Paul Bradbury

Today I want to discuss a niche software company that went public in 2019 2021. The company has a strong founder-led CEO and has grown revenue and customers in recent years.Company share price rises It has grown more than 12% so far this year and nearly 40% compared with the same period last year.

However, this is still an unprofitable company that hasn’t done much for shareholders yet, as the share price is still falling since going public.

The company is Procore Technologies, Inc. Let’s take a closer look at the company to see if the business can continue to grow and reward shareholders in the coming years.

company

Pro core technology (NYSE:PCOR)was founded in year 2002 Author: Craig “Tooey” Courtemanche. Courtemanch was working in Silicon Valley at the time but was building a house in Santa Barbara.Courtemanche faces various problems Working with numerous stakeholders, Courtemanche created a way for all these parties to communicate with each other more effectively, and Procore was born.

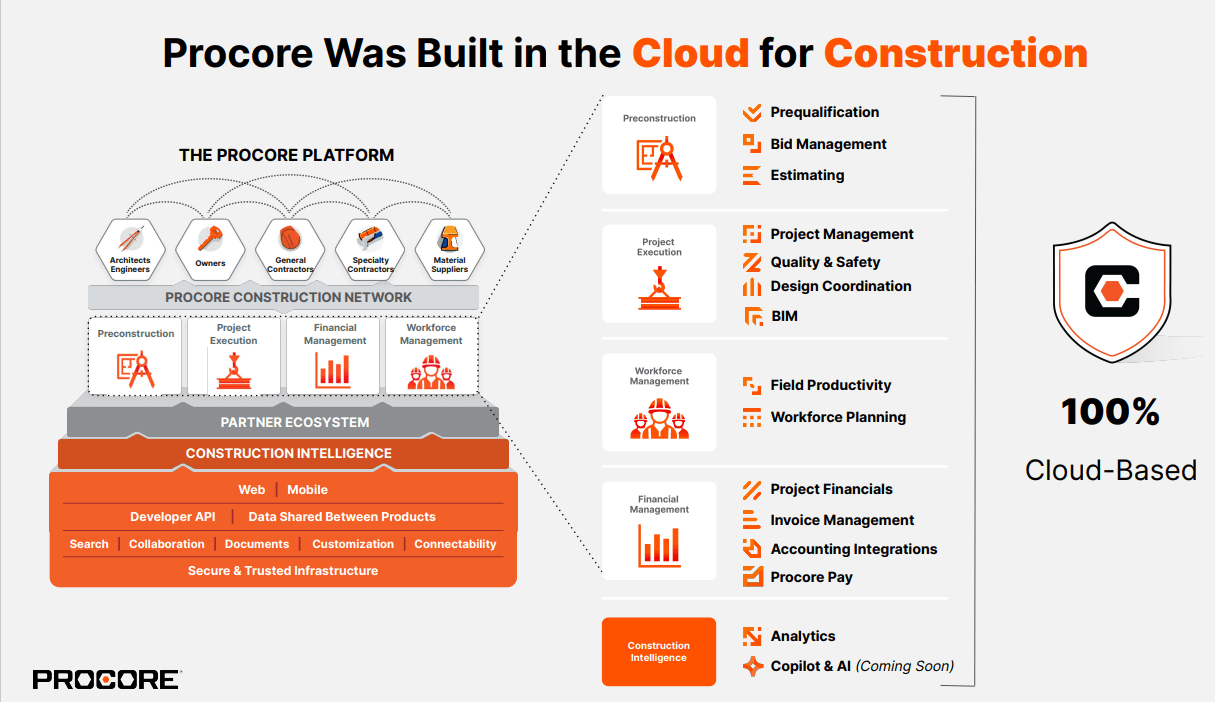

company’s mission Quite simply, “Connecting everyone in construction on a global platform.” Procore is the leader in providing cloud-based construction management software. Construction is a complex industry with many key players depending on the job or task at hand. Procore’s technology helps connect those involved in construction work, including owners, general contractors, specialty contractors, architects and engineers, so tasks are completed in a timely and efficient manner.

under figurative Procore’s products are illustrated as the company’s software is available in five distinct product categories: Preconstruction, Project Execution, Workforce Management, Financial Management and Construction Intelligence:

Investor introduction

Building intelligence products have not yet been launched, but Procore will use Microsoft’s Copilot to implement artificial intelligence functions, such as building virtual assistants.

