peshkov/iStock via Getty Images

Many things last longer than the rational thought process would suggest. When investors are filled with FOMO, there is no upper limit to how stupid things can get; on the contrary, things may continue to defy logic. There are even more ridiculous ways. Chasing income is preparation for this. The average investor’s view on most of these is, “This works out well for me because the dividend payments are continuing.” Obvious red flags are ignored and fourth grader logic tends to take effect until the rug is pulled out . Today we’ll take a look at one such story and how red flags raised warnings from every direction, but were ignored by investors. We’ll also see how we can almost go back to doing the same thing again.

OFS Credit Company (NASDAQ:OCCI)

According to their website, OCCI can help Investors have access to unique asset classes:

OCCI is a Nasdaq-listed closed-end fund that invests primarily in collateralized loan obligations (“CLOs”), equity and debt securities. CLOs are primarily invested in diversified first-lien, senior secured securities provided to large, rated U.S. companies. Loan pool investment vehicle. Management believes that public investors have limited options for accessing the CLO equity and debt asset classes. (Source: kill)

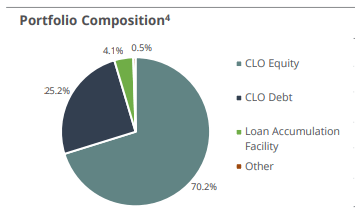

It’s certainly true that this is by far the most difficult asset class to invest in directly. The complexity of the setup and the large amounts of capital required for adequate diversification make this a no-brainer for professional management. The fund currently holds primarily CLO debt, although its composition has changed significantly since we started tracking.

kill

initial temptation

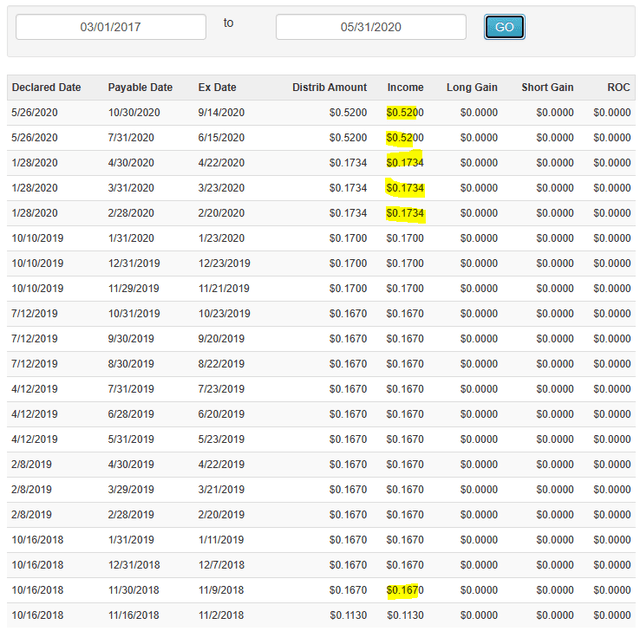

If you’re trying to chase revenue, OCCI will definitely throw the kitchen sink at you. Initial allocations started at 16.7 cents (after the first month of operations) and then remained stable until mid-2019. The fund actually increased its distribution during that time.

CEF connection

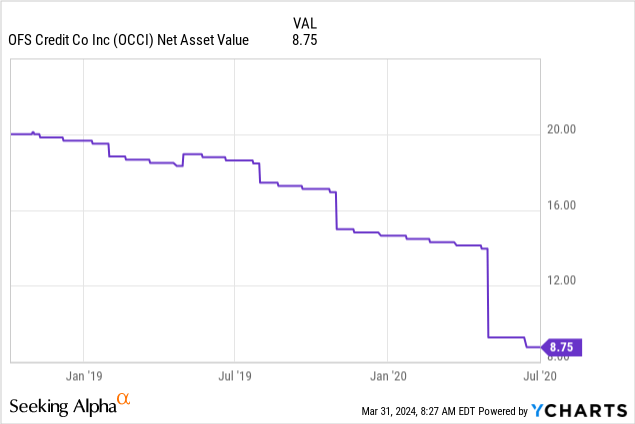

Then came COVID-19, and just when you thought they needed to cut back, they just went from monthly to quarterly. What’s fascinating is that this phase of NAV disruption began long before COVID-19. Shockingly, no one bothered to ask how this allocation was funded when the net worth looked like it was about to dive into the Mariana Trench.

