nastco

Main papers and background

The purpose of this article is to evaluate the PIMCO Income Strategy Fund (NYSE:PFL) as an investment option at current market prices. PFL is a closed-end fund which invests objective yes “The pursuit of high current income is consistent with capital preservation.”

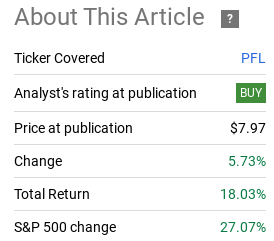

I wrote an article about PFL about a year ago, and at the time I was optimistic about the fund’s prospects. I think high yield is going to get a broad push, and I see some underlying value in this particular CEF. In hindsight, my assessment was correct, as the fund has performed quite well since then:

Fund performance (Seeking Alpha)

While it’s always fun to score a win when a call turns out well, the more important thing here is deciding whether still worth buying PFL at these levels. Whenever I see a move into the 20% range, it triggers an automatic re-evaluation of any investment idea. This doesn’t mean an automatic sell (or change my attitude), but it does mean re-evaluating whether what was once a good buy should still be one.

With this in mind, my stance on the PFL today is more moderate. Recent gains will be difficult to sustain given the fund’s premium to NAV, poor income metrics and general headwinds surrounding high-yield credit. Therefore, I’m changing my rating to “Hold,” and I’ll explain why below.

Valuation is no longer a ‘buy’ factor

First thing to talk about is a quick question. As my followers know, valuation is always critical to me when considering any fund. The same goes for stocks, but especially when I look at CEFs because the premiums (and discounts) at which some stocks can trade are very large.

In the case of PFL, the fund was trading close to par this time last year. I see a variety of supporting factors as to why I think this fund is about to rise, and the valuation doesn’t worry me. Today, the story has changed a bit, with PFL now trading at a premium of over 4% to NAV:

Quick statistics (Pacific Investment Management Company)

In fact, it’s not “cheap”, but it’s not really “expensive” either. While I don’t like the 4% premium, to be fair, it’s not shocking. Therefore, if one already has a position, there is no need to worry unduly. I certainly wouldn’t sell it on that alone.

But for those considering a new position or buying for the first time, this scenario is harder to establish. It’s hard to justify the NAV premium, especially when there are so many discount options. With PFL’s valuation a bit stretched, I think more caution should be exercised and believe this supports my downgrade to Hold.

Income Indicators – What’s in the World?

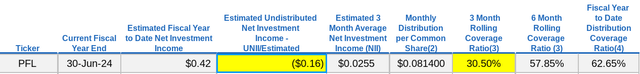

This next topic has me a little confused. This has to do with revenue production, and this past week PIMCO released its February numbers. As far as PFL is concerned, these metrics are pretty alarming to say the least:

revenue metric (Pacific Investment Management Company)

As you can see, the fund’s UNII balance remains negative and the coverage ratio indicates significant income pressure. This is concerning and will require extremely close monitoring over the coming months.

To be fair, I wouldn’t put too much weight on these numbers and wouldn’t make a buy or sell decision on PIMCO CEF based on one month’s worth of data. These numbers can (and often do) fluctuate significantly from month to month. Therefore, PFL’s actual performance may be a little better than it appears on the surface, especially given its issuance history.

Even so, it’s hard for me to stand up and say that this fund is still worth buying despite these headwinds. Until I see some improvements, I’ll at least make a “leave it” decision on this. In short, this is a strong argument in favor of becoming more cautious at these levels.

High-yield bonds remain important but face headwinds

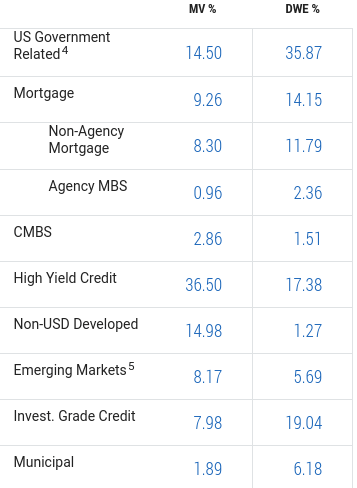

I will now turn to the underlying holdings of PFL. It’s a big bet on high-yield credit as the fund’s followers have certainly left. But it’s worth noting that over time, PFL has become less and less dependent on this industry. In my 2023 review, the sector accounted for almost 43% of the fund’s total assets. Today, high-yield accounts for just over 36%, as shown below:

PFL Holdings (Pacific Investment Management Company)

Now this isn’t inherently a bad thing. It depends on what exposure the investor is looking for, their risk tolerance, and their unique view of the industry. No one knows for sure what the future will hold, so whether high-yield credit is right for you is truly a subjective decision.

Even so, it’s still important to know what a person has. I’ve heard people refer to PIMCO CEF as a “black box” and that PIMCO “knows what they’re doing” so they don’t pay much attention to what’s actually going on. exist Funds they own. In my opinion, this is not prudent investment management and followers of PFL need to understand that the fund is biased towards extremely risky investments. This has been the case for a long time and remains true today.

Having said that, why should I be worried? One reason is that the high-yield market continues to be increasingly risky. What I mean is that the lower-rated bonds and loans that make up the sector have become more dominant in the broader high-yield index. For example, the percentage of debt rated BB has declined over time, while debt rated B (lower quality) has increased:

High Yield Market Composition (Global) (Bloomberg)

My takeaway was once again not panic. This trend has been going on for a few years and everything is going great. In fact, lower-rated stocks have actually outperformed since 2023, so perhaps that’s the type of exposure investors want. But regardless, followers of PFL or the broader high-yield industry as a whole should understand that this is riskier territory than before.

