adventurer

introduce

If your main goal is income, the REIT industry is a great way to earn stable and growing dividends.Over the past few years, I have increased my focus on dividend-focused investing, investing a large portion of my portfolio in sector (XLRE). Healthcare REITs have performed particularly well over the past year, while their retail peers have underperformed over the same period.

One reason is the need for essentials like hospitals, nursing homes and skilled nursing facilities. I’ve previously profiled a REIT that’s popular with dividend investors, Omega Healthcare Investors (NYSE: OHI). While they currently pay a decent dividend, it wasn’t reflected well in the most recent quarter. I think there are better options in healthcare.In this article, we discuss OHI’s latest earnings, 2024 guidance, and potential catalysts that could benefit the REIT long term.

Previous papers

While healthcare REITs have performed well over the past year, some REITs have still run into trouble, primarily tenant issues, including Omega Healthcare Investors. In my last paper in September: Is the dividend sustainable? , I rate the stock a Hold due to tenant issues. At the time, the REIT had four non-cash forms, including its largest tenant, Lavie Care Canters.

Their payout ratio has also climbed above 90%, putting the dividend at risk. Still, the company does have a strong balance sheet, manageable debt maturities, and an investment-grade credit rating. Their expiring leases are also very good, which is something I like about this company. Fast forward 7 months later and the stock is down nearly 6%, but I still rate it a Hold for reasons I’ll discuss later in this article.

brief overview

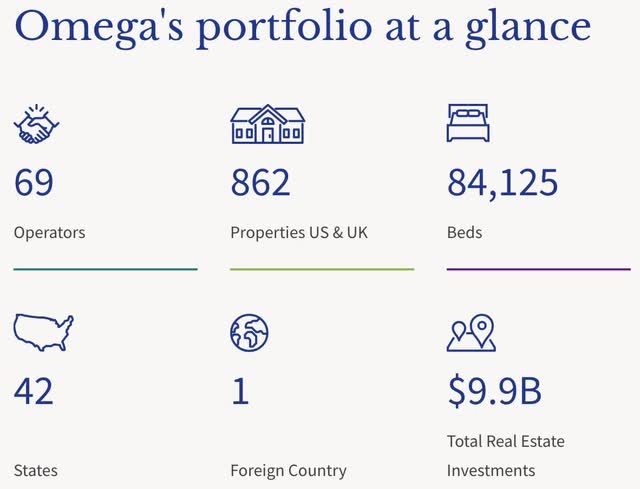

Before we get into the specifics, for those of you who are unfamiliar with Omega Healthcare Investors, they are a healthcare REIT focused on acquiring skilled nursing and assisted living facilities. They currently have 69 operators in 42 states, with a diverse portfolio that includes the most populous states of California and Texas. Others include Indiana, Florida and New York. In addition, they also have a large presence in the UK, currently owning 113 properties in the UK.

OHI Investor Introduction

2023

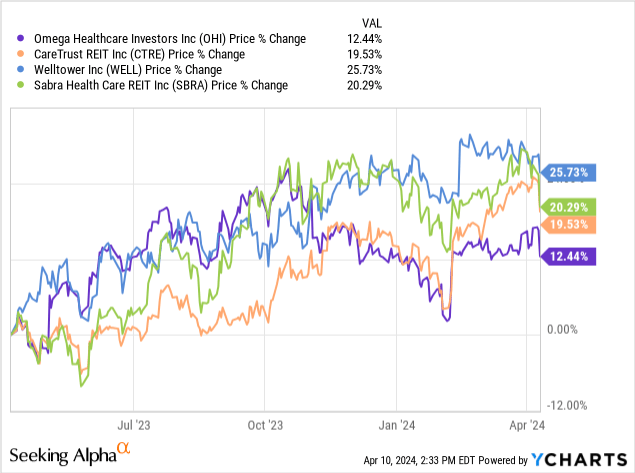

As most people know, last year was a tough year for REITs, with higher long-term interest rates. This has caused the sector to fall out of favor with dividend investors as they opt for safer fixed-rate investments. But despite this, healthcare REITs have remained strong throughout the year. Looking at the chart below, you can see that all four healthcare REITs are in the green, with OHI rising 12.44%.

