Afternoon pictures

Written by Nick Ackerman and co-produced by Stanford University chemists.

Several new call ETFs have been launched over the past few years. These funds are designed to provide higher relative allocations to income-focused investors.They do this primarily through investments A diversified basket of equity securities that provides regular dividends. Another source of distributions paid to investors is option fees that a Fund can earn by selling options.

One of the latest launches in this space is Parametric Equity Premium Income ETF (NYSE:PAPI). This appears to be an attempt to replicate the huge popularity the JPMorgan Equity Premium Income ETF (JEPI) has enjoyed. JEPI launched in mid-2020 and has nearly $34 billion in assets under management (AUM). PAPI was launched on October 16, 2023, and currently has a net worth of approximately US$36.5 million So far.

PAPI basics

- Dividend frequency: quarterly

- Dividend Yield: 3.02% SEC Yield, 6.88% Distribution Yield

- Expense ratio: 0.29%

- Leverage: N/A

- Assets under management: US$36.52 million

- Structure: Active ETF.

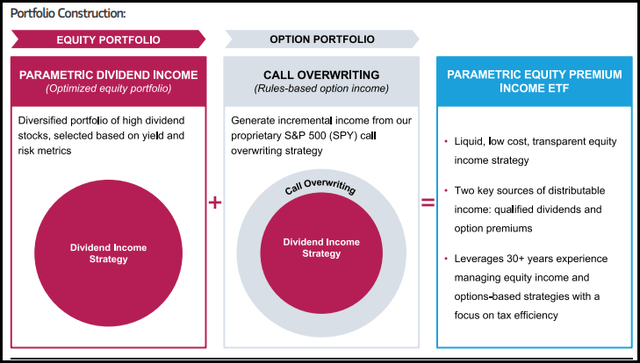

Papui investment objectives is “to provide stable monthly income while maintaining the prospect of capital appreciation.” They do this by investing in “a diversified portfolio of high-dividend stocks selected based on yield and risk metrics.” They then “generate incremental revenue through an appropriate S&P 500 Index (SPY) call option coverage strategy.”this can also include Sell a call option on the S&P 500 Index itself and the SPDR® S&P 500 ETF Trust (SPY). The portfolio will consist primarily of companies selected from the Russell 3000 Index.

PAPI Portfolio Construction (parameter)

The fund’s expense ratio is 0.29%, well below the average ETF expense ratio of about 0.50%. In my view, this is considered a positive for an actively managed fund that is still small.

Comparison and performance

For those unfamiliar, the Parametric team is part of Eaton Vance, a company now owned by Morgan Stanley (MS).multiple sclerosis Complete acquisition Back in early 2021, Eaton Vance served as the company’s fund manager. This may be worth noting because one of the managers, Thomas C. Seto, also manages some of Eaton Vance’s very popular closed-end call agency funds. These include the Eaton Vance Tax Management Buy-Write Opportunities Fund (ETV) and the Eaton Vance Tax Management Buy-Write Income Fund (ETB).

PAPI manager (parameter)

JEPI and a number of other call ETFs launched over the past few years seem likely to be peer comparisons; PAPI is a bit different in that it targets the Russell 1000 Value Index. This ultimately creates a portfolio that is significantly different from other popular call options funds. A clear example is that the average market value of assets held by PAPI reaches $56.6 billion.

JEPI’s portfolio, on the other hand, has a weighted average market capitalization of $283.9 billion. Therefore, JEPI is clearly targeting much larger companies than PAPI. The same is true when compared to ETV and ETB, which target the Nasdaq 100/S&P 500 and S&P 500 index benchmarks themselves.

Therefore, they complement each other well rather than comparing head-to-head. PAPI can provide a more value-oriented product portfolio, while JEPI and ETB are more technology-oriented. The J.P. Morgan Nasdaq Equity Premium Income ETF (JEPQ) and ETV are more tilted toward technology stocks.

A more appropriate comparison that comes to mind is the BlackRock Enhanced Equity Dividend Fund (BDJ). The fund uses a covered call strategy and also targets the Russell 1000 Value Index.

Another interesting point about PAPI: While their portfolio could reflect a more value-oriented portfolio, they are writing a call against SPY. This is generally seen as a negative because there is some mismatch between the projects in which the fund invests and the projects in which the fund is opposed. In such an event, the Fund’s portfolio may decline and the option arbitrage may incur losses.

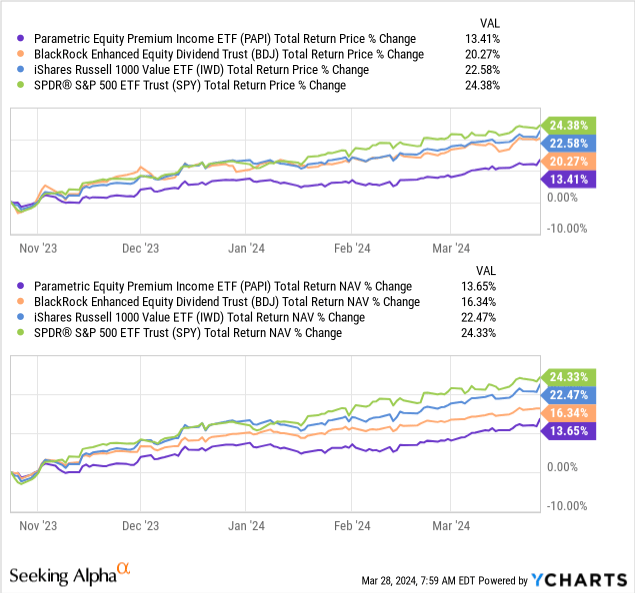

The launch of PAPI comes at a very interesting time, just as the wider market is going through a very brief correction. This means it has been able to experience a rebound since then. The fund has underperformed since then compared to PAPI and BDJ.