Our take and today’s story

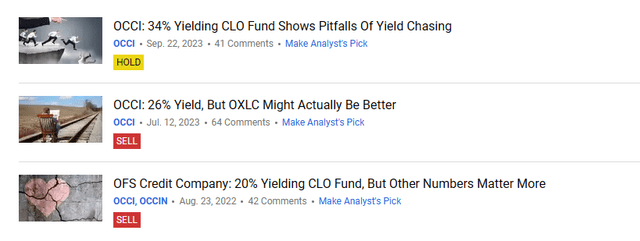

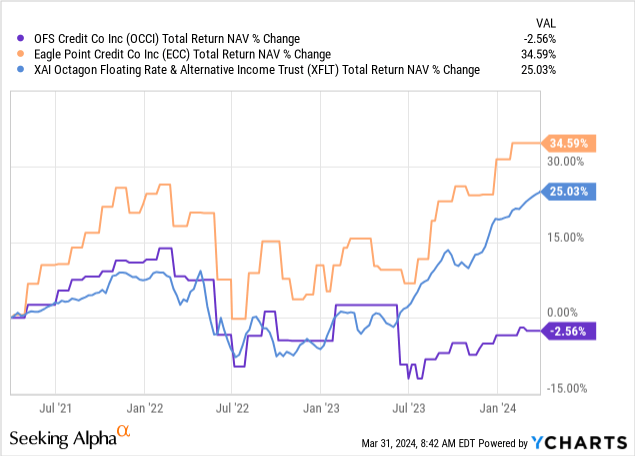

There’s no story more obvious heading toward disaster than this one, so an initial sell rating is easy. We switched to Hold when the discount to NAV became sizable, and the fund has actually performed well since then.

Seeking Alpha

This remains the case although allocations have since decreased. This just goes to show that valuation and making money are far more important than distribution extracting capital.

Today’s story is equally interesting. Can OCCI maintain its 16% yield? There are 3 ways to look at it and they all say the same thing.

1) What have you made in the fund in the past?

Income investors may hate the total return on equity concept, mostly because it forces them to look in the mirror, but it’s always a good place to start.

CEF connection

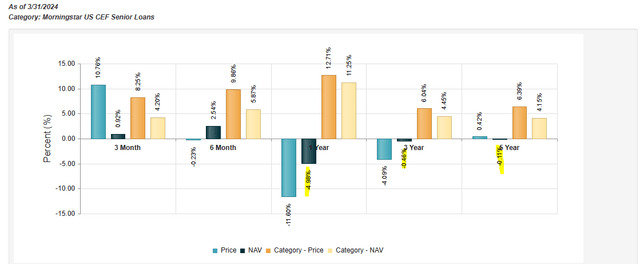

For OCCI, this figure was negative in years 1, 3 and 5. So when you start fantasizing about returns of around 16%, your dreams are met with cold water. The past 3 years are particularly telling, as most CLOs have performed exceptionally well during this time.

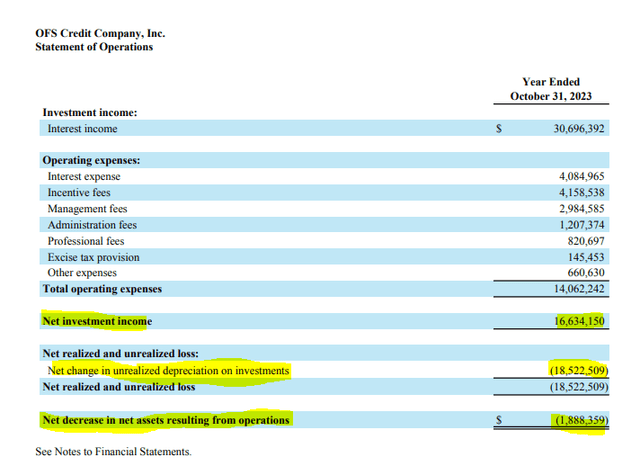

2) What the income statement shows

The last annual report ended on October 31, 2023. Arguably, this was not the best time frame for us to read as the market was pretty bleak at the time. But it’s still an interesting report card. The Fund generated net investment income of $16.6 million, offset by investment depreciation (unrealized losses) of more than $18.5 million.

