John Holmdahl

I’ve been sounding the alarm about the risks of Novavax (NASDAQ: NVAX) since “Novavax: the little engine that just can’t do it” on 11/2016.My most recent Novavax article is 11/2023’s “Novavax: Less is Less – A Shrinking COVID Market causing losses (rating downgrade)”.

This article reviews the investment merits of anxious trading following its fourth-quarter 2023 earnings release (the “Release”), presentation (the “Presentation”), 10-K (the “10-K”) and conference call (the “Conference Call”) .

Novavax’s disappointing earnings prompted a strong reaction from the market.

Novavax announced its fourth-quarter 2023 earnings before the market opened on February 28, 2024. Its GAAP earnings per share were -$1.44, $0.99 lower than analysts’ expectations; its revenue was $291 million, $30.97 million lower than expected.

Novavax Stock closure Priced at $6.02 on February 27, 2024. After the financial report was released, the stock opened at $4.64; its trading price fell to $4.23, and the closing price that day was $4.41, a drop of more than 25% from the previous day’s closing price.not atypical Shares subsequently recovered as the market digested the situation. As I write, they closed at $5.39 on March 1, 2024.

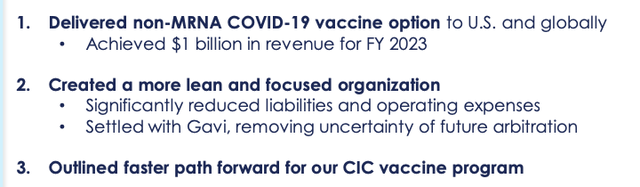

The call reports on Novavax’s progress in achieving its three priority focus areas in 2023:

- Vaccines available for fall updates;

- Control its finances by reducing expense rates, managing cash flow, and developing scale and structure;

- Leverage its technology platform, capabilities and assets to create additional value based on using only one approved vaccine, Nuvaxovid

The following excerpt from its briefing slide 4 summarizes its progress on these priorities:

Seeking Alpha.com

Its progress on the first project is already quite mature. Items 2 and 3 require more explanation. Unfortunately, as Novavax scrambles to fully respond to the pandemic, it has become so bloated that “significant” reductions in debt and operating expenses may not be enough. The jury is still out on this.

As for Gavi’s settlement, to put it simply, it refers to the arbitration of the Vaccine Alliance (GAVI). In the arbitration, GAVI is seeking to recover $700 million in unused coronavirus vaccine advance purchase agreements (APAs).

During the call, Chief Financial Officer Kelly detailed his analysis of the situation and its impact on Novavax; speaking of the current liabilities portion of the balance sheet, he noted:

… Approximately $700 million is related to Gavi … and more than $500 million of that will be transferred to long-term liabilities as we move forward.

In other words, the appeal of the settlement was not the absolute discount on Novavax’s liability, but the payment terms. The five-year payment converts the obligation from a current liability to a long-term liability. CEO Jacobs described the financial impact as:

…enabling us to better manage cash flow and make appropriate investments to grow our business. Based on an assessment of present value and capital costs, we estimate the settlement cost to be between $300 million and $400 million.

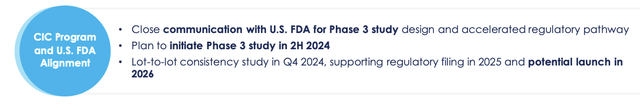

As for Priority 3 CIC, it refers to Novavax’s COVID-19-influenza combination. I think this vaccine is a viable path to relevance and potential financial health for Novavax. In this regard, I noticed the confluence of two cultural memes that point out its importance, as follows:

- Expectations and adherence to annual flu shots;

- fatigue and increased resistance to regular coronavirus vaccinations;

- Despite more than 2 cases, COVID-19 remains an ongoing chronic health threat.

If Novavax can develop a competitive CIC, it will allow patients to kill two birds with one stone. What’s going on with Novavax? The following excerpt from Briefing Slide 12 provides some answers to this critical question:

Seeking Alpha.com

There are two factors known to reduce hopes for this potential, including:

- Novavax’s track record of failure in developing timely vaccines, in which I point not only to its fall to third place in developing a standalone COVID-19 vaccine, but also to its failure to develop an approved RSV vaccine after years of effort , and gave up its own vaccine research and development plans. When the NanoFlu vaccine is about to submit its BLA;

- Moderna (mRNA) leads the way in development of combination vaccine dose Its first Phase 3 study participant (

- Pfizer (PFE) vs. BioNTech (BNTX) in hunting with portfolio candidates.

I continue to rate Novavax a “Sell” given its risky past and lack of a clear path forward.

