Best Photos of Everyone/iStock via Getty Images

OptimizeRx Corporation (NASDAQ: OPRX) is on a path to exponential growth, which has pushed valuation multiples to the lowest levels in the company’s history.But the market did not react much to this With the excellent guidance announced recently, we think there’s an opportunity to capitalize on possible valuation repricing in 2024. Based on peer valuations and software industry median multiples, OPRX is likely undervalued by approximately 30%.

Building software suites for tomorrow’s healthcare systems

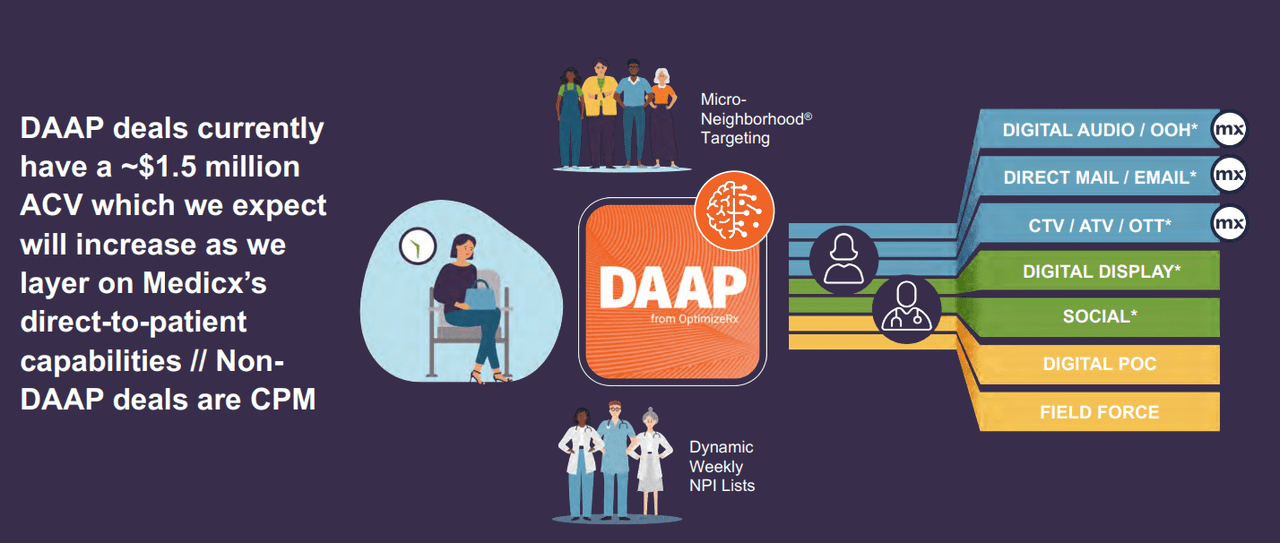

As the name suggests, OptimizeRx provides a platform to expand the reach of pharmaceutical distributors to include as many doctors (and patients) as possible. To do this, they use advanced AI-based direct messaging technology combined with efficient positioning strategies.All of their products are rolled into one suite called Dynamic Audience Activation platform, or DAAP. Their two main services are (1) patient discovery, and (2) script optimization and improvement. Basically, OPRX finds customers and then focuses on driving script growth organically by increasing the visibility of a specific brand relative to others.

DAAP Overview (Latest Enterprise Demo)

The strength of their suite is the integration of various pipelines and services, providing valuable synergies in data collection and distribution. Currently, the average contract value of their transactions is approximately US$1.5 million, which is expected to increase through cross-selling to existing customers as they appreciate the results of the DAAP platform.

