Bopav

introduce

While looking for income funds focused on asymmetric risk and return profiles, I stumbled upon the Defiance NASDAQ 100 Enhanced Option Income ETF (NASDAQ: QQQY).I look back at the first 60 days of it November 2023.

This article will serve as a follow-up to my previous conclusion, which is:

I will try to cover QQQY again… to see how the strategy changes and evolves… Until then, I have to rate this fund a Hold because I don’t believe we have the data to say how this investment will perform, and I don’t currently see it having a place in my income mix.

Six months later, in April 2024, we have more data. Let’s take a look at QQQY again to see if it can demonstrate its power.

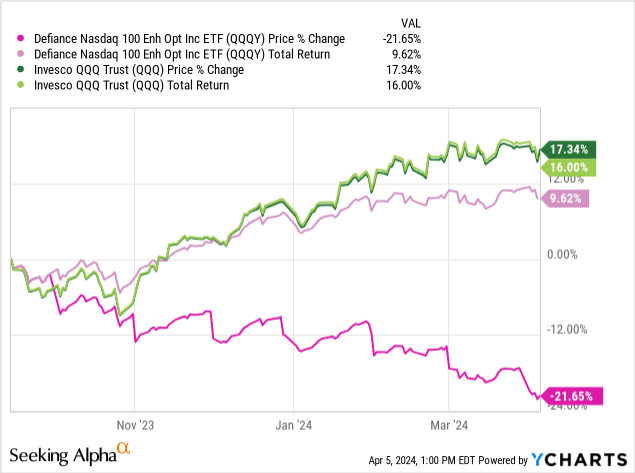

Here are the prices and total returns for QQQY and QQQY Its underlying index is QQQ.

Overview

QQQY is unique among ETFs that sell options in that it seeks to sell the 0DTE ITM put. For those unaware, this means that the fund sold an option on QQQ that expired on the same day as the sale and was sold at the strike price that would have been exercised at expiration.

A typical options-based ETF sells call options on its holdings, which have very different profit and loss possibilities and risk profiles.

Because an ETF sells options, it can use margin to secure its options. This allows cash in the portfolio to be allocated into positive-yielding bonds and assets to help boost overall yields.

contempt Their strategy is also explained.

QQQY’s goal is to provide investors with consistent and outsized monthly yield distributions combined with stock market exposure to the Nasdaq 100 Index. QQQY is an actively managed exchange-traded fund (“ETF”) designed to grow income and consists of Treasury and Nasdaq 100 Index options. The goal of this strategy is to generate excess monthly distributions by selling option premiums on a daily basis. The fund utilizes daily options to achieve rapid time decay by selling currency puts at 0DTE.

The Fund’s primary investment objective is to seek current income. The Fund’s secondary investment objective is to seek the performance of the Nasdaq 100 Index (the “Index”) with limited potential investment income.

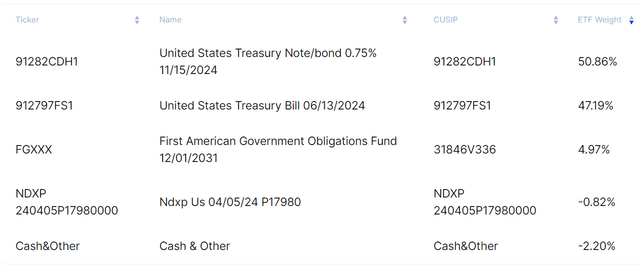

Look at QQQY Currently held here, as they change every day. Depending on when you read this article, these options may look completely different.

figure 1 (Rebel ETF)

Those who read my first article will note that the fund has now deployed all of its cash, going from 29% cash in November to a negative cash balance now.

This is a good sign for the ETF because it means that it is not “accelerating” its business and is deploying all its cash into Treasury bonds and money market funds as its liquidity to complete transactions.

Treasury bonds have lower yields because they are purchased at a deep discount, allowing them to be sold for capital gains rather than receiving most of the proceeds in the form of dividend income. This allows the Fund to distribute primarily its option income rather than UST distributions.

