sorry

investment thesis

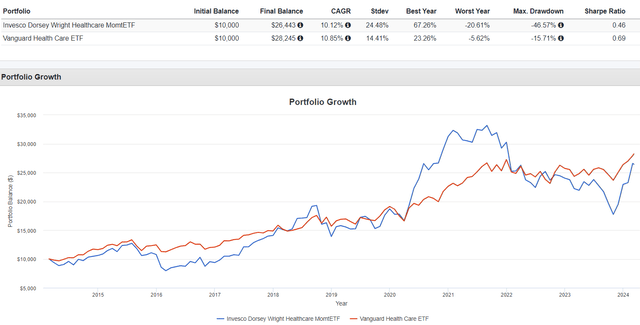

Invesco Dorsey Wright Healthcare Momentum ETF (NASDAQ:PTHThe fund has underperformed since changing the index a decade ago, trailing the Vanguard Healthcare ETF (VHT) by about 13%.Most of the poor performance is probably due to Attributable to PTH’s exorbitant 0.60% expense ratio. Still, these results suggest that for most healthcare stocks, a passive approach to managing momentum won’t work. In this article, I’ll evaluate PTH’s performance and fundamentals against two benchmarks and explain why you should avoid this speculative small-cap fund. I hope you enjoyed this analysis.

Overview of parathyroid hormone

Since February 19, 2014, PTH has tracked the DWA Healthcare Technology Leadership Index, selecting the top 2,000 U.S. healthcare stocks based on a proprietary relative strength indicator.Eligible securities must meet the following standards described in Section 2.1.2 of the Securities Act method file.

- become a Member of Nasdaq US Benchmark Index

- Top 2000 by market capitalization

- Classified as common stock

- Average daily USD trading volume of at least 3M USD 1 million

All securities are scored based on medium- and long-term price movements relative to a representative market benchmark, and the index is rebalanced and reorganized at the end of the year. per calendar quarter. As of March 12, 2024, the index selected at least 30 securities but held 59.

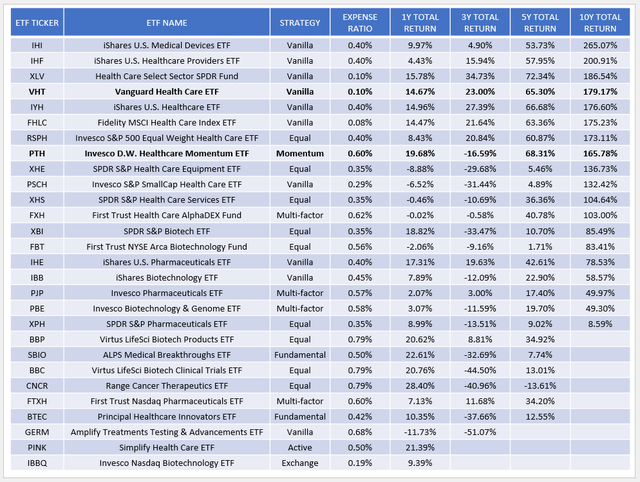

High expense ratios are not unusual for specialty funds, but PTH’s 0.60% expense ratio is tied for the sixth-highest among health care ETFs. As shown below, these high-fee funds often underperform over the long term, so the first takeaway for readers is that you don’t always get what you pay for. Simple and effective.

Sunday Investor

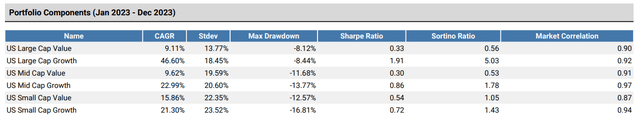

PTH has underperformed VHT by 13.39% over the past decade through February 2024 (165.78% vs. 179.17%), although its five-year total return was 3% higher, primarily due to greater success than the previous year . This is not surprising considering that momentum strategies often overlap with growth strategies. As I’m sure readers are aware, growth stocks outperformed value stocks in 2023 across all market segment sizes.

Portfolio Visualization Tools

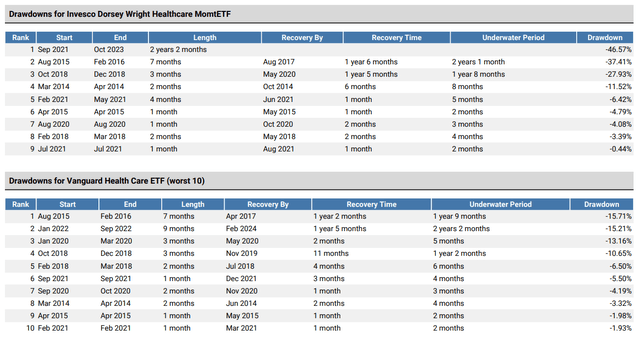

From a portfolio construction perspective, the overlap between momentum and growth is critical. If you’re already heavily invested in growth stocks, it’s not wise to add a dedicated momentum fund to your portfolio. Additionally, you may end up with unnecessary volatility. The chart below shows that since March 2014, PTH has not only underperformed VHT by 0.73% per year, but the standard deviation has been 10 percentage points higher. Between September 2021 and October 2023, FTH also fell significantly by 46.57%.

