Trygve Finkelsen/iStock Editorial via Getty Images

Pole Star (NASDAQ: PSNY), a maker of premium-looking electric vehicles and a spinoff of Volvo Cars (OTCPK:VOLAF), is facing stiff competition and poor unit economics as investors look to invest in an EV company. The company’s potential turnaround should begin with reading this article.

Volvo’s history

Volvo Cars is a leading automobile manufacturer that produces and delivers 708,716 Cars to be launched in 2023, here is a brief review of the history of Volvo Polestar:

- 2015: Volvo acquires previous performance tuning partner Polestar;

- 2017: Volvo and Volvo parent Geely Holding (OTCPK: GELYF) announced that Polestar would focus on producing only electric vehicles;

- 2022: Polestar begins publicly trading on Nasdaq.

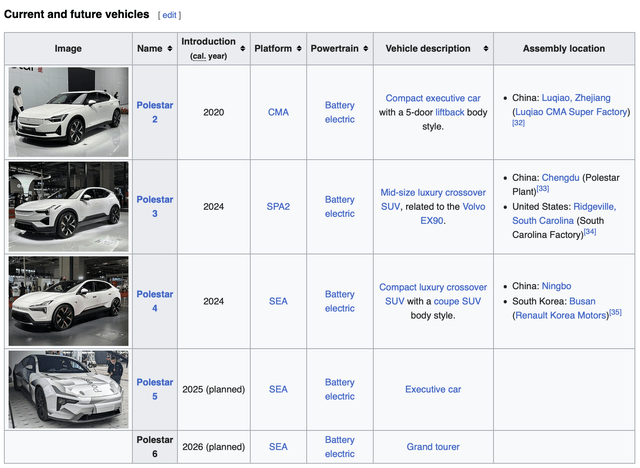

The table below lists the company’s current and planned products, along with their launch year, brief description, and assembly location:

Wikipedia

February 27, Polaris declare it started Polestar 3 production. However, it has been reported that Tesla (Tesla) has published over 100 articles on Seeking Alpha since 2016 and has seen firsthand ramp As with the production of any vehicle, let alone an electric vehicle, I would expect Polestar 3 production to take at least a year to reach high volume, and another year to optimize inefficiencies throughout the production line and supply chain to achieve profitability. If all goes well, I don’t expect Polestar 3 to make a meaningful contribution to Polestar’s bottom line until 2025 at the earliest.

Raise $1 billion

To this end, Polestar was able to raise nearly US$1 billion A consortium of 12 international banks including BNP Paribas, Natixis, Standard Chartered, BBVA, HSBC and Shanghai Pudong Development Bank provided the loan in the form of a three-year loan.

In the same press release, Polestar also shared the following ambitious operating targets for 2025:

- Achieve cash flow balance;

- Annual production exceeds 155,000 units; and

- The gross profit margin is in the high teens.

I wish them luck, but I think it’s unlikely, as I discuss in the rest of this article.

Cash isn’t always king

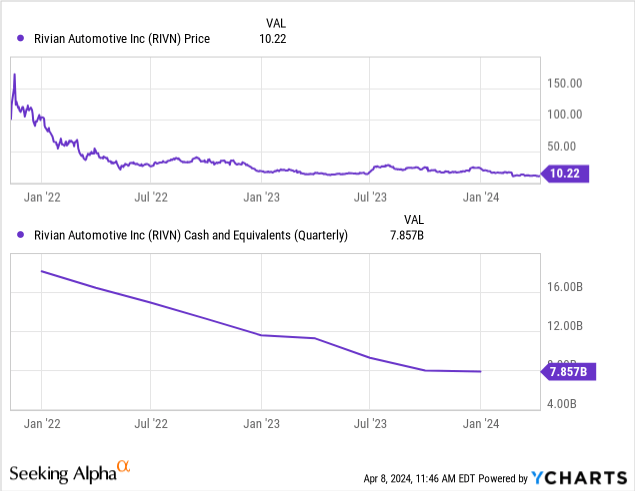

I often see investors turn a blind eye to the billions of dollars of cash sitting on the balance sheets of emerging EV manufacturers and assume that EV companies are likely to succeed simply because they have the financing to get through tough times. For example, bulls on Rivian (RIVN) point out that the company has a strong balance sheet and that the stock price is down nearly 95% in 18 months:

I urged investors to sell Rivian stock in an article titled “Rivian: Hyping the Hype,” which I recommend you read to fully understand the article.

