Leo Patriz

PNM Resources Inc. (NYSE: PNM) is an energy holding company whose two regulated utilities collectively provide more than 800,000 homes and businesses in New Mexico and Texas.

PNM Resources has two regulated utility divisions, PNMvertically integrated New Mexico Electric Power Co., which owns distribution, transmission and generation assets, and TNMP, the Texas transmission and distribution company.

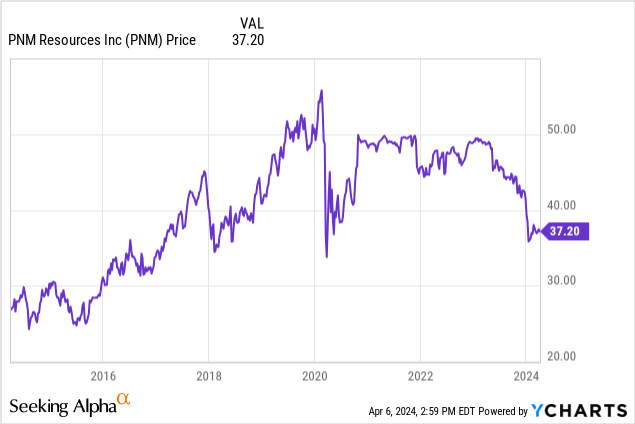

PNM Resources shares are well below their pre-pandemic highs in early 2020.

A key reason for the decline is Avangrid Termination of Merger Agreement Due to regulatory hurdles, the company acquired PNM Resources on December 31, 2023 for $50.30 per share in cash. Other reasons for the underperformance include rising interest rates from 2022 and disappointing PNM rate decisions.

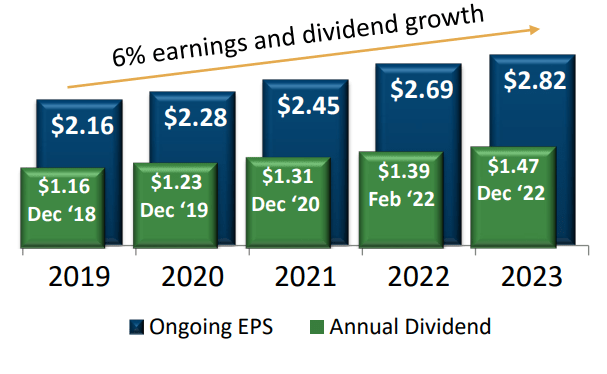

Despite its stock’s poor performance since 2020, PNM Resources’ consistent earnings per share and annual dividend have Nonetheless, the growth rate is approx. Growth of 6% per year from 2019 to 2023.

PNM Resources Investor Introduction

On February 6, 2024, PNM Resources reported 2023 profit results, showing further growth. For the medium term (excluding 2024), management is optimistic about the company’s EPS growth potential given the expected growth in the regulatory rate base. However, PNM Resources has less financial flexibility than some other utilities, given its leverage.

2023

for 2023PNM Resources reported ongoing diluted earnings per share of $2.82, up from $2.69 in 2022 due to factors such as load growth and weather.

On a segment basis, continued diluted earnings per share for the PNM segment increased from $1.90 in 2022 to $2.22 in 2023, while continued diluted earnings per share for the TNMP segment increased from $1.07 in 2022 to $2.22 in 2023. $1.11. Loss of $0.51 in 2023 and $0.28 in 2022.

One reason for higher losses at the corporate and other divisions is higher interest rates on variable-rate debt.

My conclusion is that PNM Resources is positioned for growth in 2023, given continued growth in the company’s two utility segments, despite increasing interest rate headwinds.

Appearance

PNM Resources management expects more earnings growth in the future, except for 2024.

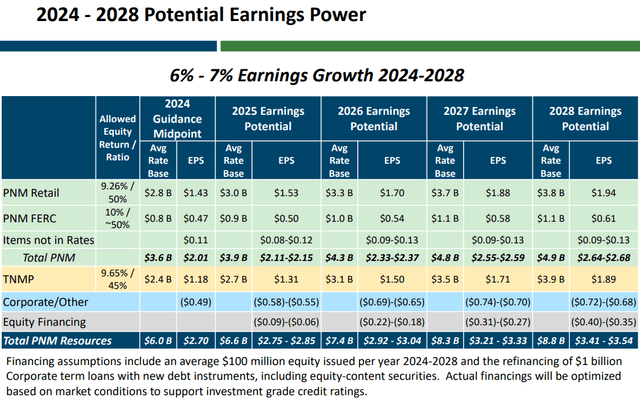

For 2024, management’s sustained profit guidance range is $2.65-$2.75 per diluted share. By comparison, PNM Resources’ 2023 diluted earnings per share were $2.82.