Portfolio Visualization Tools

Parathyroid hormone analysis

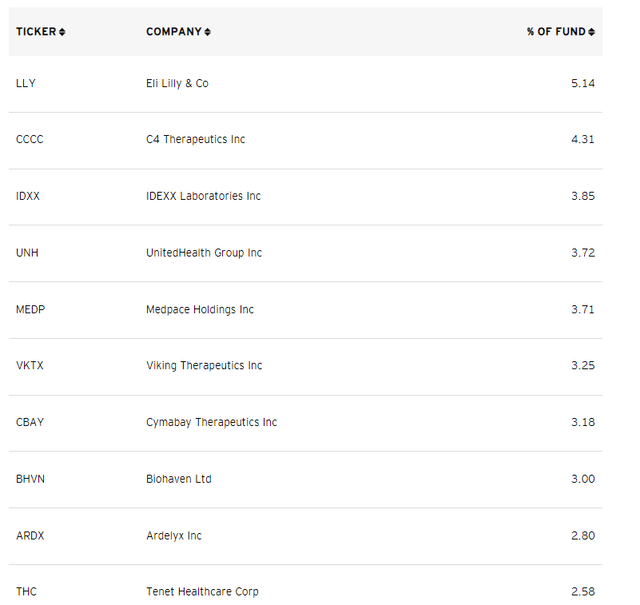

Top 10 holdings

PTH’s top ten holdings are as follows, together accounting for 35.54% of the portfolio. Some household names are also on this list, such as Eli Lilly (Li Lai) and UnitedHealth Group (united nations institutes of health). However, the majority of the portfolio is in small-cap stocks. Different providers have different definitions of this segment, but 44/59 stocks (63.59% by weight) have market caps under $5 billion, with a median market cap of just $2.87 billion, so it’s definitely one right now Small Cap ETFs.

Invesco

PTH involves 10 sub-industries under the Global Industry Classification Standard (GICS). Index providers don’t use this system, which is why the ETF has a small allocation to life and health insurance stocks.

- Biotechnology: 49.48%

- Drugs: 18.79%

- Healthcare equipment: 8.55%

- Managed healthcare: 6.07%

- Life science tools and services: 5.23%

- Healthcare facilities: 4.02%

- Medical and health supplies: 3.29%

- Healthcare services: 2.35%

- Life and health insurance: 1.45%

- Healthcare technology: 0.77%

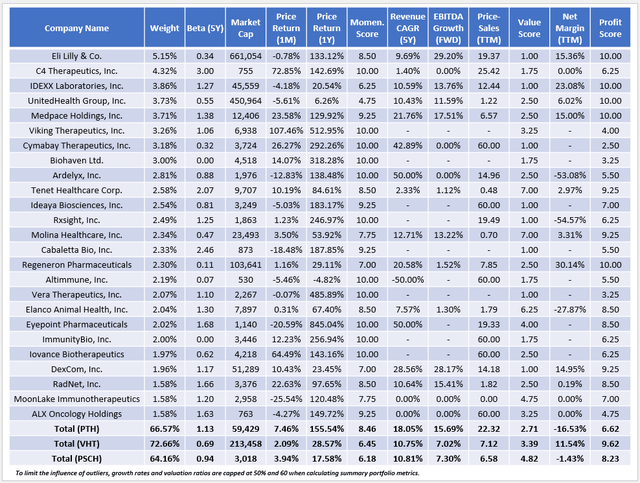

PTH Fundamentals by Company

The table below highlights selected fundamental metrics for PTH’s top 25 stocks, which together make up 66.57% of the portfolio. The table includes several momentum indicators and shows how well each assesses other factors such as volatility, growth, valuation, and quality. As a benchmark, I include VHT and the Invesco S&P SmallCap Health Care ETF (public safety center).

Sunday Investor

Here are three more takeaways:

1. PTH has a five-year beta of 1.13, proving that it is currently a highly volatile fund in the sector. PTH shareholders don’t have the same downside protection as VHT, which typically outperforms the market on drawdowns. I mentioned PTH’s 46.57% retracement before, but it also declined 37.41% between August 2015 and February 2016, and 27.93% between October 2018 and December 2018.

Portfolio Visualization Tools

2. Applying momentum strategies to many small-cap healthcare stocks is a mistake. Consider that there are 283 healthcare stocks in the top 2,000 in size terms, many of which are early-stage companies. Given the challenges of valuing these companies, which often have no track record of business or sales, you’d end up owning too many stocks with charts like this:

Seeking Alpha

Viking Therapy (vKTX) was one of three stocks that fell more than 10% on March 11, 2024, but PTH included it because the share price rose 211% in the two weeks to February 28, 2024. In effect, PTH investors take the risk of buying at the top, and because these short-term returns are so unusual, it’s best left to an active fund manager to decide whether it’s worth taking profits. VKTX’s one-month return is about half of its peak gain.

3. Evaluating PTH is challenging because many companies have no sales or profits. In these cases, they are excluded from portfolio growth forecasts and price-to-earnings ratios, thereby reducing the value of these ratios. Among companies with reported growth and valuation metrics, PTH trades at 22.32x trailing sales, roughly three times VHT and PSCH, while offering 2x projected EBITDA growth. Still, the key takeaway is PTH’s weak Profit Score of 6.62/10, which highlights the speculative nature of the ETF.

Investment Advice

PTH is a highly speculative ETF that selects nearly 300 U.S. healthcare stocks. At any given time, there may be several small, early-stage companies with incredible momentum characteristics, and since PTH only requires 30 companies for its index, it’s likely to pick this one. With price increases of over 50% becoming the norm in the short term, timing becomes critical. I don’t believe that passively managed indexes do this well, and I would feel more comfortable with actively managed managers who can capture these unusually large profits when the time is right. Therefore, since I disagree with the strategy and am not interested in its track record, I give PTH a “Sell” rating. Thank you for reading and I look forward to your comments below.