Dobrila Vignjevic/E+ via Getty Images

“Warren, forget about buying another company like Berkshire. But now you control Berkshire, add great businesses to buy at fair prices, and give up buying fair businesses to great prices.

That’s it Charlie Monger famously said something about Warren Buffett. It sums up my thinking behind investing in Oddity Tech Ltd (NASDAQ:ODD). This is a great business that may not be the next large-cap stock, but is definitely a long-term winner that I could buy today at a reasonable price.

When looking at any new stock, I focus on four things.

-

Story: What does the company do and why is it important?

-

Business: Is it durable and does it have room to grow?

-

Valuation: Is my investment a good deal?

-

Management: Do I trust the people in charge?

Oddity checks all of the above boxes for me, and I’m excited to share why I put my money into this company. Let’s take a closer look!

Story: Beauty and Wisdom?

Oddity is an Israel-based technology-driven beauty and wellness company that aims to disrupt industries through cutting-edge artificial intelligence solutions. They sell direct to consumer (DTC) and have two main brands: IL MAKIAGE and Spoiled Child. They call themselves an AI company, aren’t they just another fancy brand with cool technology? Let’s investigate.

Old Ways vs. New Ways Strange Ways

Most large cosmetics brands, such as L’Oréal (OTCPK:LRLCF), Unilever (NYSE:UL), and Estee Lauder (NYSE:EL), follow traditional distribution methods. They rely on a network of retailers for distribution. These companies have strong, long-lasting relationships with department stores, pharmacies, and supermarkets. They also offer DTC options to consumers. However, they rely heavily on sales to retailers (B2B). This limits valuable customer insights and experiences, unlike Oddity; they have always been DTC.

Oddity’s technical focus

-

AI-driven molecular discovery: Oddity Labs uses artificial intelligence to analyze large numbers of molecules, much like innovative pharmaceutical companies. Artificial intelligence helps them discover potential new cosmetic ingredients for their products. The move aims to simplify and speed up the time-consuming research and development process.

-

Personalized Tools: Oddity uses imaging technology and questionnaires to understand your skin type, concerns and goals. Their product matching algorithm then recommends the right products for you.

-

Skin’s AI Doctor (coming soon): Oddity is developing a mobile app that uses AI to analyze your skin and suggest solutions. It also tracks your progress just like your skin doctor.

Data power

Because Oddity sells products directly to you, they can collect and analyze consumer data such as product usage, feedback, and other metrics. This information helps them improve their personalization tools and develop better products in the future.

By selling directly to consumers, Oddity controls marketing, data, customer experience and profits. Their technology-driven solutions give them advantages that are difficult for competitors to replicate.

in short

-

The DTC business model gives Oddity control over its marketing, data collection, customer experience and high profit margins.

-

AI-driven labs and personalized tools ensure optimized R&D processes and an outstanding customer experience.

They’re not just another beauty brand; they’re a beauty brand with a brain.

Business: A good start?

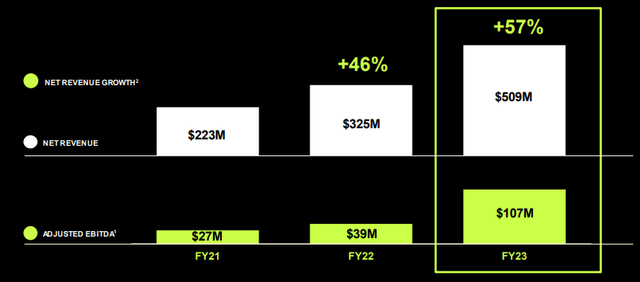

Since its founding in 2018, Oddity has been growing rapidly. They went public in 2023 and are already profitable and cash flow positive. Oddity has an impressive financial profile. As you can see below, their revenue has continued to grow over the past three years.

