPE ratio (which looks back at 10-year trends). ).

Multipl.com – S&P 500 price-to-sales ratio, since 2001 Multipl.com – S&P 500 price-to-sales ratio, since 2000 Multipl.com – S&P 500 price-to-sales ratio since 1872

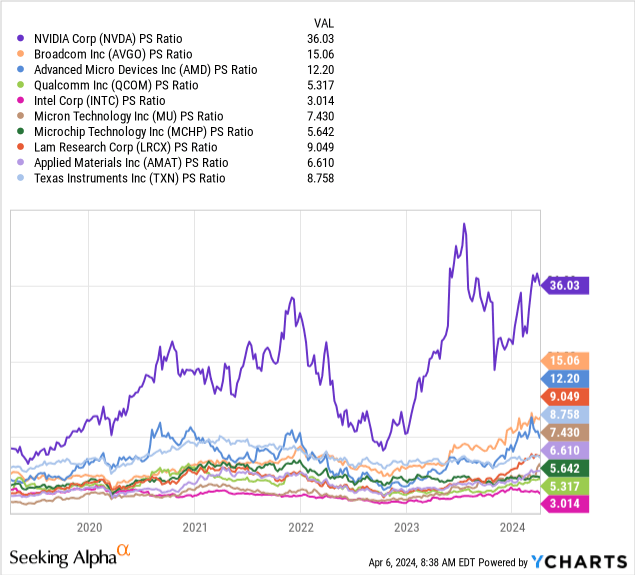

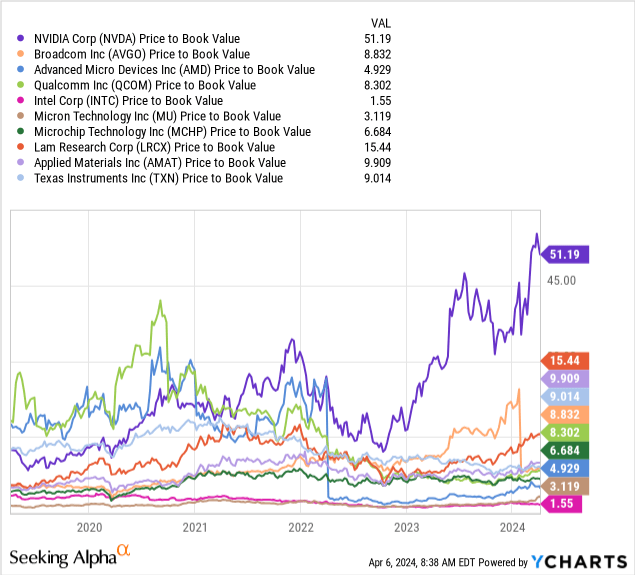

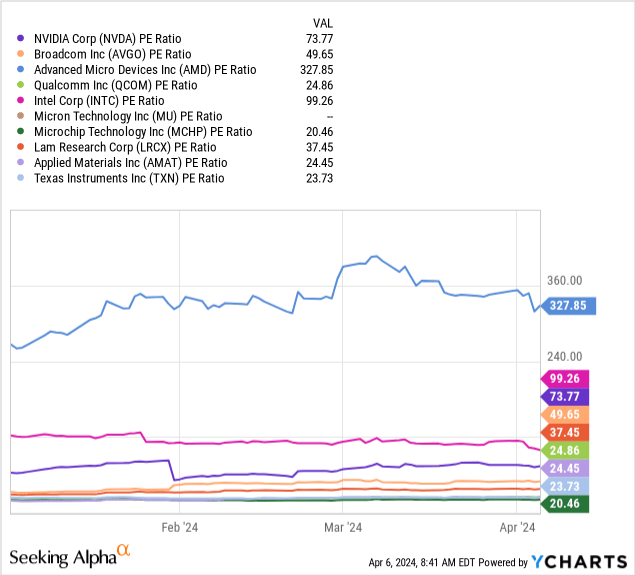

Even worse news is that SOXL’s holdings in major semiconductor companies are valued at even higher valuations. Looking back at some of the most heavily weighted positions in SOXL, it’s easy to understand that for today’s new buyers, the underlying valuation is quite high.i include Nvidia (NVDA), Broadcom (AVGO), Advanced Micro Devices (AMD), Qualcomm (Qualcomm), Intel (International Trade Centre), Micron (mu), Microchip Technology (MCHP), Pan-forest research (I am), Applied Materials (Amat), and Texas Instruments (TXN) in my chart. This group accounts for approximately 50% of the underlying index weighting used by SOXL.