Distro

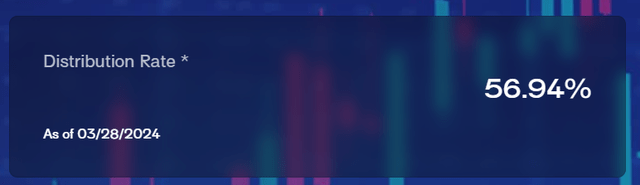

QQQY has been maintaining a dizzying distribution ratio for some time, far exceeding my expectations for a fund distribution ratio of over 50%.

figure 2 (Rebel ETF)

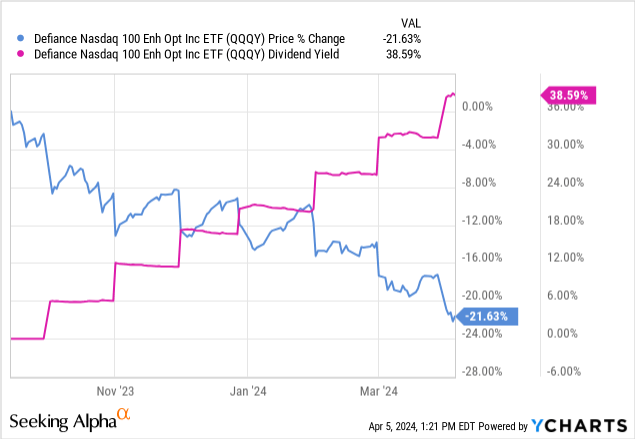

Allocations themselves have been declining, but the ratio remains high due to falling prices.

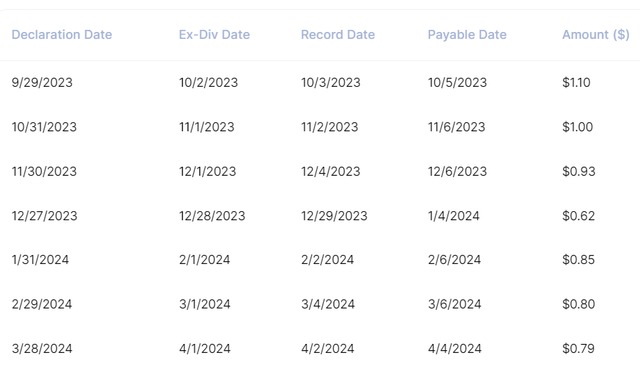

image 3 (Rebel ETF)

When I wrote the original article on QQQY in November, the circulation was $0.93, and the market price at the time of publication was $18.50. This means that if this continues, the yield will be closer to 65%.

Now, with the market price at $15.75 and the latest allocation at $0.79, investors are still eyeing a yield of around 60%.

However, if you bought after my last post and still held, your cost would have been $18.50, the most recent allocation was $0.79, and your yield would have been more like 51%.

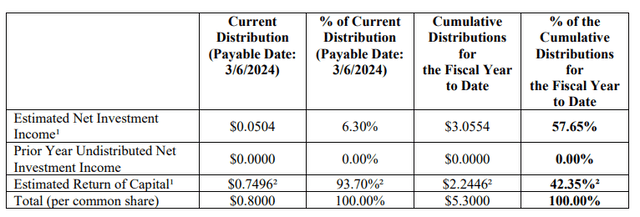

The reduction in allocation size has resulted in a significant reduction in the trailing yield (“TTM”), which is currently approximately 38.5%.

This yield is still crazy to me, but more in line with my expectations for this fund: it will maintain the current high distribution yield by eroding the price of the fund.

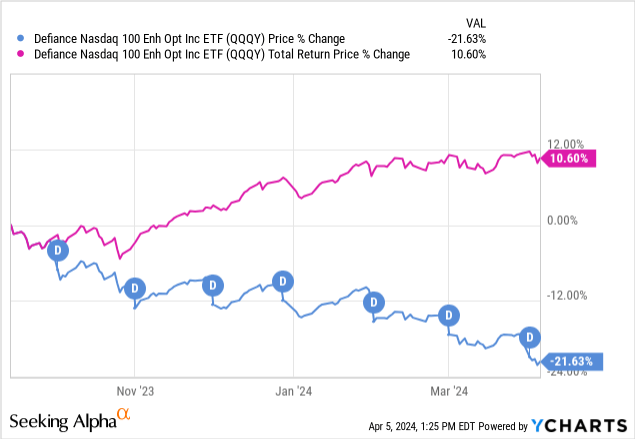

This resulted in investors receiving a total return of 10.60% from the start, while the fund’s price fell by 21.63%.

Note: The “D” symbol in the chart is the time when dividends are paid.

