onurdongel/E+ via Getty Images

Orion Office Real Estate Investment Trust (NYSE:ONL) Management predicts another decline over the next year. Real estate, even office real estate, tends to be cyclical.Generally speaking, the time to buy is when the market thinks there is nothing left to do future headwinds. However, as in any industry, if returns are insufficient, then investment—in this case new construction or otherwise adding office space capacity—slows or even stops until prices begin to recover. Management appears to have a track record of weathering downturns in good shape while being able to capitalize on the next inevitable cyclical recovery, which will see the share price rise sharply. Over time, this management may grow the business, as it did with VEREIT.

This recession essentially began with the 2020 pandemic, when legions of workers discovered they could work “Anywhere” from home. Since then, the idea has met with some resistance, as some companies have discovered the benefits of bringing everyone into the office. Still, for some, the work environment has changed, meaning there’s an oversupply of office space. But as with other economic downturns, the oversupply will diminish as certain industries and certain functions will still need office space. The current cycle is not fundamentally different from any other recession, as every recession has its own causes of oversupply.

manage

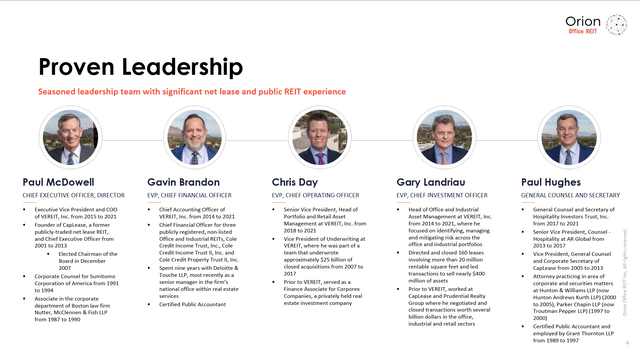

As shown below, this management comes from VEREIT following the sale of a majority stake in the company to Realty Income (O), along with the spin-off of the office space portion of both companies to current management.

Orion Office Advanced Management Summary (Orion Office Q4 2023 Earnings Conference Call Slide)

Management clearly has the ability to sell a majority stake in the company to companies like Realty Income. This alone is enough reason to consider this investment before evaluating other achievements when others would not.

Since obviously the risk is probably a bit higher than it would be if these properties were part of a diversified portfolio, it makes sense to make this investment part of a basket of investments so that if any one idea fails, the basket of correctly chosen ones remains will show good results. I’ve never been a fan of “all in”. But I do think the death of the office space has been overdone.

stock price

The current share price and yield of around 9% should further indicate potential rising risks.

Orion Office REIT Common Stock Price History and Key Valuation Metrics (Seeking Alpha website February 27, 2024)

Clearly, the dividend yield tells any investor that risks are higher than normal and investors should probably plan for future dividend cuts. It probably won’t happen, but the yields suggest the likelihood of it is certainly greater than zero.

However, for those who are not yet retired, current share prices may be low enough that future dividends may compare very well to today’s investments once the cyclical recovery begins. This will take some time to develop (and the company will have to achieve this). But for those willing to take the risk (as part of a basket), this could be a good future income proposition “down the road”.

debt

One of the things that scares many investors is debt maturities from the previous article.

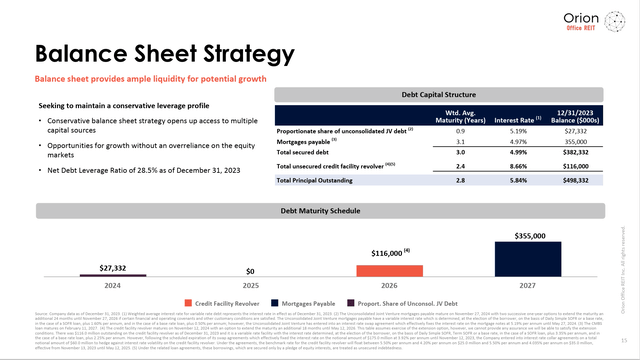

Orion Office REIT Debt Maturity Profile Summary (Orion Office Company Presentation Q4 2023)

The scary thing for many investors is that a significant amount of debt is coming due this financial year. But management assumes they will extend debt maturities, as shown above. At the same time, management reduced the amount of its revolving credit by about one-third since last year. last quarter report.

Debt maturity schedules remain tight. But overall, total debt is low, and management has time to figure out what to do with it going forward. Investors shouldn’t assume, as many do, that management will “sit back and wait.” Competent management will see this situation and deal with it. Therefore, this is the most reasonable assumption for the future.

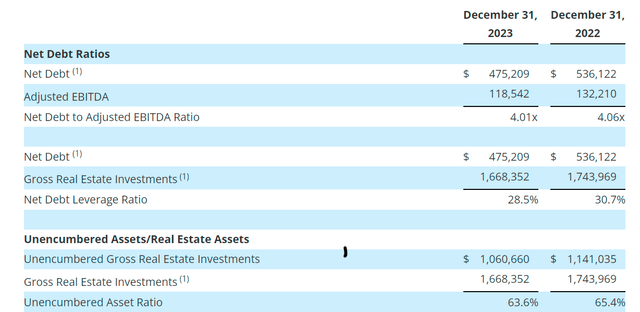

Orion Office Summary of Key Debt Statistics (Orion Office Q4 2023, Earnings Press Release)

this Debt Ratio Coverage Because the interest is still reasonable. Things will definitely be better and likely to improve once the cyclical recovery begins.