For early-stage companies, like Polestar and Rivian today, or Tesla in the early 2010s, there’s more to the business than cash on hand. unit economics For vehicles, once the production rate reaches the nameplate capacity of the installed production line, because if the unit economics are good then the company may raise cash to move to the next stage of its growth, but if the unit economics are not good then cash alone will not Very likely to change the company’s downward trajectory.

With this in mind, let’s analyze how competitive the Polestar 2 and Polestar are globally best sellerTesla Model Y.

| Specification | Polestar 2 | Polestar 3 | Tesla Model Y |

| Vehicle Type | fastback sedan | High performance SUV | Crossover SUV |

| Price (USD) | $49,900 | $74,800 | $39,900 |

| Range(EPA) | up to 270 miles | up to 300 miles | up to 310 miles |

| Battery | 69 kWh – 78 kWh | 111kWh | 75kWh |

| 0-60 mph | 4.5 seconds | 4.7 seconds | 3.5 seconds |

| Transmission system | Front wheel drive/all wheel drive | all wheel drive | Rear wheel drive/all wheel drive |

| top speed | 127-130 mph | 130 mph | 135-155 mph |

| TOLL | Up to 155 kW | Up to 250 kW | Up to 250 kW |

| Distinctive features | Google Automotive Operating System, simple design | LiDAR sensor, advanced driving assistance | Spacious interior space, pressurized network |

Are you surprised by the price of Tesla Model Y? I explained the many ways Tesla is making its vehicles increasingly affordable in my recent article titled “Tesla: Here’s Why It’s Down 24%” which I recommend reading to fully understand this article .

The table above shows that potential buyers can now buy the Tesla Model Y for less than the Polestar 2, which is stronger than the Polestar 3 in every aspect, while the Polestar 2 is inferior to the Polestar 3 and Tesla Model Y in terms of performance. range and charging speed; therefore, I don’t expect Polestar to hit “more than 155,000 units per year” or “gross margins in the mid-teens” unless the company finds enough buyers who just want one that looks A powerful electric car that’s different from the mainstream options, and one you’re willing to pay tens of thousands of dollars extra for.

Competition intensifies further

BYD (OTCPK: BYDDF) recently launched a powerful electric vehicle $9,700While it doesn’t compete directly with the Polestar 2 or Polestar 3 in the premium car segment, BYD and Tesla’s price war could put pressure on margins across the industry in the coming years.

Additionally, there are rumors that Tesla will upgrade The launch of the Model Y in 2025, just as the Polestar 3 is expected to enter volume production, could put pressure on Polestar’s profitability in 2024 and 2025 as potential buyers adopt a wait-and-see approach.

basic knowledge

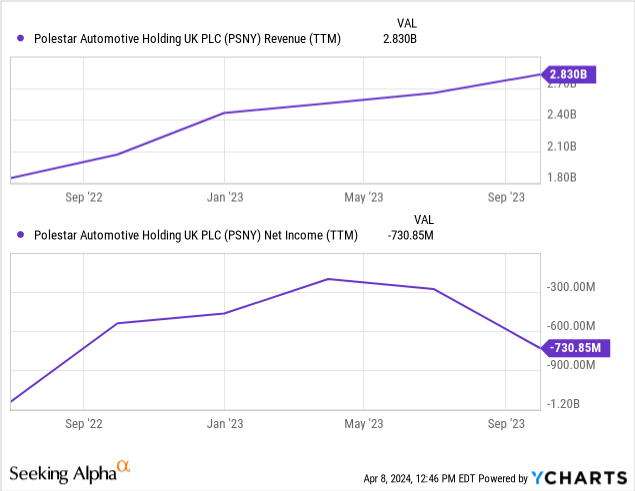

The chart below shows that although Polestar sold tens of thousands of Polestar 2s and increased revenue over time, profitability did not follow:

Importantly, the company’s profitability (or lack thereof) has gotten worse in recent quarters, with trailing 12-month net losses reaching $731 million, which tells me that the company’s recent $1.0 billion Financing could extend Polestar’s life to 2025, but not beyond.

Where is my analysis wrong?

Polestar’s ties to Volvo Cars and Geely Holding could allow it to raise more cash in the future if rivals such as Tesla Inc. By bringing it to market on time and at an affordable price, Polestar may be able to reduce production costs over time and achieve good unit economics.

in conclusion

Polestar’s latest funding round may be delayed, but it’s unlikely to reverse the ongoing decline in the stock price.I will rate the stock strong sell And will update my analysis as further data becomes available.