Jose Luis Pelaez Inc/DigitalVision via Getty Images

introduce

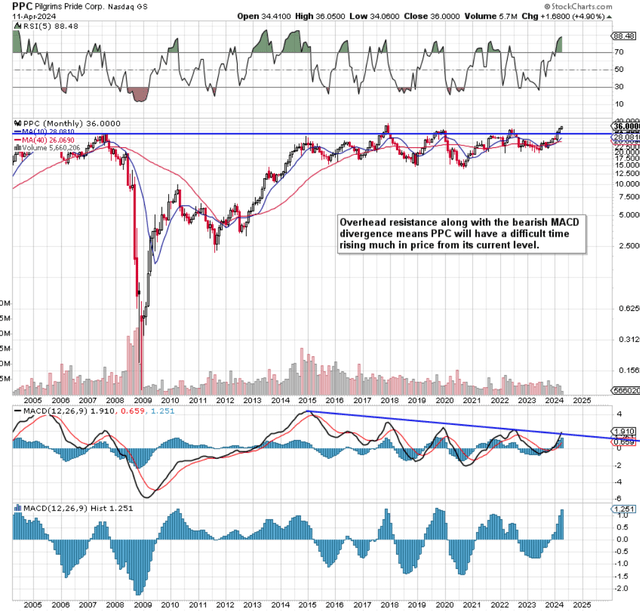

We wrote about Pilgrim Pride Inc (NASDAQ:PPC) (chicken and pork distributor) In December, we reiterated our “hold” rating on the packaged food company.However, the share price continues to rise In recent months, the stock has gained more than 75% since last June’s lows and more than 37% since our most recent review. We noted this in December, when we said Pilgrim’s Pride still had upside potential as its shares had yet to reach significant long-term overhead resistance, as shown below.

Perhaps the most revealing long-term technical indicator is Pilgrim’s MACD indicator’s bearish divergence from the company’s stock price trend. The MACD indicator is especially noteworthy on long-term charts because it requires a lot of information to digest, and it measures both momentum and trend Pilgrim’s pride. Suffice it to say, the bearish divergence dates back to 2014, which in our view reduces Pilgrim’s chances of breaking above the overhead resistance with any authority.

PPC long-term technical aspects (Stockcharts.com)

To validate what we’re seeing technically, Pilgrim’s profitability and valuation trends shouldn’t suggest it’s undervalued, poised for continued bullishness.

Limited profitability and growth trends

PPC management quotes EBITDA and Adjusted EBITDA metrics in its earnings report, which we believe do not accurately reflect the company’s underlying profitability. The reason is that the company invests a lot of money in capital expenditures every year, exceeding $540 million in fiscal year 2023 alone. As a result, while the company’s adjusted EBITDA margin remained above 5% in fiscal 2023, net margin fell to 1.85% (5-year average of 2.09%). This is key and here’s why.

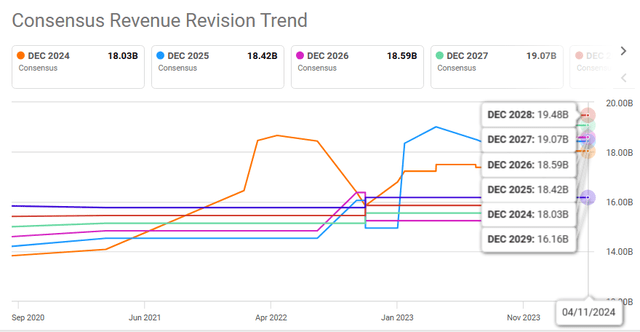

Pilgrim’s financials are derived from the company’s sales curve, where revenue growth drives the income statement over time. For fiscal 2023, net income was $17.36 billion, down slightly from $17.46 billion the previous year. While profit growth over the next few years is generally considered reasonable, the fact that this growth would have to come without growth in sales is concerning. Starting in fiscal 2024, revenue forecasts only reach the low single-digit growth curve (averaging 1% to 3% annually), which essentially means that continued cost-cutting measures must succeed over time (which is disappointing) worry).

PPC consensus revision trends (Seeking Alpha)

Secondly, the higher cost environment in fiscal year 2023 resulted in a gross profit of approximately US$1.19 billion, equivalent to a gross profit margin of 6.44%. The 5-year average of this key profitability metric for Pilgrim is 8.34%. So from an investor’s perspective, the concern is that if the cost of revenue continues to grow, it will take a toll on bottom-line profitability in Pilgrim’s income statement. Severe stress (nothing changes). We say this because, given the razor-thin margins in this industry, every basis point lost in gross margin is bound to impact Pilgrim’s net profit over time.

Suffice it to say, depressed margins and lackluster revenue growth are consistent with what we see in Pilgrim’s technical indicators mentioned above. Considering how rapidly this industry is changing, as chartists, we believe that every known fundamental information is already priced into PPC’s stock price movement on the current technical charts. This means that at this stage the market has priced in pricing trends, chicken supply and demand dynamics and forward looking pork and beef production will impact chicken demand. Furthermore, given Pilgrim’s below-average profit margins, investors are fully aware that returns on capital will only gain traction if the company’s products can be rolled out more quickly.

balance sheet leverage

A company’s balance sheet, specifically the trend in equity debt versus equity, is an important driver of a company’s long-term valuation. As of the end of fiscal 2023, PPC reported long-term debt of nearly $3.34 billion and shareholders’ equity of nearly the same ($3.34 billion). This means that Pilgrim’s Pride has a reported debt-to-equity ratio of about 1, which is a good starting point for many value investors when evaluating the investment case for the stock.

However, when calculating the debt-to-equity ratio, we want to exclude goodwill and intangible assets, which currently total $2.14 billion (total). Because these assets are not tangible (they are more susceptible to depreciation over time from potential impairment charges), our adjusted debt-to-equity ratio is now a whopping 2.77. Suffice it to say, given that Pilgrim’s long-term debt continues to grow, it puts more pressure on these goodwill and intangible asset items to maintain their value over time.

Our above concerns about Pilgrim’s balance sheet stem from the company’s aforementioned large capex budget. While PPC continues to generate strong operating cash flow ($678 million in fiscal 2023), much of that cash is used in the capital expenditures budget. For example, in fiscal 2023, significant cash was invested in facilities in Mayfield, Kentucky, and Athens, Georgia. In addition, an additional $500 million is expected to be spent on capital expenditures in fiscal 2024. We acknowledge that there are many factors beyond Pilgrim’s control, but the risk here is that the company cannot continue to invest aggressively over time. So, with net interest expenses hitting $167 million in fiscal 2023, Pilgrim’s believes it must start paring down its high debt. FY24 will tell us a lot on that front.

in conclusion

In summary, we maintain our Hold rating on PPC due to rising leverage (which adversely affects stock valuation) and limited profitability. Furthermore, the stock doesn’t look cheap or profitable enough to break out convincingly, given that the stock is currently facing long-term, multi-year technical headwinds. Let’s see what second-quarter numbers come in early May. We look forward to continuing the coverage.