Revenue increases year over year (Oddity Investor Presentation, Q4 2023)

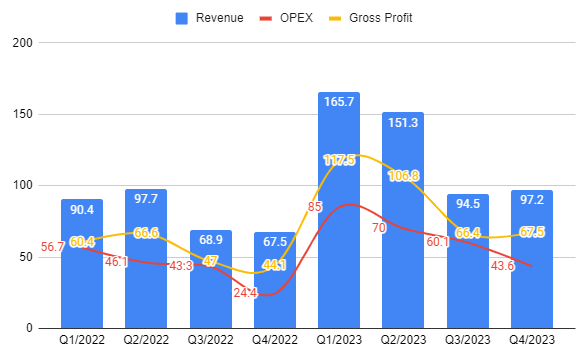

Month-on-month revenue (author)

Although the above quarterly revenue chart suggests that growth has peaked in the first two quarters of 2023, this is not the case. The high growth in the first two quarters was driven by their second brand Spoiled Child and strategic marketing, but now Oddity is working hard to achieve sustainable long-term growth.

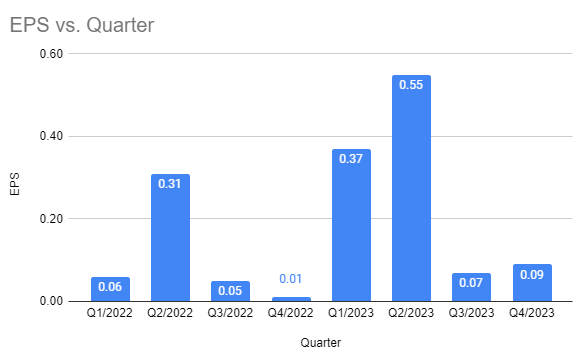

Their earnings per share have been positive over the past two years, and after the launch of Spoiled Child, earnings per share took a healthy jump.

EPS MoM (Author)

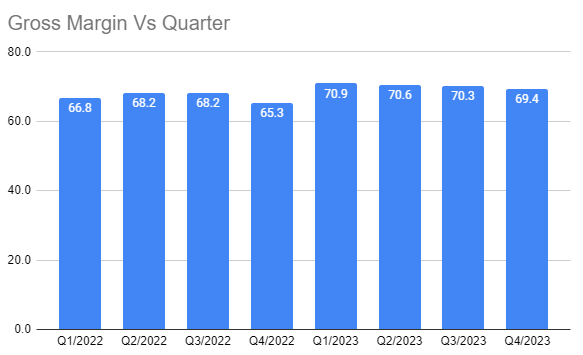

From the perspective of gross profit margin, the gross profit margin is stable at around 70%. This is great for a new company like Oddity, which we can attribute to the DTC-only nature of the business and loyal customers.

Quarter-on-quarter gross profit margin (author)

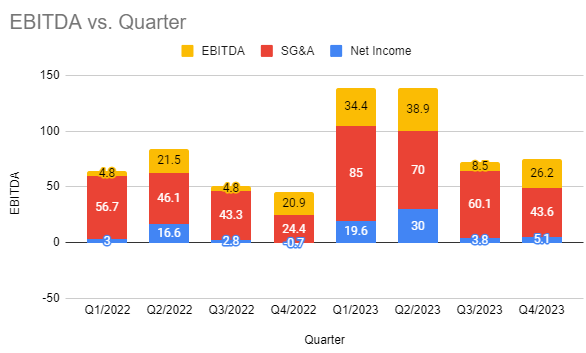

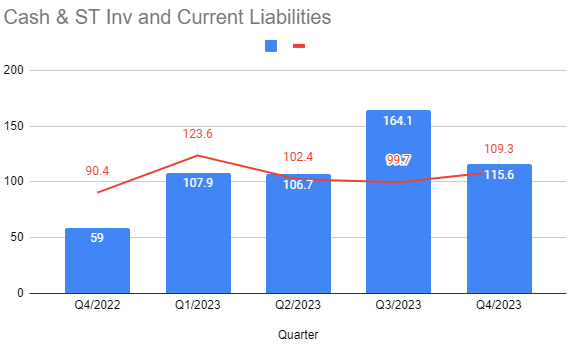

In addition to a quarter of net profit and a 20% EBITDA margin, they also maintained positive net profit, which is an excellent sign for both a young company and a growing brand. Despite their rapid growth, their balance sheet looks very healthy. Cash and short-term investments continue to increase, while current liabilities remain stable. Their strong balance sheets put them well-positioned to weather any possible deterioration in consumer confidence.

