big country

investment thesis

opera(NASDAQ: OPRA) continues to demonstrate good financial performance due to its strategic initiatives and growth prospects.However, OPRA shares have risen since our initial coverage and the upside is currently less attractive, so we downgraded the stock to catch.

Profit Review and Revenue Outlook for the Fourth Quarter of Fiscal Year 2023

The company reported fourth-quarter 2023 results that beat our expectations.

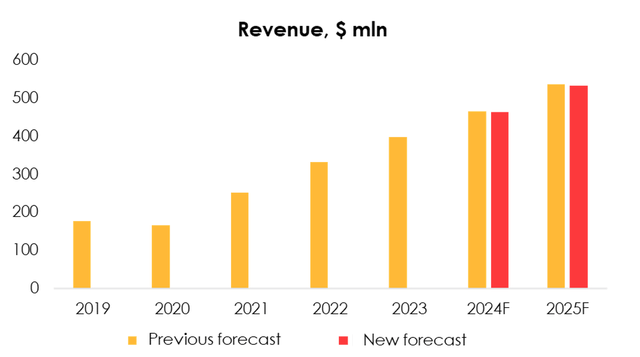

- Revenue reached US$113 million (year-over-year growth of 17.4%), compared with our forecast of US$113.2 million, in line with our expectations.

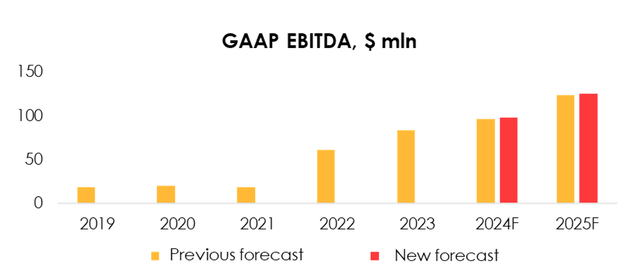

- GAAP EBITDA totaled $24.9 million (up 21% year over year), exceeding our expectations of $21.5 million due to lower marketing and personnel expenses.

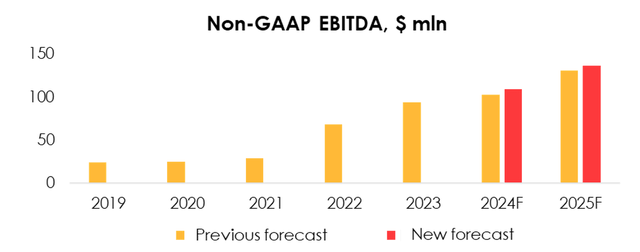

- Non-GAAP EBITDA (excluding dilution) was $27.8 million (up 21.9% annually), 20% above our guidance of $23.1 million due to a smaller base and a higher employee share-based compensation ratio.

Company revenue shows high levels and EBITDA growth, driven by improved product penetration and customer LTV (primarily due to the transition to GX):

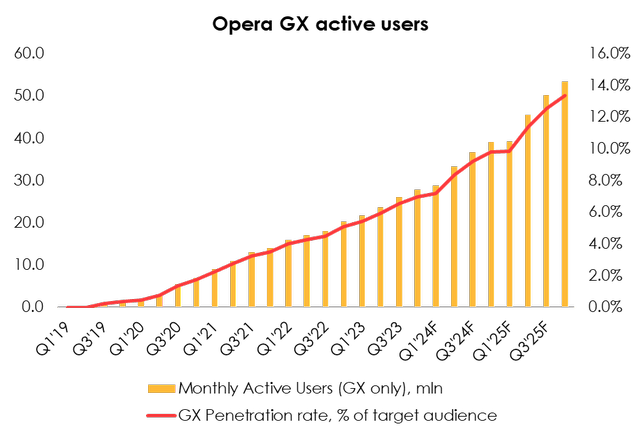

- Active users (MAU) totaled 307.1 million (-1.9% year-on-year), slightly below our expectation of 308.9 million (-1.8% year-on-year) due to slower customer uptake of Opera GX products. Despite this, browser user growth remains strong: 40.7% year-on-year to 39.1 million.

- The difference in user numbers was offset by higher ARPU, which totaled $1.20/month (21.8% annual growth), slightly higher than our forecast of $1.19/month.

