Daniel Balakov

We present a follow-up briefing from OCI NV ( OTCPK:OCINF ), a leading global fertilizer company.We previously issued a Buy rating on the stock, emphasizing strong momentum in the nitrogen and methanol businesses, exposure to green trends, and significant free cash Traffic generation and valuation discounts. The stock has returned nearly 16%, including dividends, since we published our report, and the company has made significant asset sales over the past few months. We’ll provide a brief overview of fourth-quarter results, analyze recent transactions, and revisit our investment case in light of the strategy review.

Fourth quarter results

OCI’s Fourth quarter results Basically in line with sell-side analyst consensus. OCI’s fourth-quarter sales fell 45% year-on-year (due to lower nitrogen fertilizer sales and lower prices), and increased 13% quarter-on-quarter. Adjusted EBITDA topped VA consensus by nearly 3% at $310 million, and earnings per share (EPS) Priced at $0.98, it fell short of consensus. FCF was negative $975 million and net debt was $3 billion. Capital expenditures were $239 million, while management said 2024 capital expenditures will be approximately $600 million, primarily for Texas blue ammonia.

Management expressed optimism about the outlook for urea prices, which will be supported by China’s export restrictions, severe damage in the Red Sea and limited supply in the medium term. Additionally, management believes ammonia demand is likely to be higher, supported by new application development and incremental demand in East Asia. OCI management is also optimistic about methanol prices, supported by rising oil prices and limited new supply. We hold a neutral view on operating performance and believe that the main drivers of OCI’s stock price are strategic review and cash allocation.

Strategy review and asset sales

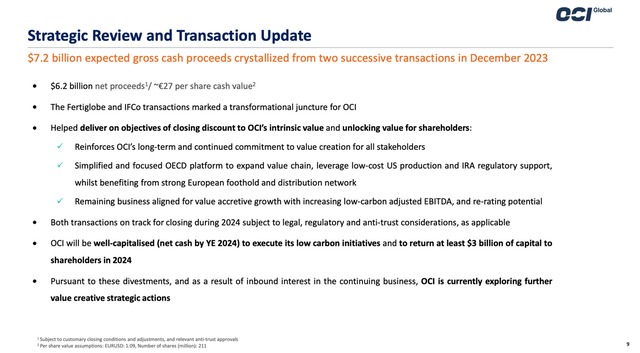

In March 2023, OCI’s Board of Directors approved a strategic review of all business lines aimed at crystallizing value. In December 2023, OCI announced two major transactions.OCI to sell 50% of its shares as part of strategic review Complete positive reviews (Abu Dhabi and North Africa nitrogen business) to its partner ADNOC, which has an ambitious strategy in chemicals, for a total consideration of $3.62 billion. OCI will also receive portions of the proceeds in 2024 and 2025. The transaction is subject to regulatory and antitrust approvals and is expected to close in 2024. A few days later, OCI announced the sale of all shares (100%) of its subsidiary IFCO (Iowa Fertilizer Company) to acquire Koch Industries for a total consideration of $3.6 billion. Net proceeds are likely to be around $2.6 billion. The transaction does not require approval by a shareholder vote but is subject to antitrust and regulatory approval and is expected to close in 2024.

Total sales totaled $7.2 billion. The company expects net income to be between $61.0 billion and $6.2 billion. 27 euros per share. OCI will also receive Fertiglobe’s second half dividends and IFCO’s cash flow until the transaction is completed.

OCI NV Season 4 Presentation

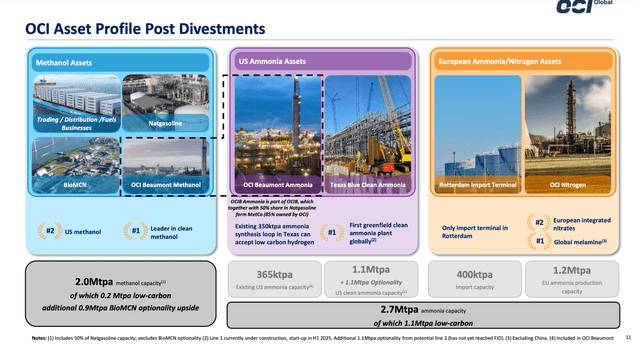

The company said the total proceeds will provide flexibility to deleverage at the group level, invest in the energy transition space and return capital to shareholders. Further strategic actions are being considered for the remaining business. OCI management expects mid-term EBITDA from the remaining operations to be $600-700 million, with free cash flow conversion approaching 50% (excluding Texas Blue’s contribution). The current net debt of $3.7 billion will transform into a net cash position by the end of this year, with nearly $3 billion (or about 60% of current market capitalization) distributed to shareholders by 2024. It’s unclear how this will be achieved, but it will largely depend on tax efficiency. Regular dividends will also be discontinued.

retain company Valuation and updated investment case

It is estimated that, excluding the Texas blue ammonia project, OCI has sold 2/3 of its profits. Methanol and nitrogen exposure increased significantly after the transaction. The Texas blue ammonia project in partnership with Linde is expected to be completed in 2025. OCI is committed to creating and maintaining first-mover advantages in the industry. There have been several project announcements, but OCI is the only one implemented.

OCI NV Season 4 Presentation

OCI’s current market capitalization is $5.6 billion. We expect the net cash position to reach $4 billion by fiscal 2025, implying an enterprise value of $1.6 billion. Based on company commentary, we forecast RemainCo’s EBITDA of $500 million in 2025, with corporate and other expenses of approximately $50 million, implying net EBITDA of $450 million. Assuming a conversion rate of 50%, this implies free cash flow of $225 million. This translates to an FCF/EV yield of 14%. We value RemainCo at 7x EV/EBITDA, in line with OCI’s historical average, or 14x EV/FCF (yield ~8%), implying an EV of $3.2 billion. Looking at the mid-term numbers ($600-700 million), the multiples look more attractive. We arrive at a target equity value of US$7.2 billion or €6.4 billion, which implies an upside of 27% and a share price of €32. We maintain a Buy rating on OCI stock during the company’s strategic review/split period.

risk

Downside risks include, but are not limited to, underlying agricultural market weakness and lower crop prices, new capacity to increase supply due to lower barriers to entry, lower nitrogen, ammonia and methanol prices, lower utilization, higher natural gas prices, adverse weather events, Failure to complete announced transactions, improper allocation of funds, etc.

in conclusion

We maintain a Buy rating and expect returns of over 25% next year.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.