Y chart

I also further added the iShares Russell 1000 Value ETF (IWD) for comparison. Naturally, call writing funds will be at a disadvantage when the market moves higher. This is because call options have the disadvantage of limiting active participation.

Finally, I’ve also included SPY, which has outperformed all of these funds over this fairly short period of time. This may highlight a disadvantage for PAPI, as their SPY call writing does not match the underlying portfolio.

Since they don’t actually hold SPY, they incur losses above the strike price as the index rises (i.e. they sell naked calls). In their CEF, they hold a portfolio that reflects the index they are compiling and creates a situation of essentially indirect “coverage” through the underlying portfolio.

The caveat I give here is that this fund is indeed new. Therefore, it may be premature to attempt comparisons at this time. I think we need more time to see how this strategy will perform for the fund over time.

distribute

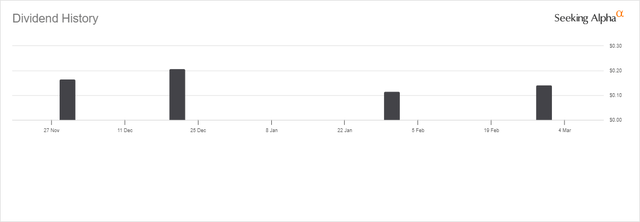

The purpose of a call fund is to distribute monthly dividends to investors, and in that regard, the fund looks to have been able to achieve its goals. Of course, time is short, and this is another area that may need more time to address. Currently, based on the last three distributions and annualized, our distribution yield is approximately 6.88%.

PAPI Dividend History (parameter)

The SEC yield listed here is about 3%. Without the option premium that the fund collects each month, that’s what the dividend yield would actually be. On its own, that’s still significantly higher than the S&P 500’s yield of about 1.3%.

PAPI’s product portfolio

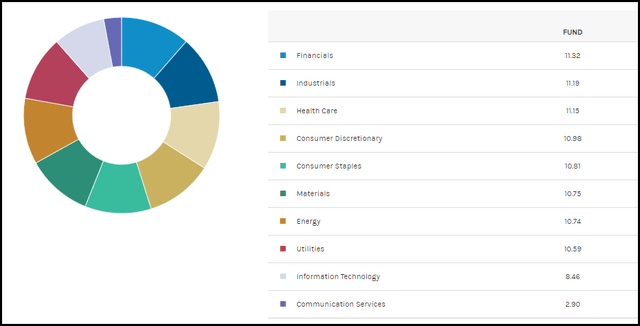

The industry allocation of the fund’s underlying holdings is mostly in line with our expectations, given the fund’s value-oriented benchmark. The largest allocations are in the financial, industrial and healthcare sectors. What I really didn’t expect, however, was how evenly distributed the portfolio allocation would be here.

PAPI industry distribution (parameter)

In some cases, the IWD fund is an ETF specifically designed to mirror the Russell 1000 Value ETF, which has a weighting of 22.5% in financials, 14.3% in industrials, and 14.26% in healthcare. In this context, it is somewhat unusual that most industries have nearly equal PAPI weights. On the other hand, some investors may prefer this more neutral approach overall.

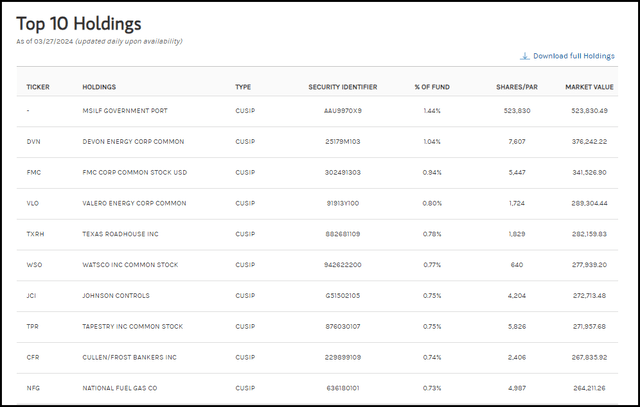

For the top holdings as of March 27, we also see how well diversified the fund is. The largest weighting here is actually in money market funds, and when we consider individual holdings, the largest is Devon Energy Corporation (DVN). Since DVN has a weight of 1.04% and other portfolio names have weights below 1%, we don’t believe any holdings in this fund are overly large. Therefore, truly minimizing single holding risk for PAPI investors.

PAPI’s top ten holdings (parameter)

in conclusion

When I saw PAPI being offered, I thought it would be an attractive way to see the success they’ve had with closed-end funds in an exchange-traded fund wrapper. For an actively managed fund, the expense ratio is quite low. However, the way they designed this fund is more like a complement to their ongoing funds, and they’re taking a somewhat unusual direction. Offers a value-oriented portfolio but still writes calls on SPY. While I believe the Parametric Equity Premium Income ETF is a fairly diversified fund and the manager has a pretty solid track record, for now, it will only remain on my watch list until it gets some use. .