lazy bear

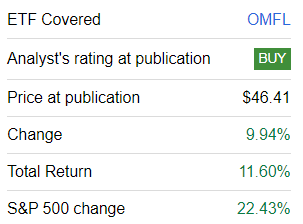

Invesco Russell 1000 Dynamic Multi-Factor ETF (Bat: OMFL) is an investment vehicle that I rated a “Buy” more than a year ago. Alas, sometimes the negative effects of strategies can be surprising.While its long-term returns remain impressive, performance since January 2023 Not as strong as I expected at the time. Having said that, I see no reason to downgrade to Hold today. Below, I’d like to provide a more in-depth review of its performance, detail why I believe OMFL currently has a combination of contrarian factors, and touch on the risks investors should be aware of before purchasing the instrument.

Review of OMFL Strategy

According to its websiteThe Russell 1000 Invesco Dynamic Multi-Factor Index has been the foundation of OMFL’s strategy since its inception in November 2017.The essential idea is to reweight The components of the Russell 1000 Index are a less selective (without net profit screen) large/mid-cap alternative to the S&P 500 Index, so that the final mix better reflects “economic cycles and market conditions (through expansion)” ) “Be prepared for a slowdown, contraction or recovery. ” In other words, it’s a macro-focused approach to market timing. The index, and obviously the fund, take high turnover approachthe occurrence of restructuring and rebalancing depends on “changes in economic indicator signals, with a frequency of once a month.”

Concerning ingredient selection, securities receipt clarified

A multi-factor score for one of five investment styles: value, momentum, quality, low volatility, and size.

according to Overviewfactor analysis is based on the following parameters:

Value: An equally weighted combination of cash flow yield, earnings yield, and price-to-sales ratio. Size: A company’s size factor score is based on total market capitalization as of the last business day of the previous month. Quality: A combination of profitability (return on assets, changes in asset turnover and accruals) and a single leverage measure. Low Volatility: Standard deviation weekly total returns over the past 5 years as of the last business day of the previous month. Momentum: Historical returns for the 11 months through the last business day of the previous month.

Please note that this index does not directly target growth factors. Still, I’ll examine the ETF’s growth risks in the notes below.

What happened in 2023?

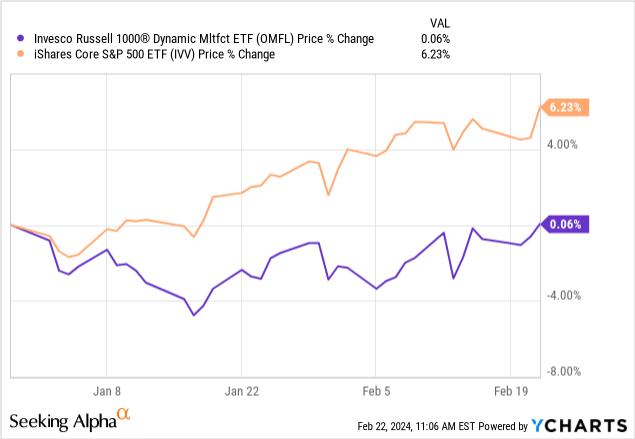

Since my article was published on January 26, 2023, OMFL has significantly underperformed the S&P 500 in the tech/growth bull market, which raises a legitimate question: is the index’s rotation strategy capable of timing the market correctly? .

Seeking Alpha

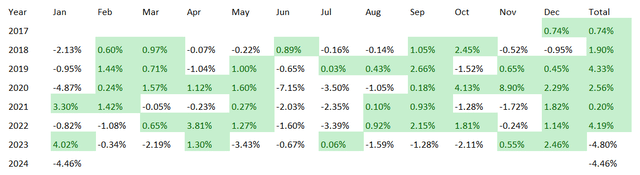

In fact, 2023 is the first year since the iShares Core S&P 500 ETF (IVV)’s inception in 2017 that OMFL has underperformed the iShares Core S&P 500 ETF (IVV), as the data below shows. Another issue is that the ETF is off to a pretty slow start in 2024, as January severely underperformed IVV. In fact, it was one of the weakest months since launch. Only January and June 2020 performed worse, 4.9% and 7.2% lower than IVV respectively.

IVV and OMFL backhaul comparison (Data creation using portfolio visualization tool)

Factoring in February, its price return is close to zero. Again, nothing to brag about.

By comparison, for the actively managed BlackRock U.S. Equity Factor Rotation ETF (DYNF), which I was initially not bullish on for the reasons described in the April 2022 article, 2023 was the best year since its inception one year (total returns of nearly 10% higher than IVV), which is something I discussed earlier this February.

Another issue is that among the multi-factor ETF group, OMFL had nearly the worst performance from February 2023 to January 2024, as shown below, while only the First Trust Lunt US Factor Rotation ETF (FCTR) performed worse. The iShares Russell 1000 ETF (IWB) has been added to ensure necessary context.