Earnings in 2024 are quite weak, largely related to the disappointing outcome of the PNM rates review, as PNM Resources files for a base rate increase $63.8 million Regulators authorized a $15.3 million increase in base rates effective January 2024.

Nonetheless, in terms of CAGR, management believes PNM Resources still has Given expected underlying interest rate growth of 10%, earnings growth potential is 6% – 7% 2024 to 2028 based on 2024 sustained earnings guidance midpoint of $2.70 per share.

PNM Resources Investor Introduction

In terms of rate base growth, PNM Resources is increasing its regulatory rate base to meet growing customer demand, enable the clean energy transition, and make the grid more reliable and resilient.

My conclusion is that management sees reasonably attractive EPS growth through mid-2028, excluding 2024, given expected regulatory rate base growth.

financial flexibility

In terms of tracking statistics, I think PNM Resources’ leverage is quite high, as the company’s financial leverage is 4.27 As of the fourth quarter of 2023.In terms of debt, the company has total debt of US$4.7837 billion As of December 31, 2023.

For PNM Resources, there are positives and negatives to greater debt.

On a positive note, given PNM Resources’ debt profile, lower interest rates may help it, as the cost of variable-rate debt may be more affordable.

According to my calculations, PNM resources total floating rate debt As of February 16, 2024, total assets were $1.3775 billion, and the weighted average interest rate ranged from 6.3% to 6.92%.

If interest rates normalize and hypothetically fall by 5%, a 5% reduction in variable rate debt of $1,377.5 million would mean a $68.9 million reduction in interest expense.In comparison, PNM Resources’ TTM EBITDA is $612.61 million.

That being said, I believe that if rates were to fall significantly, regulators would likely reduce the allowable return on a regulatory rate basis over the next few years, so the tailwind would likely not be as high as $68.9 million.

Additionally, PNM Resources also has some interest rate hedges. For example, the company has implemented $600 million in hedges through 2024 with a base rate of 3.5%.

Nonetheless, I think lower interest rates will still be a driver because I think rates will start to fall this year and normalize in a year or two, and regulators won’t reduce the rate of return allowed on top of regulated rates by nearly as much .

The downside of increasing leverage is that PNM Resources may have to fund more of its capital investments through equity, which could dilute its equity.

For example, PNM Resources raised $200 million in equity financing in 2023, with 4.4 million shares issued in December 2023. According to management, the 4.4 million shares issued had a year-over-year impact of $0.14 on earnings per share.

Given that its share price is currently lower than in December 2023, the equity financing may have a greater impact on the annual earnings per share growth rate.

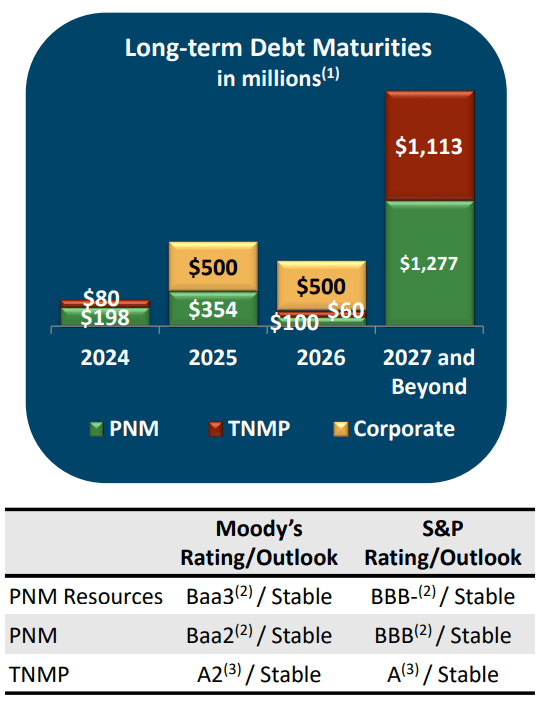

Given its current balance sheet, it’s unclear whether PNM Resources can significantly increase debt and maintain an investment-grade rating. Without an investment grade rating, PNM Resources may have higher interest rate charges.

