Massimo1g/iStock via Getty Images

introduce

Poste Italiane (OTCPK:PITAF) is a stock I recommend to any dividend investor looking for sustainable and growing high yields. In this article, I want to explain why I think this is the case.In Italy, Poste Italiane rhymes with A fairly safe company that pays a generous dividend. Nearly all income-oriented investors approaching retirement own some stake in the company, either directly or through ETFs. In this article, I’ll focus primarily on Post’s dividend to show how it’s supported by the company’s digital transformation, and why I think it shouldn’t be ignored even overseas.

company

Poste (the last “e” is pronounced as the “e” in the word “equity”) has long been, and still is, Italy’s leading mail delivery company.Therefore, it is considered a strategic asset of the country and the company owns about 65% of the shares Implemented directly or indirectly by the government. The remaining 35% is its float, 66% of which is held by institutional investors and the other 33% by retail investors.

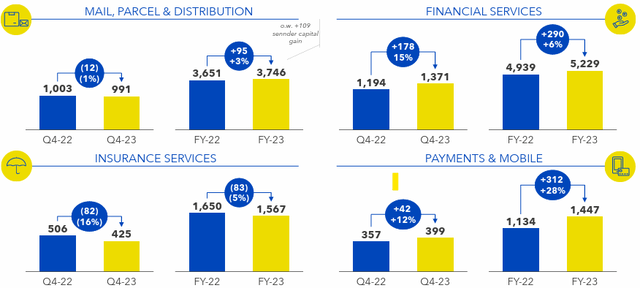

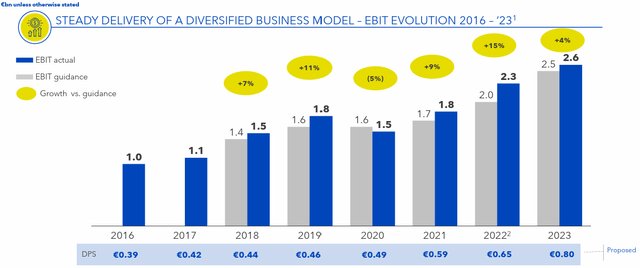

Some numbers to help you understand the revenue and profits we’re talking about. Poste Italiane reported that its revenue in fiscal year 2023 will increase by more than 5% annually to nearly 12 billion euros, and its operating profit will reach a record high of 2.62 billion euros in 2023, which is twice the EBIT in 2017.

As boring as it may be, the company has undergone a major transformation in recent years, becoming the country’s largest digital platform. What does it mean? To date, Poste has grown its business into four distinct business units, diversifying from its original mail delivery business.

We can see the Postal Service’s four divisions below: The company operates mail, parcels and other logistics services; it also has a financial services division; it operates insurance and has recently entered the payments and mobile businesses quite successfully.

Poste Italiane Annual Report

How did Poste grow into this company? Starting with its physical pipelines and post office network for mail and package delivery—its historic assets—the Postal Service has leveraged and expanded them. First, it is a long-term business that leverages its office sales staff and its reliability to get customers to entrust their savings to it. Poste enjoys the reputation of being the first to invite Italians to open a postal savings account and is considered relatively safer and more reliable than any other bank. This is a fairly traditional business, with results driven by net interest income and consumer loan distributions. High interest rates have allowed this business to thrive, mainly because of NII growth. Last year, the division alone achieved total revenues of €6.1 billion (+6% year-on-year), compared with €12 billion for the company as a whole. Postal Savings generated revenues of €1.74 billion for the company, while NII generated total revenues of €2.24 billion.

As net retail inflows increased to €1.2 billion, the group’s total financial assets now reach €581 billion, of which €326 are postal savings of its 27 million customers. This is more or less equal to 15% Italy’s gross domestic product.

Poste is the right company to give us a feel for the pulse of Italy’s savings habits and thus the country’s household debt GDP ratio 39%, one of the lowest in the Western world. The real challenge facing the Italian economy is to free up some of the huge cash reserves held in the country’s household savings accounts.

Poste 2023 fourth quarter financial report

Looking next at the other two divisions of the Postal Service, we see insurance services. This goes hand in hand with financial services: few banks today offer financial services on their own. The same goes for Poste, which once again integrates physical proximity to 96% of Italians, interacting with them through its financial and insurance services.