Additionally, Procore recently launched Procore Pay, which will enhance the company’s financial suite. Courtemanch said on the company’s latest earnings call that while it’s still early days for the launch, “…We’re excited about payments and the early feedback has been very positive. Notably, we are the only solution on the market that connects estimating, contracts, compliance documents, invoices, payment workflows, all in one place conducted on one platform”.

Moats and opportunities

Procore believes they have a huge opportunity because, as the company said in a recent report, the construction industry is “one of the oldest, largest and least digitized industries.” 10K Archives. The industry is fragmented and can be quite specialized in specific areas.

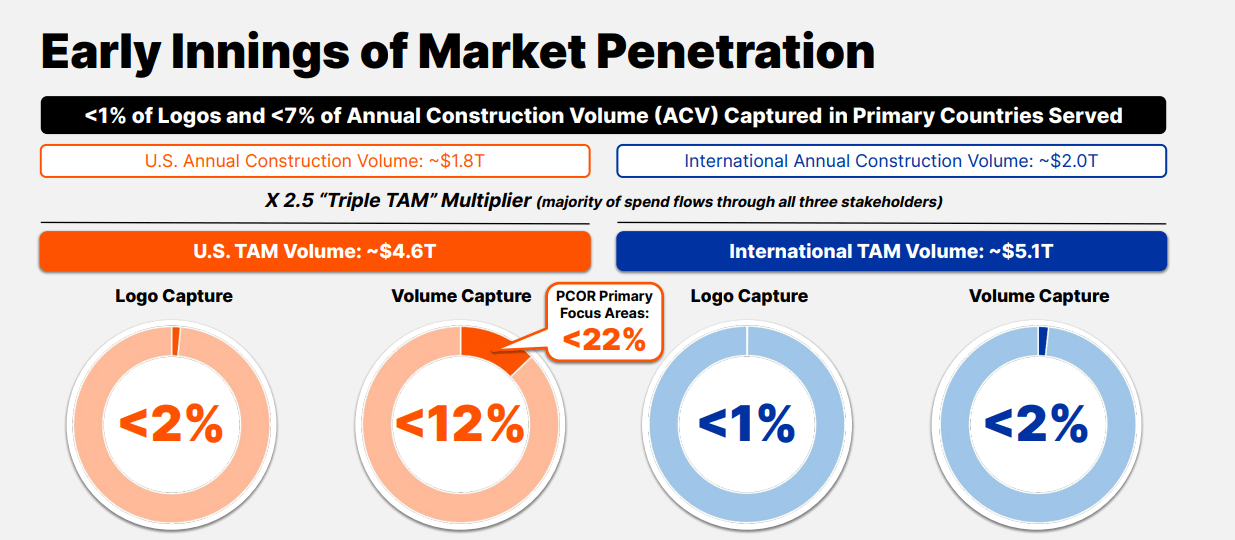

As Procore recently told an investor, construction remains a huge industry Promotional meetingGlobal construction spending was US$11 trillion in 2020 and is expected to climb to US$15 trillion by 2030. In addition, 13% of U.S. GDP came from the construction industry in 2017, and 7% of the global workforce came from the construction industry.

as the picture shows the followingProcore believes they have a domestic opportunity of approximately $1.8 trillion and an international opportunity of approximately $2 trillion:

