Renata/iStock Editorial via Getty Images

Dear readers/followers,

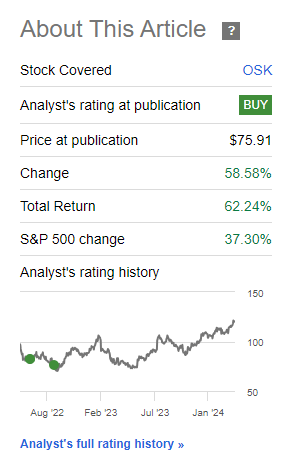

It’s time for an update on a company I haven’t written about in nearly 1.5 years. In this case, I’m talking about Oshkosh (NYSE:OSK), my last article was published here Back to September 2022.you can Find that article here, the article received a positive “buy” rating at the time. In fact, I’ve maintained a small position ever since, and as you can see, that position has significantly outperformed the market, making it what I consider to be a very successful investment over the past two years.

Seeking Alpha OSK RoR (Seeking Alpha)

In my opinion, it highlights the two lessons I am trying to impart in the article.First, lessons Buy when undervalued. Secondly, lessons patience. both In my opinion, these are crucial to successful investing. Applying these correctly can lead to excellent performance, which is actually what I rely on in my own work.

In this article, we take a look at Oshkosh’s latest results and find out what the company might be doing in 2024 and beyond. Share price performance here is positive – so let’s take a look at whether you should buy Oshkosh here.

Oshkosh – a niche but attractive business at the right price

The company’s double-digit dividend growth should be a clear indication to you that it’s a company to consider at the right price.

But what exactly makes Oshkosh a great company?

Well, I’ve written 4 articles about this business – and I’d love to tell you what I think here. In some ways, I liken Oshkosh to industrial giant Caterpillar (CAT).These are great businesses, I mean great companyif your portfolio includes holding lower-yielding businesses for greater ultimate returns, you can buy them when prices are cheap.

My approach includes this.

The company owns several brands – most of which I had never heard of in Europe, but which are very well-known in their respective fields and regions where the company sells its products.

OSK Infrared (OSK infrared)

As you can see, the company also includes the military/defense segment and the company’s focus is on telehandlers, cranes, boom lifts, lifting equipment, defense vehicles, fire trucks, commercial concrete/garbage and other types of operations .

After more than a century in business, Oshkosh has become one of the most interesting companies in this space, and I would also like to remind investors that first truck Projects built by the company are still in operation and promoted by the company, albeit more as museum pieces than for actual work.

The company is described as an innovator focused on the design, development and manufacture of purpose-built vehicles.

Oshk VIR (Oshko VIR)

Like many different companies in this space and sub-sector, Oshkosh is making progress on the “EV/ESG side of things” with new zero-emission products, such as one of the first fully integrated zero-emission waste collection vehicles.

OSK Infrared (OSK infrared)

Oshkosh has a good foundation. The company is rated IG, has a market capitalization of over $7B, and has very low overall debt. It’s a very conservative and solid business, with high dividend coverage despite a very low dividend yield.

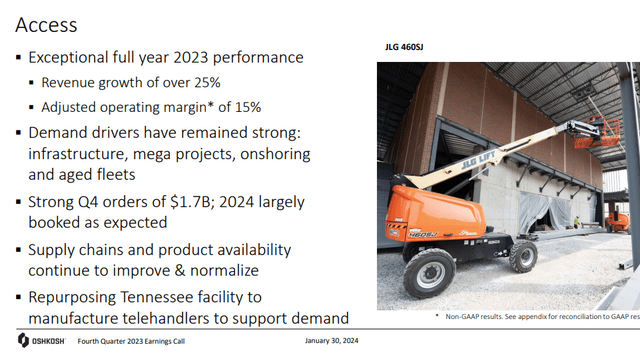

The company’s fourth-quarter revenue was outstanding, growing 12%, with adjusted earnings per share exceeding $2.50 and adjusted EBIT margin approaching 10%. The company is well positioned for future growth and has been included in the Sustainability World Index for the fifth consecutive year. For the full year, earnings per share were close to $10.