With so much uncertainty surrounding the economic backdrop, this has led to deals in the green in key areas such as healthcare. But as a dividend investor, while it’s great that your stocks are trading in the green, a company’s financial health should be the main concern when investing. Especially for someone like me who has a long-term perspective.

In OHI’s fourth-quarter earnings report in early February, the REIT’s FFO and revenue expectations exceeded expectations. FFO of $0.68 beat estimates by $0.01, while revenue of $239.32 million beat estimates by $32.74 million. Revenue grew significantly from $145.85 million over the same period last year, while FFO fell nearly 7% from $0.73 during the same period.

Revenue growth came from new investment, tenant restructuring and asset sales. The company successfully sold 30 Lavie Care facilities during the quarter, generating $317.9 million in proceeds. All of these facilities are located in Florida.

Additionally, in addition to disposing of assets, OHI made $249 million in new investments in 2023 and sold a total of 69 facilities for $485 million. As of the end of December, their portfolio occupancy rate was 74.6%, but OHI rose to 80.2% in January.

However, this is still below pre-pandemic levels of nearly 84%. This is something OHI and its peers have faced over the past few years, and it’s likely going to be a while before they get back to those levels for the foreseeable future.

Tenant issues remain

Omega Healthcare Investors has been working to strengthen the portfolio through the restructuring of the Lavie Care & Guardian portfolio and Maplewood. Ravi paid $5.3 million in rent during the quarter and another $1.45 million in January. As for Maplewood, they paid a total of $3.8 million in rent. In the meantime, the company must use Guardian’s $4.4 million security deposit to pay rent this season.

As an investor, I don’t like to see security deposits being charged because it indicates financial distress to the tenant. It also puts the company at risk of further financial problems. Especially given that interest rates are likely to remain higher for longer, the latest CPI report showed that inflation remains stubborn, climbing 0.4% in March. OHI continues to work with these business units on rent payments, lease restructuring and transitions.

catalyst

Despite ongoing tenant issues, Omega Healthcare Investors, like its peers in the healthcare industry, does have some potential catalysts that could benefit the REIT in the near future.In addition to structural adjustment, the aging of the baby boomer generation may also lead to fuel increase By 2030, Americans will need more care. In fact, this number is expected to increase by 75%.

Additionally, the number of Americans age 65 and older is expected to double over the next 30 years, from 46 million to nearly 100 million. New advances in technology and medicine have increased life expectancy. Additionally, more and more Americans are committed to health and wellness, which also contributes to longer lifespans and potential demand for medical facilities.

Dividend safety

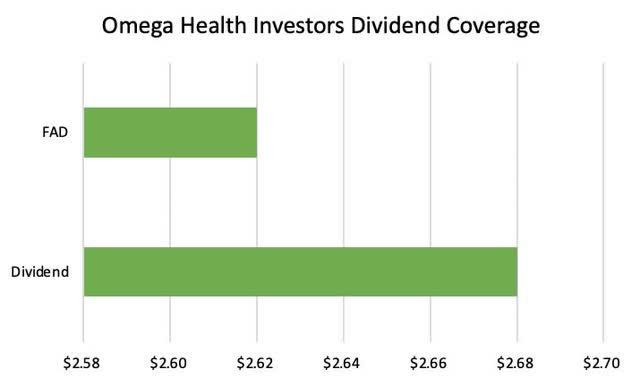

If you’re reading this, I’m assuming you are an investor in Omega Healthcare, or a potential investor with an eye on the generous dividend yield of nearly 9% at the time of writing. Considering the REIT brought in FFO of $0.68 during the quarter, one might say that the $0.67 dividend was 100% covered. But for those who may not be familiar, AFFO is the preferred method that should be considered when assessing the safety of a dividend.

In the case of OHI, investors should consider the funds available for distribution, or FAD. In the fourth quarter, this was down from the current dividend of $0.64, giving OHI a dividend yield of 102%. Additionally, full-year FAD was $2.62, below the annualized dividend of $2.68.