Investor introduction

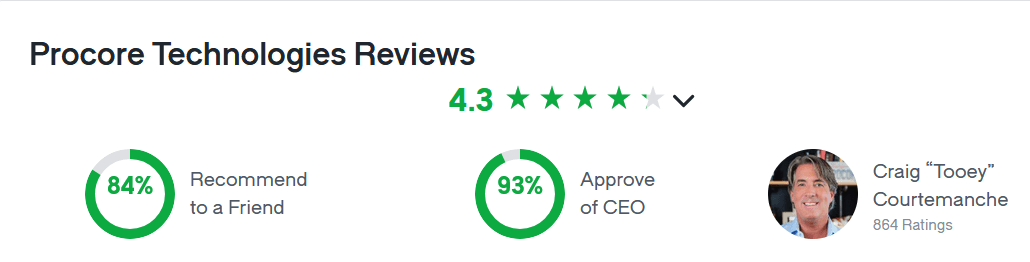

As noted in the company’s recent report 10KKey competitors include Oracle (ORCL), Autodesk (ADSK) and Trimble (TRMB). While these are all important players in the technology space, Procore appears to be the leader in this market, and I do believe Procore has a moat.When I research the top software in the construction industry, Procore is often the top software list. Procore even displays their ratings on their website website This shows how much companies love their software.

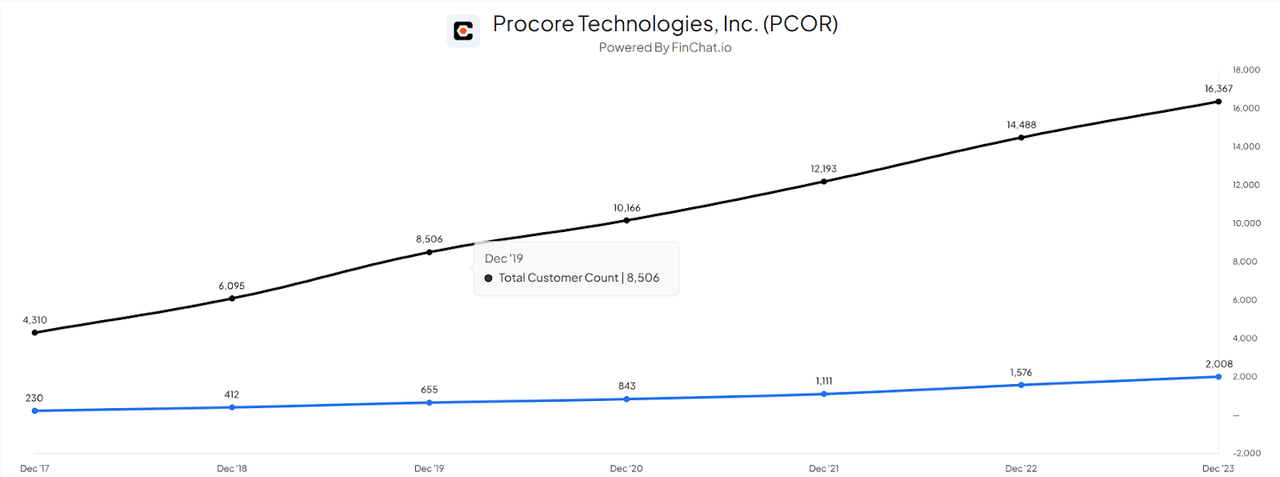

This diagram I pulled from Finchat.io illustrates this further. Procore’s customer base has been growing steadily (shown by the black line), as has the number of customers with annual recurring revenue of $100,000 or more (shown by the blue line):

finchatio

Additionally, Courtemanche noted during the company’s latest earnings call that Procore’s net retention rate was 114%, demonstrating the strength of the software. Currently, I do think Procore appears to be the market leader and their technology gives them a competitive advantage.

manage

As mentioned above, Craig “Tooey” kutmanche Is the founder, president and CEO of Procore.

Howard blessing Current company CFO. Fu has been working at Procore since 2021. He comes from DocuSign and was a key member of the organization’s finance team. Fu has also worked at Salesforce.

Glassdoor ratings show that Procore is a truly great place to work, as it was named one of the Best Places to Work in 2017, 2019, 2022, and 2023. Most recently in 2024, Procore was named the fifth best place to work by Glassdoor, which is quite fulfilling.

The following are the current glass door reviews. Procore is considered a great place to work, and employees there clearly approve of Courtemanche:

Glass door

As I’ve said in the past, I’m a big believer in founder CEOs because they tend to focus on long-term goals, and I like to have senior leadership involved. Procore’s agency of the year will be released soon, but as of the company final power of attorney Courtemanche owns more than 5% of the company’s common stock, which is what I’d like to see.

finance

Procore isn’t yet GAAP profitable, but the company has made impressive progress, as you can see in the company’s most recent report 10K Archives:

SEC.gov

Procore’s latest fiscal year revenue was approximately $950 million, a 29% increase from the previous year. Additionally, Procore’s GAAP gross margin is an impressive 82%.

from a cash flow perspectiveProcore’s operating cash inflow in 2023 will be approximately $92 million, which is significantly higher than the $12 million operating cash inflow in 2022. Free cash flow in 2023 will be approximately $47 million.