kill

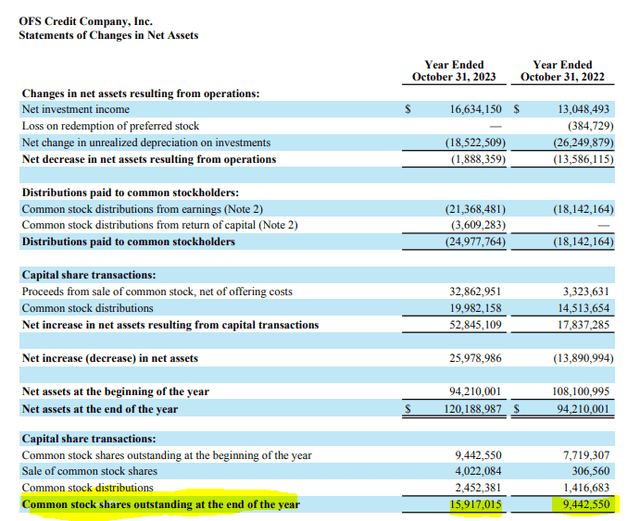

Although the fund issued a large distribution in the form of new shares, net investment income (NII) did not meet the announced distribution. You can see the number of shares has exploded over the past 12 months.

kill

But even if you take the $16 million annual run rate and divide it by the number of shares outstanding, your distribution rate is still less than $1.20.

3) Where in the credit cycle are we?

