VitaPix

investment thesis

Invesco Water ETF (Nasdaq: PHOA Hold rating is assigned to the fund due to its relatively mediocre outlook.While PHO has several strong holdings and the water industry is expected to grow strongly, the fund’s record The performance is lower than the overall market level, the expense ratio is high, and the dividend rate is low. Additionally, several of PHO’s top holdings have high valuations but lack fundamental quality. Therefore, PHO doesn’t deserve a Buy rating right now.

Fund Profiles and ETF Comparisons

PHO is an ETF designed to Track the Nasdaq OMX US Water Index. Launched in 2005, the fund owns 40 stocks and has $2.04B in AUM. Although the fund focuses on water holdings, there is considerable diversification across market sectors, with industrials accounting for 60.15%, healthcare 12.07%, and utilities 10.10%. PHO is 98.44% owned by the United States, but also includes International holdings are smaller.

Other funds used for comparison purposes include First Trust Water ETF (FIW), Invesco Global Water ETF (PIO) and Ecofin Global Water ESG Fund (EBLU). FIW is committed to Track the ISE Clean Edge Water Index. The fund holds the largest market capitalization stake in the aquaculture industry. The goal of PIO is Capture the Nasdaq OMX Global Water Index. Therefore, PIO is more internationally diversified than PHO, with holdings in the United States (52.30%), Japan (13.36%), and the United Kingdom (10.12%). Unlike FIW, PIO holds mostly mid-cap stocks. EBLU is an ESG fund and therefore incorporates environmental, social and corporate governance considerations into its holdings. The fund invests primarily in U.S. water infrastructure companies.

Industry growth and demand

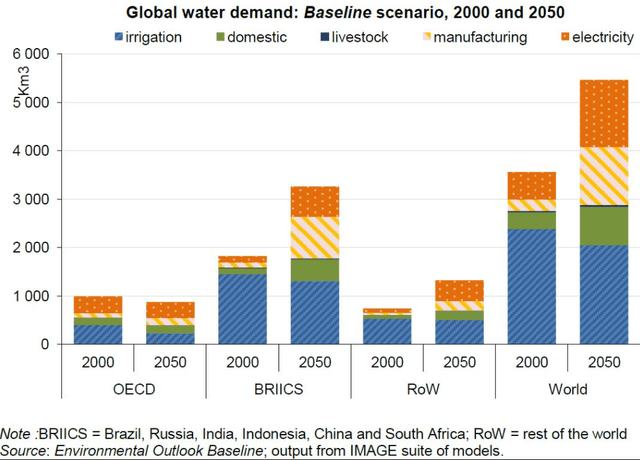

Globally, clean water supplies will become an increasingly precious commodity due to population growth and increasing demands for irrigation, livestock and manufacturing.Demand for drinking water is even projected 40% more than supply By 2030.To meet this demand, the water treatment market is expected to grow in a Compound annual growth rate of 6.3% by 2028. The industry includes water and wastewater treatment, sanitation, distribution, filtration and transportation. PHO and its fellow ETFs include companies that provide these services.

Forecast of global water demand in 2000 and 2050 (Global Sherpa, 03/07/24)

Performance, expense ratio and dividend yield

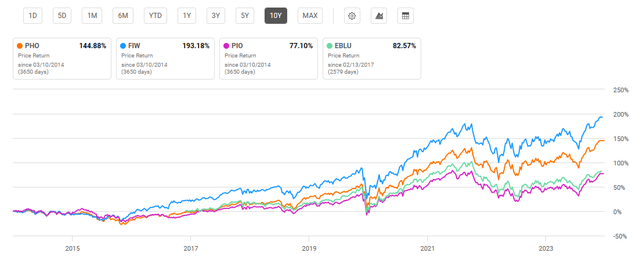

Despite expectations for strong industry growth, PHO and its peer funds overall lagged the market. PHO’s 10-year compound annual growth rate (CAGR) is 9.62%. In comparison, FIW’s 10-year CAGR is 11.67% and PIO’s 10-year CAGR is 7.09%. EBLU launched in 2017, so it doesn’t have a long-term track record, but it has averaged annual returns of about 11.1% since 2017. Using Vanguard’s S&P 500 Index Fund (VOO) as a measure of overall market returns, VOO found a 10-year compound annual growth rate of 12.66%. Personally, I’m willing to accept slightly lower performance in exchange for lower volatility. However, as I will discuss later, PHOs and peer funds are about the same volatility as the market as a whole.

