Vivek Vishwakarma/iStock via Getty Images

As growth stocks continue to drive market indexes higher, income stocks are being left behind.While it’s great to see capital gains, it’s income from a variety of sources that pays the bills The day is over. Additionally, the dividends from these stocks serve as a good hedge against market fluctuations.

Which brings me to Oaktree Professional Loans (Nasdaq ticker: OCSL), I last gave it a “buy” rating in November last year, highlighting its stable fundamentals and exposure to attractive industries.

Shares of OCSL have waxed and waned since then, rising to a 52-week high of $21.64 in January before falling back to $19.26, 3.2% below the last price I visited (a total return of 2.3 including dividends %).

OCSL Stock (Seeking Alpha)

In this article, I will revisit the key points of OCSL Updates on its most recent quarterly results and discusses why the recent price decline presents a great opportunity for income investors to get into this high-yield investment, so let’s get started.

Why choose OCSL?

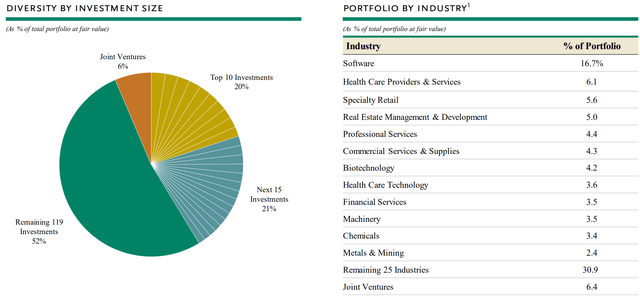

Oaktree Specialty Lending is an externally managed BDC with a large investment portfolio of $3 billion in fair value. OCSL’s investments are spread across 146 portfolio companies and its investment composition is quite conservative, with 86% of the total portfolio comprised of senior secured loans (78% first lien, 8% second lien). The remainder of the portfolio is unsecured debt at 3%, equity and joint ventures at 5% and 6% respectively.

OCSL invests primarily in the growing software and healthcare sectors, which account for nearly a quarter (23%) of the total portfolio. Other popular industries include specialty retail, real estate management and development, and professional services. As shown below, OCSL’s portfolio diversification means that the first 10 investments account for only 20% of the total portfolio, and the next 15 investments account for 21%.

OCSL Portfolio (Investor Presentation)

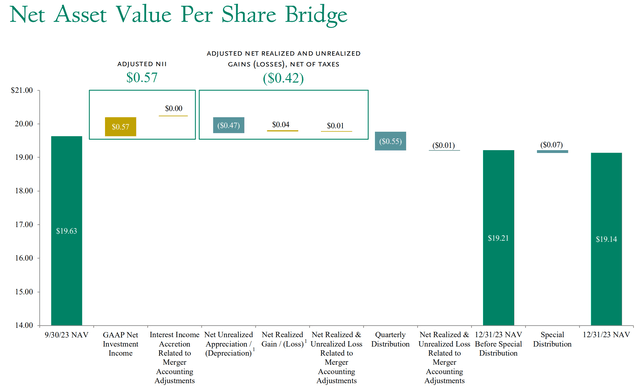

OCSL’s fourth-quarter results released on February 1 were unspectacular, with adjusted net investment income per share falling $0.05 annually to $0.57. This was due to a $5.2 million decrease in interest income due to higher non-accrual investments. Notably, non-accrual investments accounted for 4.2% of portfolio fair value at the end of Q4, up from 1.8% in Q3’23.

This had a significant impact on OCSL’s net worth per share, as the aforementioned non-accrual charges had to be written off (although this has not yet resulted in a realized loss). As shown below, $0.47 of net unrealized depreciation on investments was the primary factor in the quarter-over-quarter decline in NAV per share from $19.63 to $19.14 (excluding the quarterly distribution and covered by net investment income).

Investor introduction

While recent results may not be encouraging, asset writedowns don’t necessarily mean they will result in total losses. Management provided comments on possible solutions for some non-accrual investments, as described below on the last call:

Impel Pharmaceuticals is a biotechnology company developing drugs for the central nervous system. Sales of a key product were slower than expected, and the company filed for bankruptcy protection in the fourth quarter of last year. The company is currently in the process of being sold out of bankruptcy and we are focused on maximizing the long-term value and eventual recovery of the business. We will have more information to share about this name as the sales process unfolds in the coming months.