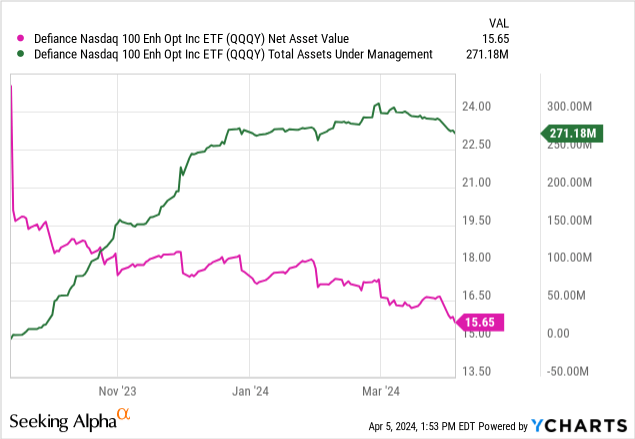

As you can see, the fund’s distributions exceeded its option sales revenue because its NAV continued to decline even as AUM increased.

This overallocation is a huge risk for the fund, and it could slowly reduce to zero while still maintaining the best marketing strategy: providing a 50%+ distribution yield.

This destruction of NAV is being passed back to investors through Return of Capital (“RoC”), which, unlike some RoCs, may be fancy accounting done on the part of the manager and is temporary, QQQY always puts it 30-50 % of the allocation is allocated to Peng.

Figure 4 (Rebel ETF)

market risk

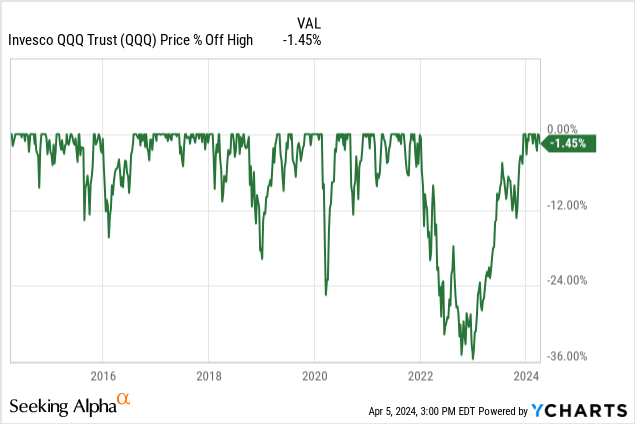

Due to the nature of the 0DTE put option, the fund’s greatest risk is a sudden and significant decline in the underlying index (NASDAQ 100).

This happens from time to time, but not during the existence of QQQY. This means that this risk has not yet been realized, and the damage it could cause to QQQY is unknown.

While you can see that the index always recovers from these dips, QQQY doesn’t get the same upside as QQQ. Due to the nature of a put option, it may not return to its highs after falling during a sharp, sudden decline.

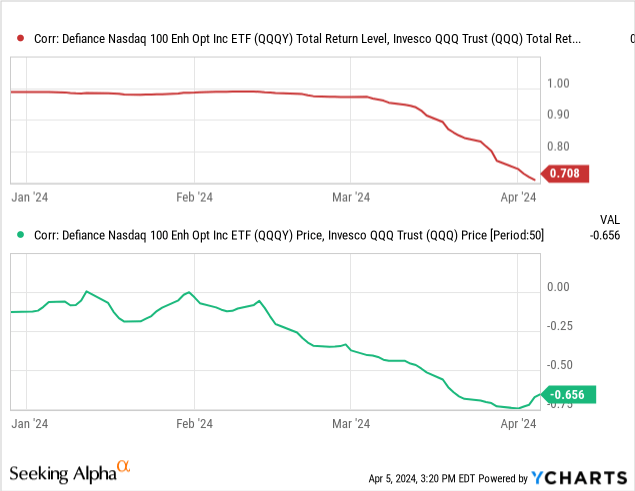

QQQY has a fairly close correlation with QQQ’s daily returns.

QQQY changes positions during market trading hours, so its risk exposure is constantly changing, and it is impossible to predict how these historical crashes will affect QQQY.

This type of unknown risk is not new to investing, and QQ suffered the same fate.

Having said that, options, especially 0DTE options; are leveraged instruments and losses may exceed losses on the underlying asset. If QQQ falls, QQY may fall even faster.

This is why there is such a difference between the correlation between price and total returns. Total returns are almost 1:1 correlated and have recently declined due to the non-payment of dividends in April. However, prices sometimes have neutral or even negative correlations.

This could be due to loss of leverage, or intraday losses realized before a new position was established.