In the 5-year chart below, you can see the average median price-to-sales and book value ratios, which are both currently in the 8x range and well above the S&P 500’s readings.

YCharts – Major Semiconductor Stocks, Price-to-Sales Ratios, 5 Years YCharts – Major Semiconductor Stocks, P/B Ratios, 5 Years

Additionally, the median trailing P/E ratio is 37 times, well above the current S&P 500 P/E level of 27 times.

YCharts – Major Semiconductor Stocks, Prices & Tracking Earnings, 3 Months

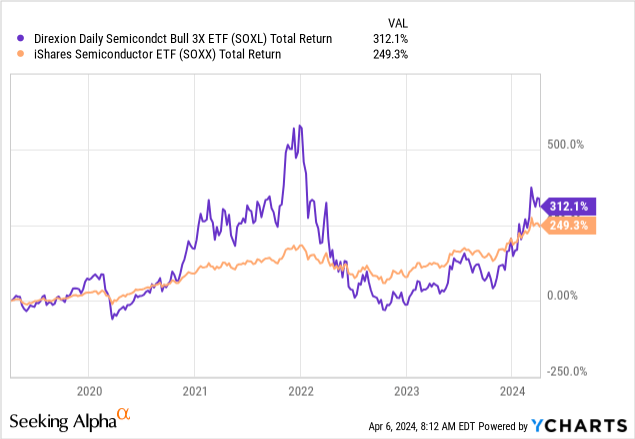

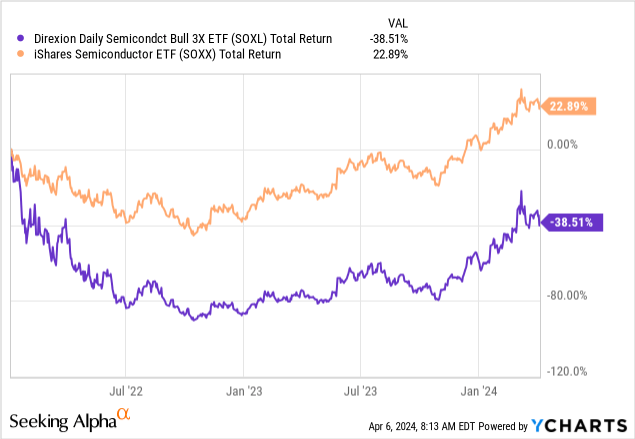

SOXL is priced use NYSE Semiconductor Index (ICESEMIT), a rules-based, modified float-adjusted market cap-weighted index that tracks the performance of the 30 largest publicly traded semiconductor companies in the United States.it is related to Philadelphia Semiconductor Index, but SOXL’s returns tend to be closely correlated with price changes in this more commonly traded and referenced index.this iShares Semiconductor ETF (SOXX) is the closest relative of SOXL to 100% long products.

Creating 3x leverage through swaps with major banks/brokers incurs additional costs over time, the industry’s wild price swings hurt rebalancing results, annual management fees are relatively high at 0.76%, and There are almost no cash dividend payments (currently yielding 0.39% per year), which makes it difficult for SOXL to keep up with SOXX. Of course, the industry’s massive growth over the past five years has helped SOXL outperform the market somewhat.

YCharts – 3x SOXL vs. 1x SOXX, Total Return, 5 Years

The worst news for new buyers in April 2024 is that after soaring prices in the previous year or two, the odds of future investment success “really” have been significantly reduced. Those who bought at the semiconductor peak in late 2021 are still waiting to regain breakeven! If you are willing to lose -90% of your investment between January and October 2022, then please. SOXL owners may experience a similar situation throughout the rest of 2024, as a massive 3x loss could be catastrophic for the bulls.

YCharts – 3x SOXL vs. 1x SOXX, total returns, since January 2022

Why am I bearish?