The company continues to launch products such as the all-electric Volterra ZSL.

The company also went on to increase its dividend by 12%. The company’s divisions are also progressing well, with Access being number one.

Oshk VIR (Oshko VIR)

Defense sector profit margins increased with an increase in orders for JLTV and a five-year contract to build medium equipment trailers for the U.S. Army worth approximately $350 million.

The so-called career segment is also doing well, with near double-digit margins, margin improvements, supply chain improvements and a focus on improving throughput. Volterra’s demand continues to grow, with significant orders coming from European and Asian airports – so the company does have international appeal.

The company’s profit margins aren’t the best in the industry. The company has a net profit margin of just over 6% and average profitability, but its financial strength is well above average, with an overall interest coverage ratio of over 12 times and a debt/EBITDA of 0.75 times.

There are some worrying signs.Company insiders are sell stock, prices are near two-year highs and the company’s assets are growing faster than revenue every year. Additionally, the company’s gross margin and operating margin levels have declined over the past few quarters.

Despite the high valuation, I can understand the argument from some investors as to why Oshkosh should still be considered a strong business.This includes things like overall Very aging fleet These types of vehicles, many of which have exceeded their expected service life and need to be replaced. There are also infrastructure investments underway around the world.

Additionally, unlike LVP, these vehicles offer the following advantages: multi-year growth cycle and the company’s role as a defense project proven winner Works with the U.S. Department of Defense and other state and government agencies such as trash, fire trucks, and the U.S. Postal Service. While sales and earnings per share will continue to be impacted by increased operating costs, which is part of the reason for the current margin decline (and also higher incentive compensation), the company is able to drive pricing, product mix, and CCA to maintain its margins and bottom overall results are attractive.

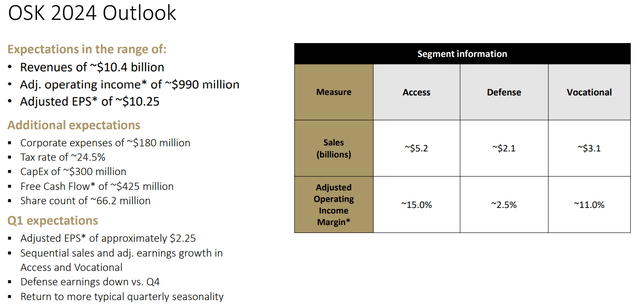

The company also gave us an outlook for the next fiscal year, predicting revenue growth, with operating income rising to nearly $1 billion and earnings per share well over $10.

OSK Infrared (OSK infrared)

Overall, the company remains well positioned to deliver very positive results going forward. While I expect the company to continue growing, I don’t expect it to grow at the accelerated rate we’ve seen over the past 6-month period, including the 100%-plus EPS reversal during fiscal 2023. The current outlook for 2024 implies EPS growth of less than 5%, a level I don’t expect the company to be able to surpass macroeconomically for the foreseeable future.

Let’s look at valuation.

Oshkosh Valuation

Oshkosh is cyclical anyway, so in order to be happy with Oshkosh you need to be comfortable with cyclicality and low returns.

We’re currently talking about a yield of less than 1.6% and a multiple of about 12x. That doesn’t sound like much, and it isn’t – but the company can only manage 12-14x P/E over time, in this case 20-year normalized P/E.

Whenever you invest in something that doesn’t have a very high yield and is cyclical, you want to be careful not to buy it at too expensive a price because it could end up taking a long time to get your money back in a negative scenario. If you buy too expensive, the benefits may never actually materialize.

