Alex Huang/Getty Images News

investment thesis

My previous bullish paper on Palantir (NYSE:PLTR) stock has aged well, rising 47% over the past three months, while the S&P 500 Index (SPX) has gained 11%.today i want Update my paper by reviewing recent developments and valuation updates. PLTR is up 52% since the start of 2024, and my valuation analysis suggests the stock is currently overvalued by around 15%. While I reiterate my long-term bullish view on PLTR, I believe buying the stock at a 15% premium is very risky and there may be better buying opportunities in the future. As a result, I downgraded PLTR to “Hold” from “Strong Buy.”

recent developments

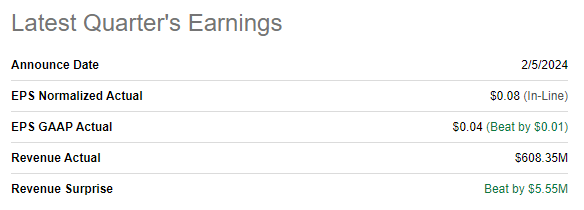

The latest quarterly earnings were released on February 5, when PLTR’s revenue was slightly above consensus estimates and in line with expectations from a net profit perspective.i always pay Focus on profitability indicator dynamics, especially for a company like PLTR that is expanding aggressively. This is critical as margin expansion shows the strength of the business model and increases the likelihood of the potential to absorb economies of scale in the future.

Seeking Alpha

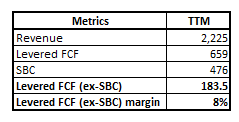

From the perspective of profitability, Palantir performed extremely well, with gross profit margin expanding from 79.5% to 82.1% compared with the same period last year. The expansion of gross profit margin, coupled with the improvement in the ratio of selling, management and administrative expenses to revenue, enabled the operating profit margin to expand from -3.5% to 10.8%. Another bullish factor is the expansion of operating margins without sacrificing innovation, with R&D as a share of revenue rising to 18% from 16.1% in the same period last year. Double-digit operating margins enable PLTR to generate TTM leveraged free cash flow (FCF) margins of up to 30%. A significant part of FCF is stock-based compensation (SBC), but even excluding SBC, the TTM FCF margin is 8%.

Author’s calculations

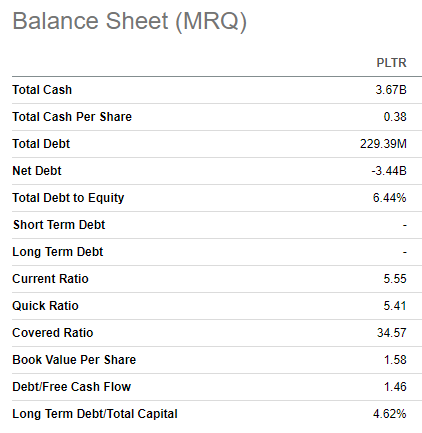

The rapid improvement in FCF margins helps PLTR strengthen its financial position. As of the latest reporting date, the company had nearly $3.7 billion in cash and almost no debt. As such, the company has significant potential to reinvest in innovation or acquisitions for future growth. With little leverage, PLTR is also able to raise debt financing on favorable terms, which is also a strategic advantage.

Seeking Alpha

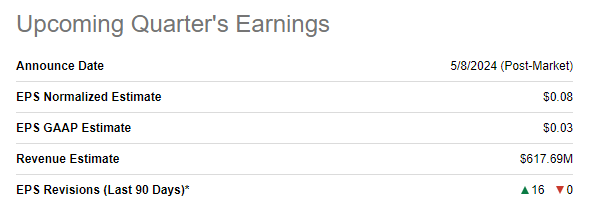

Upcoming quarterly earnings are expected to be released on May 8. The consensus estimate is that revenue will increase 17.7% year over year, with adjusted earnings per share rising from $0.05 to $0.08. Wall Street analysts are quite optimistic about this earnings release, as EPS has been revised upwards 16 times in the past 90 days.

Seeking Alpha

While I understand Palantir’s huge potential for long-term growth and profitability improvement, there are some signs that make me more cautious from a tactical standpoint. First-quarter adjusted EPS is expected to be flat sequentially despite consensus estimates for sequential revenue growth, which could indicate that PLTR is close to realizing its full potential of operating leverage.

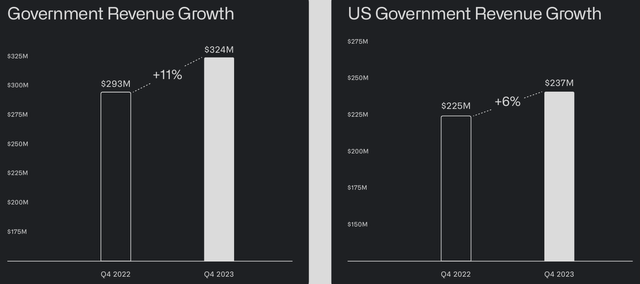

Another sign that makes me cautious is the recent dynamics of government revenue growth. U.S. government revenue growth in the fourth quarter was very modest, only 6%, and total government revenue growth was also close to single digits, with an annual increase of 11%.