EBITDA sequentially (author)

Cash & ST inventory month-on-month (author)

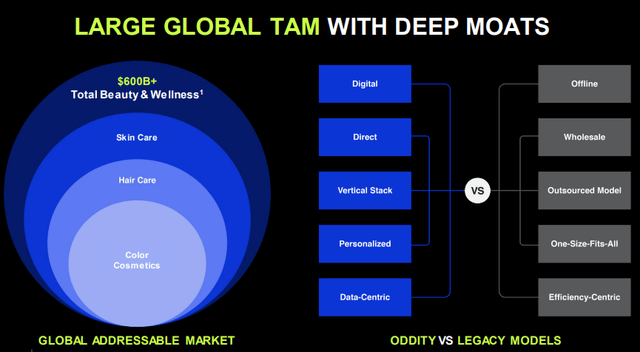

The global beauty and personal care market is a huge 600B+ industry. Expected compound annual growth rate of 8% over the next few years. As TAM continues to expand, especially the online industry, which is growing at a faster pace, this provides Oddity with ample room to expand its market share. This bodes well for Oddity’s future.

TAM (The Strange Investor Presentation, Season 4, 2023)

Valuation: Finding Fair Value

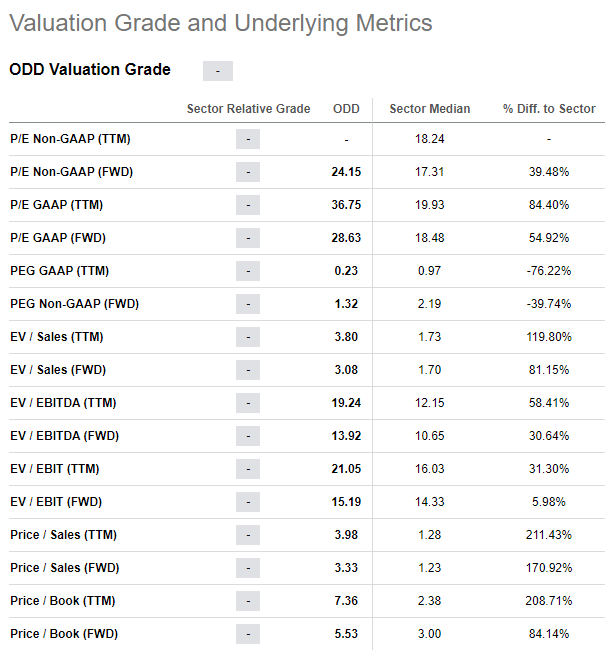

At first glance, Oddity’s current valuation seems high. But when their potential for growth is considered, a different perspective emerges. Oddity’s historical price-to-earnings ratio is 36.75 and its FWD price-to-earnings ratio is 24, making its valuation quite reasonable. This is higher than the industry medians of 19.9 and 17.3 respectively. However, Oddity is a young and growing company with a PEG ratio (TTM) of 0.23, and a PEG ratio close to 1 is considered fair. Oddity appears to be undervalued by this metric. But management insisted on the first-quarter earnings call that they would reduce growth to a more sustainable 20%. This means that the PEG FWD is about 1.2, which is a fair value.

Valuation Grade (Seeking Alpha)

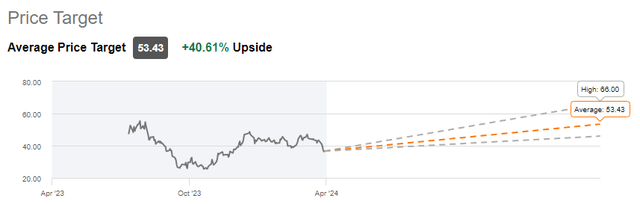

Wall Street analysts are positive about Oddity. Four out of seven analysts rate Oddity a Strong Buy, with none assigning it a Sell rating. The average analyst price target suggests the stock could rise 40%.

