mosa images

generalize

During the COVID-19 pandemic, PayPal Holdings Inc. (NASDAQ:PYPL) experienced a sharp rise, with its stock price nearly tripling. However, the company’s performance has since fallen by about 80% from its peak, mainly due to slower growth and increased competitive pressure.The current valuation of the stock Conservative estimates do not appear to offer a compelling entry point, although it is not considered to be excessively overvalued. An entry point around $50 would result in a more attractive risk-to-reward ratio. While we maintain a neutral stance on PayPal stock, we acknowledge the arguments in favor of the investment. A strategy to consider is selling slightly undervalued call options, which could generate low to mid-double digit annualized returns if the stock price remains stable or appreciates, providing a potentially attractive effective basis.

Company Profile

PayPal operates a two-sided network Diversified product offerings support digital payments and simplify the commerce experience on behalf of global merchants and consumers.

It operates through a range of brands/products including PayPal, PayPal Credit, Braintree, Venmo, Xoom, PayPal Zettle, Hyperwallet and Paidy. It has two detailed reporting sections:

- Trading revenue: Fees charged to merchants and consumers by transaction: exchange rate (3.49% + $0.49 per transaction), currency conversion, transfer of funds to bank account, purchase or sale of cryptocurrencies, contracts

- Other value-added services (“OVAS”): Interest and fees earned on partnerships, referral fees, subscription fees, gateway fees, other services, loans receivable and underlying assets of customer balances

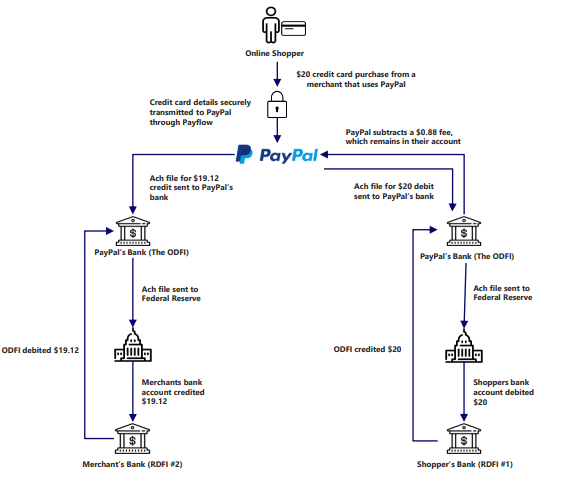

Transaction description (Nine Heavens)

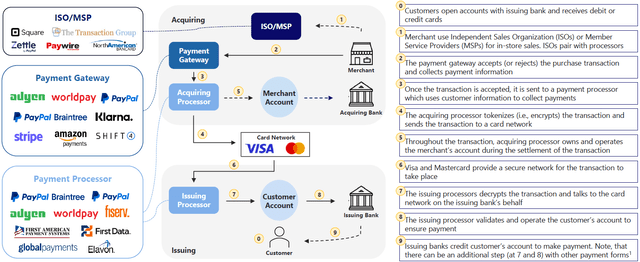

The payment systems value chain involves multiple components that merchants and customers need to conduct commerce online or in person. Although complex, all parts of the value chain work together to create a seamless experience for customers, all within seconds.

payment value chain (Nine Heavens)

PayPal has enjoyed great success as e-commerce sales surged due to the COVID-19 outbreak; however, recent macro challenges and increasing competition have led to a slowdown in active account counts, leading to underperformance.

PYPL 5 Year Share Price History (CapIQ)

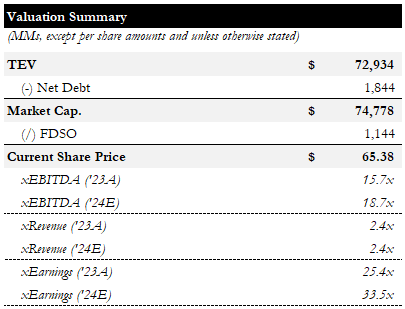

Valuation

Since hitting a low in the mid-$50s, the stock has risen nearly 30% to around $60. Current prices imply EV/EBITDA of around 16x.