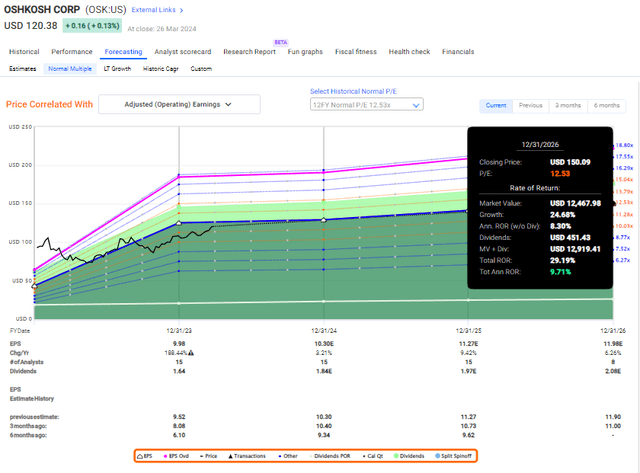

But in this case, we do have an upside — it’s just that the upside doesn’t meet my basic requirement of 15% or more annualized upside. In fact, the company’s annualized return in 10-12 years is about 12.5 times, and on an annualized basis, the company does not even reach double digits.

Kingfisher Upside (quick chart)

As you can see, in order for Oshkosh to produce any kind of alpha, you have to predict it At least 14-15x P/E.

Is this possible, and within reason?

Absolutely! There are a lot of positives for the company, and the S&P Global analyst average for the business is actually higher than the current share price, which currently stands at $121.6 PT compared to $120.38 as I write this. So you can see that the upside is relatively small – and closer to 12-13x P/E than 14-15x P/E.

Some investors refer to OSK as a dividend growth investment. I wouldn’t say that’s the case. While the company’s dividends have certainly grown, the company’s dividend history is, for lack of a better word, simply “terrible.” The company cut its dividend in 2010 and didn’t cut it until 2014, then had 10 consecutive years of dividend growth, but it didn’t “grow” the way I’d expect from a dividend growth stock.

No, my view on OSK is to buy it at a deep discount and enjoy the dual benefits of capital appreciation and a yield of over 2%.because safethat’s the thing about this company – the long-term debt ceiling is below 20%, so that’s not a problem.

But at this price, is it a predictable and reliable investment? Negative turnover rate is 45% and MoE is 20% (source: FactSet), but that’s not the case for me. On the basis of 1-year forecast, the forecast accuracy is as high as 9% and the MoE is 10%. These numbers mean this company is difficult to predict.

Quantitative Ratings and Wall Street give Oshkosh a “buy” rating. I had the same experience before writing this article. I wouldn’t rate Oshkosh a “sell” as some do, but I would adjust my rating on Oshkosh to a “hold” now and in 2024 unless the company’s valuation declines significantly in the near term.

The 2024 paper I wrote for the company is as follows:

paper

- This is a very high-quality business with good fundamentals and excellent management, in a range of attractive (if cyclical) market segments. The current fundamentals pave the way for a very convincing move higher, assuming you can buy it at the right price.

- In my first article, I said the cyclical nature of this company would bring the company back to fair value. This happens again, then disappears, and here I am calling the company “fairly valued” and giving it a long-term PT of $120/share.

- Therefore, I call the company a Hold at this valuation and change my rating.

Remember, my whole purpose is to:

1. Buy undervalued companies at a discount—even if the undervaluation is slight and not mind-numbingly large—and let them normalize over time while reaping capital gains and dividends.

2. If the company moves well beyond normalization levels and into overvaluation, I would reap the gains and move the position to other undervalued stocks, repeating #1.

3. If the company does not enter an overvalued state, but instead hovers within the fair value range, or returns to an undervalued state, I will buy more shares as time permits.

4. I reinvest earnings from dividends, work savings, or other cash inflows specified in #1.

This process allowed me to triple my net worth in less than 7 years – and that’s what I plan to continue doing (even if I don’t expect the same rate of return in the next few years).

If you’re interested in higher returns, I’m probably not the company for you. If you’re interested in a 10% yield, I’m not the guy for you either.

However, if you want to grow your money conservatively, safely, and reap great dividends in the process, and your time frame is 5-30 years, then I might be right for you.

These are my overall standards and how companies achieve them.

- The overall quality of this company is high.

- This company is basically safe/conservative and well-run.

- The company pays a generous dividend.

- Prices from this company are very cheap at the moment.

- The company has realistic upside based on earnings growth or multiple expansions/returns.

The company is neither cheap nor undervalued here, which means I’d call it a Hold for now.