Brandon Woyshnis/iStock Editorial via Getty Images

Following the release of Porsche Car Holding AG’s (OTCPK: POAHF) (OTCPK: POAHY) financial results for fiscal 2023, we comment on the company again today.Here at the Lab, we recently updated our readers on the latest news from Porsche Two key investments by Auto Holdings, PhD. Ing. hc F. Porsche AG (OTCPK:DRRPF)(OTCPK:DRPRY) and Volkswagen (OTCPK: Volkswagen)(OTCPK:VWAPY)(OTCPK:VLKAF). In addition to its two listed investments, Porsche Car Holding holds minority stakes in several technology companies in Germany, Israel and the United States.

For those new to our analysis, we recommend starting with our comprehensive coverage, Porsche Automobil Holding SE is a clear buy. This in-depth analysis from Dr. Ing provides the latest news from Porsche Car Holding. hc F. Porsche AG (or P911) and Volkswagen AG stock classes ensure you have a thorough understanding of the company’s current status.

As a reminder, our The supportive Buy rating is based on the sum of the partial valuations of Volkswagen AG and Dr. Ing. hc F. Porsche AG.

profit result

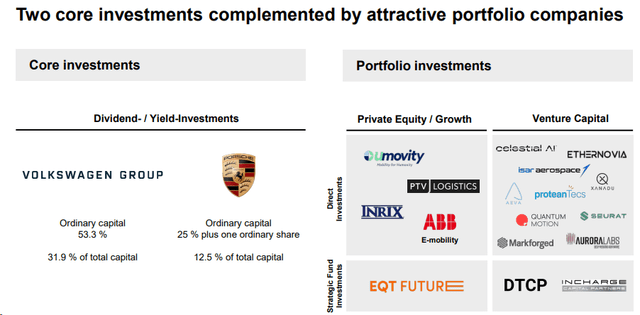

Porsche Car Holding GmbH manages and holds its investments. Currently, the company owns 12.5% of Dr. Ing. hc F. 31.9% stake in Porsche AG and Volkswagen AG. Therefore, reporting the latest fourth-quarter financial data is critical.

Porsche Car Holding Portfolio

source: Porsche Car Holding Ltd. Fiscal Year 2023 Results Presentation – picture. 1

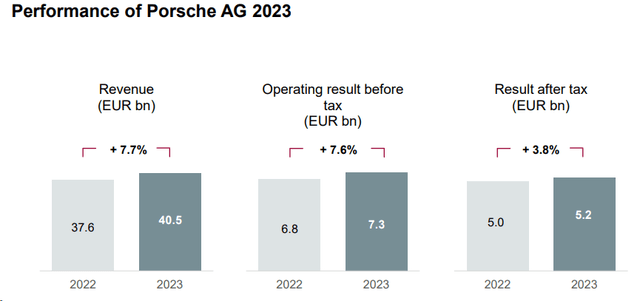

Starting with Dr. Ing. hc F. Porsche AG (or P911), the company is having a strong year in 2023. Following the share price decline, our team revised our rating to Buy.

Porsche CEO said, company “2023 proved that we are resilient, highly profitable and financially sound, even in turbulent times.On this basis, in 2024 we will lay the foundation for take-off in 2025”.

Here at the Lab, we’re positive about the P911 because of 1) its ability to increase prices and sales, and 2) the appeal of its new special-edition models. Looking at the numbers, P911’s annual sales reached a record high of 40.5 billion euros, with operating profits of 7.3 billion euros (Figure 2). To this end, the CEO confirmed the payment of dividends of €2.3 billion. So, based on our calculations, Porsche Car Holding could receive a dividend of €287.5m.

Dr. Inge. hc F. Porsche AG Results 2023

figure 2

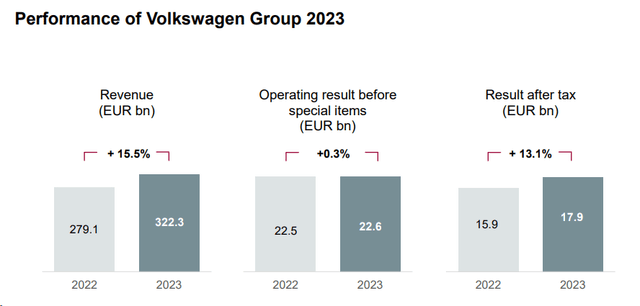

Continuing our analysis of Volkswagen AG, our team reiterated its strong buy recommendation following its fourth-quarter results. We also raised our buy target from €196 to €217.1 per share. In terms of performance, Volkswagen’s annual sales increased by 12% to 9.24 million vehicles.These positive results are also recorded in January. In 2023, the company’s sales and operating profit reached 322.3 euros and 22.6 billion euros respectively (Figure 3). In addition, Volkswagen’s performance in 2024 is optimistic, with sales and operating profits reaching at least 338 euros and 23.6 billion euros respectively. Volkswagen already has positive net automotive liquidity and free cash flow improvement guidance. This is supported by lower-than-expected evolution of capex from new collaborations. To this end, the CEO increased the dividend per share to 9 euros. Therefore, according to our calculations, Porsche Car Holding will potentially receive dividends of approximately 1.44 billion euros.

