Champix

Palantir (NYSE:PLTR) and Oracle (ORCL) announced a partnership to jointly provide cloud and artificial intelligence solutions to enterprises and governments. This changes the story in two impactful ways for every company.For Oracle, the partnership will allow the company to access to the highly sought-after and underserved sovereign government space. For Palantir, this solves two challenges.

The first came during the Q3 2024 earnings call, where the company encountered some minor headwinds in growing its sales force to meet growing demand for its products. Second, with Oracle’s regional modular data centers, Palantir’s software can be easily hosted regionally at Oracle locations and can easily maintain localized data privacy laws.

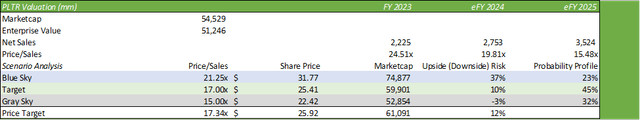

I believe this is a positive catalyst for both companies and will increase my forecast and price target.I offer PLTR shares Strong buy recommendation, with a target price of US$25.92 per share, equivalent to 17.34 times FY25 P/E.

This partnership is both surprising and unsurprising. Palantir’s platform products compete with Oracle’s OBIEE and OBIA products for enterprise business intelligence and optimization. Although this partnership was unexpected, it should not be viewed as as far left as one might think. For the sake of data integrity, cybersecurity and customer experience, much of the technology industry has been working on cross-integration rather than independent silos.

This can be seen across various platforms including Microsoft (MSFT) Azure and VMware (AVGO), which competes in virtual servers, networking and communications. Microsoft has established a direct path for customers to host cloud applications on the VMware cloud platform. Microsoft also has a partnership with Oracle, which is increasing competition in hyperscale data centers and ERP applications with its Microsoft Dynamics product.

As I discussed in my report on Oracle, the company is building more than 20 data centers in partnership with Microsoft Azure. Intel ( INTC ) is working to do the same with its foundry business, decoupling its design and manufacturing processes later this year in order to build rivals’ advanced chipsets.

The partnership between Oracle and Palantir will allow for more seamless deployment of the Palantir platform, with Foundry hosted on Oracle Cloud Infrastructure, while Gotham and AI platforms can be deployed across Oracle’s decentralized cloud network. Despite the competitive elements, this partnership will greatly benefit both companies. I believe Oracle management may view Palantir’s applications as a potential threat to Oracle’s core software business, as Palantir’s artificial intelligence and decision-making applications may be more popular than Oracle’s BI applications.

I also believe that Oracle’s management is forward-looking enough to see the writing on the wall and would rather get a piece of the pie than lose it all. I also expect this partnership to open the door for Oracle to attract sales to sovereign governments looking to deploy AI applications. Given Palantir’s deep roots in government entities, I believe this strategic partnership will benefit both companies in their respective ways.

Additionally, I believe this partnership will greatly benefit Palantir as it will accelerate the deployment of its highly sought-after applications. As management mentioned in the Q4’23 earnings call, the company has a sales staff shortage to meet growing demand for its product suite.

Overall, this partnership will enable a more robust, decentralized regional deployment as Oracle selectively establishes regional data centers around the world. Given that Oracle’s data center is a highly modular design built for scale, this should allow Palantir to easily distribute its software since compatibility won’t be a factor. The regional nature of the data centers will also provide Palantir with greater opportunities to gain business in regions with strict data privacy laws that require localized data hosting.

I believe Palantir is moving in the right direction to achieve superior growth while improving margins. The company has proven that their product can scale effectively and deliver significant economies of scale to its bottom line. One factor that I found particularly attractive was their sales process for their AIP products. The company helps AIP camps interact directly with clients in small, classroom-like settings.

I believe this close relationship allows Palantir to gain a deep understanding of the fundamental challenges that executives face in corporate environments and to solve these challenges through demonstrations using real-time data. This approach resulted in major wins for Palantir: Announced March 6, 2024Companies such as Lennar, General Mills, Lowe’s and OpenAI become AIP customers and partners. I think the market is underestimating Palantir’s ability to scale its platform, and the only thing holding the company’s stock back is the widespread stigma attached to its ties to military operations.

In terms of financials, I believe Palantir will be well positioned to beat eq1’24 guidance of 612-616mm and well ahead of consensus estimates as software adoption accelerates. I believe partnering with Oracle will help strengthen the sales process and remove the risk factor from managed services. Given Oracle’s modular approach to designing data centers, I believe this can eliminate some of the operating costs associated with customization for hardware and software compatibility.

company report

Valuation and shareholder value

company report

In terms of risk factors, I think the positives far outweigh any negative risks that could worsen my investment thesis for PLTR. Palantir’s products are specifically targeted at businesses’ higher interest in improving operations while cutting costs. I believe this partnership will only enhance Palantir’s ability to expand its products into new markets and open the door to accelerated sales.

Downside risks to consider include negative market sentiment regarding its ties to military action. While I don’t see this as a negative, I believe some investors may choose to ignore Palantir as an investment option for “ethical” purposes. PLTR stock trades at a relatively high valuation of 24.51 times historical sales, and any snag in the growth story could cause the stock price to drop quickly. As mentioned in the text of this report, Palantir is actively recruiting sales personnel to meet growing customer demand. This could add some pressure to operating margins, as new salespeople may need to increase their salary packages given demand.

company report

I offer a Strong Buy recommendation for PLTR stock with a price target of $25.92 per share, representing 17.34x FY25 net sales. I believe the company is indeed well positioned to deliver on my blue sky vision if eq1’24 sales far exceed my expectations, which are already above the $2.64-2.80b consensus range for eFY24. Under a gray sky scenario, the benefits of the Oracle partnership are minimal, resulting in numbers closer to my previous estimated growth rate.

company report