Mulunni

Back in January, I shared my opinion on the Invesco Golden Dragon China ETF (NASDAQ:NASDAQ: PGJ). The bet on China has paid off so far, with it slightly outperforming the S&P 500.However, China’s stock market rally has stalled for more than a year moon. Now it’s time to discuss again what happened and whether we should expect the next wave of gains in Chinese stocks.

Recent economic data from China shows dynamic imbalances in key indicators, which in my opinion should not be considered a deal-breaker, at least for now. At the same time, the right time to invest in China remains one of the most important aspects of maximizing returns.

In this regard, I downgrade the PGJ ETF to Hold and be slightly more cautious on China’s economic outlook.

PGJ ETF Performance Review

for For reference, the Invesco Golden Dragon China ETF aims to track the investment results of Chinese companies Nasdaq Golden Dragon China Index. The fund invests at least 90% of its total assets in the securities that make up the index mentioned above.Different from similar funds network and FXIIt seems that the PGJ ETF is more biased towards Chinese technology companies in terms of shareholding structure.

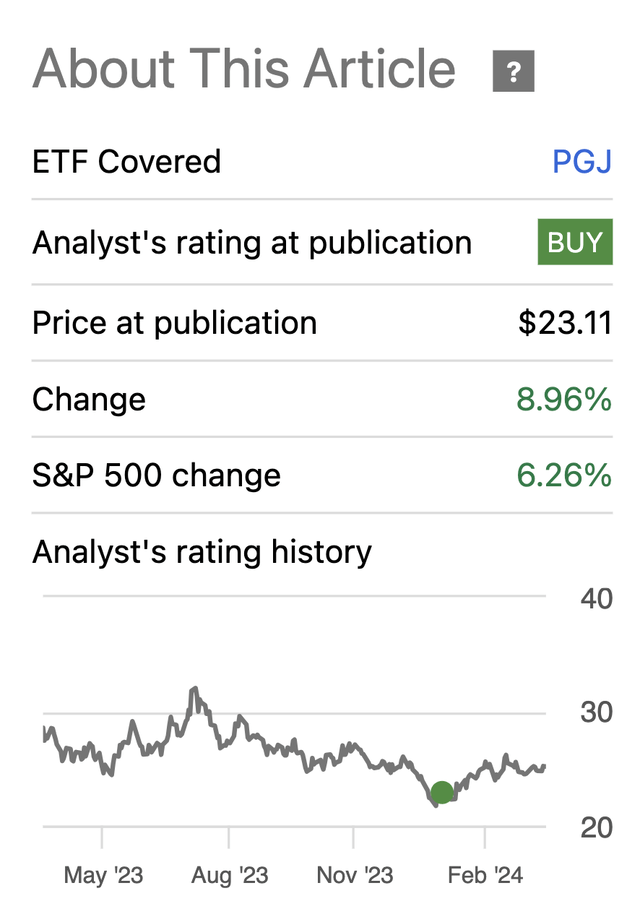

Since my last article on the PGJ ETF in late January, PGJ has returned +8.96% while the S&P 500 has returned +6.26%, slightly better than the U.S. index.

Seeking Alpha

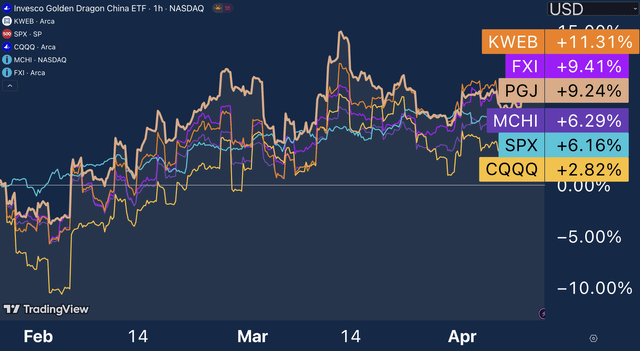

Compared with many China-related ETFs, PGJ has shown relatively strong performance over the past few months.

trading view

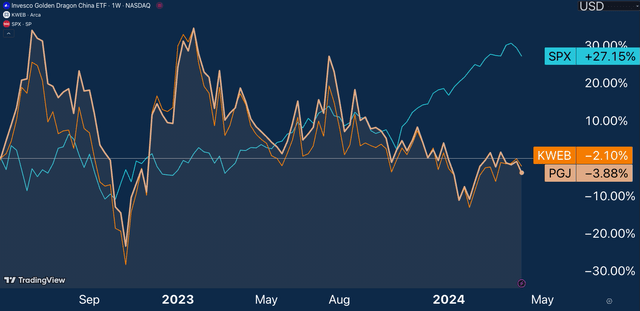

My bullish call came at the right time in late January, when China’s stock market bottomed. Still, the scale of the recovery is nowhere near what we saw in late 2022 and early 2023, when Chinese stocks soared 20-50% in a matter of weeks.

trading view

The problem is that despite all the government intervention I mentioned in my article on another China ETF, CQQQ, current economic data still don’t provide enough support for Chinese stocks.