Volkswagen’s 2023 results

image 3

Estimate changes

There were some surprises in the fiscal 2023 results. This is because the company’s performance is fairly predictable considering Dr. Ing. hc F. Porsche AG and Volkswagen AG accounted for 99.8% of the company’s profits. That said, we should report that Porsche Car Holding AG harmed Volkswagen AG. However, this is a non-cash item and will not affect the company’s dividend payments.

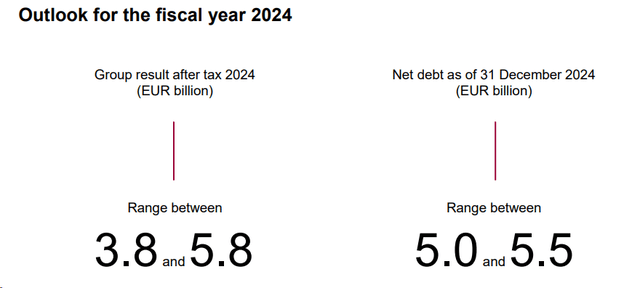

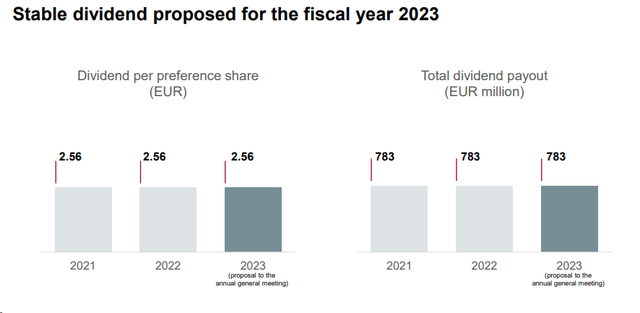

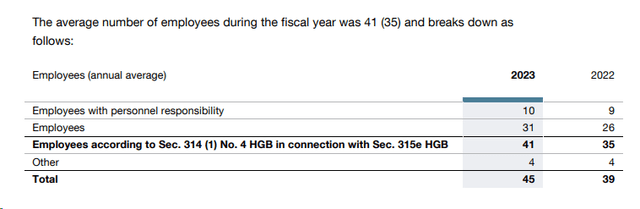

Judging from the company’s guidance, Porsche Car Holding will focus on deleveraging (Figure 4). In fact, looking at consensus estimates, the company’s dividend per share was 19% lower than consensus estimates. Taking into account Porsche SE’s limited expenses (the company has only 45 employees – Figure 6), we expect operating cash flow to be €1.33 billion. This included the company’s expenses of 37 million euros and interest payments of 283 million euros. Taking into account the unchanged dividend policy and a total company valuation of €783 million (Figure 5), we arrive at a net debt valuation of €5.1 billion in 2024.

Porsche Car Holding SE deleveraging plan

Figure 4

Stable DPS

Figure 5

Porsche Car Holding SE Number of Employees

Figure 6

Valuation

At the lab, we value Volkswagen at €217.1 per share, Dr. Ing. hc F. Porsche AG €96 per share. Therefore, valuing Porsche Car Holding AG at our reference target price, we arrive at an enterprise value of €47.9 billion (€37.0 billion related to Volkswagen AG and €10.9 billion related to Dr. Ing. hc F. Porsche AG related). Taking current debt into account, our equity value amounts to €42.8 billion. Applying a holding discount of 25%, we arrive at €32 billion, compared to a current market capitalization of €15 billion.

Porsche Car Holding AG is valued based on the current market capitalization of Volkswagen AG and Dr. Ing. hc F. Porsche AG, we arrive at an enterprise value of €31.5 billion and an equity value of €26.4 billion. Using a holding discount of 25%, we arrive at an equity value of €19.8 billion, compared with a current market capitalization of €15.0 billion. Therefore, we believe that the current market price still has room for at least 32% growth. Therefore, without considering upside, we arrive at a target price of €64.54 per share. In fact, Porsche Car Holding’s discount to net asset value is unjustified. Additionally, the company has a yield of 5.2%.

At Labs, we recommend checking Exor’s analysis and progress since the rating update.

risk

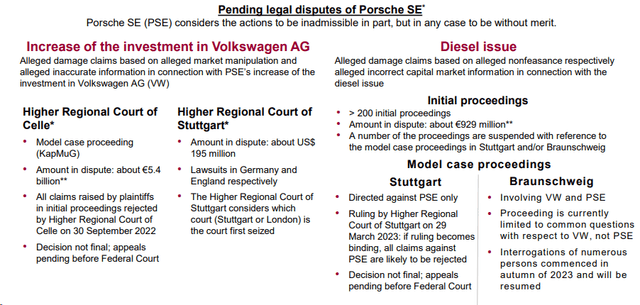

There is no word on pending litigation (Figure 7). Downside risks also include 1) negative foreign exchange at portfolio companies, 2) electric vehicle development and execution risks, 3) corporate governance complexities, 4) declining automotive demand, and 5) credit risk.

Porsche Car Holding SE Pending Litigation

Figure 7

in conclusion

We believe the company is a holding company and trades at a significant discount to net asset value. In addition, Porsche Car Holding is fully funded by dividend inflows from its two core investments and leverages its expertise in the automotive industry value chain. Even applying the current Volkswagen AG and Dr. Ing. The market value of hc F. Porsche AG is available at a 32% discount. Therefore, our team decided to maintain a Buy rating as we believe the downside is limited.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.