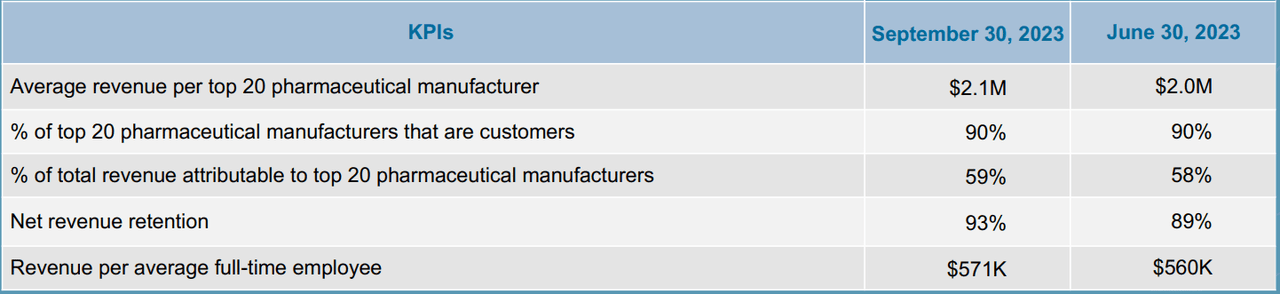

Key Performance Indicators (latest corporate presentation)

KPIs also provide some useful insights. OPRX has been able to reach 90% of the top pharmaceutical manufacturers and 60% of its revenue comes from these customers. We believe this is a strong signal of confidence and shows that the largest players in the industry are appreciating the high ROI the software offers. Another important point is the revenue retention rate, which reached 93% and increased sequentially.

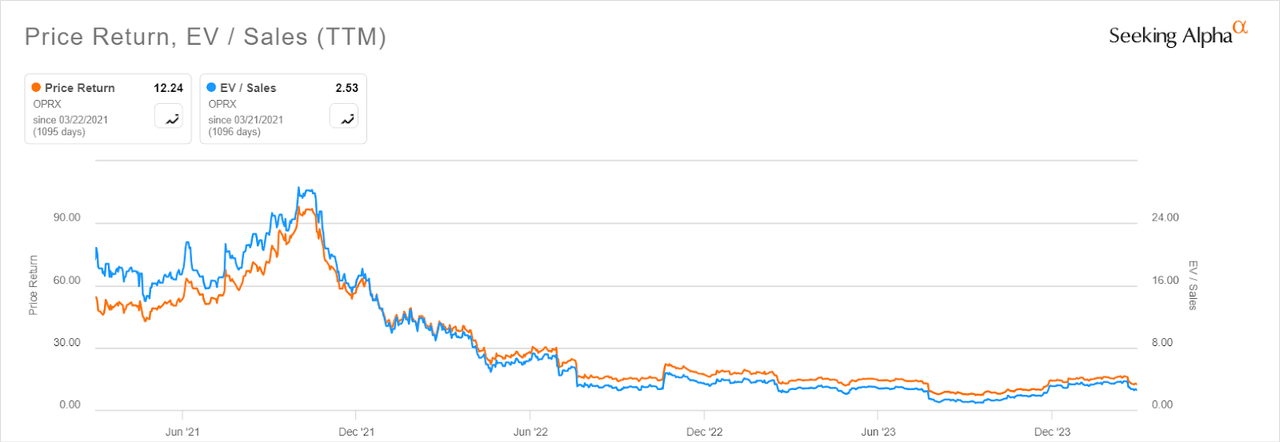

Financials: The rise and fall of OPRX valuation

OptimizeRx’s past performance has been very similar to many other software companies. Their valuations in 2020-2021 were very high, trading at well over 20x revenue. However, revenue growth was relatively stable between 2021 and 2022, which later contributed to an aggressive revaluation after 2021.

Price Returns and Valuation (Seeking Alpha)

After trading as high as $90 a share and trading at 25x revenue, the stock is now trading at $12 and has an EV/Sales of 2.5, almost down significantly. But this all comes at a time when financials are actually improving, and the company is now starting to deliver on its previous forecasts.