| Folder | content | intravenous injection | Xtrackers Russell US Multi-Factor ETF (DEUS) | WisdomTree United States Multifactor (USMF) | Internal whiteboard | dynamic neural network | FCTR |

| Initial balance | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 |

| final balance | $10,701 | $12,075 | $10,893 | $11,147 | $12,012 USD | $12,904 | $9,638 |

| CAGR | 7.01% | 20.75% | 8.93% | 11.47% | 20.12% | 29.04% | -3.62% |

| standard deviation | 17.67% | 14.07% | 15.97% | 12.85% | 14.34% | 15.32% | 21.53% |

| best year | 10.18% | 18.87% | 8.62% | 8.27% | 18.54% | 26.47% | 0.07% |

| worst year | -2.88% | 1.58% | 0.28% | 2.95% | 1.34% | 2.03% | -3.69% |

| maximum.retracement | -12.94% | -8.32% | -9.30% | -6.74% | -8.67% | -8.84% | -20.03% |

| Sharpe ratio | 0.17 | 1.05 | 0.29 | 0.51 | 1 | 1.42 | -0.31 |

| Sortino Ratio | 0.29 | 2.17 | 0.55 | 1.04 | 2.06 | 3.2 | -0.48 |

| market relevance | 0.95 | 0.99 | 0.94 | 0.9 | 1 | 0.99 | 0.92 |

Data from portfolio visualization tools

More background information on performance

But what about long-term performance? The fact is that while 2023 is a bit softer than I expected, OMFL’s annualized returns between December 2017 and January 2024 compare favorably with the results provided by IVV, IWB and some other multi-factor peers. Still the highest. Transaction history.

| Folder | content | intravenous injection | Ultrasound heart test | Medical PhD | Internal whiteboard |

| Initial balance | $10,000 | $10,000 | $10,000 | $10,000 | $10,000 |

| final balance | $21,329 USD | $20,318 | $16,435 | $17,554 | $19,931 |

| CAGR | 13.07% | 12.18% | 8.39% | 9.55% | 11.83% |

| standard deviation | 19.21% | 17.79% | 18.76% | 16.82% | 18.08% |

| best year | 35.58% | 31.25% | 28.80% | 23.52% | 31.06% |

| worst year | -13.97% | -18.16% | -11.19% | -8.83% | -19.19% |

| maximum.retracement | -22.11% | -23.93% | -27.31% | -22.89% | -24.57% |

| Sharpe ratio | 0.63 | 0.63 | 0.42 | 0.51 | 0.6 |

| Sortino Ratio | 1.06 | 0.96 | 0.62 | 0.76 | 0.92 |

| market relevance | 0.92 | 1 | 0.96 | 0.95 | 1 |

Data from portfolio visualization tools

OMFL currently has a combination of contrarian factors

As of February 20, OMFL’s portfolio surprised me quite a bit. After doing my research, I can confidently conclude that at this moment in time, ETFs have a more contrarian mix of factors. It’s not just that the fund is completely ignoring the Big Seven, the group that has generated the lion’s share of the S&P 500’s returns during this bull market. That’s because it favors value over growth and mid-cap stocks over large-cap stocks. Interestingly, this contrasts with DYNF’s view. Let me share the key factor data below:

| Metric | Holdings as of January 23, 2023 | Holdings as of February 20, 2024 |

| Market value | US$10.307 billion | US$11.569 billion |

| Pressure/Pressure | 1.5 | 1.61 |

| Ernst & Young | 8.6% | 6.5% |

| sales forward | 9.6% | 2.7% |

| EPS forward | 14% | 3.6% |

| roe | 25.3% | 17.1% |

| long | 6.7% | 5% |

| Quantitative Valuation B- or better | 33.2% | 41.3% |

| Quantitative valuation D+ or worse | 36.4% | 30.6% |

| Quantitative Profitability B- or better | 77.9% | 74.5% |

| Quantitative profitability D+ or worse | 4.3% | 5.2% |

| Quantity Growth B- or better | 28.6% | 34.1% |

| Quantitative Growth D+ or worse | 50.8% | 32.8% |

The author uses data from Seeking Alpha and ETFs for calculations.Financial data as of February 21

An important point is that the holdings set contains 375 common stocks and REITs, including Ardagh Group SA (not to be confused with Ardagh Metal Packaging SA (AMBP), which is also in this portfolio), and since its delisting in October I Just ignore it for 2021.More information about the holding can be found at OMFL annual report.

So, what can we tell from the above indicators?

- Although the ETF has replaced more than 22% of the portfolio in the January 2023 version, it remains confidently overweight mid-caps (about 48%), large-caps are completely absent, and the most generous valuation is Interactive Brokers Group (IBKR), with a market capitalization of $43.9 billion. I even found seven small-cap stocks (market caps under $2 billion), even though they accounted for only 0.27% of net assets.

- The mid-cap tilt supports strong value characteristics, and OMFL has a lot to offer on that front right now. Its weighted average return and price-to-earnings ratio speak volumes. Second, most holdings (excluding financials) have solid cash flow yields (median 11.9%).

- Growth Exposure leaves a lot to be desired.

- Quality is largely solid by mid-cap universe standards. The ROA could have been better, though.

- I also noticed that this ETF has many low beta stocks. Nearly 44% of net assets are allocated to assets with factors below 1x.

- Of course, the risk is that if the growth rebound continues and the factor mix does not change in time, OMFL may unexpectedly decline again.

final thoughts

OMFL is not a perfect ETF, because a completely perfect investment vehicle probably does not exist. Since the last article, it has been even more disappointing as its index failed to properly identify the zeitgeist and position itself sufficiently to beat the Russell 1000 and S&P 500. However, as I said in my last article, this macro information strategy has handled the challenges of trade wars, epidemics, capital rotations and even a drought in the 2022 growth model brilliantly. I’m even more optimistic today as I expect this strategy to continue delivering significant gains over the long term. Additionally, the current portfolio iteration provides a solid margin of safety in case the market excitement ends abruptly, for example, if there is a monetary policy surprise. Of course, this mix is subject to change, as the index is “dynamic” and can respond quickly to new macro signals. I should also point out that if investors disagree with OMFL’s current inverse factor mix, they should take a closer look at actively managed DYNF, which is heavily invested in growth and quality stocks with little value exposure.