In terms of equity financing prospects, PNM Resources expects to raise an additional $500 million from 2024 to 2028, or an average of about $100 million per year.

Management also stated Actual financing will be optimized based on market conditions to support investment grade credit ratings So if they can’t raise as much debt as expected while maintaining their investment grade status, they have the opportunity to get more equity financing.

In terms of its long-term debt maturity schedule, PNM Resources has debt of $278 million in 2024 and $854 million in 2025. Ideally, PNM Resources will be able to replace maturing debt with new debt rather than equity, but this depends on market conditions and the company’s ability to maintain its investment-grade credit rating.

PNM Resources Investor Introduction

solar cost

While more capital expenditure may be required, it’s unclear whether PNM Resources will be able to earn as much return on its regulated rates in the future as it has in the past few years. Reduce solar power generation costs.

Given that PNM Resources operates in New Mexico and Texas, many areas in those two states have greater solar potential because they receive more sunlight than average.

As a result, PNM Resources is arguably more at the forefront of solar’s impact on utility generation.

As solar power becomes increasingly competitive, I believe regulators may not allow PNM Resources to earn the returns it expects on the basis of its regulated rates due to being more ahead of the curve. As PNM Resources’ ongoing 2024 EPS outlook indicates, the impact of regulatory decisions on the rate base could be a significant headwind.

Still, I think PNM Resources is in a better position than many other utilities to handle lower electric bills if that happens, considering the average monthly residential PNM electric bill is $73.95compared to the national average of $132.15.

risk

Given the falling cost of solar power, electricity prices may fall more than expected.

PNM Resources is fairly highly leveraged. If electricity usage is lower than expected or costs grow more than expected, the company’s finances may face greater pressure.

Regulators may not allow PNM Resources to earn as much return as the market expects based on its regulated rates.

Valuation

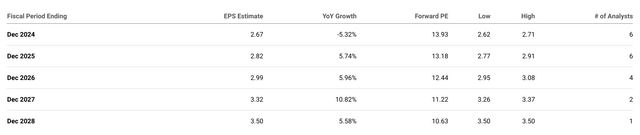

In terms of estimates, analysts on average expect PNM Resources to earn $2.67 per share in 2024, $2.82 per share in 2025, and $2.99 per share in 2026, according to Seeking Alpha. This gives the company a forward price-to-earnings ratio of 13.93 in 2024, 13.18 in 2025, and 12.44 in 2026.

Seeking Alpha

In terms of management estimates, they expect 2024 diluted EPS guidance to be in the range of $2.65-$2.75, 2025 USD 2.75-2.85$2.92-$3.04 in 2026, so analyst estimates are within management’s guidance.

When incorporating debt, PNM Resources’s forward EV/EBITDA ratio is 9.85, compared to the industry median of 10.42 and the company’s 5-year average of 11.23.

Considering the forward EV/EBITDA and its forward P/E ratio, I think PNM Resources is fairly attractively valued if it can meet EPS expectations (within management’s guidance).

However, as the weak 2024 earnings outlook suggests, regulatory decisions could cause the company to underperform management guidance.

In the future, I believe that the increased economic competitiveness of solar power has the potential to result in lower than expected allowable returns on a regulatory rate basis.

That said, even if the cost of solar power is a headwind, I’m cautiously optimistic that the growth in electricity demand will increase PNM Resources’ growth in the long term, given the growth of electric vehicles, data centers, and other relatively new energy sources. Earnings per share because it can significantly increase the regulatory rate base.

Given that I think rates will come down this year and be a pretty decent tailwind, I think PNM Resources will be able to meet or exceed expectations for 2024, 2025, and 2026.

Therefore, I rate PNM Resources a Buy, and I include it in a diversified portfolio that includes seven capital companies. I wouldn’t “overweight” it, though, as the company is small and fairly highly leveraged. There is also uncertainty given the likely decline in energy generation costs in the future.

In terms of my price target, I think PNM Resources should have a forward EV/EBITDA of 10.42, which is the industry average, and earnings per share of about $42.59.

I think the earnings report and any potential rate cut news will be catalysts, and I will be watching interest rates, rate base decisions, electricity prices and electricity consumption trends.