Author’s creation

In the fourth quarter, management did issue 2024 FFO guidance of $2.70 to $2.80, but did not issue guidance on funds available for distribution. This includes no new investments or asset sales this year. So this could be higher than expected as I suspect management is giving a baseline to manage expectations and get a clearer picture of interest rates and the economic backdrop.

Additionally, FAD could also increase, bringing its payout ratio back below 100%. This is something OHI investors should pay close attention to in the coming quarters, especially the second half of this year.

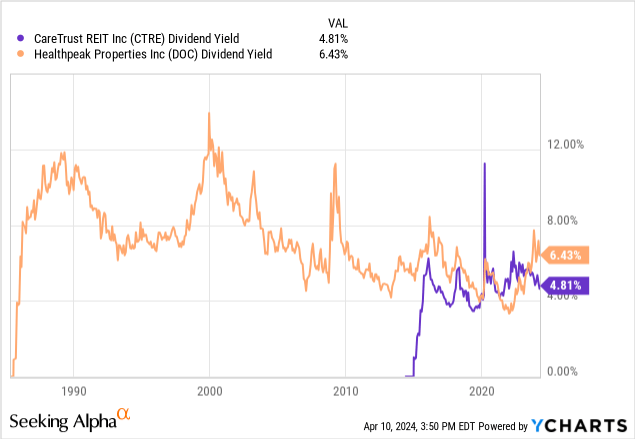

Additionally, peers CareTrust REIT and Healthpeak are better options for dividend seekers. The yield they offer isn’t quite as attractive as what OHI currently offers, but their dividend payout ratio is currently safe at 6.43% and their yield of nearly 5% is attractive.

I recently profiled CTRE in an article you can read here , in which the REIT uses funds available for distribution and has a very conservative payout ratio of 76%. They also recently raised their dividend by 4% for the ninth consecutive year, while OHI has not raised its dividend since 2019.

Healthpeak Properties is another healthcare REIT with a lower end of 2024 guidance of $1.50 and a forward AFFO payout ratio of 80%. Although they don’t have a dividend track record with CareTrust REIT, they haven’t increased their dividend since they cut it during the recent pandemic. However, as recent mergers and the aging baby boomer generation create a need for more medical facilities, this should drive dividend growth for the foreseeable future.

Valuation

As mentioned earlier with the latest CPI report and uncertainty surrounding interest rates, I think OHI and other companies could trade closer or even lower. The forward P/FFO ratio, calculated using the midpoint of 2024 guidance, is 11.2x, which is lower than peer CareTrust REIT, which trades at about 17x and the industry median. However, they do trade at a premium to Sabra Health Care REIT (SBRA)’s 10.68x multiple.

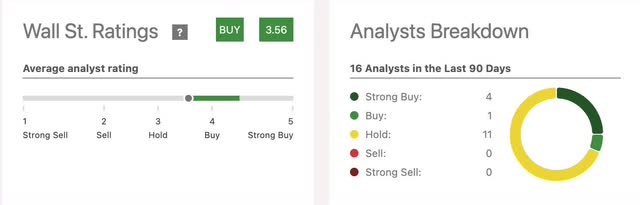

I think this is a good entry point for investors as the stock trades below its 5-year average and the stock has a P/FFO ratio of over 16x. Additionally, if you’re willing to take on risk and have a long-term outlook on the stock, now might be a good time to buy. However, I agree with most analysts’ current Hold rating on this REIT and would like to see how they address future tenant issues and whether they can increase the amount of funds available for distribution in the coming months to lower the current payment rate.

Seeking Alpha

bottom line

Omega Healthcare Investors is a REIT popular among dividend investors, with a dividend yield of nearly 9%, and for good reason. But what’s the point of collecting dividends if they’re not sustainable? While REITs have higher payout ratios because of the structure of their businesses, I like REITs with lower payout ratios to retain cash and reinvest it back into the business for organic growth.

With the current payout ratio of 102%, dividend investors should remain cautious going forward, especially with uncertainty about interest rates. While I expect OHI to maintain its dividend for now, any further tenant pressure could force the REIT to cut its dividend in the process. Additionally, the current yield is attractive, but there are better options in the healthcare sector, and I continue to give OHI a Hold rating.