flavijus/iStock Editorial via Getty Images

The story of big tech companies

Before discussing why Big Tech may be fundamentally vulnerable, it’s important to understand Big Tech’s story. First, big tech companies are the tech giants at the forefront. Innovation: Microsoft (Microsoft Corporation), apple(AAPL),Nvidia(NVDA), Amazon (Amazon), Yuan (Mehta) and the alphabet (Google) (Google).

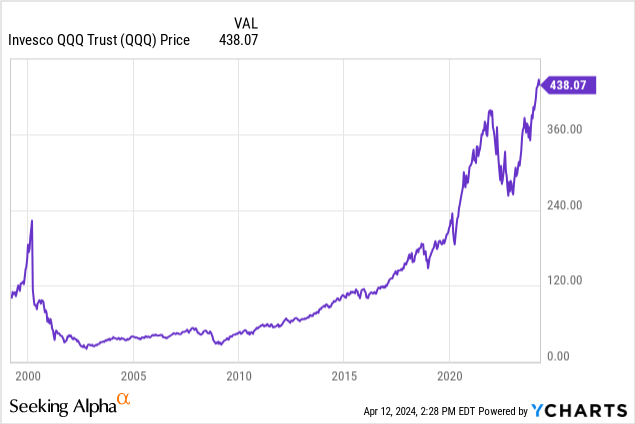

Together, these six companies account for nearly 45% of the Nasdaq 100 index tracked by the Invesco QQQ Trust ETF (NASDAQ: QQ).

This is a long-term chart of the Nasdaq 100 QQQ ETF. After the 2000 dot-com bubble, the Nasdaq 100 underperformed until around 2016, and the upward trend accelerated in 2020 near the 2000 bubble high. But tech stocks really started to rise in the wake of the pandemic, led by big tech companies.

So, let’s focus on Tech performance after the pandemic or since 2020.

Yes, the profits of large technology companies have shown explosive growth in the past 3-4 years, but the price increases have been even greater. According to data from Yahoo Finance, QQQ’s current price-to-earnings ratio is 35.66, which is bubble-like.

A price-to-earnings ratio of 35 indicates that investors expect the earnings growth of the past 3-4 years to likely continue, or perhaps even accelerate. However, earnings growth is unlikely to continue at the same pace, and in fact, earnings growth for the big tech companies is likely to slow significantly.

Specifically, the epidemic has triggered huge demand from companies and individuals for technology products that enable remote work and distance education. Additionally, the combination of extraordinary fiscal and monetary stimulus has provided an infusion of cash to consumers, who are spending heavily on 1) technology products, 2) online shopping, and 3) social media for leisure and entertainment. So big tech companies are clear beneficiaries of the pandemic.

However, big tech companies are starting to miss 2022 profit expectations, forcing some of them to cut jobs and improve cost efficiencies. Then, the 2023 GenAI investment cycle added a new dimension to Big Tech’s performance and profits, which brings us to where we are today.

Barring another return of pandemic-related lockdowns and extraordinary procyclical stimulus, Big Tech’s earnings growth will likely slow despite GenAI’s hype.

analyze

A complete analysis involves three parts: 1) macro story, 2) company-specific story and 3) momentum.

macro story

The big picture story is simple:

- An inversion of the yield curve, which results in a recession after a long and variable lag in previous monetary policy tightening eventually hits the economy.

- Due to “stickiness” and rising inflation, which is well above the Fed’s target, the Fed cannot preventively cut interest rates to avoid a recession.

- It can be seen that QQQ is facing a declining bear market.

- However, in the short term, the repricing of Fed policy and rising interest rates may cause the P/E multiple to shrink and fall back.

Company specific story

Analysis of company-specific factors suggests that Big Tech is becoming vulnerable.

- Microsoft is the largest company in the index, accounting for 9% of QQQ. Microsoft is also fundamentally the most powerful company—but maybe too powerful. Specifically, Microsoft is leading the GenAI race and has begun incorporating Copilot into productivity tools with the support of Azure.But Microsoft also tried to combine the Netscape browser with productivity tools in the 1990s, but this was blocked antitrust litigation. Microsoft is now playing the same playbook with Copilot, and it’s likely to end the same way – with an antitrust lawsuit.

- Apple basically still focuses on iPhone and iPhone-related services, and has a large business in China. Apple is always looking for the next big thing (it won’t be the iCar) and it looks like they really don’t have anything, maybe an AI iPhone, but it’s still an iPhone.In addition, Apple also faces antitrust litigation Blocking the iPhone ecosystem from competitors—an existential threat.

- Nivida essentially benefited from panic buying of GenAI-enabled chips in 2023, but now it appears many of the big tech companies are producing those chips in-house, while other chipmakers are catching up.

- 85% of Amazon’s revenue comes from online shopping, 15% of its revenue comes from the cloud service AWS, but 80% of its profits come from AWS. Therefore, Amazon is AWS. Virtually all of the big tech companies are now focusing on the cloud and data centers – a major growth driver for Microsoft. Therefore, competition will be fierce.

- Meta makes 98% of its revenue from ads on Facebook and Instagram, and it invests heavily in artificial intelligence to achieve “better engagement,” but that’s likely ad targeting, possibly based on AI’s “social scoring” and “predictions.” “Sexual Policing”.The problem is that these practices are now illegal in Europe, according to I have taken action. Meta’s AI business will be seriously threatened by global AI regulation, which could be an existential threat.

- 88% of Google’s revenue comes from advertising and subscriptions, 56% of which comes from search. ChatGPT could be a new way to gather information without ads. Google’s ad-based search model is under threat, and Google is trying to reposition itself, possibly competing in (guess where) the cloud.

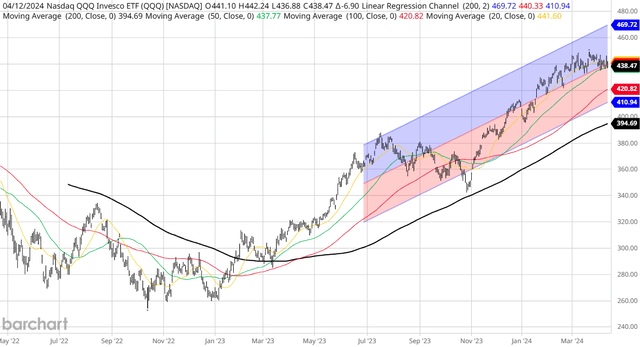

momentum

QQQ’s strong upward trend since October 2023 is fading. In fact, QQQ has been flat since March 1 and declined last month. The important uptrend support level of the 20-day moving average has been broken, and QQQ is currently “sitting on” the key 50-day moving average support level. Once this support is broken, QQQ will face a 10% retracement to the 200-day moving average of 394.

bar chart

Influence

All big tech companies face serious threats, either from regulatory and antitrust issues or from artificial intelligence-related disruptions. The unfolding GenAI revolution will likely result in the obsolescence of one of these giants, possibly Google.

As support, consider that many tech companies from the 1990s didn’t survive. Cisco (CSCO) remains below its 2000 highs; it took Microsoft 15 years to regain its 1999 highs.

In the short term, the macro situation is deteriorating, suggesting that overpriced QQQ may face a deep correction. The weakening momentum is increasing the likelihood of a 10% correction. What’s more, this could be the beginning of a long-term recessionary bear market.

So I downgraded QQQ from Hold to Sell.