59 yuan

introduce

Okeanis Eco Tanker (NYSE:ECO) is my favorite way to take advantage of the ongoing bull market in the crude oil tanker industry.I have been long the stock since 2022 and have been occasion (here it is association to my most recent coverage).In this post, I revisit the paper in light of a recently published Fourth quarter financial results.

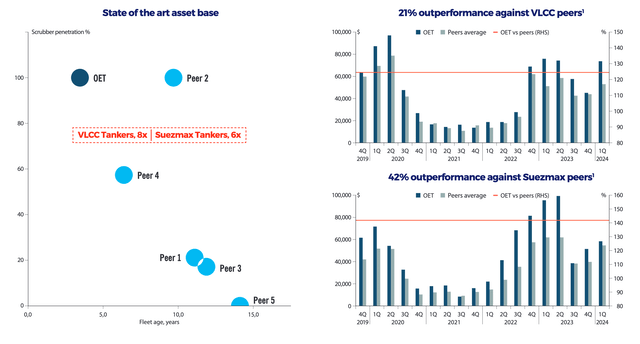

Okeanis has several competitive advantages over its peers, including a newer, more modern fleet, a strong commercial performance record, and transparent, shareholder-friendly corporate policies that are rare in the industry. While it does trade at a higher price compared to some of its competitors, I believe the premium is justified.

As for the fourth quarter of 2023, the situation is largely unremarkable due to the continued weakness in VLCC freight rates carried over from the third quarter.Therefore, the dividend is The fourth quarter will be similar to the third quarter, i.e. significantly lower than the special dividend paid in the first and second quarters. However, based on the dates that have been set, Q1 will be a stronger quarter. I expect VLCC rates to gain positive momentum in the second half of the year, especially if OPEC reverses its voluntary production cuts.

Looking at the mid- to long-term prospects for the crude oil tanker sector, fundamentals remain strong. This is a result of the limited number of orders, ongoing disruptions in the Red Sea, and increasing pressure from the Dark Fleet involved in Russian trade. In addition, new orders are also gradually increasing. While it is unlikely that the Russia-Ukraine conflict or the global economic recession will be resolved in the near future, such events will have a negative impact on ton-miles and stock valuations. After two extraordinary years, I believe it may be time to start thinking about an exit strategy.

notes: As of December, U.S. investors can finally buy shares of the company on the New York Stock Exchange under the ticker symbol ECO.

Outperform peers

The table below compares Okeanis to its direct peers DHT Holdings (DHT), Nordic American Tankers (NAT), and Frontline (FRO) based on its fourth quarter 2023 financial results. It includes the average daily TCE rate achieved in Q4 2023, the average daily TCE rate locked in Q1 2024, and the percentage of days that have been fixed in Q1 2024. These indicators are classified separately for VLCC and Suezmax tankers.

| Q4 VLCC TCE | Q1 VLCC TCE | Q1 VLCC coverage | Q4 Suezmax tanker TCE | Q1 Suezmax tanker TCE | Suezmax tanker coverage in first quarter | |

| dihydrotestosterone | $42,800 | $50,800 | 83% | – | – | – |

| NAT | – | – | – | $39,170 | $40,690 | 57% |

| Free travel | $42,300 | $55,100 | 81% | $45,700 | $52,800 | 72% |

| ecosystem | $45,200 | $73,900 | 76% | $45,600 | $58,800 | 88% |

In the fourth quarter, Okeanis’ growth rate was comparable to Frontline’s and it performed significantly better in the VLCC space. In the Suezmax segment, the company also significantly outperformed North Atlantic tankers. This can be attributed to the fact that ECO’s fleet consists of younger vessels equipped with scrubbers, while NAT’s fleet is older.

Going into the first quarter, Okeanis is expected to deliver a stronger performance. Specifically, in the VLCC field, ECO has obtained high-quality freight rates of approximately US$74,000 per day through timely fixed arrangements. This is approximately 34% higher than the rate Frontline has achieved to date. In the Suezmax segment, Okeanis continues to outperform its rivals, locking in rates approaching $59,000 per day. This is an impressive 11% increase compared to Frontline and an impressive 44% increase compared to Nord Atlantic Tankers.

In conclusion, while the fundamentals of the crude oil tanker market are favorable for the industry as a whole, picking the right stocks can generate significant alpha. Okeanis has a proven track record of commercial performance, consistently delivering superior rates. As shown in the chart below, Okeanis has historically outperformed its peers by approximately 21% in the VLCC space, and an even more impressive 42% in the Suezmax space.