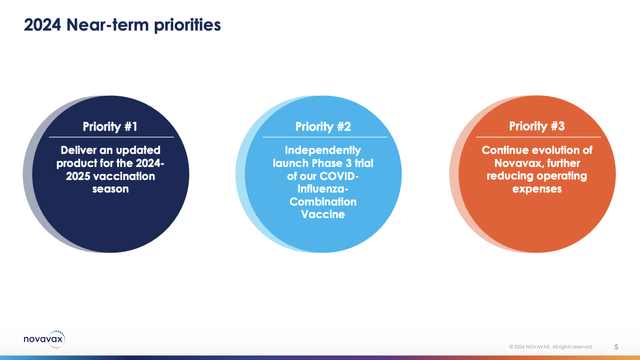

Slide 5 of Novavax’s presentation lays out priorities for 2024. They’re not exactly the same as the priorities for 2023, but as the saying goes, they certainly rhyme:

Seeking Alpha.com

I have no further views on Priorities 2 and 3 for 2024 beyond the discussion above. As for priority 1, this is important to achieving critical revenue. I think this is an existential requirement. During the call, CCO Trizzino identified target dates for investors to include in Novavax’s calendar.

He suggested:

For 2024, our focus is on launch in early September, which we expect will be the start of the vaccination season. We also intend to offer vaccination via prefilled syringes and, if approved, under full license from the BLA. We know that in the first post-pandemic season, the vast majority of COVID-19 vaccinations will be administered in pharmacies, so we have realigned and streamlined our customer engagement team to focus on this pipeline.

Therefore, priority 1 is fully met including the full wish list to be achieved by early September 2024. As I wrote in early March 2024, there are less than six months left. is it possible? Of course it must be so, but how?

During the call, TD Cowen analyst Smith had the same thought. He asked what further steps needed to be taken before full approval could be obtained. CEO Jacobs referred questions to CCO Trizzino, urging him to talk about the differences between the 2024 plan and the 2023 plan. Trizzino responded:

…Three key elements for success in 2024 are on-time product availability in early September ahead of the vaccination season. The BLA, which is currently being processed through rolling submissions and prefilled syringes, makes it easy and convenient for pharmacists to use. We believe these will have a significant impact on our results in 2024.

The ongoing rolling submission BLA does not reveal much information. When evaluating this September date and the BLA and prefilled syringes, please consider the sequence of events.Prefilled syringes are medical devices with their own approval standard. Syringe contents also require approval. Product approval should be obtained before filling syringes.

Can all this approval and processing actually be done in six months? Of course it must be so. Can Novavax do that in six months? Shareholders better hope it happens. This is one of several reasons why an investor might reasonably choose to sell any interest in Novavax.

The “going concern” recommendation in the 10-K is concerning.

The 10-K includes a list of typical business risks. Without minimizing any of the other risks listed, I find the following 2 risks at the bottom of the list on page 4 to be particularly concerning:

- Given our current cash position and cash flow forecasts, as well as the significant uncertainty related to our 2024 revenues, we have significant doubt regarding our ability to continue as a going concern within one year from the date of the financial statements included in this annual report.

- Repayment of the 5.00% Convertible Senior Unsecured Notes due 2027 (the “Notes”) will require significant amounts of cash, and we may not have sufficient cash flow resources to repay our indebtedness.

Later in 10-K (82), it elaborated on the first issue as follows:

- Novavax’s current cash flow forecast estimates sufficient funds available to support one year of operations;

- This forecast is subject to significant uncertainties related to revenue;

- It also depends on its ability to execute cost-cutting plans.

I’ve previously discussed its revenue issues, which are impacted by regulatory issues beyond its control. For a company considered to be facing financial challenges, how to achieve cost-cutting measures is always a question.

Ultimately, how can a company effectively reduce costs while still meeting basic operational needs?

in conclusion

Novavax is a true battleground stock. Bullish bettors were seduced by its huge rise during the pandemic. They are willing to accept losses as the price of being eligible to repeat such gains. To these people, I suggest the pandemic is over.

This is not the case with the real coronavirus. However, the white heat that sparked OWS and government largesse is over, done, over, capped. We can’t be 100% sure about anything. I think the chances of a repeat of the mania that drove Novavax to such heights during the pandemic are slim and unattractive.

Novavax has a cumulative deficit of $4.8 billion. The company’s net losses over the past three fiscal years were $500 million in 2023, $700 million in 2022, and $1.7 billion in 2021. During the conference call, the company forecast 2024 revenue of $0.8 to $1 billion. Spending in 2023 totals about $1.55 billion, down from about $2.63 in 2022.