To improve management of both sectors, Poste developed a financial application, which is the most downloaded application in Italy and provides support and services to more than 35 million customers. The app has become the leading single point of entry for all the daily needs of Italians: it provides citizens with public administration (Poste is the leading national digital ID provider with 23.8 million customers) while helping Poste’s customers manage their finances. Not only that, through this application, the postal service can also provide customers with phone cards, energy services and mobile payments. This has led to the development of the Post’s fourth business unit, which currently has revenues of €1.4 billion but is growing the fastest of the four.

Postal Service Profitability

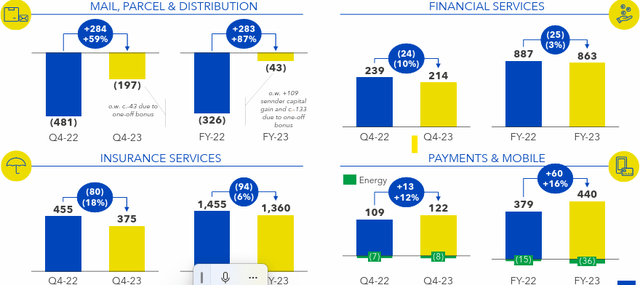

Let’s take a look at Postal Service’s EBIT per unit. We’re seeing mail, package and delivery actually losing money and now approaching breakeven. On the other hand, the payment and mobile business’s EBIT increased by 16% year-on-year to 440 million euros.

Poste Fiscal Year 2023 Earnings Report

So we’re seeing a declining business – mail distribution – being used extensively to leverage its physical assets to build new ways of connecting with Poste customers. Additionally, while further declines in mail are expected, package distribution has been ongoing and is expected to more than offset the drop in mail.

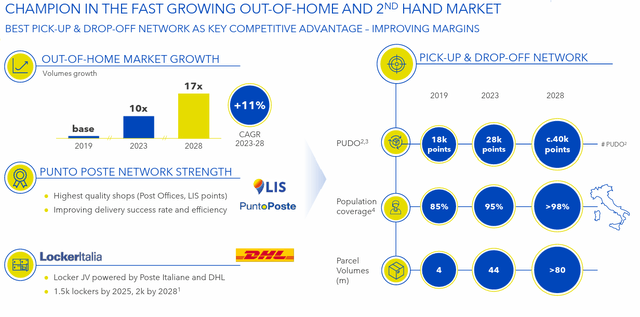

A word about the package.With its pick-up and delivery network, Poste has become a leader in the out-of-home and second-hand market, a market driven by e.g. Organize your wardrobeVinted.

Poste 2024 Capital Markets Presentation

In 2023, Poste reported over 20 million daily interactions. In one year, Poste analyzed approximately 2.8 billion transactions through data mining. More than a third of these (36% to be exact) were customer interactions handled by artificial intelligence. This allows us to understand that the postal service still has a lot of room to implement AI in its omnichannel model.

Postal Balance Sheet

We have already discussed the assets managed by the Postal Service. But when we’re dealing with a financial company like the Post, what matters most is its capital position. The capital ratio of Postal Banking Services is 22.1% (CET1 ratio is 18.9%), the leverage ratio is only 3.2%, and the solvency adequacy ratio of the insurance business is 305%.

postal dividend

Here we are. Let’s take a look at Postal Service’s dividend. Let’s start with something that has many investors cheering: given Poste’s better-than-expected 2023 results, the board is proposing to increase the dividend by 13% from its most recent guidance of €0.80 per share. Overall, Poste hopes to distribute a total of 1 billion euros in dividends to shareholders in 2023, a 23% increase from 2022.

We can see that Poste, while a slow-growing company, has been able to steadily exceed its guidance by 4% to 15% over the past six years. This has led to significant dividend growth, more than doubling from 2016 to 2023. If approved, the new dividend would have a yield of 7% and a dividend yield of 54%.