10-Year Total Price Return: PHO and Comparative Water ETFs (Seeking Alpha)

Another disadvantage of PHOs is the relatively high expense ratio. The fund’s expense ratio of 0.60% is roughly in line with other water services peers but generally higher than the average ETF expense ratio. Additionally, PHO has a lower dividend yield of 0.56%. This is by comparison the lowest among water funds. However, PHO’s dividend yield has a five-year CAGR of 22.72%.

Expense Ratio, AUM and Dividend Yield Comparison

|

PHO |

FIW |

Polyoxyethylene ether |

become possible |

|

|

expense ratio |

0.60% |

0.53% |

0.75% |

0.40% |

|

AUM |

$2.04B |

$1.58B |

$291.39 million |

$52.09 million |

|

short term dividend |

0.56% |

0.66% |

0.79% |

1.41% |

|

Dividend Growth 5-Year CAGR |

22.72% |

15.09% |

-6.39% |

13.05% |

Source: Seeking Alpha, 03/07/24

PHO Holdings and Key Differences

The concentration of shareholdings among the top 10 PHO companies is quite high, with a weight of 62.17%. Due to the specific concentration of water ETFs, these funds are not well diversified, with fewer than 50 holdings each. Each fund’s holding mix differs significantly due to different tracking indexes and objectives, and some common holding trends are shown in bold below.

PHO and compare the top 10 holdings of water ETFs

|

PHO – 40 shares |

FIW – 37 holdings |

PIO – 46 holdings |

Likely – 42 held |

|

FERG – 8.75% |

FERG – 4.79% |

Booking rate – 8.60% |

XYL – 8.28% |

|

Expected credit losses – 8.27% |

XYL – 4.46% |

DHR – 8.08% |

FERG – 8.26% |

|

DHR – 8.04% |

What –4.45% |

VLTO – 7.98% |

Expected credit losses – 8.17% |

|

VLTO – 7.93% |

Expected credit losses – 4.43% |

GEBN SW – 5.05% |

AWK – 6.18% |

|

ROP – 7.17% |

A – 4.15% |

Life FP – 4.80% |

Profit SW – 5.58% |

|

CNM – 4.83% |

IDXX – 4.07% |

Expected credit losses – 4.18% |

Wye – 5.41% |

|

Warehouse Management System – 4.37% |

CNM – 4.04% |

SBSP3 – 4.13% |

Booking rate – 4.32% |

|

XYL – 4.28% |

Warehouse Management System – 4.01% |

XYL – 3.75% |

Warehouse Management System – 4.29% |

|

Booking rate – 4.27% |

ROP – 3.96% |

FERG – 3.75% |

IEX – 4.25% |

|

What – 4.26% |

IEX – 3.82% |

ROP – 3.61% |

AOS – 3.90% |

Source: Multiple, compiled by the author on March 7, 24

A closer look at PHO’s holdings reveals that the fund has two major disadvantages going forward. First, some of the most heavily weighted stocks appear to be overvalued compared to their industries. Second, some of these holdings have also experienced low or even negative growth. These factors that will weigh on PHO, as well as alternatives for alpha-seeking investors, are discussed in further detail below.

Cons #1: Top holding companies are overvalued

The first negative factor hindering the development of PHO is the large proportion of some overvalued stocks. Ecolab Inc. (ECL), a water sanitation company, is one of the top overvalued holdings. Despite a net profit margin of 8.96% and EBITDA growth of 11.49% year-on-year, ECL’s price-to-earnings ratio is 47.08, which is 136% higher than the industry median. Additionally, the valuations of underweighted companies such as pipeline and water management company Advanced Drainage Systems, Inc. (WMS) are not borne out by fundamental indicators. Despite revenue growth of -9.37% year over year, WMS’s forward P/E ratio is still 20.6% higher than the industry median. Additionally, WMS’s P/B ratio is 293% higher than the industry median. ECL and WMS have a combined weight of 12.65% with PHO, thus constituting a disadvantage that will drag down the future performance of the fund.

