Greater Warsaw

Overview

Playtika was founded in 2010 (NASDAQ:PLTK) is a leading mobile gaming company known for its diverse portfolio of hit games. The company held an initial public offering (IPO) on January 15, 2021, with an initial valuation of approximately $11.4 billion. Playtika is headquartered in Herzliya, Israel and has been established As a prominent player in the global gaming industry. Faced with challenges such as the Israel-Gaza conflict and slowing revenue growth, the stock price has fallen nearly 80% since listing. initial public offering price.

Amid the challenges facing the mobile gaming space, the question arises: Can Playtika bounce back like its 2019 trajectory? Apply love (App). Despite recent setbacks and external pressures, Playtika still has the potential to rebound. With its solid market position and growth prospects, Playtika is currently trading at a significant discount to its competitors. Therefore, it is worth exploring whether Playtika can overcome challenges and reward investors.

Profit overview

exist Q4 2023Among them, Playtika’s revenue reached US$637.9 million, a quarterly increase of 1.2% and an annual increase of 1.1%. Among them, direct-to-consumer (DTC) platform revenue increased by 7.6% year-on-year to US$161.6 million. Although revenue increased slightly, net profit for this quarter was US$37.3 million, a decrease of 1.6% from the previous quarter and a year-on-year decrease of 57.4%. In addition, the company’s credit-adjusted EBITDA fell 8.1% sequentially and 6.8% annually to $188.9 million.

Playtika announced its first quarterly dividend of $0.10 per share and plans to allocate $600 million to $1.2 billion to acquisitions over the next three years. However, the company has paused its assessment of strategic alternatives due to ongoing uncertainty in Israel and Ukraine.

Overall, Playtika reported fiscal 2023 revenue of $2.567 billion. Notably, the company generated free cash flow of $436.4 million, compared to $383.7 million in the previous year. However, the performance of operating indicators was mixed. Average daily paying users increased by 2.3% from the previous quarter, but decreased by 2.2% year-on-year.

Looking ahead to fiscal 2024, Playtika expects revenue in the range of $2.52 billion to $2.62 billion and credit-adjusted EBITDA in the range of $730 million to $770 million. The company also expects capital expenditures to be in the range of $110 million to $115 million, including $17 million in accrued capital expenditures in the fourth quarter of fiscal 2023 that will be paid in fiscal 2024.

cheap valuation

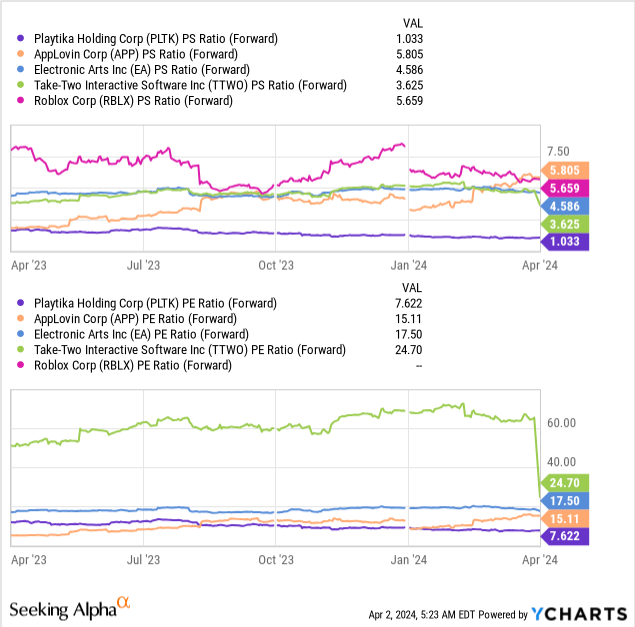

As the stock price has fallen by nearly 80% since its IPO, Playtika’s valuation has also shrunk significantly. Therefore, consider its market capitalization. Playtika trades at just 1x expected sales on nearly the same revenue of just $2.6 billion. This is especially cheap for tech companies with higher EBITDA margins like Playtika. Here, its EBITDA margin Its free cash flow is an impressive 26% margin Last quarter it reached an impressive 28%. As a result, the company trades at a price-to-earnings ratio of just 7.6x, a significant discount to its competitors. For example, AppLovin trades at 15 times earnings, while Take-Two Interactive (TTWO) trades at more than 20 times.

Still, it’s worth noting that AppLovin’s growth rate is higher, income An increase of 35% compared to last year. It also has higher EBITDA margin It was close to 35% last quarter, showing that the business is lighter on capital. Likewise, Take-Two Interactive’s valuation is higher as revenue is expected to grow 33% in 2025. release Sales of the GTA 6 game could reach nearly $3 billion.

Overall, Playtika’s valuation is primarily tied to concerns arising from the Israel-Gaza conflict. Since Playtika is headquartered in Herzliya, Israel, the conflict has raised uncertainty about its operations and potential disruptions. Geopolitical tensions and related risks weighed on sentiment despite the company’s otherwise strong performance and market share gains. Additionally, significant layoffs at Playtika have further undermined confidence in the future.

focus

Despite significant headwinds, Playtika maintains strong fundamentals and has the potential to resume growth, especially given the underlying Market size Mobile gaming is expected to grow steadily in the coming years. However, significant risks remain, including intense competition and geopolitical instability, such as the Israel-Gaza conflict, which have adversely affected investor sentiment. These factors continue to exert downward pressure on Playtika’s stock price despite the company’s low valuation. While these challenges represent significant roadblocks to future growth, a shift in sentiment could pave the way for a rebound in Playtika’s stock price.