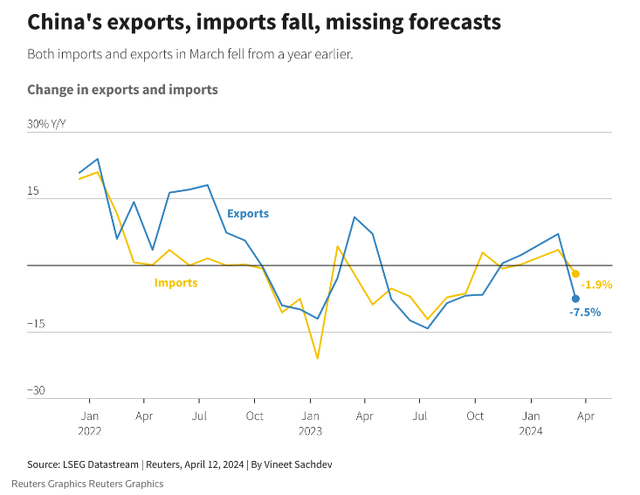

China’s exports slump again

China exports in March contracted Imports fell sharply, much lower than expected. China’s exports fell by 7.5% year-on-year, much lower than expected, reflecting the challenges faced by ensuring sales. The 1.9% drop in imports can be seen as a sign of weak domestic demand and a slowdown in economic recovery.

Reuters

For context, in still in progress After the housing crisis, Chinese authorities took a direct approach to boost economic output: accelerate Cheap Chinese goods exports. While this was one of the pillars of China’s economic growth in the 2000s, the geopolitical landscape has become more complex since then.

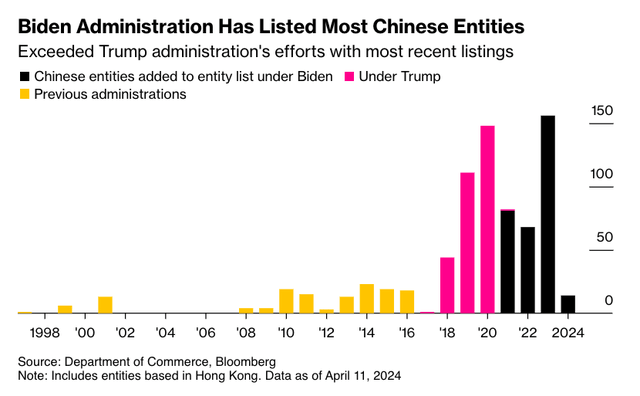

The past two U.S. administrations imposed There are more restrictions on Chinese companies than ever before in modern trade history, marking an extremely unfavorable environment for Chinese exports.

Bloomberg

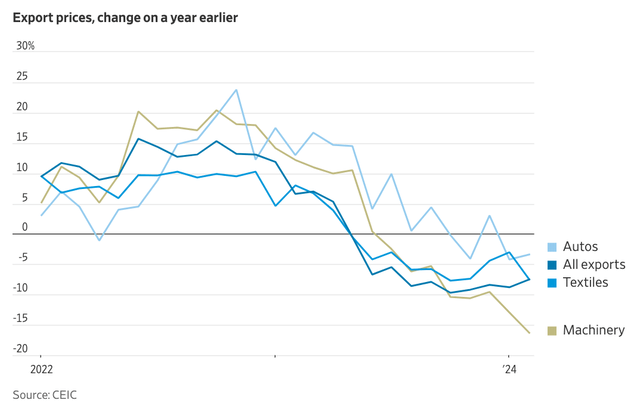

Another long-term problem facing Chinese companies is falling export prices. In just two years, the prices of some categories of China’s export products have dropped from -5% to -15%.

wall street journal

While there are certain benefits for consumers outside China to buy Chinese goods at lower prices, it also leads to lower profit margins for Chinese exporters.

Bottom line: Hold time

Currently, Chinese stocks present one of the last few opportunities to show further growth. As the U.S. presidential election approaches, geopolitical and trade tensions between China and the United States are likely to continue to intensify, negatively impacting investor confidence in Chinese companies. Regardless of who occupies the White House after the election, any U.S. presidential candidate is likely to take a tougher stance on China.

Therefore, if we do not see any significant improvement in Chinese economic data in the next one or two quarters, Chinese stocks will inevitably experience a more severe sell-off. For now, Chinese authorities are avoiding “launching” large-scale stimulus measures”bazooka“Laying the foundation for more sustainable growth.

However, judging by the current trends in China’s economy, the Chinese government may soon be faced with an unpleasant choice of either “launching a bazooka” (which will benefit the stock market in the short term due to the influx of liquidity) or dealing with a severe collapse. Not just in real estate but across multiple export-oriented industries.

As the window for the near-term rise in Chinese stocks is narrowing, I recommend gradually reducing positions in Chinese companies and suspending purchases until the Chinese economy clears up.