Finally, Singer, the world’s largest consumer sewing machine company, saw an initial surge in business during the pandemic but has since experienced a slowdown. The sponsors have previously provided additional financial support to the business and we are working with other lenders to develop solutions as the company resumes growth. While the company maintains cash interest payments based on secondary transaction prices, we believe it is prudent to convert this investment to non-accrual interest.

Despite the near-term headwinds, OCSL’s $0.55 quarterly dividend yield was covered by last quarter’s NII of $0.57 per share. It also maintains a strong balance sheet, with a debt-to-equity ratio of 1.02x at end-2023, well below the BDC statutory limit of 2.0x and down from the 1.14x level at the end of 1Q23.

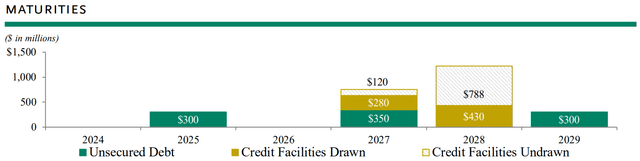

OCSL currently earns a substantial investment spread, with a weighted average yield on debt investments of 11.6%, 460 basis points higher than the weighted average rate of 7.0%, and as shown below, OCSL does not have debt maturities until next year.

OCSL Debt Maturity (Investor Presentation)

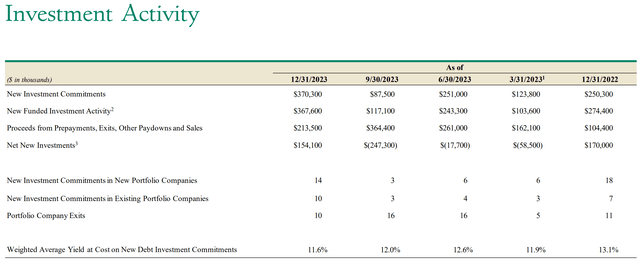

OCSL’s strong balance sheet and diversified funding sources give it ample financial capacity to source opportunistic investments. As shown below, deal activity surged in 4Q23 to $370 million worth of new investment commitments, following a sluggish performance in the previous 4 quarters, as OCSL saw renewed demand for growth capital from borrowers.

Investor introduction

Risks to OCSL include a longer-term higher interest rate environment if the Fed reneges on its promise cut interest rates 3 times this year. While OCSL does benefit from higher interest rates, as 85% of its loan portfolio is floating rate, higher interest rates also put pressure on borrowers and their suppliers, which may put a strain on borrowers’ ability to repay their debts. pressure. Over the next two quarters, I will be looking for signs of further strain in the OCSL portfolio. This includes changes in non-accrual rates and the possibility of resolving current non-accrual investments.

Taking all of the above into consideration, I believe OCSL is appropriately valued at its current price of $19.26, which represents a price-to-NAV ratio of 1.01x. That puts OCSL more or less in line with large peers Blue Owl Capital (OBDC) and Ares Capital (ARCC), which trade at P/E ratios of 1.0x and 1.04x, respectively. As shown in the chart below, over the past three years, OCSL’s trading P/E ratio has mainly been in the range of 0.9x to 1.1x P/E/NAV, and its current valuation is right in the middle of this range.

OCSL Price to Book Ratio (Seeking Alpha)

While I’d like to see more clarity on OCSL’s non-accruals in future quarters, I don’t think the current valuation is a bad entry point. In the short term, I see a Buy rating on OCSL as high as 1.05x P/N, given its good distribution and the assumption that P/N will be stable for the remainder of the year.

Important points for investors

All in all, it’s important to carefully evaluate a company’s performance before making any investment decisions. In the case of OCSL, while its fourth-quarter results may not be as expected, there are potential solutions for some of its non-accrual investments, and growth could be possible with new investment funds on the back of a strong balance sheet. leading to better dividend coverage. Additionally, OCSL maintains a strong balance sheet.

Finally, the market appears to have priced in the potential risk, as OCSL is currently trading at a premium of just 0.6% to net value, compared to a premium of 1.5% when I last visited. Additionally, with a yield of 11.4%, investors are well rewarded for holding the stock. Taking all of the above into consideration, I consider OCSL a speculative “Buy” right now due to its high, covered dividend and the potential for a turnaround in the coming quarters.