gap

We previously reported on real estate income (NYSE:O) in November 2023 discussed why it remains a Buy, with the SRC deal expected to be accretive to AFFO without having to rely on expensive debt financing as management continues to provide capable Achieving growth amid an uncertain macroeconomic outlook.

We believe the pessimism embedded in the stock presents an opportunity for opportunistic income investors to add to their holdings, especially given the stable dividend thesis.

In this article, we discuss why we maintain a Buy rating on O shares, as the REIT remains well-capitalized to fund its debt and dividend obligations due to a heightened inflationary environment and slower cap rate adjustments.

Combined with a healthy balance sheet and safe dividend payments, we think dividend-oriented investors may still view O as a viable long-term income strategy in a diversified portfolio.

For Opportunistic Dividend Hunters, Real Estate Investment Trust Investment Thesis Still Excellent

Currently, O reported revenue growth on its Q4’23 earnings call with total revenue of $1.07B (+3.8% QoQ/ +21.4% YoY) and normalized FFO per share of $1.00 (-3.8% QoQ/ – annual growth of 4.7%), and the figures for fiscal year 2023 are $4.07B (annual growth of 21.8%) and $4.09 (annual growth of 0.7%) respectively.

The REIT’s bottom line failure is mainly due to the accelerated growth of total expenses, which reached $841.28M in the fourth quarter of 2023 (4.3% quarterly growth/22.5% annual growth) and $3.18B in fiscal 2023 (25.1% annual growth).

This is based on the inherently dilutive nature of most REITs, with management reporting holding 724.6 million shares as of the latest quarter (up 15.06 million shares QoQ/up 91.23 million shares YOY).

On the one hand, O’s focus on aggressive growth has clearly had an impact, with its reliance on long-term debt increasing to $20.13B (up 4.7% QoQ/+15.2%/+162.4% from the $7.67 level in FY19B).

This will naturally cause the REIT’s annualized interest expense to expand to $833.24 million (+13.1% QoQ/58.6% YOY) and cause annualized FFO growth to slow down by Q4 2023 to US$2.89B (-2% quarterly/8.7% annual growth).

On the other hand, we believe O’s debt reliance remains somewhat justified, with a stable debt-to-EBITDA ratio of 5.25x in 4Q23, which is well balanced. This compares to 5.15x reported leverage in Q3’23, 5.59x reported in Q4’22, and 5.68x reported in FY2019.

O’s Portfolio Profile

Seeking Alpha

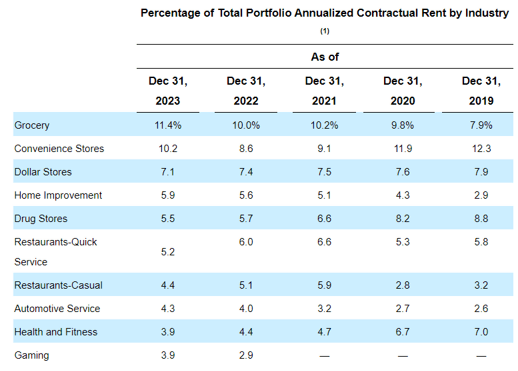

At the same time, its portfolio remains diversified, with no single tenant accounting for more than 4% of annualized contracted rents, and O’s rental income and revenue/profits have remained flat regardless of the uncertain macroeconomic outlook.

along with Consumer Price Index January 2024 Up 0.3% from the +0.2% reported in December 2023, rising inflation clearly remains a temporary driver for REITs.

That’s because 82.2% of rental increases in O’s portfolio are tied to inflation, fixed increases and a percentage of total tenant sales, which will account for less than 1% of FY23 rental revenue.

This means the REIT is still likely to deliver excellent revenue growth in the coming quarters, with management stressing that it “needs ~12 months The cap rate adjusts based on changing interest rates,” depending on when the Fed pivots and the macroeconomic outlook normalizes.

As a result, we don’t think readers should be surprised by O’s projected fiscal 2024 FFO per share guidance of $4.23 (up 3.9% year-over-year) versus the consensus estimate of $4.25, primarily due to bottom-line headwinds to its operating expenses and higher Rising inflationary pressures on interest obligations.

Readers must also note that approximately 94% of its total debt is fixed-rate, with a weighted average interest rate of approximately 3.83% (+0.68 percentage points year-on-year), which is lower than the weighted average interest rate of 5.05% in fiscal 2019.

These numbers suggest that O’s aggressive growth plans remain under control, with management able to execute effectively and grow despite the headwinds it faces.

Consensus forward estimate

Seeking Alpha

Consensus has also modestly increased their forward forecasts due to the recently completed Spirit Realty acquisition, with O forecasting top-line/bottom-line CAGR of +0.6%/+3.6% through fiscal 2026.

Compared to previous forecasts, historical growth is +2.2%/+1.9% and +20.8%/+21.2% in FY2023, respectively, with the top-line/bottom-line growth slowdown primarily attributable to lower expectations going forward Several years of CPI.

Valuation

Seeking Alpha

The same pessimism is reflected in O’s stock valuation, with a FWD price/FFO ratio of 12.32x, close to the REIT industry median of 12.55x, compared with the 1-year average of 13.66x and the 3-year average of 19.23x.

As the macroeconomic outlook normalizes and the REIT industry is likely to be in for some pain, these discounted valuations appear to provide an excellent entry point for opportunistic dividend hunters looking for monthly payouts.

So, is O stock a buy?sell, or hold?

O 5-year stock price

trading view

Based on fiscal 2023 FFO of $4 per share and a FWD price/FFO valuation of 12.32x, O appears to be trading close to our fair value estimate of $49.20.

Assuming its price/FFO valuation improves to close to the pre-pandemic 3-year norm of 19x, we could see the stock trade an impressive +64% to our bullish long-term price target of $86 Upside potential, coupled with the fiscal 2026 FFO consensus estimate of $4.53.

Meanwhile, O stock offers an excellent annualized dividend payment of $3.078, with the recent correction expanding the forward yield to 5.89%. By comparison, its 4-year average is 4.64%, the industry median is 4.76%, and U.S. Treasury yields range from 4.16% to 5.37%.

While it is uncertain when the Fed will turn, it is undeniable that the Fed’sStill firm “Returning inflation to 2% over time”, the normalization process is a matter of when, not if.

Combined with a solid interest coverage ratio of 2.36x and an FFO payout ratio of 74.23%, we think dividend-oriented investors may still consider REITs such as O as a viable long-term income strategy in a diversified portfolio.

We maintain our buy rating on O stock.