Ecological demonstration

This outperformance cannot be attributed to rising Russian oil prices (especially now that the Urals are trading above the price ceiling). As the chart above shows, Okennes was already outperforming its peers even before the war in Ukraine broke out. Key drivers of this outperformance are the youth and scrubber-equipped nature of its vessels. With an average fleet age of just over 4 years and all ships equipped with scrubbers, Okeanis enjoys a high premium in the market.

Additionally, Okeanis stands out for its transparent corporate policies and commitment to shareholder returns.this Alafossos family Holds a 57% controlling interest in the company. Contrary to many other shipping companies with opaque corporate policies, the family has developed a very transparent strategy that is very much aligned with shareholder interests. In practice, this means two things:

-

Strategic vessel sales during capital cycles: After growing fleet size and optimizing debt structures in recent years, the logical next step is to sell vessels at the right time, i.e. later in the cycle. However, it is worth noting that we have not reached this stage yet.

-

Implement a full dividend payout strategy: As long as earnings remain strong, it makes perfect sense to reward shareholders as much as possible in the form of dividends. It should be noted that technically dividend payments are made as a return of capital and are not subject to any withholding tax.

dividend payment

In 2023, Okeanis distributed a huge dividend, especially in the first and second quarters. However, dividends were relatively small in the third and fourth quarters due to OPEC production cuts and lower VLCC freight rates.

| Dividend per share (USD) | Daily fleetwide TCE rates | |

| Q3 2022 | 0.30 | $38,400 |

| Q4 2022 | 1.25 | $63,800 |

| Q1 2023 | 1.60 | $70,800 |

| Q2 2023 | 1.50 | $72,000 |

| Q3 2023 | 0.60 | $48,900 |

| Q4 2023 | 0.66 | $45,400 |

Based on the number of days already fixed for the first quarter, and assuming Okeanis is able to obtain similar rates for the remainder of the quarter, TCE for the entire fleet is expected to be approximately $67,000 per day. By simple regression, the expected dividend for the first quarter of 2024 is approximately $1.38 per share. This represents an annualized dividend yield of 18.6%.

Going forward, I expect Q3 and Q4 to be equally strong (if not stronger) quarters. OPEC is likely to reverse its voluntary production cuts in the second half of the year. If this happens, it could be the catalyst for VLCC rates to reach the long-awaited $100,000 daily milestone.

In the words of Okeanis CEO Aristide Alafouzos:

With OPEC+ extending production cuts, we are not getting the fourth quarter we all dreamed of. But the silver lining is that OPEC+ continues to focus on managing inventory levels, which we believe will continue to fall and ultimately require more oil to come back to the market (…) We estimate that the situation will be completely reversed. Voluntary production cuts and OPEC+ production cuts will create an additional 48 VLCC demand equivalents, which is a huge number. This will have an immediate impact on the tanker market and prepare us for entry into a market we have been eagerly anticipating.

Fundamentals remain strong

The mid- to long-term fundamentals for the crude oil tanker sector remain very strong.In particular, VLCC order volumes remain at historically low levels, although some new building Recently ordered, including 4 new VLCCs Ordered by DHT a few days ago.

To quote Aristides Alafozos again:

Never in my career has a four-year runway had such limited delivery. In contrast, by 2027, more than 54% of the VLCC fleet will be over 15 years old and 56% will be Suezmax. Fifteen years of age is the first age barrier and charterers begin to consider the vessel to be overage. These ships will lose efficiency and be unable to compete on all cargoes. By 2027, 25% and 28% of the VLCC and Suezmax fleets will be over 20 years old, which is the usual maximum age for all normal operations.

ECO Q4 Demo

Additionally, there is growing concern about imposing sanctions on oil tankers. dark fleet, that is, tankers transporting Russian crude oil at prices above the price ceiling. This stricter enforcement may lead to a reduction in the dark boat fleet and, thus, a reduction in overall supply in the market. Therefore, this may have a positive impact on rates for the remaining fleet.

in conclusion

Okeanis is best positioned to take advantage of strong rates in the crude oil tanker market. Such ratios are likely to continue for at least a few years.

However, it is important to acknowledge that this cycle is maturing, with a significant number of new deliveries expected from 2026 onwards. Additionally, unforeseen events such as the easing of sanctions on Russia, resolution of tensions in the Red Sea, or a global recession could trigger a sell-off in tanker stocks.

With these factors in mind, I think now may be the time to consider reducing exposure to trade and reallocate some profits to other industries that are in the early stages of the cycle.