Although the number of active users has slowed down, GX still has low penetration relative to its target audience, which according to our calculations is about 7.0%. We believe OPRA will be able to increase penetration to 13% by the end of 2025, nearly doubling its GX user base.

Investment Hero

We have slightly adjusted our MAU and ARPU forecasts to reflect slower user base growth but higher ARPU growth. As a result, we lower our 2024 revenue forecast from $466 million (17.4% annual growth) to $464 million (16.8% annual growth) and our 2025 revenue forecast from $536 million (15.2% annual growth) Revised downward to US$532 million (14.7% annual growth). .

Investment Hero

Management expects 2024 revenue to be in the range of $450-465 million, in line with our expectations.

EBITDA bottom line growth better than expected

In terms of operating costs, the company reported better numbers than we expected, as personnel expenses were approximately $1 million below our forecast and marketing expenses were $2 million below our forecast.

However, the proportion of employees’ cash compensation declined during this period due to an increase in equity-based compensation. The company’s hiring rate is likely to remain low. We lower our 2024 cash compensation cost forecast to $74.4 million (13% annual increase) from $78.5 million (13% annual increase), but raise our equity compensation forecast to $11.1 million from $6.3 million (6% annual increase) (Yearly growth of 6%). By 2025, it will increase from US$7.1 million (annual increase of 13%) to US$11.9 million (annual increase of 6%).

We also adjusted our calculation of the company’s other total expenses (content costs, sold inventory and third-party platform commissions) for seasonality and lowered our forecast from $116.5 million (up 24% year-over-year) to $112.9 million (+ 2024 year-over-year growth of 21%), from US$128.7 million (annual growth of 11%) to US$126.9 million (annual growth of 12.4%) in 2025.

As a result, we are raising our 2024 GAAP EBITDA guidance from $97 million (annual growth of 21%) to $98 million (annual growth of 18%), and from $124 million (annual growth of 28%) to $125 million (annual growth of 28%). %). ) by 2025. For Adjusted EBITDA, we are raising our forecasts from $103 million (up 10% year-over-year) to $109 million (up 17% year-over-year) and from $131 million (up 27% year-over-year) to $137 million (up 27% year-over-year). 25%). % annual growth rate to 2025) given the increasing share of non-cash employee benefits.

Investment Hero Investment Hero

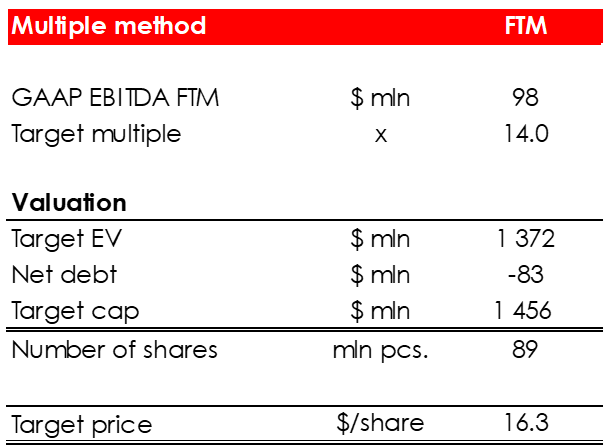

Valuation

For valuation purposes, we use an industry EV/EBITDA multiple of 14.0x. Peer groups with multiple forecasts include Alphabet (GOOG) (GOOGL), Baidu (BIDU) by 2022, Meta Platform (META) and others.

We raised our price target from $15.2 to $16.3 for the following reasons:

- Improved 2024-2025 EBITDA guidance;

- Net cash increased from $75 million to $83 million;

- Shifts in FTM valuations.

Based on new assumptions, we downgrade the stock to Hold.

Investment Hero

in conclusion

Despite strong competitors such as Microsoft (MSFT) and Alphabet, Opera has managed to find its target audience and occupy an unoccupied niche in the market. Opera GX products meet the needs of modern gamers better than similar products, allowing the company to grow its user base and ARPU at a rapid rate. In addition, the company’s profit level is stable and shareholders’ capital has not been diluted. However, following earnings growth, we downgraded the stock to Hold.

To manage your positions, we recommend following Opera earnings releases.