Poste 2024 Capital Markets Presentation

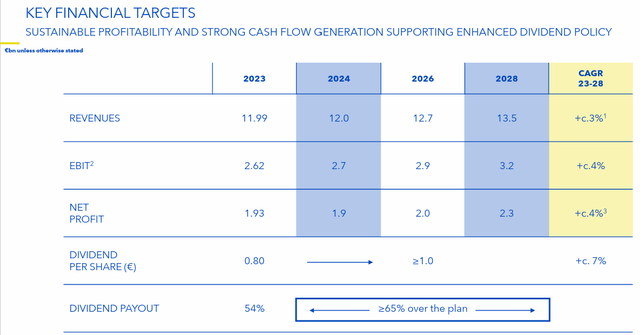

Recently, the Post also launched a new version for 2024-2028 Strategic Plan.

We believe Poste is targeting 3% annual growth from 2024 to 2028. Annual EBIT growth should be faster, at 4%. This means Poste is targeting an EBIT margin of close to 24% by 2024, compared with a reported EBIT margin of 21.8% at the end of fiscal 2023. We must fully understand this margin expansion trajectory to avoid being fooled by slow revenue growth.

Poste 2024 Capital Markets Presentation

This expansion in profitability is achievable because the fastest growing business unit is the one with the highest profit margins of the four segments. This gives Poste enough confidence to increase its payout ratio from 54% to over 65% without jeopardizing its financial health.

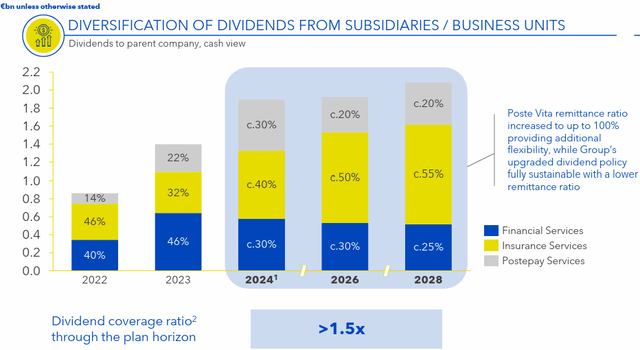

What I mean is well explained in the bar chart below, where Poste shows the diversification of dividends across its subsidiaries and business units.

We found that the financial services industry accounted for about 46% of Poste’s 2023 dividend. By 2028, this will reach about 25%, partly because NII is expected to normalize, but also because other business units will contribute more. In particular, insurance services are growing strongly due to its high remittance rates and improved sales processes targeting the Post’s large customer base.

Poste 2024 Capital Markets Presentation

risk

First, Poste’s stock symbol is F, not Y. This means it typically has higher trading commissions and lower liquidity. Therefore, it might be wise to look directly at Euronext Milan shares, which trade as PST.

Related to the first risk, we can find another risk. Foreign dividends are taxed, and the Italian government cuts them by 26%. This obviously cannibalized a large portion of the Post’s circulation.

Operationally, we have seen that the decline in mail delivery is not a big issue as it will be offset by growth in parcel delivery.

However, the financial services business may be at risk as NII declines in the coming years. While this is a threat, we will see how the Post handles and leverages its large existing customer base.

Valuation and conclusion

Currently, Poste does not have a valuation for SA Quant Grades. However, we see that the company’s P/E ratio of 7.65 is well below (the industry average of -2.5%), and its P/E/FCF ratio is just under 10. Considering its unique assets and properties and large customer base, I think these multiples are a bit low, especially after explaining the dividend policy and currently leading the company to offer a 7% yield. I think fair valuation is at least 9x P/E, which would mean a price of €13.50 on Euronext Milan (up 18%). Companies like Postal Service can be priced at a higher price-to-earnings ratio due to their resilience and predictable cash inflows.

From a dividend perspective, the current yield of 7% is well supported and quite attractive. This is all the more so considering that from 2026 Poste will pay a dividend of at least €1.00 per share, giving us a yield of 8.7% in 2026 based on current valuations. Based on the yield, I think Poste may be trading at a reasonable price when the stock offers a 5% dividend yield. This would give the stock a price target of €16, with room for 40% upside.

All in all, Poste Italiane has a reliable reputation and a successful digital transformation, which has helped it become the first choice for Italians to entrust their savings and use their finance and services. As its revenue continues to grow, Postal Service is also able to operate its business units profitably, which makes me think we’ll see strong cash generation to support shareholder returns. That’s why I recommend it to any dividend investor looking for a sustainable and growing yield.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.