Palantir latest financial report

Of course, U.S. business revenue is up 70% year over year, and total business revenue is up 32%, which is very impressive, but I prefer to look at the context. In absolute terms, commercial revenue increased by $69 million annually, which looks minuscule for a company with a market capitalization of nearly $60 billion. Additionally, comparability in the business sector is very low, making them easily beaten by staggering percentage points. However, as the segment expands, revenue growth may also naturally slow.

Palantir’s stellar profitability expansion and strong revenue growth track record add to my long-term optimism, but it’s clear the company will need to unlock new revenue drivers in the coming quarters to sustain its confident double-digit revenue growth. This will be through new product launches or acquisitions, but since recent developments haven’t given any indication in either direction, I have a lot of uncertainty about the pace of revenue growth in the second half of 2024.

Valuation update

PLTR is up 220% in the past 12 months and is off to a brilliant start in 2024, with shares up 52% year-to-date. Almost all valuation ratios look extremely high, but the forward non-GAAP PEG of 1.68 looks modest. After last year’s massive run up, PLTR has a market capitalization of over $57 billion, and I wanted to compare that to my fair value estimate.

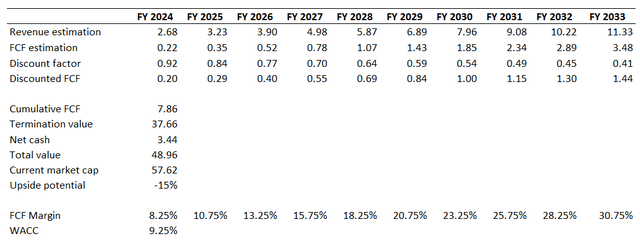

For growth stocks, I use the discounted cash flow (DCF) method.I’m using a 9.25% WACC, which is my previous discount rate minus Three interest rate cuts expected Increase by 25 basis points each through 2024. The long-term consensus revenue estimate hasn’t changed much; therefore, there are only minor revisions to revenue, with a CAGR of 17% over the next 10 years. Significant improvement was in free cash FCF margins ex-SBC. TTM FCF ex-SBC margins are 8%, which is twice as good as my previous valuation. I use 8% as a first-year free cash flow margin assumption and project a substantial expansion of 250 basis points per year.

Author’s calculations

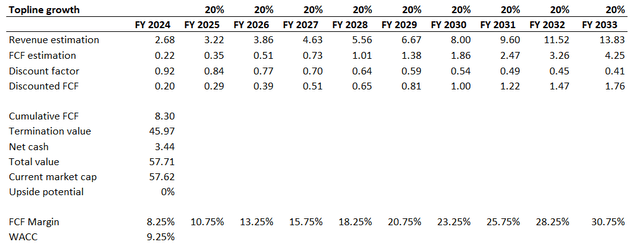

According to my first scenario, the fair value of the business is approximately $49 billion, which is significantly lower than the current market cap. This could be a sign that the recent gains have been too steep and that the market has already priced in an upward revenue guidance increase by its next earnings release. To demonstrate that revenue growth rates justify current capital, I’ll run another scenario. With all other assumptions held constant, a revenue CAGR of 20% gives the company a total fair value of approximately $58 billion, in line with current market capitalization.

Author’s calculations

For a company that is growing rapidly and has posted revenue growth of less than 20% for five consecutive quarters, it’s hard to imagine Wall Street analysts raising their long-term revenue CAGR forecasts by about three percentage points. Therefore, I believe PLTR is significantly overvalued at current levels. I cut the last close by 15%, which gives me a price target of $22.

Risks to my thesis

Not only does the fair value of a business depend on revenue growth, but overall profitability, especially free cash flow margin, can have a significant impact on fair value estimates. Since PLTR’s profitability has improved significantly in recent months, the new quarterly earnings could surprise from a profitability perspective, which could also serve as a solid catalyst for the stock price. Alternatively, the Fed could cut rates sooner than expected if the economy begins to cool less than the Fed expects.

Beyond that, this rally could be driven by special events. For example, Palantir regularly wins large government and military contracts, which improves sentiment on the stock. Large new government contracts worth hundreds of millions of dollars could also lead to a short-term rise in stock prices. For example, the company recently won a large US Army contract worth $178 million, and its stock price rose 5% in a single day.

It’s important to remember that the market we’re currently in is likely to be heavily influenced by FOMO investors. It looks like the 2020-2021 stock market mania saw zero-delivery electric vehicle (EV) companies achieve sky-high market caps, and investors are currently experiencing the consequences of that mania. Currently, we are seeing a similar situation in the field of artificial intelligence. While I’m generally optimistic about Palantir, I find the current valuation unreasonable even for such a high-quality company. But current market sentiment could fuel a further rally, and I’m highly unsure how long this FOMO-driven rally will last.

bottom line

All in all, PLTR is a Hold at these share price levels. Recent developments have made me more optimistic about the company’s long-term prospects, but tactically a 15% premium to fair value doesn’t look like a good deal to investors. To justify such a generous valuation, management should significantly increase guidance, but in the reality of slowing government revenue growth, that seems unlikely.