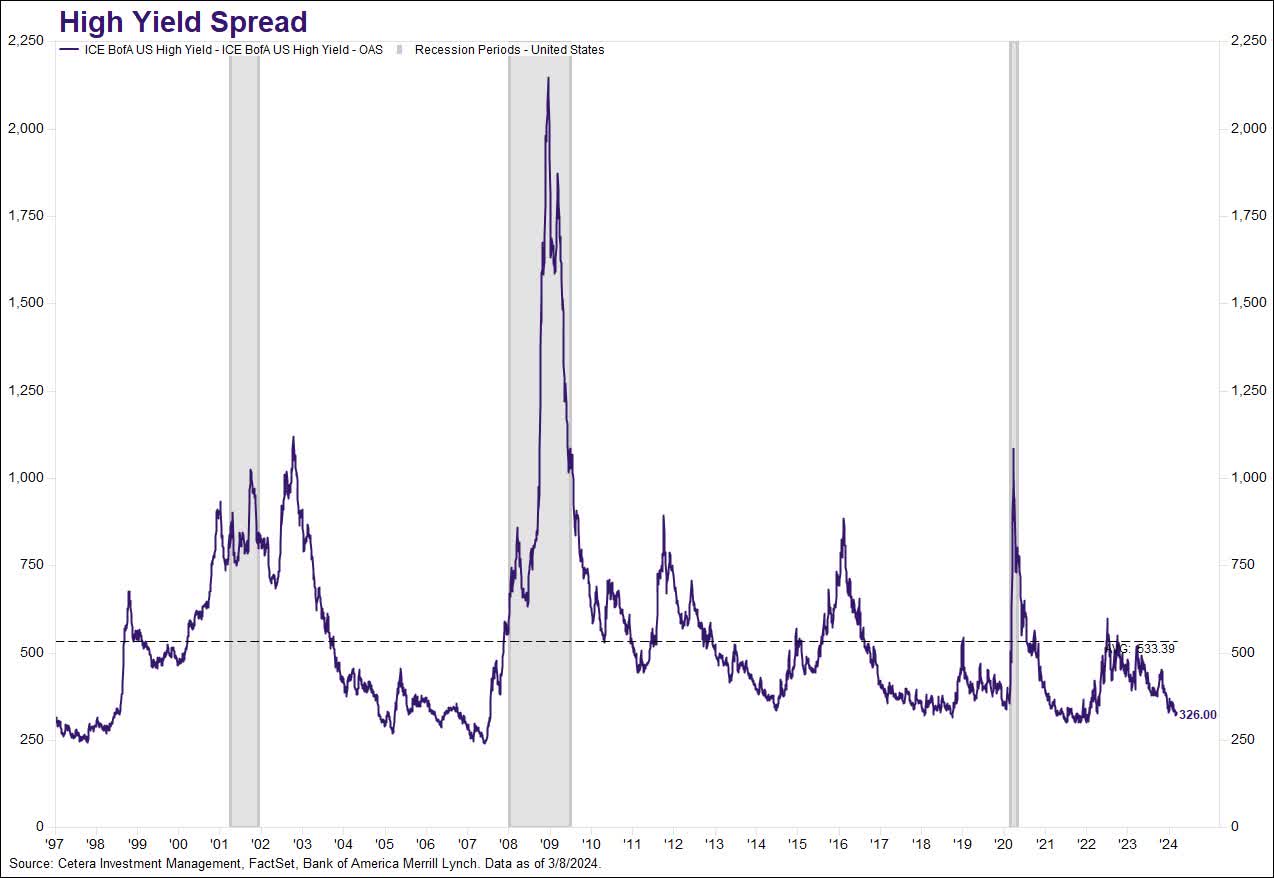

Junk bonds are expensive, as evidenced by their high-yield spreads relative to Treasuries. This chart shows the current spread of 3.26%, which is well below the average spread of 5.33% over the past 27 years.

Bank of America

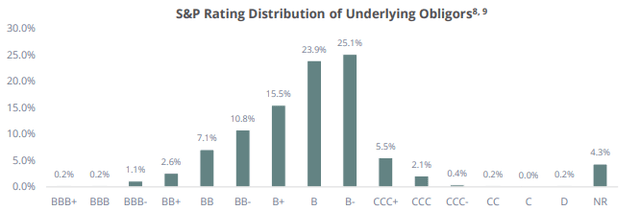

In a mature credit cycle, this could pose a bigger problem. OCCI also owns the final piece of crap here, as evidenced by the B- emphasis.

kill

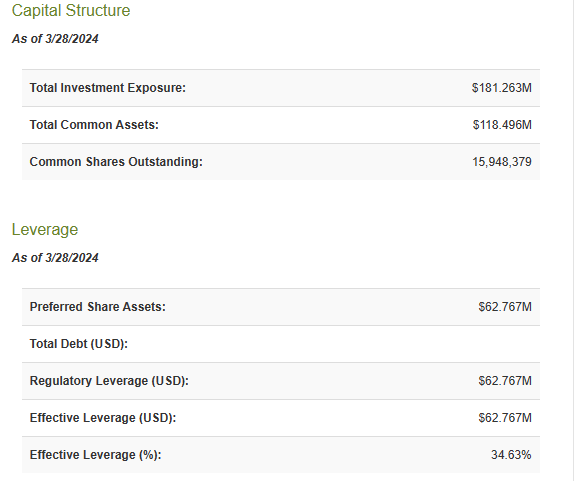

On top of that, the fund has increased its own leverage.

CEF connection

judgment

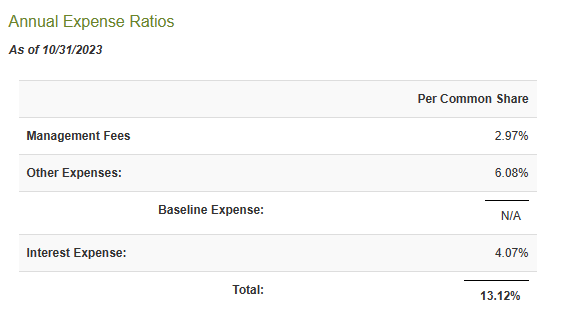

The expense ratio is on the high side.

CEF connection

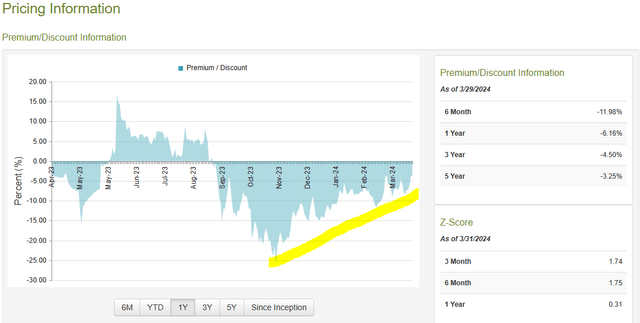

For most people, this in itself is not a deal breaker as they are solely focused on “income”. But this will create significant barriers to achieving positive returns in down cycles. Of course, we haven’t had a situation like this in the past few years, and recession predictions have proven premature. But we did have the longest sustained curve inversion in history, and when things break, this is not a fund you want to hold for income. The recent performance may have deceived some investors, as the fund’s discount to NAV has ended rapidly since late October 2023.

CEF connection

While we’ve seen sillier things in the market, this tailwind likely won’t be repeated (the fund will have to pay a big premium). The current Z-score indicates that the fund is currently affordable, where we would like to exit.