Average Price Target (Seeking Alpha)

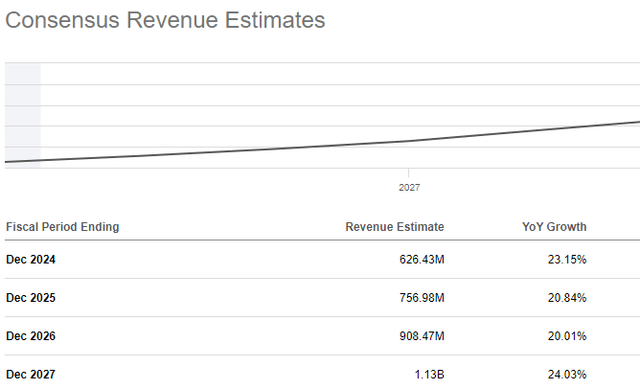

Analysts also predict that the company’s revenue will grow by more than 20% in the next few years. This is in line with management’s expectations and target growth rate.

Revenue Estimates (Seeking Alpha)

Management: Stable at the helm

Oddity is a founder-led company, with Oral Holtzman as CEO and Ms. Shiran Holtsman-Erel as Chief Product Officer. Chief Financial Officer Lindsay Drucker Mann joins the company from Goldman Sachs, where she served as a managing director for more than 16 years.

Baillie Gifford, the largest institutional investment firm, recently purchased 80% of the outstanding shares, giving institutions a majority stake, a vote of confidence in Oddity’s future. In Q4 2023, they purchased 300,828 shares at a price of $36.45, increasing their total stake in the company to 12.9%. This suggests that the current price is considered fair from the perspective of the largest institutional investors.

In evaluating management through the 2023 Q4 earnings call, I was surprised by its maturity, despite the company being relatively new to the market.

In the first quarter of 2023, I made a mistake and grew too much. We grew 83%, which resulted in 57% growth for the year, and we decided not to do that anymore, even though I firmly believed we could. As we mentioned before, the long-term goal is 20% plus and 20% EBITDA margin, and by adjusting the growth rate, I ensure that this goal will be achieved and will continue to be achieved.

For the first quarter, we built the model and managed 22% to 24% year-over-year growth, and I will say again, the pace of growth is my decision. But even if we increase our growth to over 20%, we’re growing much faster than my traditional competitors, which are growing in the single digits, and we’re still securing the business at the beginning of the year, which is This is still the most important time of the year. us. In 2023, 60% of our revenue will come from first generation, and by 2024, we expect the first generation ratio to be very similar to 60%. But we don’t need to increase the first quarter or first half as a percentage of the year’s total to do that.

The CEO’s comments above during the Q4 2023 earnings call indicate that despite the success of their newest brand, Spoiled Child, and explosive growth in 2023, they recognize that the key to long-term success is continued growth. As a result, they are slowing down and focusing on long-term growth goals. This will enable them to scale in a timely manner and ensure that consumer satisfaction is maintained.

My thesis is at risk

Oddity is a consumer discretionary company that is susceptible to swings in consumer confidence and broader economic trends. North America remains Oddity’s largest market, although their business model allows them to easily expand to other markets around the world. So far, U.S. consumer confidence has shown resilience in a high interest rate environment, but that’s no guarantee it won’t deteriorate. However, their strong balance sheet should help them weather such a storm.

The beauty and wellness market is a highly competitive one with many innovative new-age companies vying for market share. Although Oddity is well-positioned with technology-enabled manufacturing and product optimization, competition could intensify and hinder market share growth. In fact, the industry has traditionally seen the emergence of many new players but failed to grow market share in the long run.

In addition to the above factors, overall macro sentiment and the Israel-Hamas war affecting operations at the Tel Aviv R&D center could also lead to a decline in the share price, although I see this as an opportunity to reduce the cost base.

in conclusion

As I wrap up my analysis, Oddity appears to be a well-funded, profitable company well-positioned to disrupt the traditional beauty and wellness industry with its technology-driven approach. Their strong financial strength, founder-led leadership and focus on sustainable growth make them an attractive investment opportunity, echoing Charlie Munger’s wisdom: “It’s best to buy great businesses at fair value” .