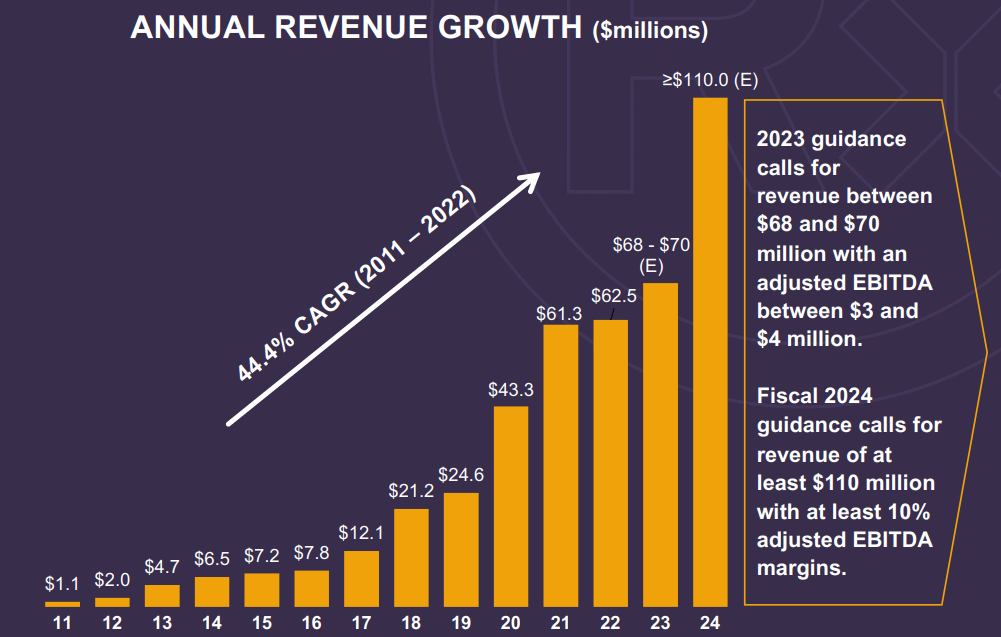

Annual Growth (Latest Company Profile)

This is revenue growth over the past 13 years, including guidance for 2024. Note that growth is not linear but is concentrated in certain years when new contracts are signed or existing customers increase the size of existing agreements. However, things are different in 2024. The significant revenue growth is expected to be due to the $95 million acquisition of Medicx, which was completed in the fourth quarter of 2023. Medicx is a customer-focused omnichannel marketing and analytics provider. As a result, we think there may be some data-related synergies that could be implemented that could drive top-line growth and improve offerings (and marketing ROI) for existing customers. Assuming standalone OPRX contributions of $75 million, this means Medicx was acquired at about 3 times revenue, below the industry median of 3.6 times. The acquisition was funded through a $40 million credit facility and existing cash.The entity is expected to have approximately $12 million in cash per quarter Corporate Communications.

Risks: Be aware of integration risks and competitive threats

When a company acquires a business about half its size, a lot can go wrong. While we won’t discuss Bayer and Monsanto here, there are still potentially harmful integration risks to be aware of in this acquisition. Additionally, the former president of the acquired company serves as chief commercial officer of the new test prep company. Differences in perspective and strategy can create conflicts within top management, to the detriment of shareholders. However, we expect the overall results to be positive. Both teams have a wealth of professional experience and are therefore expected to be effective in this deal.

Another source of risk is competition. This is a fast-growing industry that is evolving rapidly, and new competitors may emerge with disruptive technologies that take market share from companies like OPRX. The good news is that, like many other software companies, customer loyalty is typically very high due to high switching costs.

What’s the future outlook for OptimizeRx’s valuation and share price?

We believe that the pro forma company resulting from this acquisition will be significantly undervalued in the current market environment. In fact, there does exist some opportunity to grow revenue organically due to the quality of the data sets OPRX will have after this transaction.

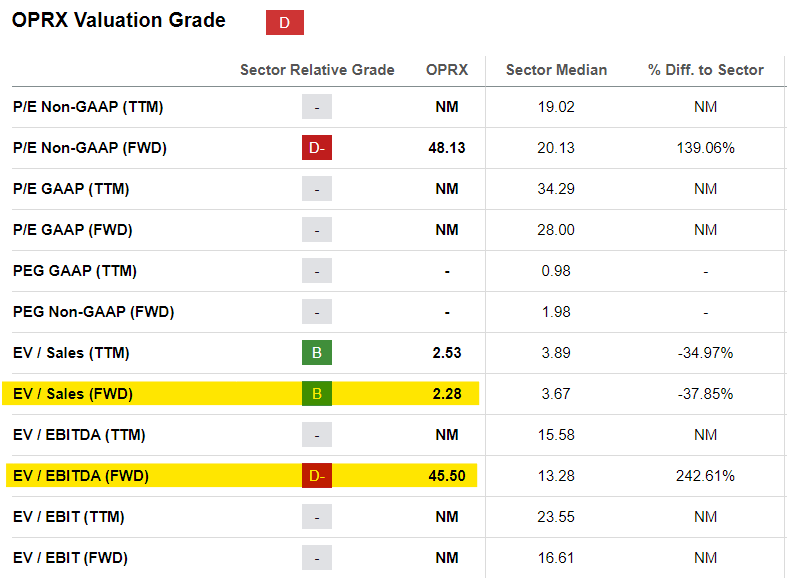

Valuation – Industry (Seeking Alpha)