Valuation summary (Nine Heavens)

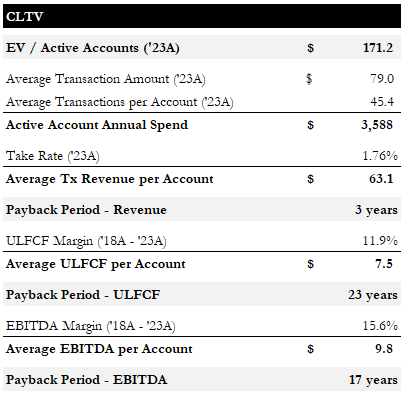

While we have PayPal’s DCF model, we rely heavily on it because we have a lot of questions about growth and discount rates, pricing power, and appropriate discount rates. Instead, we prefer to consider EV/Active Accounts and likely Customer Lifetime Value (“CLTV”). As of December 23, the market currently places a value of approximately $171,000 per active account. Based on the average transaction volume per account and the average transaction volume per account on December 23, each customer generated approximately $3,600 in payment volume. Using the latest adoption rates, we calculate ~$63 per account in trading revenue and ~$7.50 in ULFCF or ~$10 in EBITDA based on recent average profits. This means the payback period for ULFCF and EBITDA is approximately 23 years and 17 years respectively.

CLTV (Nine Heavens)

While this analysis assumes no growth in the user base, we believe this is a conservative assumption given the recent weakness (note that active accounts declined ~2% year over year from ’22 to ’23). We use EV/Active Accounts/(Revenue, ULFCF, EBITDA) as the payback period, although they can also be viewed as multiples. From 2018 to 2023, the company’s EBITDA and ULFCF grew at a CAGR of 14% and 19% respectively, and we believe these multiples are at moderately high levels.

Given the backdrop of increased competition (discussed further below) and pricing pressure, we do not believe there will be a significant price dislocation or margin of safety. However, we do not think the stock is significantly overvalued.

risk

1) Competition in the payment field intensifies

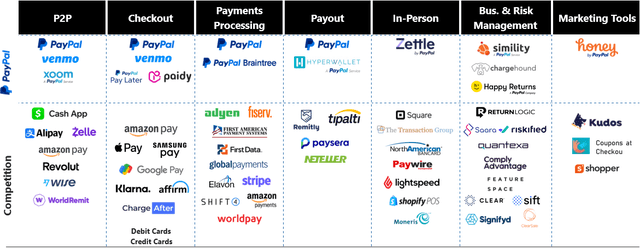

There are more digital wallets than ever before, and while PayPal is the largest provider, it’s not immune to competition. Increased competition in the industry may result in pricing pressure or loss of market share.

competitive landscape (Nine Heavens)

Potential mitigation measures: While it faces competition in branded checkout and processing, PayPal’s massive scale and two-sided network effect will serve as a resilient economic moat against rivals.

2) Customer churn rate increases and revenue base decreases

PayPal’s slowdown in net new active customer growth over the past two years worries investors. Given PayPal’s high customer churn rate, this could lead to negative earnings revisions by management in the future.

Potential mitigation measures: The recent increase in customer churn has more to do with the customer base PayPal added during the pandemic than with structural issues with the business. After these user losses, PayPal should be able to return to its typical user growth rate, especially with the introduction of new products and enhancements.

3) Loss of exclusivity with major merchants

PayPal continues to face a degree of pessimism over its ability to maintain agreements with certain large online marketplaces after it lost its exclusivity to eBay.

Potential mitigation measures: Considering that PayPal’s average acceptance rate is twice that of eBay’s customer acceptance rate, PayPal losing exclusive rights to eBay is not at all a future risk to the business’s customer base. PayPal’s agreement with eBay at the individual merchant level has caused PayPal adoption to decline over time, and this agreement change will only stabilize adoption.

4) Global e-commerce growth prospects are limited

Growth in e-commerce demand due to the coronavirus pandemic has positioned PayPal to benefit from increased customer acquisition, but weakening long-term e-commerce trends could become a significant headwind for the business.

Potential mitigation measures: Although the slowdown in PayPal’s total transaction volume growth can be attributed to the slowdown in global e-commerce penetration, PayPal’s core business has not lagged behind industry growth.Other headwinds, such as China’s reimposition of lockdowns, have also led to lower cross-border volumes, but they will eventually recover

in conclusion

Following COIVD’s sharp rise, PayPal shares plunged about 80% as growth slowed and competitive pressures intensified. Under conservative assumptions, the current price does not appear to provide a very attractive entry point, although we do not believe it is significantly overvalued. We’d be more comfortable with stocks around $50. While we’re not interested in stocks, we understand what bull markets are like. One way we could easily play PayPal today is to sell ITM calls slightly, providing low/mid double-digit annualized returns on a potentially attractive effective basis if the stock price stays flat or rises.

t