Shahrir Maulana

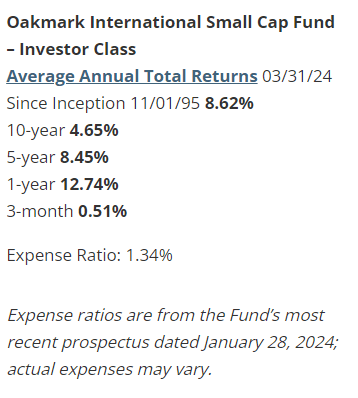

Oakmark International Small Cap Fund (MUTF:OAKEX) (the “Fund”) returned 0.51% for the quarter ended March 31, lagging behind the benchmark MSCI World ex U.S. Small Cap Index (net), which returned 2.58% over the same period. Since its inception in November 1995, the fund has returned an average of 8.62% annually. For more information on our views on market conditions in the most recent quarter, please see our International Markets Commentary.

Past performance is no guarantee of future results. Performance data quoted represent past performance. Current performance may be lower or higher than quoted performance data. Investment returns and principal values vary, so an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain the most recent month-end performance data, Check it out here.

Konecranes (OTCPK:KNCRF, OTCPK:KNCRY) (Finland) is the top contributor this season. In February, the industrial company reported strong fourth-quarter results. Organic revenue growth exceeded our expectations, driven primarily by the Services and Port Solutions segment. Services sales in local currencies increased 11%, driven by strength in spare parts and field services. We like that Konecranes’ services business is delivering higher growth that is recurring in nature and of a much higher quality than the growth in the equipment manufacturing segment. This is a key component of our investment thesis. In addition, Port Solutions’ local currency revenue grew more than 38% in the fourth quarter as the business delivered a large number of early orders and improved comparable EBITA margins. It is also worth noting that entering 2024, the order volume for port solutions is higher than the previous year. Finally, Konecranes’ reported 2024 guidance was largely in line with our expectations. We continue to believe this investment has attractive advantages.

St. James’s Place ( OTCPK:STJPF ) (UK) has been the most criticized company this season. In January this year, the wealth manager reported net inflows in 2023 would be £4.6 billion lower than in 2022. The disappointing update comes after the company announced a massive overhaul of its fee structure. In February, the company announced its full-year results for 2023. Underlying cash results were below our expectations primarily due to margins on new business and other revenue and expenses. The biggest misstep, in our opinion, was the huge provision charges St James’ Place charged for reimbursement from potential customers. A growing number of customers are complaining that the company is charging them without actually providing any advice. St. James’s Place conducted an internal survey that cited service gaps before the company implemented Salesforce (CRM) in 2021. Provision costs include the appointment of a survey assessment, the expected cost of refunding service fees, a refund plan for operational management costs, and interest charges to compensate for the time value of money. We met with management following the results release and continue to believe in St. James’s Place’s long-term prospects.

This season we have launched new positions in the following areas:

- Fielmann (OTCPK: FLMNF, OTCPK: FLMNY) (Germany) is one of the world’s largest eyewear retail companies. It offers eyeglasses, contact lenses, hearing aids and primary eye care services — all products that benefit from steady demand and significant barriers to online disruption. Industry headwinds related to rising costs and weak consumer sentiment have weighed on the stock price, but we feel comfortable with Firman’s defensive positioning and pricing actions to offset inflation. The company’s profit margins have declined in recent years due to investments in internal programs that are nearing completion, which should provide opportunities for improved cost control and profitability going forward. We believe the company’s fundamental performance is approaching an inflection point and we are able to purchase shares at a discount to our estimated intrinsic value.

- TIS, Inc. (OTCPK:TISNF) (Japan) is one of Japan’s largest IT services companies. We are familiar with TIS as we owned it previously but sold it when the share price reached our estimate of intrinsic value. The stock has underperformed recently as growth is likely to slow next year due to the completion of several large projects, making comparison bases difficult. However, excluding these large projects, business fundamentals remain strong as Japan’s IT spending remains very strong. We believe the country lags behind most developed countries in digitalizing its economy. This fact, coupled with the shortage of IT engineering talent, bodes well for Japan’s future IT spending. In addition to long-term structural demand for IT services, we like that TIS is led by a strong management team with a proven track record of creating shareholder value through smart capital allocation decisions.

During the quarter, we sold Applus Services (OTCPK: APLUF) and Vitesco Technologies Group (OTCPK: VTSCY, OTCPK: VTSCF) under tender offers.

Geographically, we ended the quarter with approximately 54.9% of our holdings in Europe, 20.5% in the UK, 7.9% in Asia and 5.7% in Japan. The remaining locations are Australasia 4.2%, the Americas, Latin America 3.1%, North America (Canada) 2.3%, and Africa/Middle East 1.5%.

Thank you for your continued trust and support.

The securities listed above represent the following percentages of Oakmark International Small Cap Fund’s total net assets as of March 31, 2024: Applus Services 0%, Fielmann Group 0.3%, Konecranes 2.4%, St. James’s Place 1.8%, TIS Inc 0.2% and Vitesco Technology Group 0%. Portfolio holdings are subject to change without notice and do not constitute a recommendation of individual stocks.

The information, data, analysis and opinions provided herein (including current investment themes, the Portfolio Manager’s research and investment process and portfolio characteristics) are provided for informational purposes only and represent the investments and opinions of the Portfolio Manager and Harris Associates LP as of the date of writing , are subject to change without prior notice based on market and other conditions. This content is not a recommendation or an offer to buy or sell securities, and its correctness, completeness or accuracy is not guaranteed.

Certain comments in this article are based on current expectations and are considered “forward-looking statements.” These forward-looking statements reflect assumptions and analyzes made by the portfolio managers and Harris Associates LP based on their experience and perceptions of historical trends, current conditions, expected future developments and other factors they believe are relevant. Actual future results are subject to a number of investment and other risks and may differ from expectations. Readers are cautioned not to place undue reliance on forward-looking statements.

EBITA is earnings before interest, taxes and amortization and is a measure of operating income.

The MSCI World ex-U.S. Small Cap Index (net) is designed to measure the performance of 22 small-cap stocks in 23 developed markets (excluding the U.S.). The index covers approximately 14% of each country’s free float market capitalization. This basis calculates reinvested dividends net of withholding taxes. The index is unmanaged and investors cannot invest directly in the index.

From time to time, Harris may determine, based on its analysis of a particular multinational issuer, that a country classification different from MSCI best reflects the issuer’s investment risk. In these cases, reports with country weights and performance attributions will differ from reports using MSCI classifications. Harris uses its own country classifications in its reporting process and these classifications are reflected in the material included.

The fund’s portfolio tends to invest in a relatively small number of stocks. Therefore, an appreciation or depreciation in the value of any one security held by the Fund will have a greater impact on the Fund’s net asset value than if the Fund invested in more securities. While this strategy has the potential to generate attractive returns over time, it also increases the fund’s volatility.

Stocks in smaller companies generally involve more risk than stocks in larger companies. The stocks of smaller companies tend to be more volatile and have smaller public markets than the stocks of larger companies. Small companies may have shorter operating histories than larger companies, may have less ability to raise additional capital, and may have less diverse product lines, making them more susceptible to market pressures.

The risks associated with investing in foreign securities may be greater in some respects than investing in the United States. These risks include: currency fluctuations; varying regulations, accounting standards, trading practices and levels of available information; generally higher transaction costs; and political risk.

Unless otherwise stated, all information provided is as of March 31, 2024.

Editor’s note: Summary highlights for this article were selected by Seeking Alpha editors.