At the same time, management has a lot of unencumbered assets that should be useful if some debt restructuring is needed.

Another consideration is that the market is now expecting interest rates to fall. This again has its own cycle, but visibility is very low. Attempts to plan for the interest rate environment can have many possible outcomes and are subject to a high degree of uncertainty. What should be assumed is that management will handle the situation and then leasing will do the same. There may be some delay time. But this is unlikely to be a permanent disadvantage.

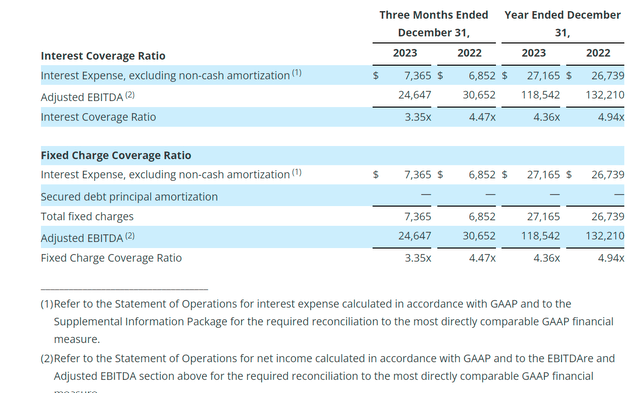

Orion Office Flat Fee Coverage Summary (Orion Office Q4 2023, Earnings Press Release)

Fixed expense ratios have compressed significantly and, based on current guidance, may further compress in the future. However, companies also appear to be no longer allowing more employees to work from home. In fact, the trend now is to bring workers back into the workplace.

While some jobs are now flexible, the demand for office space over the past few years looks set to increase. This means that demand is starting to rise even as excess supply persists. The trend rarely goes straight up or down. But the reversal of trends means more office space will be needed than originally thought.

This strongly implies that the currently predicted downward trend will (probably) reverse at some point in the near future. These conditions never last as long as the market expects.

generalize

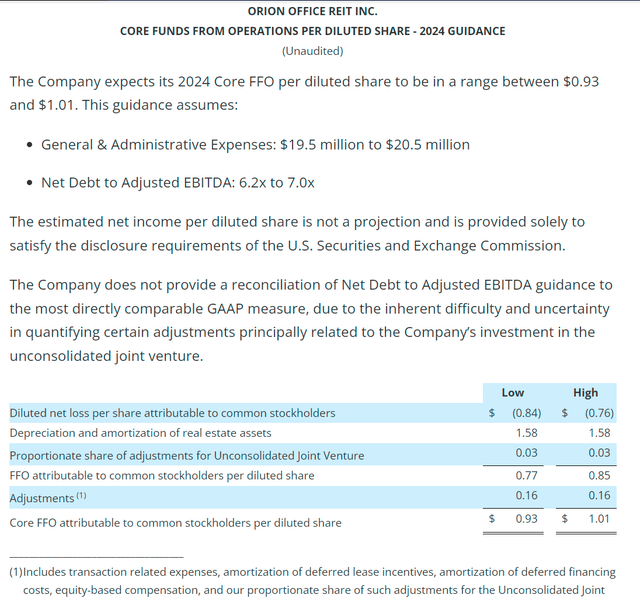

The guidance predicts that the soft office market is likely to persist.

Orion Office REIT 2024 Guide (Orion Office Q4 2024, Earnings Press Release)

This may be the last year for this trend, as activity in new office spaces appears to be waning and business trends are bringing more employees back to the office than was the case just a few years ago. There is always a risk that the downturn could last longer than expected. This will have a significant impact on the company’s financial position and future prospects.

It does look like key debt ratios will compress, but nothing too severe. With debt levels low, maturing debt is less likely to become a burden. However, the risk of lower-than-expected occupancy could make this idea optimistic (and therefore an investment risk).

Management claims a prime location in growing suburbs, most of which are in growing states such as Texas. Time will tell whether the strategy has enough advantages to deliver superior returns to shareholders.

It appears that share prices and yields will contain considerable risk and pessimism, with little, if any, likelihood of an eventual cyclical recovery. Work habits and work locations have changed (of course). But change is the nature of any business. Even though some jobs no longer require offices and business locations, they still require them.

This stock is a higher risk stock (like a speculative stock) and is only suitable for those interested in higher risk. However, the management did sell some assets to Real Estate Income Management. This is not an achievement that many can claim. Management with a track record of past success have a better-than-average chance of greater success. But this is far from a guarantee.

Orion Office REIT Inc. stock is a speculative strong buy for those betting on an eventual recovery in real estate. Even income investors may be interested in this as a speculation, since in the event of any office space recovery (and stronger lease prices), income is likely to surge above current yields, even if the dividend is cut first before the recovery. But the idea may not be suitable for average or conservative investors.