Now at first glance, OPRX may appear expensive relative to the industry. The forward EV/EBITDA is about 45 times, much higher than its industry’s 13 times. However, this figure does not take into account new guidance and a new capital structure following the acquisition.

Management expects adjusted EBITDA margin to be “at least 10%” on revenue of at least $110 million. This implies a baseline EBITDA of $11 million, with some upside potential. Net debt is expected to be approximately $30 million to $40 million in credit facilities, less $12 million in cash. Overall, this implies a forward EV/EBITDA of 22x, less than half the original number. However, from an industry perspective, it still appears expensive.

However, this comparison is misleading for one main reason: the industry as a whole hasn’t grown at the same 27% CAGR that OPRX has over the past 5 years. Therefore, we need to adjust for this superior performance, and to do this we will compare it more closely with two similar companies. However, we use EV/sales multiples for this calculation because most of these companies still have negative EBITDA.

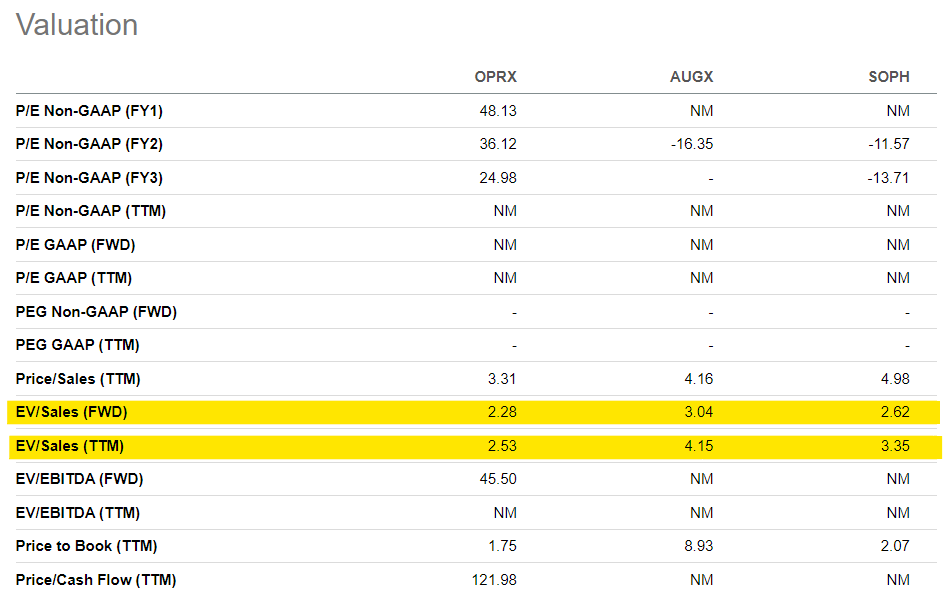

Valuation – Peers (Seeking Alpha)

We immediately notice that within this group, OPRX stands out as being cheap, while its closest competitor, Augmedix, Inc. (AUGX) – is valued at about 50% higher while achieving roughly the same growth rate. Therefore, we believe it is possible to recalibrate the average between the two competitors (2.8x EV/sales) by 2024. At this multiple, the stock trades at about $16, which implies a 30% upside potential. Current price.

in conclusion

OptimizeRx is a rapidly growing industry disruptor bringing cutting-edge technology to the forefront of patient positioning in the healthcare industry. They’ve built a strong product, and the revenue retention KPIs and revenue growth prove it. The market failed to properly value the pro forma company following their latest acquisition, and we expect upside potential of around 30% on a 2024 valuation re-rating.