Performance

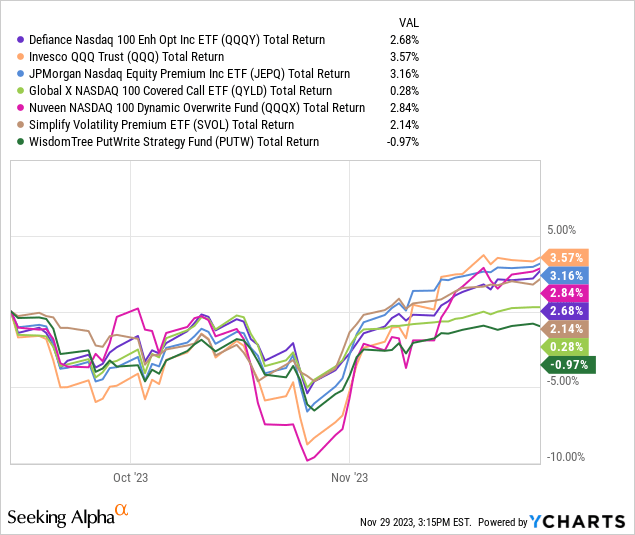

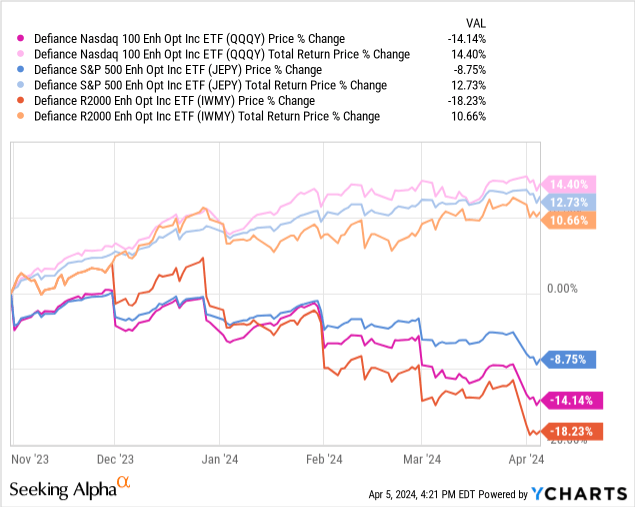

Back in November, I compared QQQY to several other similar ETFs. I’d like to bring them back again to see how things have changed. Here is the total return graph from my last article to give new readers some reference.

Figure 5 (Y chart)

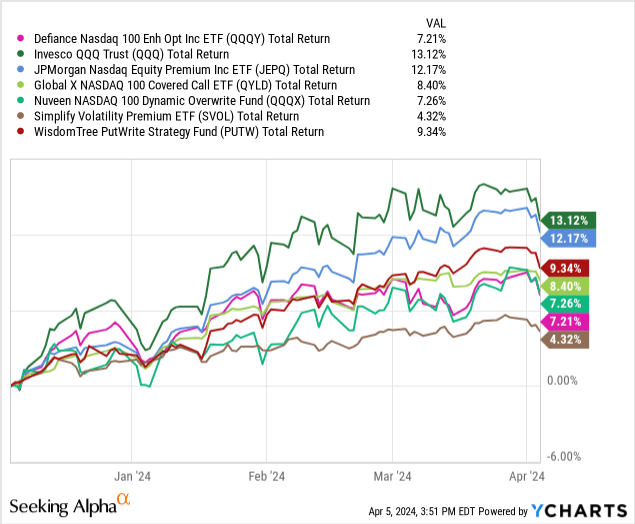

So how did this change? The next chart starts where this chart ends.

Note: The color of each security has been changed to match the color coding of this article.

In the last data set, the benchmark fund (QQQ) beat all other funds in terms of total returns, and it still does. After-tax returns make a bigger difference because most of these funds distribute a large amount of their earnings as dividends, whereas QQQ’s primary source of returns is capital gains.

The next question is, how does it perform compared to sister funds that track other indexes like the S&P 500 and Russell 2000?

Among the three funds under Defiance, QQQY has the best performance. This could be due to excessive volatility in the Nasdaq 100 relative to the S&P 500 and Russell 2000, but due to intraday activity, it’s unclear why it behaves this way. This excessive volatility may not apply to the index itself, but specifically to the strike prices selected by managers for daily options.

in conclusion

I’m still holding the Defiance Nasdaq Enhanced Yield ETF (QQQY) because its returns haven’t really impressed me yet and it comes with significant risks that have never been fully tested.

Without knowing how QQQY would respond to a black swan crash, the fund faces too much risk of a sudden implosion. Think of it this way: I don’t want to wear a bulletproof vest that I’ve never been shot at before, even if the manufacturer swears it’s actually bulletproof.

Currently, the fund’s net asset value is declining and its assets under management have stabilized. This combination does not bode well for QQQY’s future. I’ll wait and see how things change. If we see QQQY actually test its metal, and I feel safe enough to include it in my income portfolio, I’ll write another update.

Until then, there seemed to be insufficient justification for its inclusion.

thanks for reading.