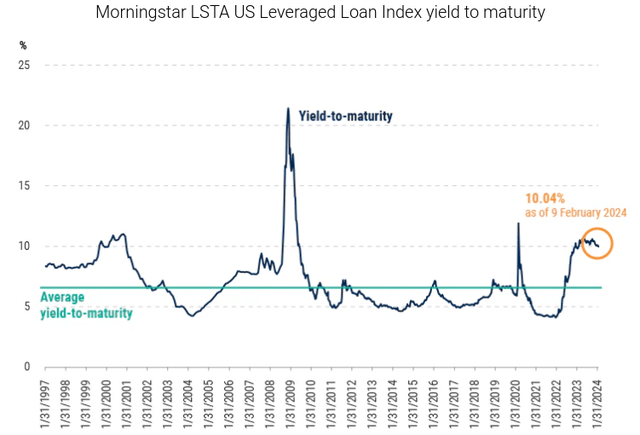

But the story here isn’t all bad. As mentioned, I am not bullish on the industry or PFL. There are valid reasons for this. First, as the risk profile increases, the profitability of the entire industry also increases. Let’s take the leveraged loan market (which accounts for a large portion of PFL’s exposure) as an example. Although yields have retreated from recent highs, they remain above long-term averages:

Leveraged Loan Yield Curve (U.S.) (Morning Star)

What this tells me is that with risk comes reward. To be sure, investors are taking a lot of risk here. While some may feel this is going too far, the reality is they are paying the price. Yields have risen – taking into account the Fed’s risk-free rate and inflation data – but they are still rising. That’s certainly something income-oriented investors are happy about, and it’s helping PFL maintain double-digit payouts.

I ask this question to help balance the comments. Of course, PFL also has some pitfalls and risks. But it’s also possible to gain more. The most recent year has shown how well this fund can perform in the right environment, and there’s no guarantee it will stop suddenly. Therefore, there are trade-offs to be weighed in any analysis.

The strength of the dollar and its impact

My final thought is to look at how the US dollar is performing and why it remains a thorn in the side of international (non-US) bonds and debt. When interest (or dividends) are paid to a U.S. investor in local currency, it must be converted into U.S. dollars domestically. That means currency fluctuations are an important consideration for buyers of U.S. bonds and loans when doing business overseas. As with all investing, there is the potential for gains, but also losses.

But wait, you might ask – what does this have to do with a US fund like PFL? Well, the answer is that PFL doesn’t just hold U.S. assets. As the holdings chart (above) shows, the fund has emerging markets and developed markets debt in the fund. In fact, non-U.S. holdings account for about a quarter of the fund’s total assets–no small amount!

Similar to the junk debt discussion, this is not inherently a bad thing. But the strength of the dollar is putting pressure on U.S. investors in such assets. When the dollar appreciates, payments made in local currencies lose value, as has been the case in the past few years. This also extends to PFL’s distributions, because if the interest it earns is worth less in dollar terms, it becomes more difficult to maintain the dollar amounts paid to fund investors.

The challenge in 2024 is for the Fed to keep interest rates high, with no major moves expected this year.While markets were predicting (or perhaps just hoping for) a big rate cut as early as last summer, the rate cut never materialized and the Fed reinforced its hawkish stance message this afternoon (3/20).

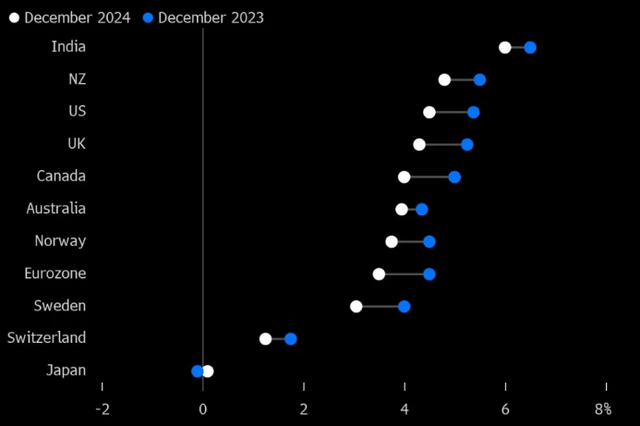

The practical implication is that other central banks are likely to be more aggressive, or at least as aggressive as the Fed. This will maintain dollar strength and continue to challenge non-U.S. debt holdings. Specifically, take a look at how U.S. benchmark interest rates will compare to other major economies around the world at the end of 2024:

Central bank policy rates (and forecasts) by country (Yahoo Finance)

What I conclude from this is that USD-denominated debt will still be in my favor in 2024 – but at the expense of non-US debt. Since PFL contains a lot of overseas debt, I have to abandon it for the time being. Of course, the benefits of diversity are a perk, but one I don’t really want to be exposed to in the short term.

bottom line

PFL has certainly gained ground since my last article (a year ago), and this momentum is certainly a welcome sign for fund holders. Going forward, I think CEF is more likely to match the market than outperform. Premiums, weak revenue metrics and reliance on non-U.S. holdings are all factors that make PFL challenging going forward. Therefore, I think a downgrade to Hold makes sense, and I would caution readers to be very selective with any entry points at this time.