The logic for selling or avoiding SOXL is that the Fed appears to be stuck in tighter credit/banking policy than the market or economy will have for the rest of the year. And, with investor enthusiasm rising again and valuations once again reaching extreme levels seen in late 2021, I feel this ETF is riddled with downside “risk.”

Friday (April 5) saw strong U.S. employment data, U.S. inflation reports unexpectedly rising for two consecutive months, crude oil prices soaring in 2024 (up 20% from January 1), and gains in many food commodities since mid-2019 A misunderstood and ignored 2023, and the jump in gold/silver since early March (gold at all-time highs, silver at multi-year highs), screams that the inflation outlook is about to get worse.

The bond market is starting to take notice (prices have been falling for weeks), and the Fed seems equally lost on what’s going on in early 2022. Inflation will fall back to the Fed’s “hope” 2% annual target may soon be suppressed, forcing stock market investors to reassess how they price the high-growth technology sector. My concern is that a 4% or 5% change in the Consumer Price Index (CPI) by the end of the summer, with the growing likelihood of a Fed rate hike, could lead to a significant re-rating of semiconductor stocks, to achieve an acceptable valuation. Additionally, this scenario means we have to revisit the recession issue later this year, in addition to injecting new anxiety/uncertainty into the critical November election cycle.

What I’m saying is that disaster may be imminent for SOXL, and there’s a real chance that the price of its 3x design will drop in the -80% or greater range.

final thoughts

Putting all thoughts together, the Direxion Daily Semiconductor 3x Bull ETF was a risky security in April (that actually broke). I know that after a staggering 307% price increase between the October low and March peak, it would be easy to believe that instant wealth from artificial intelligence is part of the SOXL investment story. But all good things must come to an end.

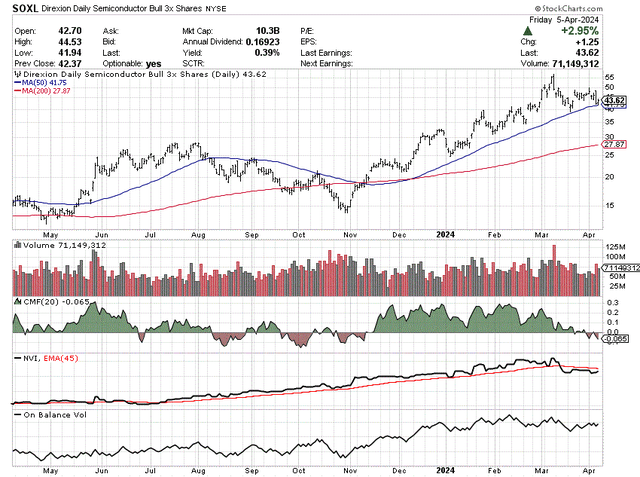

Technical chart strength for late 2023 has faded rapidly since March. The ETF’s momentum indicator peaked a few months ago, and prices are close to breaking above the 50-day moving average for the first time since early November.

On the 1 year daily trading chart you can look back 20 days Chaijin Fund Flow The indicator has turned towards sell territory.this negative volume index The strength in 2023 reversed into a bearish trend in March-April. and, balanced volume Statistics peaked in February.

StockCharts.com – SOXL, 12-month daily price and volume changes

My biggest concern is that U.S. semiconductor stocks will see a major top in early 2024. Unexpected spikes in inflation and interest rates mean that Big Tech’s valuations are not only overvalued, but worth falling back to long-term normal levels. If this is true, SOXL could be in for a serious sell-off. Then, if we do find ourselves in a recession and the decline in semiconductor and wafer demand in late 2024 and early 2025 materializes, SOXL could go from one of last year’s best investments to one of the worst-performing investments in 2024.

My rating for SOXL is a Sell and avoid. In order for the price of this security to rise significantly in December, we would have to experience further declines in inflation and interest rates without a recession. At this stage, I think the probability of a Goldilocks scenario is less than 25%. If rising interest rates lead to a further credit crunch, a recession later this year could be as high as 75%. For U.S. stocks, this may be a “watch below” moment worth considering.

thanks for reading. Consider this article the first step in your due diligence process. It is recommended to consult a registered and experienced investment advisor before entering into any transaction.