Procore does have a solid balance sheet, as shown below:

SEC.gov

The company’s cash balance has grown to nearly $358 million, and its current asset balance covers all of the organization’s current liabilities.

risk

Procore lays out the many risks facing businesses in its latest report annual report. I will discuss two risks that I believe could harm the organization.

As Courtemanche discussed on the company’s recent earnings call, the construction business is cyclical and closely tied to the economy and interest rates. Here’s part of Courtemanche’s opening statement that really reflects how these factors impact Procore’s business:

“So I’ll be the first to admit that 2023 is proving to be a challenging year in a tough economic environment. Much of the comments we shared on our last earnings call remain relevant to what we’re seeing today. Yes For our industry, 2022 and 2023 are very different years.

In 2022, our customers are showing optimism in sentiment and purchasing behavior. Much of this optimism stems from our customers’ backlog levels and their confidence in future workflows, but 2023 brought a significant shift. Although the backlog remains strong, sentiment has changed partly as interest rates rise rapidly and the industry begins to hedge against future work as a precaution.

“This sentiment drives conservatism about the future and causes the industry to be cautious about future production commitments in light of future demand. As we all recognize, the construction industry and our economy are cyclical. “

The U.S. economy has remained resilient recently, but if the country falls into a recession, as some suggest, predict If it happens, this will hurt the construction industry and, by extension, Procore.

As mentioned earlier, Procore competes with several large companies such as Oracle, Autodesk, and Trimble. Procore must continue to innovate and create superior technology in order to maintain customer loyalty. If Procore fails to do this, their position as the leader in this niche software industry will certainly be in jeopardy.

Valuation

As you can see from the valuation metrics below, Procore has an overall value grade of ‘D-‘ from Seeking Alpha.

Seeking Alpha

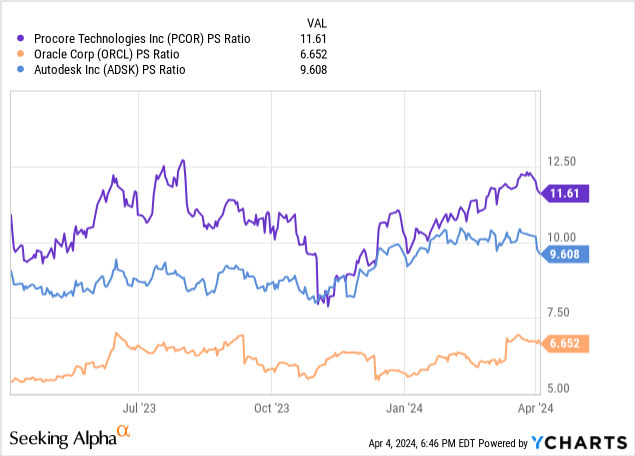

Since Procore is not yet profitable, I believe the price-to-sales ratio is the best metric to measure the organization.

In this case, Procore does appear to be trading at a premium compared to the competitors I mentioned above, as you can see in the chart below.

However, since Procore is the market leader, I’m willing to pay a premium for the industry leader. I would build a position at these levels and would be happy to add if this metric drops.

in conclusion

Procore is a leader in its niche market with growing revenue and customer numbers.

Procore’s founders are led by CEOs with many years of experience in the construction industry and a sizable stake in the business. Employees also seem to approve of Courtemanche, and the work environment he and the management team have created at Procore is considered one of the best companies to work for in the country, according to Glassdoor.

Since the construction industry is not as “digital” as other industries and is highly fragmented, Procore appears to have a good chance of continuing to grow as long as the company can continue to deliver best-in-class technology and retain customers.

I believe Procore is an excellent opportunity for long-term investors as I think this founder-led company can continue to grow in the coming years.