Weakness #2: Lack of Growth

The second difference is the lack of growth in some of its top holdings. Despite the growth in global water demand discussed earlier, PHO may be hampered by the lack of growth at several key holdings such as Danaher Corporation (DHR) and Ferguson PLC (FERG). DHR’s EBITDA annual growth rate is -22.29%, and its ROE annual growth rate is -38.65%. In addition, Ferguson PLC (FERG), PHO’s largest holding, has an annual EBITDA growth rate of -6.89%. FERG’s ROE annual growth rate is -20.77%. Ferguson, a plumbing and heating products company, may be in line for continued returns. However, with the share price up more than 40% in a year, any positive qualities appear to have been priced in.

Alternative course of action: Personal holdings

In addition, investors can also obtain better returns by investing in some of their personal holdings in PHO. Core & Main, Inc. (CNM) is the first positive example of an attractive individual holding. The company distributes water and drainage products and has seen an impressive 739% year-over-year increase in operating cash flow. CNM’s EBITDA grew by 15.01% annually, and its EBITDA profit margin was 13.56%. Despite these metrics, the company’s P/E ratio is 3.82% lower than the industry median, making it an attractive alternative to PHO’s broader inclusion of less desirable holdings. Another example is Pentair PLC (PNR), a UK-based company that provides water solutions globally. Pentair’s price-to-earnings ratio is 21.11, which is 13% lower than the industry median, and its valuation is also very good. However, the holding company demonstrated solid fundamentals, including annual EBITDA growth of 8.02% and net profit margin of 15.17%.

Valuation and risks to investors

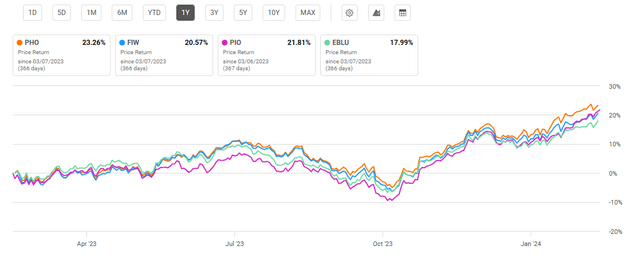

At the time of writing, PHO’s current price is $64.60. The price was near the top of the 52-week range of $46.65 to $65.03. PHO has outperformed all similar water ETFs over the past year. However, similar to the 10-year performance review, these funds have lagged the S&P 500, which has returned more than 29% in one year.

One-year price returns: PHO and peers review water funds (Seeking Alpha)

Compared to peer water ETFs, PHO underperforms its peers on several valuation metrics. As discussed, this is primarily due to the greater weighting of top holdings that currently have higher valuations. For example, PHO’s price-to-earnings ratio is 34.29, the highest among similar funds. In addition, PHO also has the highest price-to-book ratio at 6.46.

Valuation metrics for PHO and industry competitors

|

PHO |

FIW |

Polyoxyethylene ether |

|

|

P/E ratio |

34.29 |

31.17 |

23.82 |

|

price to book ratio |

6.46 |

6.11 |

3.57 |

Data source: Compiled by the author based on multiple sources, March 7, 2024

Despite expectations for strong industry growth, PHO is likely to lag its peers due to higher valuations for some of its top holdings. Additionally, the lack of growth discussed previously will also be a factor that hinders PHO’s future returns. While I might argue that this underperformance trades for lower risk, PHO is more volatile than the overall market. Using beta as an indicator of implied volatility, PHO’s 5-year beta is 1.16. In comparison, PIO’s beta is 1.03 and EBLU’s 5-year beta is 1.16.

concluding summary

Investors seeking alpha may be disappointed by PHO’s quality. Despite strong growth in the water services industry and strong overall global demand for water, PHO’s overall performance has historically underperformed the market. People are willing to accept this underperformance in exchange for lower volatility or higher dividend yields. However, PHO’s volatility is about the same as the S&P 500 Index, but its dividend yield is lower than that of the S&P 500 Index Fund. After reviewing PHO’s individual holdings, it was discovered that some of these stocks are at risk of being overvalued due to low growth or profitability. However, some of PHO’s key holdings may outperform the fund’s overall performance and are worth considering.