Michael Vi/iStock Editorial via Getty Images

PayPal Holdings Inc. (NASDAQ:PYPL) In the past two months, investors have experienced another roller coaster ride, as follows PayPal’s guidance is relatively weak During the fourth quarter earnings call in early February 2024. As a reminder, I upgraded my paper PYPL to Buy Before the earnings report, I assessed the buy accumulation as constructive. However, I didn’t expect PayPal’s outlook to be more cautious than expected, leading to a sharp post-earnings sell-off.

Still, I believe investors must give PayPal’s new management enough time to justify the organizational changes needed to get PYPL out of trouble. Chief Executive Alex Kreiss stressed that he had “overhauled much of the leadership team.” As the competitive landscape intensifies, such significant changes in senior executives can create execution risks.Additionally, with PYPL still nearly 80% below its all-time high, it is clear that the market Lost confidence in PayPal’s ability to execute.

PayPal management acknowledged that the direction and execution of the previous team (under Dan Schulman) fell short of Chris’ expectations. He stressed that PayPal “lacks a clear value proposition for consumers and merchants.” In addition, “lack of focus” hinders its product development pace and launch efficiency.

However, Chris said PayPal “has made significant changes in just four months that may improve its ability to execute more effectively. Despite management’s optimism, PayPal does not expect “to achieve real results anytime soon.” Results.” So I assessed PayPal’s tepid forward guidance as indicating cautious optimism about not overpromising and underdelivering.

PayPal expects adjusted earnings per share in 2024 to be “consistent” with the $5.1 target achieved in 2023. Surprise Wall Street As the market re-evaluates PYPL’s ability to provide a premium valuation for its stock. Nonetheless, PayPal management emphasized its confidence that PYPL is significantly undervalued and plans to repurchase at least $5 billion of stock in 2024.

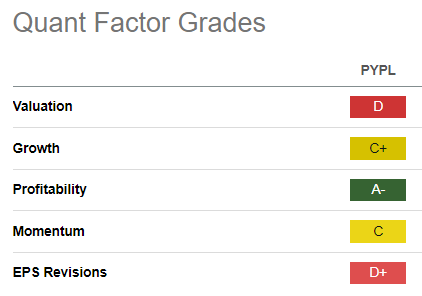

PYPL Quantitative Score (Seeking Alpha)

As such, PayPal’s confidence in returning significant value to shareholders should underpin the robustness of PayPal’s fundamentally strong business model (an “A-” profitability grade).

Through the massive growth of its consumer and merchant ecosystem, PayPal facilitates $1.5T in commercial transactions through its platform. Therefore, I believe PayPal’s leadership position gives it a significant advantage even if competition is fierce.

However, it also questioned whether PYPL still deserves the growth premium and was assigned a “C+” growth rating. PYPL trades at a clear premium compared to its Financials (XLF) peers. However, given that guidance for 2024 points to flat year-over-year earnings growth metrics, it’s clear that PayPal’s challenges won’t be resolved anytime soon. In other words, PayPal has to prove to the market that it can sustainably return to profitable growth before a major rating happens.

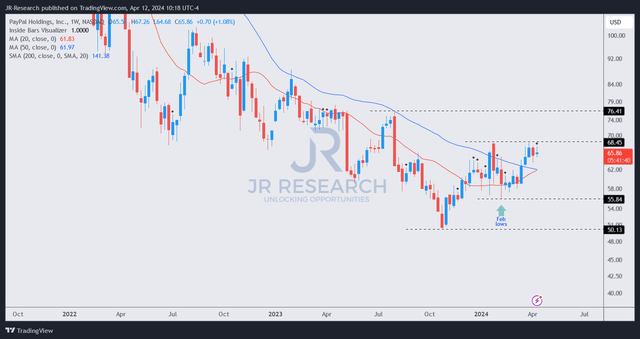

PYPL Price Chart (Weekly, Midterm) (Trading View)

The good news is that PYPL’s price action suggests the worst may be over in 2023. Despite the post-earnings sell-off in February 2024, PYPL continued its recovery in April, retesting the $68 level.

The market appears to be leaving PayPal management skeptical of changes to its strategy. However, further recovery may require good execution from PayPal, giving more investors the confidence to make returns.

Is PYPL stock a buy, sell, or hold?

PayPal believes its scale and market leadership can better execute and restore investor confidence. However, the market will likely put PayPal in the penalty zone over the next four quarters to assess its execution.

I don’t expect major changes in its strategy, suggesting continuity with the Schulman era. Therefore, the focus is likely to be on its ability to execute and demonstrate its growth premium.

Although the company faces significant headwinds, it competes from a strong position with a proven business model. Combined with the improvement in buying sentiment over the past four months, I believe bargain hunters have been accumulating. At current levels, the risk/reward balance still favors buyers.

Rating: Maintain Buy.

IMPORTANT NOTE: Investors are reminded to conduct due diligence and not to rely on the information provided as financial advice. Consider this article a supplement to the research you need. Please always think for yourself. Please note that ratings are not intended to refer to specific entry/exit times at the time of this writing unless otherwise stated.

I want to contact you

Have constructive comments to improve our paper? Spot a critical gap in our perspective? See something important we didn’t? Agree or disagree? Leave a comment below to help everyone in the community learn better!